Contactless Stays Market Size, Growth | 27.5% CAGR

Global Contactless Stays Market Size, Share & Analysis By Type of Accommodation (Vacation Rentals, Apartments, Hotels, Resort, Hostels), By Technology Used (Keyless Entry, Mobile Check-In and Check-Outs, Touchless Payment, Other Technologies), By Booking Channel (Online Travel Agencies, Direct Bookings, Travel Agents, Other Channels), By End-User Industry Regions & Key Players – Smart Hospitality Trends & Forecast 2025–2034

Report Overview

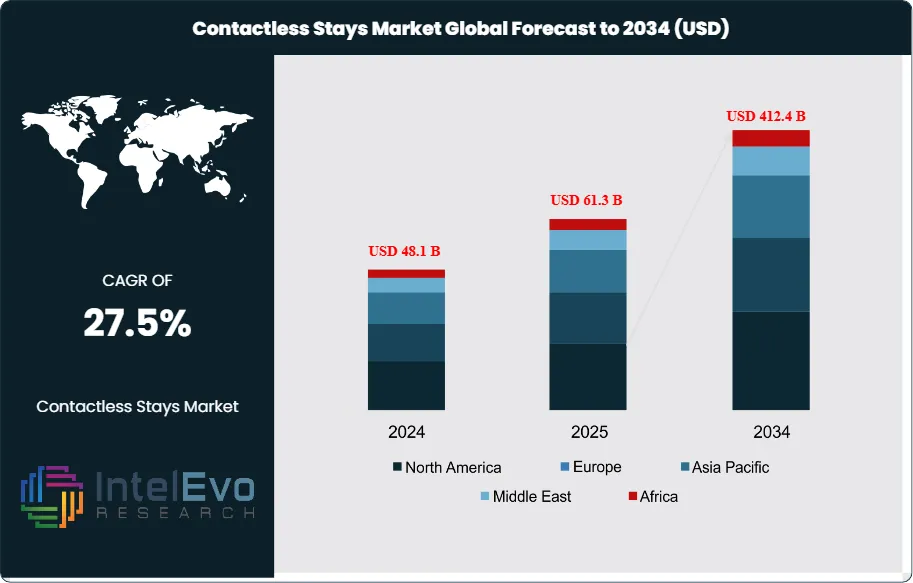

The Contactless Stays Market is estimated at USD 48.1 billion in 2024 and is on track to reach approximately USD 412.4 billion by 2034, implying a strong compound annual growth rate of about 27.5% over 2025–2034. Rapid adoption of digital check-ins, biometric authentication, IoT-enabled room controls, and automation-led guest services continues to reshape the hospitality landscape. As travelers increasingly prioritize safety, convenience, and frictionless experiences, hotels and short-term rentals are accelerating investment in AI-driven concierge tools and app-based property access systems.

Get More Information about this report -

Request Free Sample ReportThis shift is redefining global travel expectations—contactless stays are no longer a pandemic-era trend but a core pillar of next-generation hospitality. With smart hotels expanding across the U.S., Europe, and APAC, the category is set to dominate premium guest engagement strategies and remain one of the fastest-scaling segments in the travel-tech ecosystem.

The contactless stays segment has shifted from a niche accommodation model to a fast-scaling global preference. Initially driven by the operational disruptions of COVID-19, demand accelerated as both travelers and providers prioritized safety, efficiency, and convenience. What began as a pandemic workaround has matured into a competitive necessity across hotels, serviced apartments, and short-term rentals. Adoption has deepened in North America and Western Europe, where over 65% of large hotel chains introduced mobile check-in and digital room access by mid-2024. At the same time, Asia-Pacific is seeing double-digit year-on-year growth in smart hospitality infrastructure, particularly in urban and resort corridors.

Key drivers include rising traveler expectations for autonomy, labor shortages in hospitality, and cost-reduction imperatives. Digital key systems now support over 50 million room nights annually, reducing front desk staffing needs by up to 40% per property. Operators report operational savings of 12–15% after deploying self-service platforms. Yet challenges persist. Capital expenditure on integrated property management systems can be high for mid-sized players. Data privacy regulations remain fragmented, limiting seamless tech deployment in markets like the EU and South Korea.

Technology adoption continues to shape differentiation. Biometric verification, AI-based guest messaging, and IoT-enabled room controls are shifting the service model. In 2024 alone, smart lock installations grew 34%, while over 70% of new hotel builds in the U.S. included digital concierge functionality. Material innovation also plays a role; antimicrobial surface coatings and touchless sensor systems reduce hygiene concerns while supporting operational compliance.

Investor interest is tracking with regional momentum. Dubai and Singapore have emerged as active development hubs, backed by regulatory support for smart tourism. In the U.S., major hospitality REITs are redirecting capital toward retrofit programs for contactless systems across aging portfolios.

As the sector evolves, contactless stays are no longer a feature—they are fast becoming a baseline expectation. Providers who fail to meet this shift risk disintermediation from digital-first platforms and traveler defection to tech-enabled competitors.

Key Takeaways

- Market Growth: The global contactless stays market reached USD 48.1 billion in 2024 and is projected to hit USD 412.4 billion by 2034, registering a CAGR of 27.5%. Growth is driven by guest demand for low-touch experiences, labor cost reduction, and widespread digital transformation in hospitality.

- Accommodation Type: Vacation rentals lead the market, accounting for over 45% of global revenue in 2024. Their decentralized operations and flexible service models accelerate adoption of keyless access and automated check-in systems.

- Technology: Keyless entry systems are the dominant technology, integrated in over 60% of newly built or renovated properties by 2024. Mobile check-in and digital concierge tools are gaining ground, particularly among mid-tier hotel chains and urban serviced apartments.

- Driver: Labor shortages and operational efficiency targets are pushing adoption. Properties using mobile-based check-in reported a 12–15% reduction in front desk staffing needs and a 9% increase in guest satisfaction scores.

- Restraint: High upfront costs for tech integration and fragmented data privacy laws slow adoption. In the EU, compliance with local data rules has delayed full-scale deployment in over 30% of hotel groups surveyed in 2024.

- Opportunity: Asia Pacific offers strong growth potential, with smart hospitality investments rising 18% year-over-year. Urban centers like Tokyo, Seoul, and Bangkok are investing in retrofit-ready infrastructure to support automated stays.

- Trend: Digital room access, self-check-in kiosks, and AI-powered guest messaging systems are becoming standard. Smart lock installations rose 34% globally in 2024, with brands like Marriott and Hilton expanding contactless service models across major city properties.

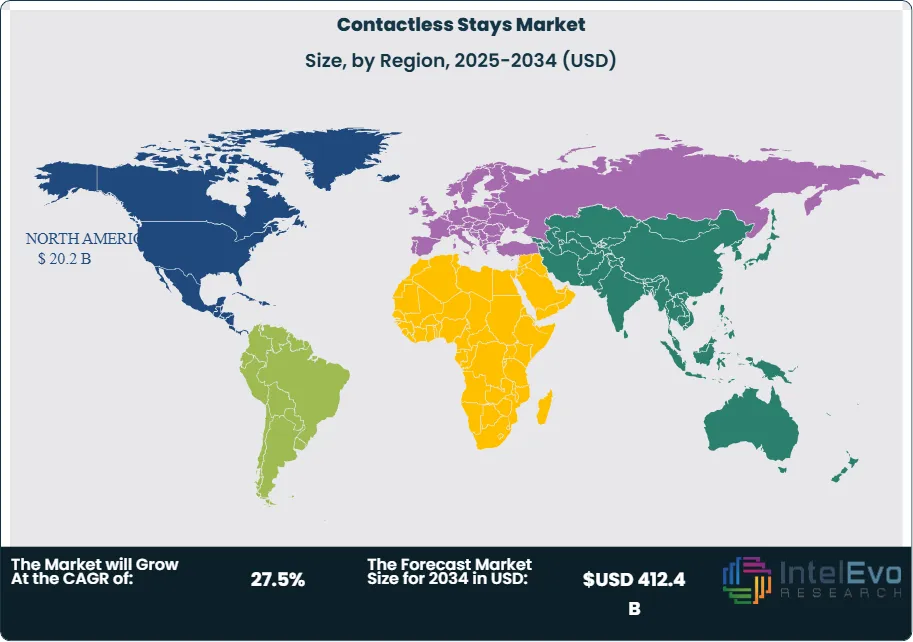

- Regional Analysis: North America holds the largest revenue share at 38% in 2024, driven by early tech adoption and strong OTA partnerships. Asia Pacific is the fastest-growing region, forecasted to grow at a CAGR above 28% through 2032 due to rising domestic tourism and government-backed smart travel initiatives.

Accommodation Type

Vacation rentals remain the highest-performing segment within the global contactless stays market, contributing an estimated 38.5% to total market revenue in 2022. This category continues to gain momentum in 2025, supported by a projected CAGR of 26.2% through 2032. The operational model of vacation rentals—typically run by individuals or small-scale property managers—allows for quicker implementation of digital systems such as self-check-in, smart locks, and automated communication. Platforms like Airbnb and Vrbo have invested heavily in mobile-based access solutions and cleaning protocols, reinforcing guest confidence and streamlining property turnover.

Apartments represent the fastest-growing accommodation segment in this market. With an estimated market share of 24.5% in 2022, apartment-based stays have surged due to rising demand for private, low-contact environments. These properties often feature in-unit amenities such as kitchens and laundry, aligning with guest preferences for autonomy and hygiene. As of 2025, mid-tier serviced apartments in urban centers are increasingly integrating app-based access and automated checkout systems to meet growing traveler expectations and maintain competitive differentiation.

Technology Analysis

Keyless entry systems accounted for the largest share of revenue in 2022, contributing 48.6% to the global contactless stays technology market. These systems—enabled via mobile phones, RFID cards, or Bluetooth—allow guests to access their rooms without front desk interaction. By 2025, adoption is accelerating, particularly among hotel chains seeking to cut labor costs and reduce guest wait times. Property managers report improved operational efficiency and higher guest satisfaction scores following keyless system implementation, with some reporting a 15% reduction in overhead tied to staffing.

Mobile check-in and check-out services are the fastest-expanding segment within the technology category, recording a CAGR of 26.6% from 2022 to 2031. These tools enable guests to manage their arrivals and departures via smartphone apps, reducing the need for physical touchpoints. By 2025, over 70% of new hospitality developments in North America and Europe have embedded mobile check-in options into their booking infrastructure. This shift aligns with broader consumer behavior trends favoring speed, autonomy, and minimal contact.

Booking Channel Analysis

Online travel agencies (OTAs) continue to dominate the booking landscape for contactless stays, with a 51.2% share in 2022 and an expected CAGR of 27.8% through the forecast period. OTAs have been quick to integrate contactless technologies, including seamless payment gateways, mobile check-ins, and digital guest communication. Their platforms cater to a broad customer base seeking convenience and real-time availability, making them a preferred channel for both independent travelers and business users.

Direct bookings are gaining ground as the fastest-growing channel, with a projected CAGR of 26.3%. By 2025, this segment accounts for an estimated 26.8% of market value. Hotels and vacation rental hosts are increasingly investing in their own websites and reservation tools to reduce reliance on third-party platforms. Direct bookings allow operators to control the end-to-end guest experience, offer flexible pricing, and establish more personalized relationships—all while reducing commission costs. As mobile responsiveness and integrated tech improve, this channel is expected to capture a larger share of repeat customers.

Regional Analysis

North America led the global contactless stays market in 2022, accounting for 40.6% of total revenue. The region continues to hold its lead in 2025, driven by widespread tech infrastructure, high mobile penetration, and aggressive investment in smart hospitality. Major hotel chains and rental operators across the U.S. and Canada have retrofitted existing properties with digital locks, self-service kiosks, and automated messaging systems. The early influence of the COVID-19 pandemic further catalyzed adoption, and contactless service is now seen as a standard offering across urban and leisure travel markets.

Asia Pacific is the fastest-growing regional market, posting a CAGR of 25.8% and a projected market value of 25.5% by 2025. Demand is being fueled by a rising middle class, growing domestic tourism, and strong government support for smart infrastructure. Countries like China, Japan, and South Korea are expanding hotel and vacation rental footprints, with high adoption rates of mobile-first platforms. In Japan, for example, over 60% of new hotel developments in 2024 integrated contactless guest entry and voice-assisted room controls. This momentum is expected to continue as digital solutions become embedded in standard hospitality operations across the region.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Type of Accommodation

- Vacation Rentals

- Apartments

- Hotels

- Resort

- Hostels

By Technology Used

- Keyless Entry

- Mobile Check-In and Check-Outs

- Touchless Payment

- Other Technologies

By Booking Channel

- Online Travel Agencies

- Direct Bookings

- Travel Agents

- Other Channels

By Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 48.1 B |

| Forecast Revenue (2034) | USD 412.4 B |

| CAGR (2024-2034) | 27.5% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Type of Accommodation (Vacation Rentals, Apartments, Hotels, Resort, Hostels), By Technology Used (Keyless Entry, Mobile Check-In and Check-Outs, Touchless Payment, Other Technologies), By Booking Channel (Online Travel Agencies, Direct Bookings, Travel Agents, Other Channels) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Booking.com, Hilton Worldwide Holdings Inc., OYO Rooms, AccorHotels S.A., Agoda.com, Expedia Group, Airbnb.co.in, Marriott International, Other Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date