Control Centers Market Size & Share, Growth, Trends|CAGR of 11.6%

Global Control Centers Market Size, Share, Analysis Report By Type (Standalone, Integrated) Component (Software System, Communication System) Industry (Water/Wastewater, Renewable Energy, Oil and Gas, Electrical Distribution, Transit) End User (Private Utility, Public Utility) Application (Software, Service, Consulting, System Integration, Support and Maintenance) Industry Region & Key Players-Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends & Forecast 2025-2034

Report Overview

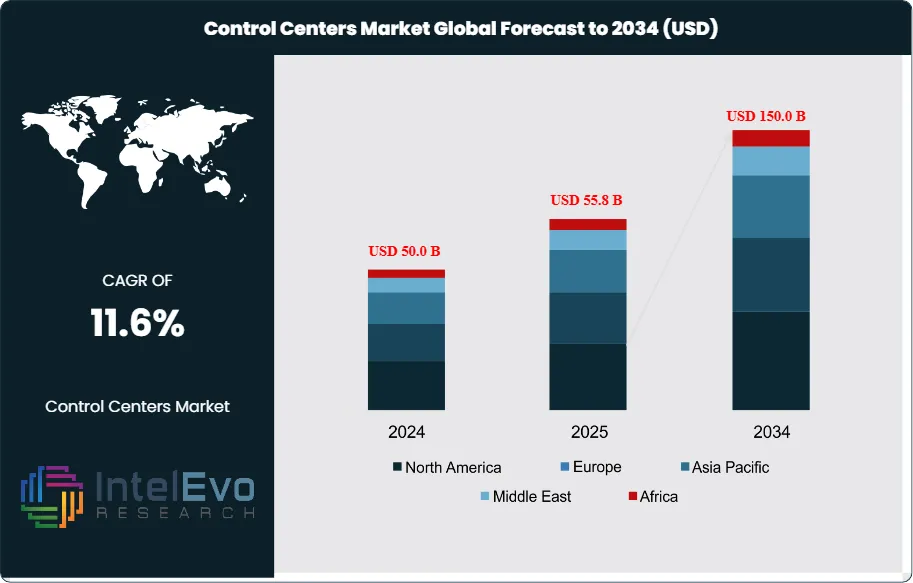

The Control Centers Market is projected to reach around USD 150.0 Billion by 2034, increasing from USD 50.0 Billion in 2024. This represents a growth rate of 11.6% during the period from 2024 to 2034. Control centers act as central hubs that monitor, manage, and control various industrial operations, utilities, and critical systems. They bring together software systems, communication tools, and analytics to support real-time decision-making and improve operational efficiency. These centers are widely used across several sectors, including water and wastewater management, renewable energy, oil and gas, electrical distribution, and transit. They ensure reliability, safety, and compliance.

Get More Information about this report -

Request Free Sample ReportThe market is growing due to the rising demand for digital transformation in utilities, increasing investments in smart grids, and the greater use of IoT and AI-powered monitoring systems. Modern control centers integrate automation, cybersecurity, and cloud-based solutions to manage complex data and infrastructure needs. Vendors emphasize incorporating advanced SCADA systems, edge computing, and predictive analytics to improve operational resilience.

The COVID-19 pandemic sped up the digital transformation of critical infrastructure. This pushed utilities and industries to adopt remote monitoring and cloud solutions. However, supply chain disruptions affected hardware availability. Additionally, geopolitical tensions and trade restrictions impacted sourcing components and forming technology partnerships. The recovery after the pandemic, along with a stronger focus on resilient infrastructure, is increasing investments in modern control centers.

Regional conflicts among major economies and ongoing trade tensions have notably affected the dynamics of the Global Control Centers Market. These conflicts can disrupt global supply chains for essential hardware components, like semiconductors and specialized displays. They can also raise raw material costs and create uncertainties that discourage investment. Export controls and sanctions may limit market access for specific technologies or players. On the other hand, such tensions can boost the need for better cybersecurity in critical infrastructure control centers and encourage regional self-sufficiency in technology, possibly leading to new regional players and varied supply chains. Increased defense spending in conflict-prone areas also directly fuels demand for military command and control systems.

Key Takeaways

- Market Growth: Driven by smart grid deployment and industrial digitalization.

- Leading Segments: Integrated control centers are gaining dominance due to centralized data visibility and automation features.

- Fastest-Growing Applications: System integration and consulting services are expanding due to customized requirements across industries.

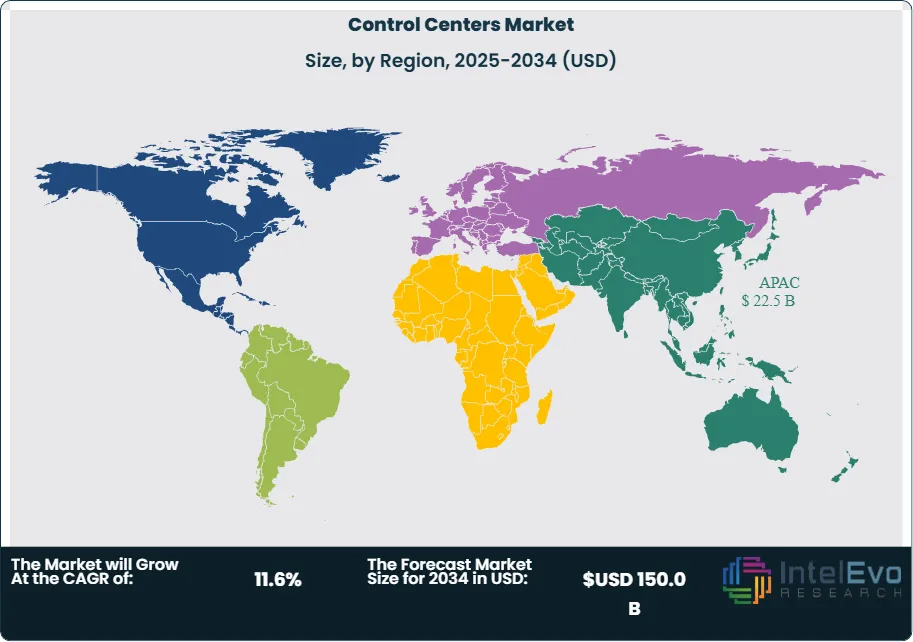

- Top Regions: North America and APAC lead due to technological advancements and infrastructure modernization.

- Driver: Increasing automation and digitalization across industries, coupled with a growing focus on critical infrastructure protection, are the primary drivers.

- Restraint: High upfront investment, integration complexities with legacy systems, and data security concerns are key restraints.

- Opportunity: The emergence of edge computing, development of AI-powered autonomous operations, and demand for integrated platforms present significant opportunities.

- Trend: A prominent trend is the shift towards remote monitoring and operations, alongside the increased use of video walls and modular solutions.

- Regional Analysis: North America and Europe are current market leaders, but Asia-Pacific is poised for the fastest growth due to rapid industrialization and urbanization.

By Type

The market is divided into Standalone and Integrated control centers. Integrated control centers hold a larger share and are expected to grow the fastest because they can centralize real-time data from different systems. This offers better operational visibility and automation. Utilities, oil and gas operators, and transit networks are increasingly choosing these centers for their cost efficiency, reduced downtime, and improved decision-making through data integration. Standalone control centers still matter for smaller applications or industries that need isolated systems, but the trend is shifting towards integrated solutions as part of the global digital transformation.

By Component

The Software System segment is likely to see the highest growth. This is driven by the increasing use of cloud-based SCADA platforms, AI-driven analytics, and predictive monitoring systems. As industries aim to improve operational efficiency and lessen downtime, innovative software solutions with real-time dashboards, cybersecurity features, and digital twin capabilities are becoming essential. The Communication System segment, while important for connectivity and data transfer, is expected to grow at a slower pace since hardware is becoming standardized. Most innovation continues to focus on software advancements.

By Industry

Renewable Energy and Electrical Distribution are the fastest-growing segments. This growth is driven by the global shift towards clean energy, smart grids, and decentralized energy management systems. The oil and gas sector continues to adopt advanced control centers for pipeline monitoring, safety management, and predictive maintenance. Water and wastewater management systems are also growing steadily due to infrastructure modernization projects. Transit and transportation control centers are gaining popularity, especially with the rise of smart city initiatives and intelligent traffic systems.

By End-User

The Public Utility segment holds a larger market share due to government investments in infrastructure modernization, renewable energy integration, and smart city projects. Public utilities often need robust, large-scale control centers to handle critical infrastructure like power grids, water distribution, and urban transit systems. The Private Utility segment is expected to grow rapidly, particularly among independent energy producers and industrial players who are investing in digitization and predictive operational control systems.

By Application

System Integration is becoming the fastest-growing application. This is due to the increasing demand for customized and unified control platforms that blend hardware, software, and analytics into a smooth operational ecosystem. The Software and Service segments are also dominant as industries adopt cloud-based platforms, real-time monitoring tools, and consulting services to enhance workflows. Support and maintenance are crucial for ensuring system uptime and managing cybersecurity risks, especially in sensitive sectors like oil and gas and energy distribution.

By Region

North America currently leads the market, supported by advanced smart grid projects, oil and gas infrastructure, and the strong presence of key players like ABB, GE, and Schneider Electric. The Asia-Pacific region is the fastest-growing area, driven by rapid industrialization, urbanization, and government investments in smart city and renewable energy projects in countries like China, India, and Japan. Europe remains an important market due to strict environmental regulations and the widespread adoption of renewable energy. Latin America and the Middle East and Africa are emerging markets, with growth driven by infrastructure modernization and oil and gas investments.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

By Type:

- Standalone

- Integrated

By Component:

- Software System

- Communication System

By Industry:

- Water/Wastewater

- Renewable Energy

- Oil and Gas

- Electrical Distribution

- Transit

By End User:

- Private Utility

- Public Utility

By Application:

- Software

- Service

- Consulting

- System Integration

- Support and Maintenance

By Region:

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 55.8 B |

| Forecast Revenue (2034) | USD 150.0 B |

| CAGR (2025-2034) | 11.6% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Type (Standalone, Integrated) By Component (Software System, Communication System) By Industry (Water/Wastewater, Renewable Energy, Oil and Gas, Electrical Distribution, Transit) By End User (Private Utility, Public Utility) By Application (Software, Service, Consulting, System Integration, Support and Maintenance) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Survalent, ABB Group, Oracle Corporation, CGI Group Inc., Futura Systems, General Electric, Schneider Electric, Siemens, Indra Sistemas, Advanced Control Systems, Etap/Operation Technology, AVEVA Group plc, Cisco Systems, Inc., Eaton Corporation plc, Emerson Electric Co., Hexagon AB, Hitachi, Ltd., Honeywell International Inc., IBM Corporation, Inductive Automation (Ignition SCADA), Microsoft Corporation, Mitsubishi Electric Corporation, Motorola Solutions, Inc., OSIsoft LLC (now part of AVEVA Group plc), Rockwell Automation, Inc., Yokogawa Electric Corporation |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the Control Centers Market?

Unlock the Power of Data! Global Control Centers Market surges to $150 BILLION by 2034. Discover how intelligent operations are revolutionizing industries at an 11.6% CAGR!

Who are the major players in the Control Centers Market?

Survalent, ABB Group, Oracle Corporation, CGI Group Inc., Futura Systems, General Electric, Schneider Electric, Siemens, Indra Sistemas, Advanced Control Systems, Etap/Operation Technology, AVEVA Group plc, Cisco Systems, Inc., Eaton Corporation plc, Emerson Electric Co., Hexagon AB, Hitachi, Ltd., Honeywell International Inc., IBM Corporation, Inductive Automation (Ignition SCADA), Microsoft Corporation, Mitsubishi Electric Corporation, Motorola Solutions, Inc., OSIsoft LLC (now part of AVEVA Group plc), Rockwell Automation, Inc., Yokogawa Electric Corporation

Which segments covered the Control Centers Market?

By Type (Standalone, Integrated) By Component (Software System, Communication System) By Industry (Water/Wastewater, Renewable Energy, Oil and Gas, Electrical Distribution, Transit) By End User (Private Utility, Public Utility) By Application (Software, Service, Consulting, System Integration, Support and Maintenance)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date