Cybersecurity Insurance Market Size, Share & Growth | CAGR 16.9%

Global Cybersecurity Insurance Market Size, Share & Analysis By Offering (Solution, Services), By Insurance Type (Standalone, Tailored), By Compliance Requirement (Healthcare Compliance, Financial Services Compliance, GDPR Compliance, Data Privacy Compliance, Other Compliance), By Insurance Coverage (Data Breach, Data Loss, Cybersecurity Liability), By End-User (Healthcare, Retail, BFSI, IT & Telecom, Manufacturing, Government agencies, Other End-Users), Risk Assessment Models, Pricing Trends, Competitive Strategies & Forecast 2025–2034

Report Overview

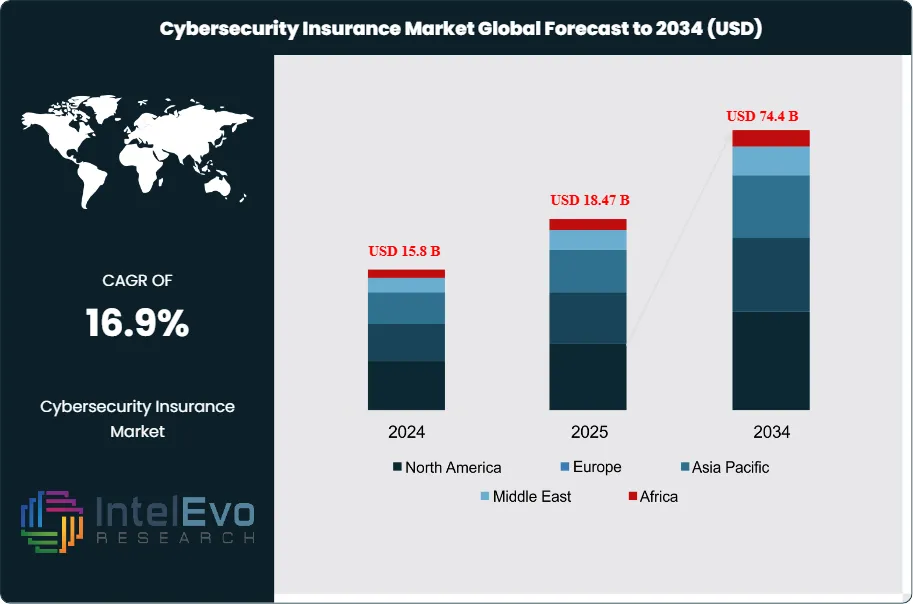

The Cybersecurity Insurance Market size is expected to be worth around USD 74.4 billion by 2034, up from approximately USD 15.8 billion in 2024, growing at a CAGR of 16.9% during the forecast period from 2025 to 2034. Cybersecurity insurance has rapidly evolved from a niche offering into a critical pillar of enterprise risk management, reflecting the intensifying scale and complexity of digital threats. As businesses expand their reliance on cloud computing, remote work systems, and digital platforms, the exposure to ransomware, phishing attacks, data breaches, and insider threats has surged dramatically. This heightened risk environment has accelerated demand for insurance products that safeguard organizations from the financial and reputational fallout of cyber incidents, covering costs related to business interruption, regulatory penalties, legal expenses, and data recovery.

Get More Information about this report -

Request Free Sample ReportThe market’s trajectory is underpinned by two key forces: rising cyberattack frequency and increasing regulatory scrutiny. Governments and industry bodies worldwide are enforcing stricter compliance frameworks—such as the European Union’s GDPR, the U.S. SEC’s cyber disclosure rules, and India’s Digital Personal Data Protection Act—which compel businesses to strengthen cyber resilience. Insurance has emerged as a vital complement to preventive cybersecurity measures, offering organizations an additional layer of protection that ensures continuity and financial stability in the aftermath of cyber events.

Technological advancements are also shaping the market, with insurers deploying artificial intelligence and advanced analytics to improve risk assessment, pricing models, and claims processing. AI-driven underwriting tools are enabling insurers to tailor coverage to specific organizational risk profiles, while real-time monitoring solutions are being integrated to proactively reduce exposure. Insurtech players are further driving innovation by streamlining policy management and expanding accessibility to small and medium-sized enterprises (SMEs), which are increasingly targeted by cybercriminals but often underprepared.

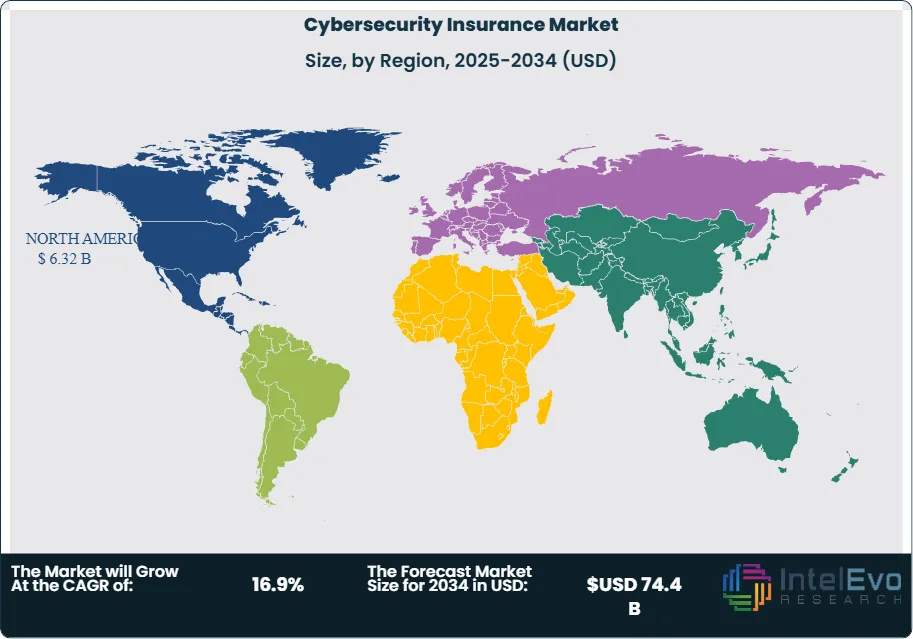

Regionally, North America leads the cybersecurity insurance market, supported by early regulatory adoption, high cyber awareness, and the presence of major insurers and reinsurers. Europe follows closely, with stringent data protection laws fueling rapid uptake. Meanwhile, Asia Pacific is emerging as the fastest-growing market, propelled by rapid digitalization, smart city initiatives, and rising cyber threats across financial services and critical infrastructure sectors. Latin America and the Middle East & Africa are also witnessing steady adoption as organizations in banking, energy, and government increasingly recognize cyber resilience as a strategic priority.

With cyber risks projected to escalate in both frequency and severity, cybersecurity insurance is poised to become an indispensable investment across industries, reinforcing its role as a safeguard for digital-first economies.

Key Takeaways

- Market Growth: By 2034, the global cybersecurity insurance market is forecast to be worth USD 74.4 billion, rising sharply from USD 15.8 billion in 2024. This growth, reflecting a CAGR of 16.9%, is being fueled by mounting cyber incidents, evolving data privacy regulations, and increasing corporate budgets dedicated to digital risk protection.

- Insurance Type: Standalone cyber insurance policies represent the dominant model, accounting for 63.6% of the market. Their appeal lies in providing specialized, clearly defined protection that goes far beyond the limited add-on coverage often found in general liability policies, enabling enterprises to align policies directly with their cyber risk profiles.

- Coverage Type: Liability-focused products capture 44.6% of revenues, underscoring the importance of financial protection against lawsuits, regulatory penalties, and customer redress following breaches or ransomware attacks. Enterprises across sectors are prioritizing liability insurance to mitigate the most costly outcomes of cyber incidents.

- End-Use Industry: The BFSI sector leads with 26.4% of market revenues, reflecting its position as a primary target for cybercriminals due to its sensitive financial data and transaction-heavy operations. Mandatory compliance frameworks such as PCI DSS and Basel III further compel institutions to integrate cyber insurance into their risk management playbooks.

- Driver: Cybercrime costs are projected to exceed USD 10 trillion annually in 2025, forcing organizations to view cybersecurity insurance as a non-negotiable safeguard. A surge in ransomware attacks, coupled with stiffer penalties for non-compliance, is accelerating adoption across both developed and emerging economies.

- Restraint: Pricing remains a barrier, with elevated premiums and limited actuarial history making policies less accessible—particularly for small and mid-sized enterprises. The presence of exclusions, including for nation-state attacks, further limits confidence and creates hesitation among prospective buyers.

- Opportunity: AI and big data are transforming underwriting and claims management. Insurers using predictive analytics can now offer more precise risk modeling, customizable coverage, and streamlined claims processes—opening up avenues to better serve SMEs and digital-first companies in underserved geographies.

- Trend: Strategic partnerships between insurers and cybersecurity vendors are gaining traction. Bundled offerings that integrate monitoring, detection, and coverage—such as alliances between AIG with IBM Security and Allianz with Palo Alto Networks—signal the industry’s pivot from reactive payouts toward proactive resilience solutions.

- Regional Analysis: North America maintains leadership with a 39.6% share, supported by regulatory mandates like SEC disclosure rules and the presence of large insurers. Europe follows with momentum from GDPR-driven compliance spending, while Asia Pacific is emerging as the fastest-growing market, buoyed by rapid digital transformation, smart city rollouts, and heightened cyber threats to financial and critical infrastructure.

Offering

The cybersecurity insurance landscape in 2025 is increasingly defined by a dual emphasis on solutions and services. While insurance policies form the backbone of this sector, services such as risk assessment, compliance consulting, and incident response advisory are becoming indispensable to enterprises managing complex digital ecosystems. Risk assessment offerings, in particular, are gaining traction as insurers provide detailed evaluations of an organization’s IT architecture, enabling businesses to identify vulnerabilities before they result in significant breaches.

Advisory and consulting services have also emerged as a critical growth area, as enterprises require guidance on navigating an expanding web of regulatory obligations and aligning insurance coverage with broader cybersecurity strategies. Leading insurers and consultancies are leveraging advanced analytics and AI-driven tools to provide tailored recommendations, helping clients not only purchase coverage but also strengthen their cyber resilience frameworks. The increasing reliance on managed services reflects a proactive approach, positioning insurers as partners in resilience rather than merely risk transfer providers.

Insurance Type

Standalone cybersecurity insurance policies continue to dominate the market in 2025, capturing more than 60% of overall revenue. These specialized policies provide comprehensive coverage against an expanding array of cyber risks, including ransomware attacks, data breaches, regulatory penalties, and cyber extortion. Unlike extensions of general liability policies, standalone offerings are designed with explicit terms and broader protections that resonate with enterprises facing increasingly severe and frequent threats.

This preference for standalone coverage reflects both the evolving sophistication of cyberattacks and the growing complexity of corporate IT environments. Tailored or add-on policies, while still relevant for small and medium-sized businesses, often lack the specificity required to address high-value exposures. As regulatory scrutiny intensifies and enterprises demand transparent, predictable coverage, standalone policies are expected to maintain their leadership, supported by insurers refining underwriting models with AI-driven risk analytics.

Compliance Requirement

Healthcare compliance remains the most prominent segment, underpinned by strict global regulations such as HIPAA in the U.S., GDPR in Europe, and emerging patient data protection laws in Asia. With healthcare data volumes surging due to electronic health records, telemedicine adoption, and connected medical devices, providers face unparalleled exposure to cyber risks. Insurance coverage tailored to healthcare compliance not only addresses regulatory fines but also helps organizations safeguard trust in patient care.

Financial services compliance also commands significant attention as banks, insurers, and fintechs contend with stringent supervisory frameworks like Basel III, PCI DSS, and evolving national data privacy laws. The need to balance innovation with security is driving this sector to integrate cyber insurance as a cornerstone of compliance. Additionally, GDPR compliance in Europe and emerging privacy frameworks in markets such as India are accelerating adoption across industries, positioning compliance-focused insurance products as a major growth engine through 2030.

End-Use Industry

The Banking, Financial Services, and Insurance (BFSI) sector continues to be the leading adopter, accounting for more than one-quarter of global market revenues in 2025. The sector’s dominance stems from its high-value data assets, heavy reliance on digital transactions, and susceptibility to sophisticated cyberattacks such as account takeovers and ransomware campaigns. Cyber insurance in BFSI serves dual purposes: financial protection and regulatory compliance. Institutions are compelled by regulators to implement robust cyber risk management frameworks, and insurance coverage is increasingly seen as a necessary safeguard to meet these obligations.

Beyond BFSI, industries such as healthcare, retail, and manufacturing are also ramping up adoption. Healthcare’s expansion is linked to digital health adoption, while retail and e-commerce players face risks tied to large-scale consumer data breaches. Manufacturing, meanwhile, is emerging as a new hotspot for cyber insurance, driven by vulnerabilities in operational technology (OT) systems and supply chain exposures. Across industries, the rising awareness of reputational damage and customer trust erosion is solidifying cyber insurance as a non-negotiable element of corporate strategy.

Regional Analysis

North America remains the global leader in 2025, capturing nearly 40% of total revenue. Its dominance is anchored by a mature insurance ecosystem, early adoption of digital-first risk management, and regulatory frameworks such as the SEC’s disclosure requirements on cyber incidents. The presence of leading insurers—including AIG, Chubb, and Travelers—further strengthens regional growth.

Europe follows closely, supported by stringent enforcement of GDPR and national-level privacy laws, driving organizations across industries to adopt cybersecurity insurance. Countries such as Germany, France, and the UK are particularly active, with growing demand from mid-sized enterprises.

Asia Pacific is the fastest-growing market, underpinned by rapid digitalization, the proliferation of fintech and e-commerce platforms, and government-backed smart city initiatives. China, Japan, South Korea, and India are leading adoption, with insurers increasingly partnering with local governments and enterprises to tailor compliance-specific products. Meanwhile, Latin America and the Middle East & Africa are in earlier stages of adoption but show strong potential, especially in critical infrastructure, energy, and government sectors, where cyber risks are intensifying.

Get More Information about this report -

Request Free Sample Report

Key Market Segments

By Offering

- Solution

- Services

By Insurance Type

- Standalone

- Tailored

By Compliance Requirement

- Healthcare Compliance

- Financial Services Compliance

- GDPR Compliance

- Data Privacy Compliance

- Other Compliance

By Insurance Coverage

- Data Breach

- Data Loss

- Cybersecurity Liability

By End-User

- Healthcare

- Retail

- BFSI

- IT & Telecom

- Manufacturing

- Government agencies

- Other End-Users

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 15.8 B |

| Forecast Revenue (2034) | USD 74.4 B |

| CAGR (2024-2034) | 16.9% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Offering (Solution, Services), By Insurance Type (Standalone, Tailored), By Compliance Requirement (Healthcare Compliance, Financial Services Compliance, GDPR Compliance, Data Privacy Compliance, Other Compliance), By Insurance Coverage (Data Breach, Data Loss, Cybersecurity Liability), By End-User (Healthcare, Retail, BFSI, IT & Telecom, Manufacturing, Government agencies, Other End-Users) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | BitSight, AIG, The Travelers Companies, Hiscox, Security Scorecard, Liberty Mutual, Axa XL, The Hartford, Zurich Insurance Group, Aon, Allianz, Axa, Berkshire Hathaway, HSB, Munich Re, RedSeal, CyberArk, Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Cybersecurity Insurance Market

Published Date : 12 Nov 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date