Data Analytics in PPA Management Market Size & Forecast 2034

Global Data Analytics in PPA Management Market Size, Share & Growth Analysis By Deployment Model (Cloud-Based, On-Premise), By Analytics Type (Descriptive, Predictive, Prescriptive), By Application (Pricing Optimization, Risk Management, Contract Performance Monitoring, Forecasting), By End User (Utilities, Corporates, Energy Traders, Independent Power Producers), Regional Outlook, Competitive Landscape, Key Players, Market Dynamics, Technology Trends & Forecast 2025–2034

Report Overview

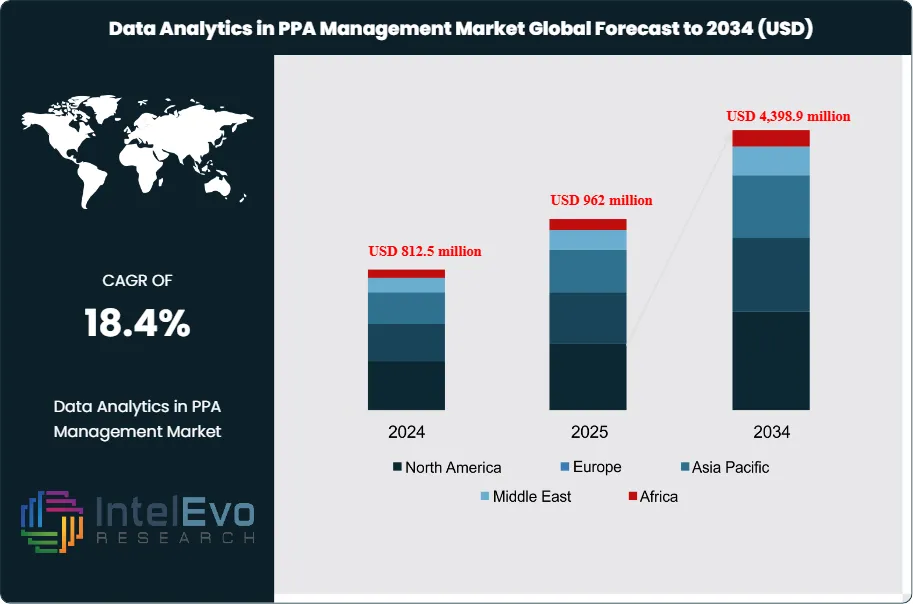

The Data Analytics in PPA Management Market is estimated at USD 812.5 million in 2024 and is on track to reach roughly USD 4,398.9 million by 2034, implying a robust compound annual growth rate of 18.40% over 2025–2034. This rapid expansion is driven by the growing complexity of renewable energy power purchase agreements and the need for real-time visibility into pricing, risk exposure, and contract performance. Utilities, corporates, and energy traders are increasingly leveraging advanced analytics, AI, and predictive modeling to optimize long-term PPA portfolios, manage volatility, and support decarbonization strategies. As renewable capacity scales globally, data-driven PPA management is emerging as a critical enabler of cost control, compliance, and sustainable energy procurement.

Get More Information about this report -

Request Free Sample ReportDemand for data analytics in power purchase agreement management rises as renewable generation expands, price volatility persists, and corporate buyers seek long-term cost visibility. Energy producers, utilities, and large offtakers deploy analytics platforms to monitor PPA portfolios, simulate alternative pricing structures, and benchmark contract performance against market indices. These tools support revenue optimization, enable more precise demand and price forecasts, and help finance teams quantify exposure to merchant risk and imbalance charges.

On the supply side, software vendors, cloud providers, and specialist energy-tech firms expand offerings that combine domain-specific data models with scalable computing architectures. Vendors embed AI and machine learning to detect anomalies in metering data, improve production forecasts, and propose optimal hedge positions. Automation of routine contract validation, invoicing checks, and compliance reporting reduces manual workload and shortens settlement cycles, which enhances cash-flow predictability for PPA participants.

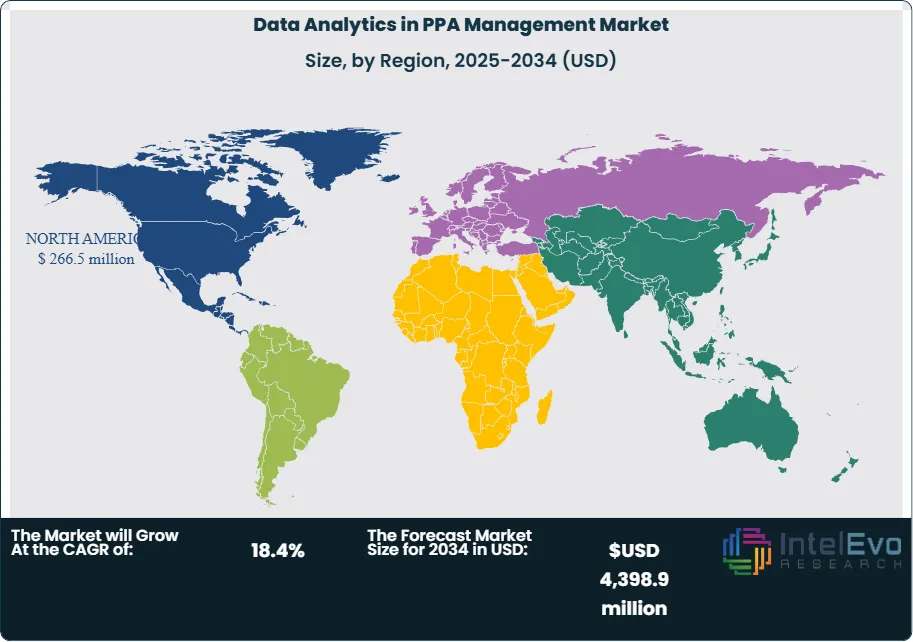

Regulation and policy frameworks shape adoption patterns across regions. In markets with active renewable auction schemes, corporate sourcing programs, and disclosure rules on climate-related financial risks, stakeholders use analytics to validate PPA assumptions and document risk controls. North America held around 32.8% of global revenue in 2024, or USD 266.5 million, supported by sophisticated trading markets and advanced grid digitalization. Europe follows closely with an estimated share of just over 29%, driven by aggressive decarbonization targets, while Asia Pacific is emerging as the fastest-growing region as corporate renewable procurement scales.

Technology advances widen the addressable market. Integration of IoT devices enables near real-time visibility into asset performance and curtailment events, feeding high-frequency data into forecasting engines. Cloud-native architectures allow enterprises to integrate PPA analytics with energy management, treasury, and enterprise resource planning systems, creating unified views of position and risk. As complexity in contract structures increases and renewable penetration deepens, investors and operators place rising emphasis on platforms that deliver transparent, audit-ready insights and that improve the accuracy of long-term energy production and demand projections.

Key Takeaways

- Market Growth: The global Data Analytics in PPA Management market stands at 812.5 million USD, 2024 and is set to reach 4,398.9 million USD, 2034, delivering 18.4% CAGR over 2024-2034.

- By Component: The Software segment leads the offering mix with 73.5% revenue share, 2024. This dominance implies an estimated: 0.6 billion USD, 2024 allocated to software-centric capabilities worldwide.

- By End-Use: Predictive analytics accounts for 37.6% of functional spending, 2024, while energy forecasting and demand prediction contributes 29.3% share, 2024.

- Driver: Rising participation of energy producers, which hold 32.4% market share, 2024, drives investment in analytics to manage revenue risk and contract performance, supporting 18.4% CAGR over 2024-2034.

- Restraint: Integration complexity and fragmented data architectures continue to slow deployments, leaving an estimated: 15.0% adoption gap, 2024 among target enterprises.

- Opportunity: Vendors that extend platforms with advanced forecasting, risk analytics, and automation modules can tap an additional estimated: 1.5 billion USD, 2030 opportunity within the broader energy data stack.

- Trend: The shift toward AI-enabled predictive and forecasting solutions accelerates as analytics-led use cases already represent a combined 66.9% share, 2024. These capabilities are expected to account for an estimated: 50.0% of all new deployments, 2030 focused on advanced PPA optimization.

- Regional Analysis: North America leads with 32.8% share, 2024, generating 266.5 million USD, 2024, while the U.S. alone contributes 223.9 million USD, 2024 and Asia Pacific follows with an estimated: 20.0% CAGR over 2024-2034 as procurement programs scale.

By Type

In 2024, software platforms accounted for roughly 73.5% of global spending on data analytics in PPA management, and this dominance is expected to extend through 2030 as utilities, IPPs, and large corporates standardize on centralized analytics environments. You see vendors bundling analytics platforms, predictive tools, and real-time dashboards into integrated suites that cover contract lifecycle management, price simulation, and settlement validation. Services such as consulting, managed services, and custom integration still represent a smaller share, but their growth tracks closely with the expansion of complex multi-country PPA portfolios that require tailored data models and workflow design.

From an analytics methodology perspective, predictive analytics held around 37.6% share in 2024, outpacing descriptive and diagnostic tools as PPA stakeholders focus more on future conditions than historical reporting. Predictive engines support forecasts of production, load, imbalance costs, and price spreads across markets, which is vital when you negotiate long-tenor physical and virtual PPAs. Descriptive and diagnostic analytics continue to provide the backbone for reporting, loss analysis, and performance benchmarking, yet the fastest budget growth through 2025–2030 is expected in predictive and emerging prescriptive use cases that recommend contract adjustments, rebalancing actions, or hedging strategies based on scenario outputs.

By Application

Energy forecasting and demand prediction represented more than 29.3% of the market in 2024 and remains the anchor application as stakeholders look ahead to 2025 and beyond. Accurate forecasts of generation and consumption support contract sizing, profile shaping, and balancing decisions in a context of rising renewable penetration and greater intraday volatility. You increasingly see forecasting models that combine weather data, market signals, asset performance history, and grid constraints to sharpen day-ahead and intra-day positions and to reduce imbalance penalties tied to PPAs.

Beyond forecasting, performance monitoring and contract analysis are gaining share as asset owners and buyers seek clearer visibility into actual versus contracted positions. Analytics engines track delivery compliance, curtailment events, and pricing outcomes across multiple PPAs, feeding dashboards for portfolio managers and finance teams. Risk management, including simulation of merchant exposure and counterparty risk, is another priority area heading into 2030 as corporates sign more complex structures such as virtual PPAs, baseload blocks with caps and floors, and multi-buyer arrangements. Cost and financial analysis applications link PPA data to treasury and accounting systems to support IFRS and hedge accounting treatment, internal carbon pricing, and capital allocation decisions.

By End-Use

Energy producers held about 32.4% of the market in 2024 and remain the most intensive users of PPA analytics as they scale wind, solar, storage, and hybrid fleets through 2030. Producers use detailed production and revenue models to structure offers, set floors and collars, and assess the trade-off between fixed-price PPAs and merchant exposure. For you as a generator, accurate forecasting and contract performance tracking directly influence financing conditions, covenants, and the ability to refinance or extend assets later in the project life.

Energy buyers, including large industrials, data centers, and commercial portfolios, now form the second-largest end-user group and show some of the fastest growth from 2025 onward. Corporate offtakers apply analytics to assess procurement scenarios across geographies, indexation formulas, and contract tenors while they track progress toward renewable energy and net-zero commitments. Traders and aggregators use higher-frequency analytics for short-term positions, shaping, and rebalancing across multiple PPAs and markets, while consultants translate complex model outputs into strategy recommendations and risk policies for clients that lack in-house analytical capacity.

By Region

North America led the market in 2024 with around 32.8% share and revenue of nearly 266.5 million USD, driven by a large base of corporate and utility PPAs in the United States and Canada. Through 2030, North American growth benefits from an active hub of software providers, strong renewable build-out under long-term policy support, and mature power markets that reward sophisticated forecasting and risk analysis. If your portfolio includes U.S. PPAs, granular analytics is increasingly a prerequisite for bankability and board approval.

Europe follows as a major market with broad PPA adoption in markets such as Spain, the Nordics, Germany, and the United Kingdom, supported by ambitious decarbonization targets and active cross-border trading. Asia Pacific is moving into a high-growth phase from 2025 onward as countries such as Australia, India, and parts of Southeast Asia open frameworks for corporate sourcing and long-term renewable contracting. Latin America and the Middle East & Africa still account for a smaller share today, yet growth in utility-scale solar and wind, particularly in markets with improving policy clarity, is creating new demand for PPA analytics to handle currency exposure, counterparty risk, and variable resource conditions across diverse project locations.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Component

- Software

- Analytics Platforms

- Predictive Analytics Tools

- Real-time Monitoring and Dashboards

- Others

- Services

- Consulting Services

- Managed Services

- Custom Analytics and Integration Services

By Type

- Descriptive Analytics

- Diagnostic Analytics

- Predictive Analytics

- Others

By Application

- Energy Forecasting and Demand Prediction

- Performance Monitoring and Optimization

- Risk Management and Mitigation

- Cost Optimization and Financial Analysis

- Others

By End User

- Energy Producers

- Energy Buyers

- Energy Traders

- Energy Consultants

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 812.5 million |

| Forecast Revenue (2034) | USD 4,398.9 million |

| CAGR (2024-2034) | 18.4% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Component, (Software, Services), By Type, (Descriptive Analytics, Diagnostic Analytics, Predictive Analytics, Others), By Application, (Energy Forecasting and Demand Prediction, Performance Monitoring and Optimization, Risk Management and Mitigation, Cost Optimization and Financial Analysis, Others), By End User, (Energy Producers, Energy Buyers, Energy Traders, Energy Consultants) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | GridEdge Solutions Ltd., Itron, Inc., Enel X S.r.l., GE Digital LLC, ABB Group, Siemens Energy, Inc., EnergyHub, Inc., Trilliant Inc., Schneider Electric SE, Uptake Technologies, Inc., Other Major Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Data Analytics in PPA Management Market

Published Date : 09 Jan 2026 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date