Creator Economy in Gaming Market Size, Growth & Forecast 2025–2034

Global Creator Economy in Gaming Market Size, Share & Industry Analysis By Creator Type (Streamers, Modders, Game Designers, Influencers), By Revenue Model (Subscriptions, Virtual Goods, Advertising, Brand Sponsorships, NFTs & Digital Assets), By Platform (PC, Console, Mobile, Cloud Gaming), By Game Genre (FPS, RPG, Sandbox, Battle Royale, Simulation), By End-User (Individual Creators, Studios, Publishers, Esports Organizations), Regional Outlook, Market Dynamics, Monetization Trends, Competitive Landscape & Forecast 2025–2034

Report Overview

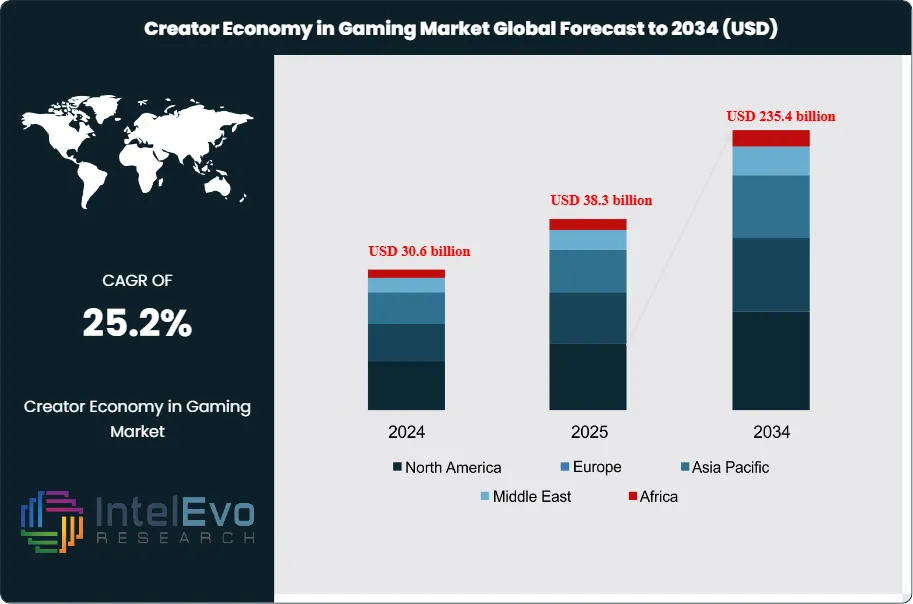

The Creator Economy in Gaming market is estimated at USD 30.6 billion in 2024 and is projected to reach approximately USD 235.4 billion by 2034, registering a robust compound annual growth rate (CAGR) of 25.2% over 2025–2034. This explosive growth is fueled by the rapid monetization of user-generated content, livestreaming, esports, and in-game economies across platforms such as PC, console, and mobile gaming. Rising engagement on creator-led platforms, integration of AI-driven creation tools, and expanding revenue streams from subscriptions, virtual goods, and brand sponsorships are transforming gaming into a creator-centric digital economy. As publishers increasingly enable modding, creator marketplaces, and revenue-sharing models, the sector is emerging as one of the most lucrative frontiers within the global gaming ecosystem.

Get More Information about this report -

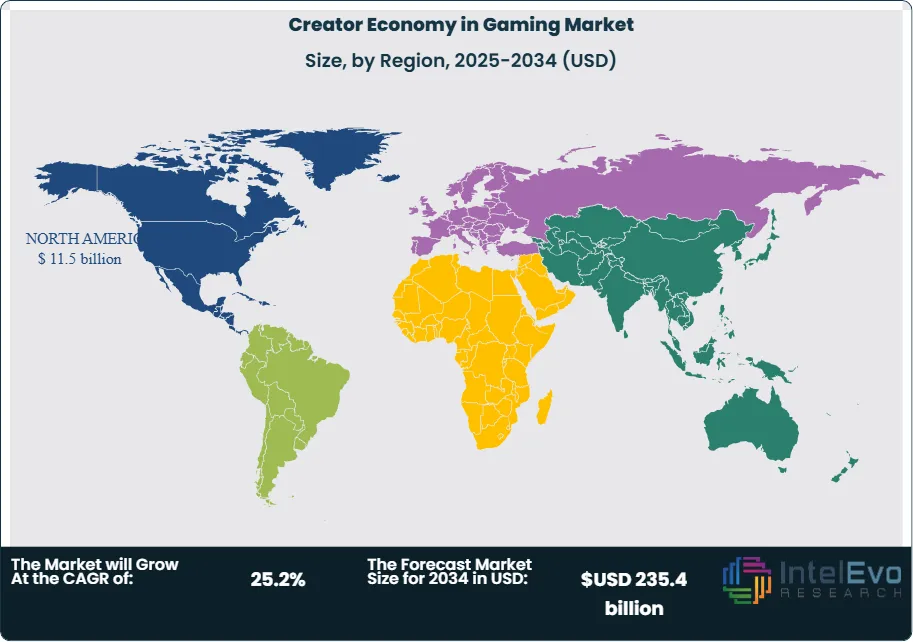

Request Free Sample ReportThis rapid expansion reflects the shift of gaming from a form of entertainment into a full-scale economic ecosystem where creators, platforms, and audiences interact in real time. North America led the market in 2024 with a 40.5% share, generating USD 11.5 billion in revenue, but Asia-Pacific is emerging as a critical growth hub, particularly India, where gaming audiences now exceed 600 million users and more than 300,000 creators actively produce content.

The market’s trajectory is shaped by both demand and supply-side forces. On the demand side, audiences are increasingly drawn to live and interactive formats, with platforms such as Twitch driving monetization through advertising, subscriptions, and donations. Viewership for game streamers has risen from 20% to 25% in recent years, particularly in Tier-II cities across India, signaling a broadening consumer base. On the supply side, creators are diversifying revenue streams to reduce reliance on a single platform, with collaborations and brand partnerships becoming central to income growth. However, challenges remain. Monetization timelines are long, with creators taking an average of 6.5 months to earn their first dollar, and 70% of creators still spend fewer than 10 hours per week on content, highlighting barriers to scaling full-time careers.

Technology is reshaping the creator economy in gaming. Artificial Intelligence is being adopted to automate editing, personalize content, and streamline production, allowing creators to focus on engagement rather than technical execution. Advanced development tools are also enabling higher-quality content at lower costs, which is critical as competition intensifies. Between 2020 and 2022, the number of gaming influencers grew by 213%, and by the end of 2024, the global total is expected to reach 467,000. This surge underscores the structural shift toward creator-led entertainment.

Investment opportunities remain strong despite a slowdown in venture capital funding. Startups that build tools to strengthen direct creator-audience relationships and expand monetization options are attracting attention. For investors, North America continues to offer scale and maturity, while Asia-Pacific, led by India, represents the fastest-growing opportunity. The combination of rising audiences, expanding creator bases, and accelerating adoption of AI-driven tools positions the gaming creator economy as one of the most compelling growth stories in digital media.

Key Takeaways

- Market Growth: The Creator Economy in Gaming market is projected to expand from USD 30.6 billion in 2024 to USD 235.4 billion by 2034, reflecting a CAGR of 25.2% over 2025–2034. Growth is driven by rising demand for interactive content, diversified monetization models, and the rapid adoption of AI-enabled creator tools.

- Content Creators: Streamers and content creators accounted for 35.1% of market share in 2024, reflecting their central role in driving audience engagement and monetization through live streaming, influencer partnerships, and branded collaborations.

- Revenue Model: Subscription-based models led with 42.7% share in 2024, supported by recurring revenue streams from platforms such as Twitch and YouTube Gaming, where audiences increasingly prefer predictable, ad-free access to content.

- Driver: The surge in gaming influencers is a key growth driver. Between 2020 and 2022, the number of gaming influencers grew by 213%, and by the end of 2024, the global total is expected to reach 467,000, significantly expanding monetization opportunities for platforms and brands.

- Restraint: Monetization remains a challenge for smaller creators. On average, it takes 6.5 months for creators to earn their first dollar, and 70% of creators spend fewer than 10 hours per week on content, limiting scalability and income potential.

- Opportunity: India represents a high-growth market with 300,000 active gaming creators and a gaming audience exceeding 600 million users. Rising adoption in Tier-II cities, where viewership for streamers has increased from 20% to 25%, positions the region as a key investment hotspot.

- Trend: AI adoption is accelerating in content creation. Creators are increasingly using AI-driven editing and personalization tools to streamline production and enhance audience engagement, reducing technical barriers and expanding creative output.

- Regional Analysis: North America led in 2024 with a 40.5% share, generating USD 11.5 billion in revenue, while the US alone contributed USD 9.28 billion with a CAGR of 21.6%. Asia-Pacific, led by India, is the fastest-growing region, supported by expanding internet penetration, mobile-first gaming adoption, and a rapidly scaling creator base.

Type of Creators Analysis

Streamers and content creators remain the largest contributor to the gaming creator economy in 2025, accounting for more than 36% of total market share. Their dominance is supported by the continued expansion of platforms such as Twitch, YouTube Gaming, and Facebook Gaming, which collectively attract hundreds of millions of monthly active users. The ability to deliver real-time, interactive content has positioned streamers as the primary drivers of audience engagement and monetization.

Revenue diversification has become a defining feature of this segment. Leading creators now generate income through a mix of subscriptions, sponsorships, advertising, and direct fan contributions. In 2025, sponsorship-linked revenues are projected to grow at over 20% annually, reflecting the rising importance of influencer-led marketing in gaming. Cross-platform streaming, enabled by policy changes that allow simulcasting, has further expanded reach and improved monetization opportunities.

Other creator categories, including game developers, influencers, and esports athletes, are also gaining traction. Esports teams, for example, are increasingly monetizing through media rights and brand partnerships, while independent developers are leveraging creator-focused platforms to distribute content directly to audiences. Together, these segments are broadening the ecosystem and reducing reliance on a single creator type.

Monetization Model Analysis

Subscription-based models continue to dominate in 2025, representing more than 43% of total revenues. Services such as Xbox Game Pass, PlayStation Plus, and Apple Arcade have reshaped consumer behavior by offering extensive game libraries at predictable monthly costs. This model appeals to cost-conscious gamers seeking variety without high upfront spending.

The growth of cloud gaming and 5G connectivity has accelerated adoption, reducing latency and enabling high-quality gameplay across devices. This has made subscription services more attractive to users in emerging markets, where hardware affordability remains a barrier. Economic conditions also play a role. During periods of financial uncertainty, consumers increasingly prefer subscriptions over one-time purchases, reinforcing the resilience of this model.

While subscriptions dominate, alternative models such as one-time purchases and pay-per-use remain relevant. Premium game launches continue to generate significant revenues, particularly for blockbuster titles, while pay-per-use models are gaining traction in esports and live event streaming. The coexistence of these models ensures a diversified revenue base for the industry.

Platform Analysis

Streaming platforms hold the largest share of the creator economy in 2025, accounting for more than 46% of revenues. Twitch, YouTube Gaming, and Facebook Gaming remain central to content distribution, supported by robust infrastructure that enables high-quality, low-latency streaming. These platforms have become the primary venues for esports broadcasting, live gameplay, and community-driven content.

Revenue models on these platforms are increasingly diversified. Beyond advertising, subscription tiers, donations, and pay-per-view events are driving engagement and monetization. For example, Twitch’s tiered subscription model and YouTube’s Super Chat feature have created sustainable income streams for creators while strengthening viewer loyalty.

Social media platforms, gaming consoles, and PC/mobile ecosystems also play critical roles. TikTok and Instagram are expanding their influence in short-form gaming content, while console ecosystems such as PlayStation and Xbox continue to integrate creator tools. Mobile-first platforms are particularly important in Asia-Pacific, where mobile gaming dominates user engagement.

Content Type Analysis

Live streaming remains the leading content format in 2025, capturing more than 31% of the market. The popularity of esports tournaments, interactive gameplay, and real-time community engagement has cemented live streaming as the core of the creator economy. Viewership for esports alone is expected to surpass 650 million globally by 2025, driving demand for live, interactive formats.

Video-on-demand content, including tutorials, reviews, and gameplay highlights, continues to expand as a complementary format. This segment benefits from long-tail consumption, where archived content generates sustained engagement and advertising revenue. Esports content and gaming tutorials are also gaining traction, particularly among younger demographics seeking skill development and competitive insights.

The diversification of content formats ensures that creators can target multiple audience segments simultaneously. This multi-format approach enhances monetization opportunities and reduces dependency on a single content type.

Regional Analysis

North America continues to lead the global gaming creator economy in 2025, accounting for more than 38% of revenues, or approximately USD 55 billion. The region’s dominance is supported by advanced digital infrastructure, high broadband penetration, and the presence of leading platforms and esports organizations. The United States remains the single largest market, with creators benefiting from strong advertiser demand and mature monetization ecosystems.

Asia-Pacific is the fastest-growing region, projected to expand at a CAGR above 25% through 2034. India and Southeast Asia are key growth engines, supported by mobile-first gaming adoption, expanding internet access, and a rapidly growing base of creators. India alone now hosts more than 350,000 active gaming creators, supported by an audience exceeding 650 million gamers.

Europe maintains a strong position, particularly in markets such as Germany, the UK, and France, where esports and streaming adoption are accelerating. Latin America and the Middle East & Africa are emerging as investment hotspots, driven by rising smartphone penetration and growing interest in esports. These regions, while smaller in absolute size, present significant long-term opportunities for investors and platforms seeking new growth frontiers.

Get More Information about this report -

Request Free Sample ReportKey Market Segments

By Type of Creators

- Streamers/Content Creators

- Game Developers

- Influencers

- Esports Athletes/Teams

By Monetization Model

- Subscription-Based

- One-Time Purchases

- Pay-per-Use

By Platform

- Streaming Platforms

- Social Media Platforms

- Gaming Consoles

- PC/Mobile Gaming

By Content Type

- Live Streaming

- Video Content (On-Demand)

- Esports Content

- Gaming Tutorials and Guides

- Others

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 30.6 billion |

| Forecast Revenue (2034) | USD 235.4 billion |

| CAGR (2024-2034) | 25.2% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Type of Creators, (Streamers/Content Creators, Game Developers, Influencers, Esports Athletes/Teams), By Monetization Model, (Subscription-Based, One-Time Purchases, Pay-per-Use), By Platform, (Streaming Platforms, Social Media Platforms, Gaming Consoles, PC/Mobile Gaming), By Content Type, (Live Streaming, Video Content (On-Demand), Esports Content, Gaming Tutorials and Guides, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | KRAFTON, Inc., Patreon, Microsoft Corporation, Activision Blizzard, Inc., Discord, Meta Platforms, Inc., Logitech Services S.A., Epic Games, Inc., Amazon.com, Inc., Google LLC, Others |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Creator Economy in Gaming Market

Published Date : 07 Jan 2026 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date