Cross-Border E-commerce Market Growth 2025–2034 | 12.4% CAGR

Global Cross-border E-commerce Market Size, Share, Analysis Report By Product Category (Food & Beverages,Electronics & Media,Fashion & Apparel,Personal Care & Beauty,Home & Furniture,Others (Automotive parts, Healthcare products, etc.)),Platform Type (B2C,C2C,B2B),Payment Method (Bank Transfers,Credit/Debit Cards,Digital Wallets),Region and Key Players - Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends and Forecast 2025-2034

Report Overview:

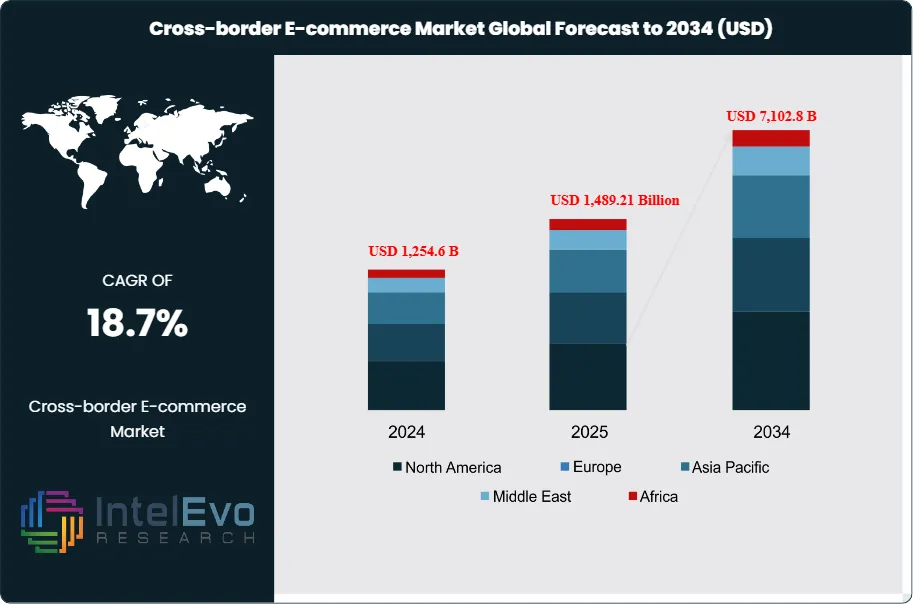

The Cross-Border E-commerce Market size is projected to reach approximately USD 7,102.8 Billion by 2034, up from USD 1,254.6 Billion in 2024, growing at a CAGR of 18.7% during the forecast period from 2025 to 2034. This tremendous growth is driven by the rapid adoption of digital payment systems, international logistics advancements, and the increasing participation of SMEs and D2C brands in global online trade. Consumers worldwide are demanding diverse, high-quality, and affordable products, fueling transactions across regions. With AI-powered personalization, blockchain-based supply chain tracking, and rising demand from emerging economies, cross-border e-commerce is transforming global retail — empowering brands to reach borderless markets and redefine international commerce.

Get More Information about this report -

Request Free Sample ReportThe cross-border e-commerce market involves the online trade of goods and services across international borders through various digital platforms. This market encompasses a broad array of product categories including electronics and media, fashion and apparel, personal care and beauty, food and beverages, and automotive parts, offering consumers access to global brands beyond domestic boundaries. Factors propelling the market growth include increasing internet penetration, the widespread adoption of smartphones, growing consumer demand for international products, and the expanding capabilities of logistics providers enabling faster and more reliable cross-border deliveries. Additionally, supportive policies and advances in secure cross-border payment solutions are facilitating seamless transactions and building customer trust.

Furthermore, the market has been significantly influenced by dynamic platform types, primarily B2C, B2B, and C2C models. B2C platforms such as Alibaba, Amazon, and JD.com dominate due to their vast product assortments, strong brand equity, and efficient fulfillment capabilities. Credit and debit card payments, along with digital wallets, have emerged as preferred payment methods, while robust logistics partnerships and advanced warehousing support have addressed cross-border delivery challenges. However, currency fluctuations, complex tax regulations, and customs clearance complexities still pose operational constraints for retailers venturing into global markets.

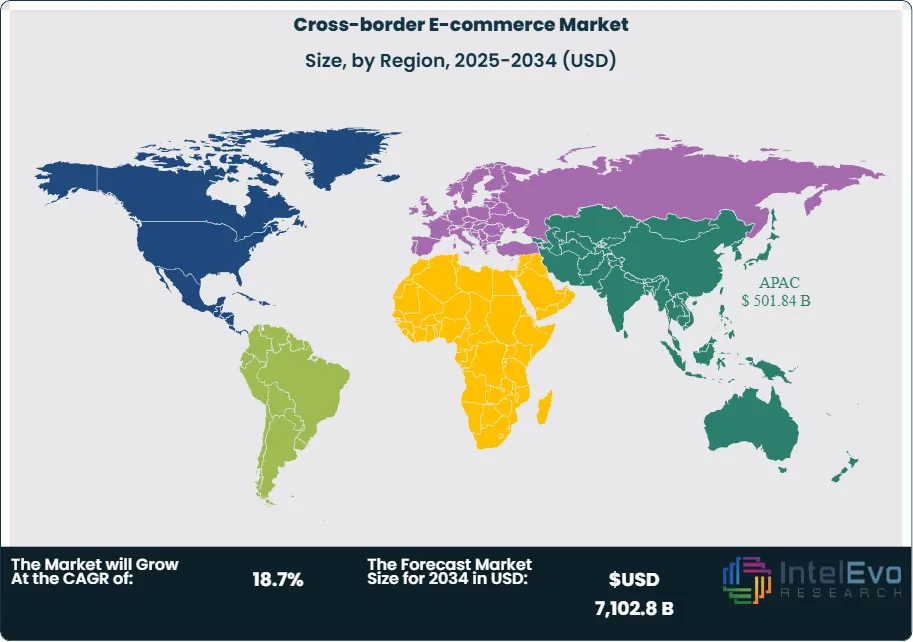

Regionally, Asia Pacific leads the cross-border e-commerce landscape, driven by a tech-savvy population, substantial growth in disposable incomes, and widespread digital infrastructure in China, Japan, South Korea, and Southeast Asia. North America and Europe also represent lucrative regions, backed by mature logistics frameworks and high demand for foreign products. Latin America and the Middle East & Africa are emerging markets that offer strong growth potential in the coming years due to their rapidly evolving e-commerce ecosystems and rising cross-border purchasing trends.

The COVID-19 pandemic had a mixed impact on the market. On the one hand, it disrupted supply chains, leading to delays and inventory shortages. On the other hand, it accelerated digital adoption as lockdowns encouraged more consumers to shop internationally online. This shift has created lasting changes in shopping behavior, with cross-border e-commerce becoming an essential component of global retail strategies.

Key Takeaways:

- Market Growth: The Cross-border E-commerce Market is expected to reach USD 7,102.8 Billion by 2034, fueled by technological advancements, evolving consumer preferences, and the globalization of retail operations.

- Product Category Dominance: Electronics and media have emerged as the dominant product category, driven by strong consumer demand for gadgets, entertainment products, and cross-border access to exclusive releases.

- Platform Type Dominance: B2C platforms lead due to their sophisticated logistics networks, trust-building measures, and efficient payment gateways, which collectively enhance the cross-border shopping experience.

- Payment Method Dominance: Credit and debit cards remain the most preferred payment method, benefiting from widespread global acceptance and perceived transaction security.

- Driver: Digital transformation, including mobile commerce and secure payment infrastructure, is a key driver fostering sustained cross-border transactions.

- Restraint: Regulatory challenges and customs complexities remain significant barriers, increasing operational costs and delivery timelines for merchants.

- Opportunity: Emerging economies and the growing demand for niche international products present immense opportunities for retailers to capture untapped markets.

- Trend: Personalization of shopping experiences and integration of AI-powered recommendation engines are transforming cross-border retail engagement.

- Regional Analysis: Asia Pacific dominates, propelled by China’s large cross-border shopper base and supportive policies, while Europe and North America continue to mature, and Latin America shows strong momentum.

Product Category Analysis:

Electronics & Media Leads With more than 30% Market Share In Cross-border E-commerce Market, Electronics and media constitute the largest share of cross-border e-commerce transactions. Consumers across regions increasingly purchase smartphones, laptops, tablets, cameras, and entertainment content from international sellers to gain access to the latest technology at competitive prices. High product margins, frequent product launches, and strong marketing campaigns have also fueled this segment. Brands leverage exclusive cross-border deals and partnerships with logistics companies to ensure timely delivery and after-sales service, further cementing consumer trust. As digital lifestyles evolve, this segment will remain central to the market’s expansion.

Platform Type Analysis:

B2C models dominate the market as platforms like Amazon, Alibaba, and JD.com have established global footprints, offering unparalleled product variety, transparent pricing, and robust customer support. These platforms invest heavily in cross-border logistics, warehousing, and localized marketing to address language, currency, and regulatory barriers. Their advanced ecosystems integrate payment gateways, fraud prevention, and real-time tracking, all of which significantly improve the shopping experience and reduce cart abandonment. Consequently, B2C channels will continue driving cross-border e-commerce growth.

Payment Method Analysis:

Credit and debit cards are the preferred payment method for cross-border e-commerce transactions, accounting for a substantial portion of sales value. Consumers trust these instruments for their fraud protection mechanisms and ease of currency conversion. Card providers have also introduced solutions tailored for international purchases, such as multi-currency wallets, installment options, and cashback rewards. This widespread adoption, combined with regulatory frameworks ensuring secure processing, will sustain cards’ dominance, although digital wallets are gaining ground rapidly among younger demographics.

Region Analysis:

Asia Pacific Leads With over 40% Market Share In Cross-border E-commerce Market, The Asia Pacific region leads the global cross-border e-commerce market, driven by its position as the world's manufacturing hub, advanced digital infrastructure, and rapidly growing middle-class population with increasing disposable income. China dominates this regional leadership through its massive e-commerce ecosystem, supported by platforms like Alibaba, JD.com, and Tmall, which have created comprehensive cross-border commerce solutions. The region benefits from government initiatives promoting digital trade, favorable regulatory frameworks, and investments in logistics infrastructure that facilitate international commerce. Additionally, the high smartphone adoption rates and mobile-first commerce strategies in countries like South Korea, Japan, and Southeast Asian nations have accelerated cross-border e-commerce adoption.

North America and Europe represent mature markets with established e-commerce ecosystems, high consumer purchasing power, and advanced payment infrastructures. These regions show steady growth with consumers increasingly seeking international products for variety and competitive pricing. Latin America and Africa present significant growth opportunities, with improving internet connectivity, rising smartphone adoption, and growing consumer confidence in online transactions driving market expansion. The electronics and media segment is expected to maintain its growth trajectory across all regions, while fashion and personal care segments show promising potential in emerging markets as consumer preferences evolve and international brand awareness increases.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

By Category

- Fashion & Apparel

- Electronics & Consumer Goods

- Beauty & Personal Care

- Food & Beverages

- Home & Living

- Automotive Parts & Accessories

- Others

By Platform Type

- B2C (Business to Consumer)

- B2B (Business to Business)

- C2C (Consumer to Consumer)

By Payment Method

- Digital Wallets

- Credit/Debit Cards

- Bank Transfers

- Cash on Delivery (COD)

- Others

By End-User

- Individual Consumers

- Small & Medium Enterprises (SMEs)

- Large Enterprises

By Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 1,489.21 Billion |

| Forecast Revenue (2034) | USD 7,102.8 B |

| CAGR (2025-2034) | 18.7% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Category, Fashion & Apparel, Electronics & Consumer Goods, Beauty & Personal Care, Food & Beverages, Home & Living, Automotive Parts & Accessories, Others, By Platform Type, B2C (Business to Consumer), B2B (Business to Business), C2C (Consumer to Consumer), By Payment Method, Digital Wallets, Credit/Debit Cards, Bank Transfers, Cash on Delivery (COD), Others, By End-User, Individual Consumers, Small & Medium Enterprises (SMEs), Large Enterprises |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Alibaba Group Holding Limited, ETao, AirBridgeCargo Airlines, AliExpress.com, Veepee, Amazon.com Inc., Fruugo.com Ltd., ASOS, BigCommerce, eBay Inc., LightInTheBox, Eunimart Multichannel, Jagged Peak, Zalando, JD.com, Vipshop, Pitney Bowes, Tmall |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Cross-border E-commerce Market

Published Date : 09 Jul 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date