Customer Care BPO Market Size, Trends & Forecast 2034 | 10.1% CAGR

Global Customer Care BPO Market Size, Share, Analysis Report By Product Type (Offshore Outsourcing, Onshore Outsourcing), End-user (BFSI, Retail and E-commerce, Telecom and IT, Healthcare and Life Science, Others), Region and Key Players - Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends and Forecast 2025-2034

Report Overview:

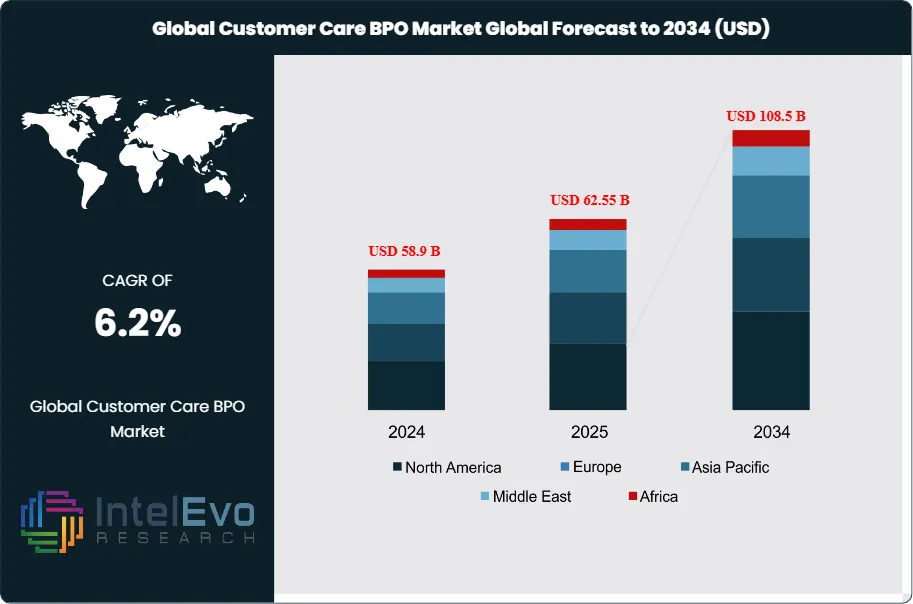

The Global Customer Care BPO Market size is projected to reach approximately USD 108.5 billion by 2034, rising from USD 58.9 billion in 2024, growing at a CAGR of 6.2% during the forecast period from 2025 to 2034. The rapid adoption of AI-driven automation, cloud-based contact centers, and personalized customer engagement strategies are reshaping the BPO landscape. As businesses prioritize customer retention and omnichannel experiences, the demand for advanced BPO services is expected to surge globally. The rise of AI chatbots, multilingual support systems, and data analytics integration is setting new benchmarks in customer service efficiency, making this market one of the most dynamic in the global outsourcing industry.

Get More Information about this report -

Request Free Sample ReportCustomer Care BPO (Business Process Outsourcing) refers to the outsourcing of customer service operations to a third-party provider. These providers manage customer interactions on behalf of a business through various channels such as phone calls, emails, live chat, and social media. The primary goal is to handle customer inquiries, complaints, technical support, order processing, and after-sales services efficiently and professionally. By partnering with a BPO, companies can reduce operational costs, access trained customer service experts, and provide 24/7 support without maintaining an in-house team. This approach is especially popular in industries like telecommunications, e-commerce, banking, and travel, where constant and high-quality customer support is essential for maintaining satisfaction and loyalty.

The customer care BPO (Business Process Outsourcing) market is experiencing steady growth, driven by a blend of technological advancement, cost optimization, and evolving consumer expectations. As companies across the globe continue their digital transformation journeys, the integration of AI-powered tools such as chatbots, virtual assistants, and predictive analytics is becoming a cornerstone of modern customer service. This shift enables businesses to provide faster, more personalized, and round-the-clock support while reducing operational costs. The demand for omnichannel customer experiences—seamless service across voice, email, chat, and social platforms—is also pushing BPO providers to adopt advanced technologies and deliver consistent, high-quality interactions.

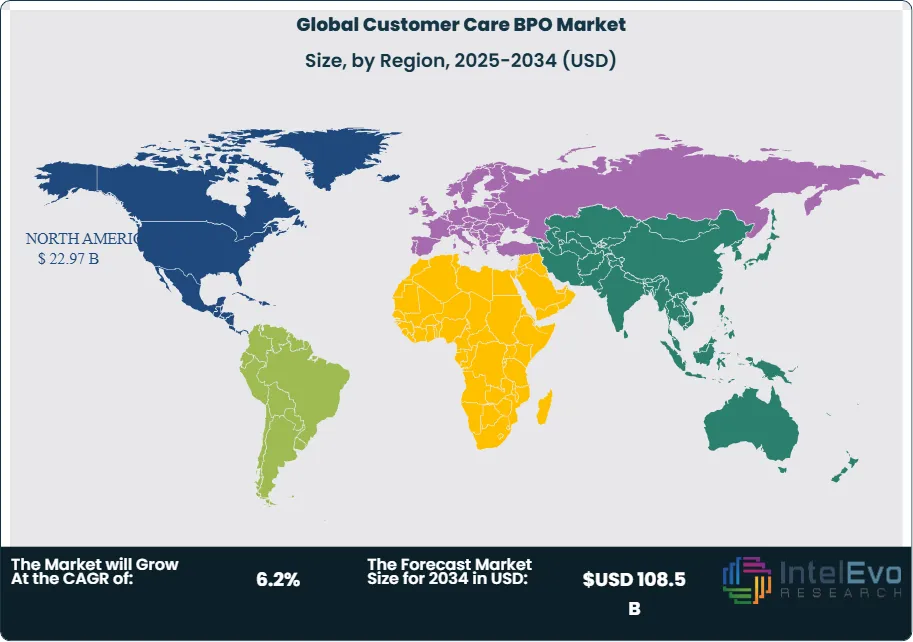

The customer care BPO market in North America is a mature and strategically important segment, driven by the region’s high demand for quality, personalized, and scalable customer support services. Companies across industries such as retail, telecommunications, healthcare, financial services, and technology are increasingly relying on BPO partners to manage growing customer expectations while maintaining operational efficiency. While traditional offshore outsourcing to regions like India and the Philippines continues for cost-saving purposes, there is a noticeable shift toward nearshoring to countries such as Canada and those in Latin America. This trend is largely influenced by the need for better time zone alignment, cultural compatibility, and enhanced data privacy in compliance with regulations like GDPR, HIPAA, and the California Consumer Privacy Act (CCPA).

The COVID-19 pandemic had a profound impact on the customer care BPO market, accelerating key changes and reshaping how services are delivered. Initially, the industry faced disruptions due to lockdowns, office closures, and limited infrastructure for remote work. However, BPO providers quickly adapted by transitioning to work-from-home models, investing in secure cloud-based systems, and implementing digital tools to maintain service continuity. This shift not only ensured business resilience but also introduced a more flexible and scalable operating model that continues to benefit the industry.

Key Takeaways:

- Market Growth: The customer care BPO market is expected to reach USD 108.5 billion by 2034, growing at a robust CAGR of 6.2%, indicating strong market expansion.

- Product type Segment Dominance: The offshore outsourcing segment is dominated by cross flow, accounting for over 63% of the market share. Offshore outsourcing is the practice of hiring companies in other countries, often in different time zones, to reduce costs and access specialized skills. It remains popular due to benefits like lower expenses, faster task completion, and easy scalability without expanding in-house staff.

- End-user Segment Insights: BFSI segment is anticipated to hold the largest market share, due to digital banking, increased customer inquiries, and growing competition. Key players focus on customer acquisition and retention, while tech advancements and government support for cashless economies further drive BPO growth.

- Driver: The growth of the customer care BPO market is driven by rapid digital transformation and the adoption of advanced technologies such as AI, chatbots, and cloud-based contact centers. As businesses seek cost-efficient ways to manage customer interactions, outsourcing has become an increasingly attractive solution. Moreover, the rising demand for 24/7 omnichannel support across voice, email, chat, and social media is encouraging organizations to partner with BPO providers that can deliver consistent, high-quality customer experiences.

- Restraint: The customer care BPO market faces key restraints such as strict data privacy regulations (e.g., GDPR, HIPAA, CCPA), which demand significant investment in compliance and security. High employee turnover affects service consistency, while offshore operations can face challenges with language barriers, cultural alignment, and quality control—impacting overall customer satisfaction and trust.

- Opportunity: Rapid urbanization and industrial growth in countries like India, China, Brazil, and Southeast Asia are increasing demand for water treatment solutions. Government initiatives to improve water infrastructure present huge market potential.

- Trend: Customer care BPO market is driven by AI, automation, and data analytics for personalized, efficient service. Key trends include self-service tools, omnichannel support, remote work models, strong data security, and employee upskilling. The focus is on tech integration and enhanced customer experience.

- Regional Analysis: The customer care BPO market in North America is mature and growing steadily, driven by rising demand for high-quality, personalized customer support across industries. Companies are increasingly adopting digital tools like AI, cloud contact centers, and omnichannel platforms to enhance customer experience. While offshore outsourcing remains common, nearshoring to Canada and Latin America is gaining popularity due to better time zone alignment and regulatory compliance. The shift to remote work has also expanded the talent pool and improved flexibility. Multilingual support, especially in English, Spanish, and French, is in high demand, reflecting the region's diverse customer base.

Service Type Analysis:

Customer care BPO market can be categorized by product type. These include offshore outsourcing and onshore outsourcing. Offshore outsourcing product type is expected to dominate the product type segment during the forecast period. Offshore outsourcing involves hiring a company located in another country—often with a significant time zone difference—to handle specific business functions. This practice gained popularity due to its potential to deliver services at significantly lower costs compared to employing in-house staff. The demand for offshore outsourcing continues to rise because it offers several key advantages. These include cost savings, access to skilled professionals who bring specialized expertise and can often perform tasks more efficiently, and the ability to scale operations quickly without the burden of hiring and training new employees. Offshore outsourcing allows businesses to focus on core activities while leveraging global talent to manage support functions effectively.

End-user Analysis:

End-user segments of the customer care BPO include BFSI, retail and e-commerce, telecom and IT, healthcare and life science, and others. The BFSI (Banking, Financial Services, and Insurance) industry is rapidly adopting digital banking, leading to a surge in customer inquiries. With increasing competition from new and existing players, companies are focusing on efficient customer acquisition and retention. As a result, demand for customer care BPO services is rising. Government support for cashless economies, advancements in credit and payment technologies, and evolving consumer behavior are also reshaping how financial firms operate. These factors collectively drive the growth of customer care BPO in the BFSI sector.

Region Analysis:

North America Leads With 39% Market Share in the Customer Care BPO Market. The North American customer care BPO market is experiencing steady and significant growth, driven by rapid technological advancements and increasing demand for efficient and personalized customer service. A major driver of this growth is the integration of advanced technologies such as artificial intelligence and automation. Companies like Verizon have reported notable improvements in service efficiency and sales through the use of AI-powered customer service tools. The shift towards omnichannel support is also shaping the market, as businesses strive to offer seamless customer experiences across phone, chat, email, and social media platforms. Data security and regulatory compliance have become key priorities, particularly in response to rising concerns over data privacy. Within the region, the United States leads the market, followed by Canada and Mexico, supported by mature IT infrastructure and a strong demand for high-quality service. Looking ahead, the North American BPO sector is well-positioned for continued expansion, with companies that focus on innovation and customer-centric strategies likely to maintain a competitive advantage.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

By Service Type

- Inbound Customer Support

- Outbound Customer Support

- Technical Support

- Omni-channel Support (Chat, Email, Voice, Social Media)

- Back-office Support Services

By Deployment Mode

- On-premise

- Cloud-based

- Hybrid

By Enterprise Size

- Small & Medium Enterprises (SMEs)

- Large Enterprises

By Industry Vertical

- BFSI

- IT & Telecommunications

- Healthcare

- Retail & E-commerce

- Travel & Hospitality

- Government & Public Sector

- Others

By Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 62.55 B |

| Forecast Revenue (2034) | USD 108.5 B |

| CAGR (2025-2034) | 6.2% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Service Type (Inbound Customer Support, Outbound Customer Support, Technical Support, Omni-channel Support (Chat, Email, Voice, Social Media), Back-office Support Services), By Deployment Mode (On-premise, Cloud-based, Hybrid), By Enterprise Size (Small & Medium Enterprises (SMEs), Large Enterprises), By Industry Vertical (BFSI, IT & Telecommunications, Healthcare, Retail & E-commerce, Travel & Hospitality, Government & Public Sector, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | TeleTech Holdings, Webhelp, Infosys BPM, West Corporation, Convergys, Atento., Acticall (Sitel), Serco, Transcom, StarTek Inc, Teleperformance SE, Concentrix Corporation, Alorica Inc., Genpact Ltd., Wipro Limited, HCL Technologies Limited, TTEC Holdings, Inc., [24]7.ai, Tech Mahindra Limited, Sutherland Global Services, Firstsource Solutions, IBM Corporation, Accenture PLC |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date