Cross-border Payments Market Size, Trends, Drivers | CAGR 7.2%

Global Cross-border Payments Market Size, Share & Analysis Report by Payment Type (Bank Transfers, Card Payments, Mobile Wallets, Blockchain & Crypto Solutions, Remittances), End-User (B2B, C2C, C2B, B2C, Financial Institutions, E-commerce, Gig Economy), Service Provider (Banks, Fintechs, PSPs, MTOs, Card Networks, Blockchain Platforms), Region & Key Players – Industry Overview, Dynamics, Trends & Forecast 2025–2034

Report Overview

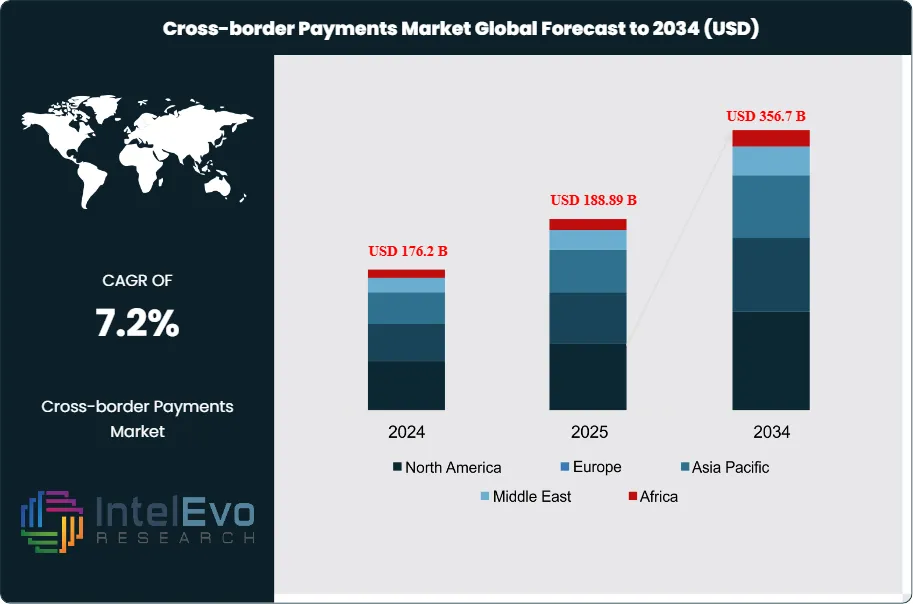

The Cross-border Payments Market size is expected to be worth around USD 356.7 Billion by 2034, up from USD 176.2 Billion in 2024, growing at a CAGR of 7.2% during the forecast period from 2024 to 2034. The cross-border payments market encompasses the systems, platforms, and services that facilitate the transfer of funds between individuals, businesses, and financial institutions across international borders.

Get More Information about this report -

Request Free Sample ReportThis market represents a critical component of the global financial ecosystem, enabling international trade, remittances, e-commerce, and investment flows. Cross-border payments include a wide range of instruments and channels, such as wire transfers, card payments, mobile wallets, remittance services, and emerging blockchain-based solutions. The market is characterized by its complexity, involving multiple currencies, regulatory frameworks, and intermediaries, as well as the need for speed, transparency, security, and cost efficiency.

The cross-border payments market is experiencing robust growth driven by globalization, the expansion of international trade, the rise of digital commerce, and the increasing mobility of people and capital. Key growth catalysts include the proliferation of fintech innovations, the adoption of real-time payment systems, and the growing demand for seamless, low-cost, and transparent payment experiences. The market benefits from ongoing regulatory harmonization efforts, public-private partnerships, and the integration of advanced technologies such as artificial intelligence, machine learning, and distributed ledger technology (DLT).

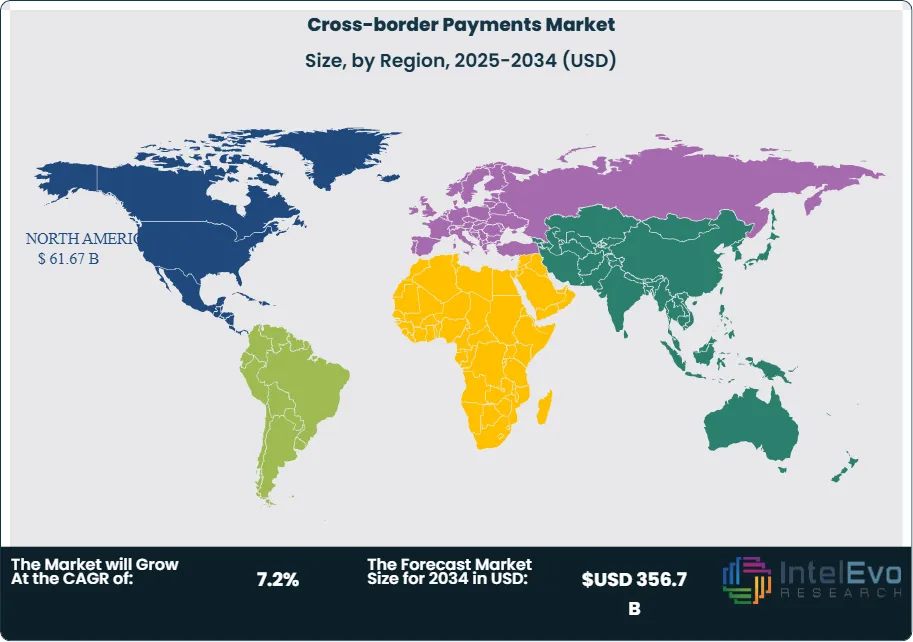

North America and Europe dominate the global cross-border payments market, with leadership stemming from advanced financial infrastructure, high volumes of international transactions, and a strong presence of global banks and payment service providers. Asia-Pacific represents the fastest-growing regional market, driven by rapid economic development, the rise of cross-border e-commerce, and increasing remittance flows from migrant workers.

The COVID-19 pandemic fundamentally accelerated the adoption of digital cross-border payment solutions as businesses and consumers shifted to online channels, remote work, and contactless transactions. The crisis highlighted the importance of resilient, flexible, and scalable payment systems, spurring investment in digital infrastructure, cybersecurity, and regulatory compliance.

Rising concerns about fraud, money laundering, and regulatory fragmentation have significantly influenced the market, creating opportunities for providers to differentiate through secure, compliant, and innovative solutions. The market is also witnessing increased demand for real-time payments, multi-currency wallets, and embedded finance, as well as the emergence of new business models such as B2B marketplaces, gig economy platforms, and decentralized finance (DeFi).

Key Takeaways

- Market Growth: The Cross-border Payments Market is expected to reach USD 356.7 Billion by 2034, fueled by globalization, digital commerce, and ongoing fintech innovation.

- Payment Type Dominance: Bank transfers and card payments remain the dominant channels, but mobile wallets and blockchain-based solutions are growing rapidly.

- End-User Dominance: Businesses (B2B) account for the majority of transaction value, but consumer (C2C, C2B, B2C) segments are expanding due to e-commerce and remittance flows.

- Service Provider Dominance: Banks and traditional financial institutions lead in volume, but fintechs and non-bank providers are capturing market share through innovation and customer experience.

- Driver: Key drivers accelerating growth include the expansion of international trade, the rise of digital platforms, and the demand for real-time, low-cost, and transparent payments.

- Restraint: Growth is hindered by regulatory complexity, high transaction costs, and challenges related to fraud, compliance, and interoperability.

- Opportunity: The market is poised for expansion due to opportunities like real-time payments, embedded finance, and the adoption of blockchain and AI for compliance and risk management.

- Trend: Emerging trends including digital currencies, open banking, and the convergence of payments and commerce are reshaping the market by enabling new business models and customer experiences.

- Regional Analysis: North America and Europe lead owing to advanced infrastructure and high transaction volumes. Asia-Pacific shows high promise due to rapid economic growth, e-commerce, and remittance flows.

Payment Type Analysis

Bank Transfers and Card Payments Lead, Mobile Wallets and Blockchain Solutions Surge: Bank transfers and card payments remain the cornerstone of the cross-border payments market. These channels are widely used for B2B, B2C, and C2C transactions, offering reliability, global reach, and integration with existing financial systems. SWIFT-based wire transfers, SEPA payments in Europe, and international card networks (Visa, Mastercard, UnionPay) facilitate trillions of dollars in cross-border flows annually.

Mobile wallets and digital payment platforms (such as PayPal, Alipay, WeChat Pay, and Revolut) are experiencing rapid growth, particularly in emerging markets and among younger, tech-savvy consumers. These solutions offer speed, convenience, and lower costs, often bypassing traditional banking infrastructure.

Blockchain-based solutions and cryptocurrencies are emerging as disruptive forces, enabling near-instant, low-cost, and transparent cross-border transfers. Platforms such as Ripple, Stellar, and stablecoin networks are being adopted by fintechs, remittance providers, and even some banks to streamline settlement and reduce friction.

End-User Analysis

Businesses (B2B) Dominate, But Consumer Segments Expand: Businesses (B2B) account for the majority of cross-border payment value, driven by international trade, supply chain finance, and global investment flows. Corporates require secure, efficient, and compliant payment solutions to manage payroll, vendor payments, treasury operations, and cross-border invoicing. The complexity of B2B payments—often involving multiple currencies, regulatory checks, and reconciliation—creates demand for specialized platforms and services.

Consumer segments—including C2C (remittances), C2B (e-commerce), and B2C (freelancer and gig economy payouts)—are expanding rapidly. The rise of global e-commerce, online marketplaces, and remote work has increased the volume and frequency of cross-border consumer payments. Remittances from migrant workers to families in developing countries represent a significant share of global flows, with digital channels gaining market share from traditional cash-based services.

Service Provider Analysis

Banks Lead in Volume, Fintechs Drive Innovation: Banks and traditional financial institutions remain the primary facilitators of cross-border payments, leveraging established networks, regulatory expertise, and customer trust. However, fintechs and non-bank providers are capturing market share by offering faster, cheaper, and more user-friendly solutions. Companies such as Wise (formerly TransferWise), Payoneer, Remitly, and WorldRemit have disrupted the market with transparent pricing, real-time tracking, and digital onboarding.

Payment service providers (PSPs), card networks, and money transfer operators (MTOs) play critical roles in enabling cross-border flows, particularly for small businesses and consumers. The rise of embedded finance—where payment capabilities are integrated into non-financial platforms such as marketplaces, SaaS tools, and gig economy apps—is further expanding the ecosystem.

Collaboration between banks, fintechs, and technology vendors is increasing, with partnerships focused on interoperability, compliance, and customer experience. The adoption of open banking APIs, real-time settlement networks, and shared KYC/AML utilities is driving efficiency and innovation.

Region Analysis

North America and Europe Lead, Asia-Pacific Is Fastest-Growing: North America and Europe dominate the global cross-border payments market, accounting for a combined market share of over 60% in 2024. These regions benefit from advanced financial infrastructure, high volumes of international trade, and a strong presence of global banks, PSPs, and fintech innovators. The United States, Canada, the United Kingdom, Germany, and France are key markets, with businesses and consumers demanding fast, secure, and cost-effective payment solutions.

Asia-Pacific is the fastest-growing region, propelled by rapid economic development, the rise of cross-border e-commerce, and increasing remittance flows. Countries such as China, India, Singapore, Japan, and Australia are witnessing significant market expansion, driven by digital wallet adoption, government initiatives, and the growth of regional payment networks.

Latin America and the Middle East & Africa are emerging markets, with growing demand for affordable, accessible, and reliable cross-border payment services. Investments in digital infrastructure, regulatory modernization, and financial inclusion are unlocking new opportunities for market growth.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

Payment Type

- Bank Transfers (SWIFT, SEPA, Wire)

- Card Payments (Visa, Mastercard, UnionPay)

- Mobile Wallets & Digital Platforms (PayPal, Alipay, WeChat Pay)

- Blockchain & Cryptocurrency Solutions (Ripple, Stellar, Stablecoins)

- Remittance Services

- Others

End-User

- Businesses (B2B)

- Consumers (C2C, C2B, B2C)

- Financial Institutions

- E-commerce Platforms

- Gig Economy & Freelancers

Service Provider

- Banks & Financial Institutions

- Fintechs & Non-bank Providers

- Payment Service Providers (PSPs)

- Money Transfer Operators (MTOs)

- Card Networks

- Blockchain Platforms

Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 188.89 B |

| Forecast Revenue (2034) | USD 356.7 B |

| CAGR (2025-2034) | 7.2% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Payment Type (Bank Transfers (SWIFT, SEPA, Wire), Card Payments (Visa, Mastercard, UnionPay), Mobile Wallets & Digital Platforms (PayPal, Alipay, WeChat Pay), Blockchain & Cryptocurrency Solutions (Ripple, Stellar, Stablecoins), Remittance Services, Others), End-User (Businesses (B2B), Consumers (C2C, C2B, B2C), Financial Institutions, E-commerce Platforms, Gig Economy & Freelancers), Service Provider (Banks & Financial Institutions, Fintechs & Non-bank Providers, Payment Service Providers (PSPs), Money Transfer Operators (MTOs), Card Networks, Blockchain Platforms) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Visa Inc., Mastercard Inc., PayPal Holdings Inc., Wise (formerly TransferWise), Western Union Holdings Inc., Revolut Ltd., Remitly Global Inc., Ripple Labs Inc., SWIFT (Society for Worldwide Interbank Financial Telecommunication), MoneyGram International Inc., WorldRemit Ltd., Payoneer Inc., Skrill (Paysafe Group), OFX Group Limited, Instarem (part of Nium), Wise Platform (B2B Infrastructure), Stripe Inc., Square Inc. (Block), Adyen N.V., Airwallex |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the Cross-border Payments Market?

Global cross-border payments market is projected to grow from USD 176.2 Bn in 2024 to USD 356.7 Bn by 2034, expanding at a CAGR of 7.2%. Explore trends and key drivers.

Who are the major players in the Cross-border Payments Market?

Visa Inc., Mastercard Inc., PayPal Holdings Inc., Wise (formerly TransferWise), Western Union Holdings Inc., Revolut Ltd., Remitly Global Inc., Ripple Labs Inc., SWIFT (Society for Worldwide Interbank Financial Telecommunication), MoneyGram International Inc., WorldRemit Ltd., Payoneer Inc., Skrill (Paysafe Group), OFX Group Limited, Instarem (part of Nium), Wise Platform (B2B Infrastructure), Stripe Inc., Square Inc. (Block), Adyen N.V., Airwallex

Which segments covered the Cross-border Payments Market?

Payment Type (Bank Transfers (SWIFT, SEPA, Wire), Card Payments (Visa, Mastercard, UnionPay), Mobile Wallets & Digital Platforms (PayPal, Alipay, WeChat Pay), Blockchain & Cryptocurrency Solutions (Ripple, Stellar, Stablecoins), Remittance Services, Others), End-User (Businesses (B2B), Consumers (C2C, C2B, B2C), Financial Institutions, E-commerce Platforms, Gig Economy & Freelancers), Service Provider (Banks & Financial Institutions, Fintechs & Non-bank Providers, Payment Service Providers (PSPs), Money Transfer Operators (MTOs), Card Networks, Blockchain Platforms)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Cross-border Payments Market

Published Date : 05 Aug 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date