Data Center Immersion Cooling Market to Reach $16B | CAGR of 21.51%

Global Data Center Liquid Immersion Cooling Market Size, Share & Analysis Report By Cooling Type (Two-Phase, Single-Phase), Cooling Fluid (Fluorocarbon-Based, Mineral Oil, Deionized Water, Synthetic), Data Center Type (Edge, Hyperscale, Colocation, Enterprise, HPC), End User (Energy, IT, Media, Telecom, Retail, Healthcare, BFSI, Others), Region & Key Players – Segment Overview, Dynamics, Strategies, Trends & Forecast 2025-2034

Report Overview

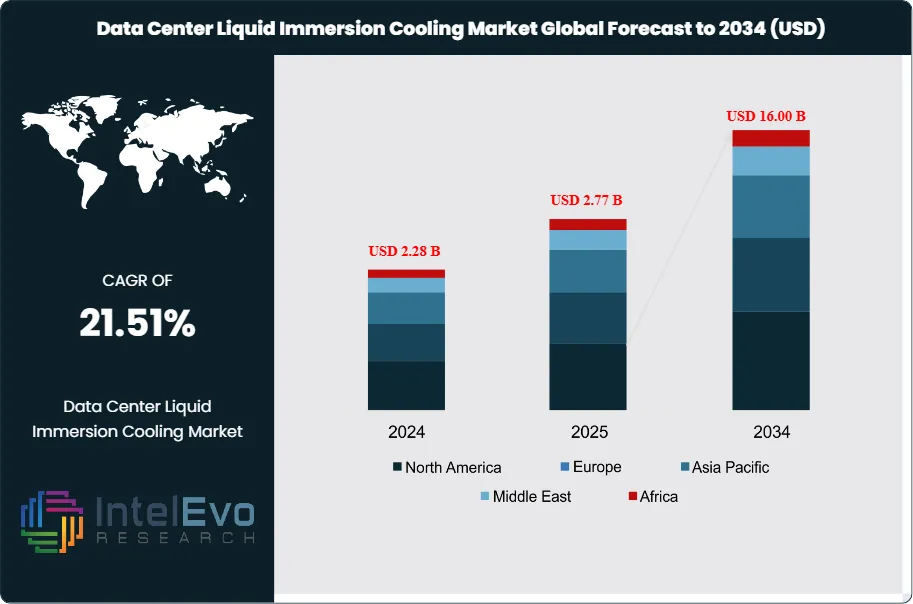

The Data Center Liquid Immersion Cooling Market size is expected to be worth around USD 16.00 Billion by 2034, from USD 2.28 Billion in 2024, growing at a CAGR of 21.51% during the forecast period from 2024 to 2034. The data center liquid immersion cooling market represents a rapidly expanding sector within the broader data center infrastructure landscape. This technology involves submerging IT hardware directly into non-conductive dielectric liquids that provide superior heat dissipation compared to traditional air-based cooling systems. The market has experienced exponential growth due to increasing demand for high-performance computing (HPC), artificial intelligence workloads, and the need for energy-efficient cooling solutions in modern data centers.

Get More Information about this report -

Request Free Sample ReportMarket growth drivers include the proliferation of hyperscale data centers, rising adoption of cloud-based services, and growing investments in sustainable cooling technologies. The technology addresses critical challenges in managing high-density power consumption while reducing carbon footprints and operational costs. Traditional air cooling systems struggle to manage the immense heat generated by next-generation applications, making liquid immersion cooling an ideal solution for cryptocurrency mining, machine learning, and complex simulations.

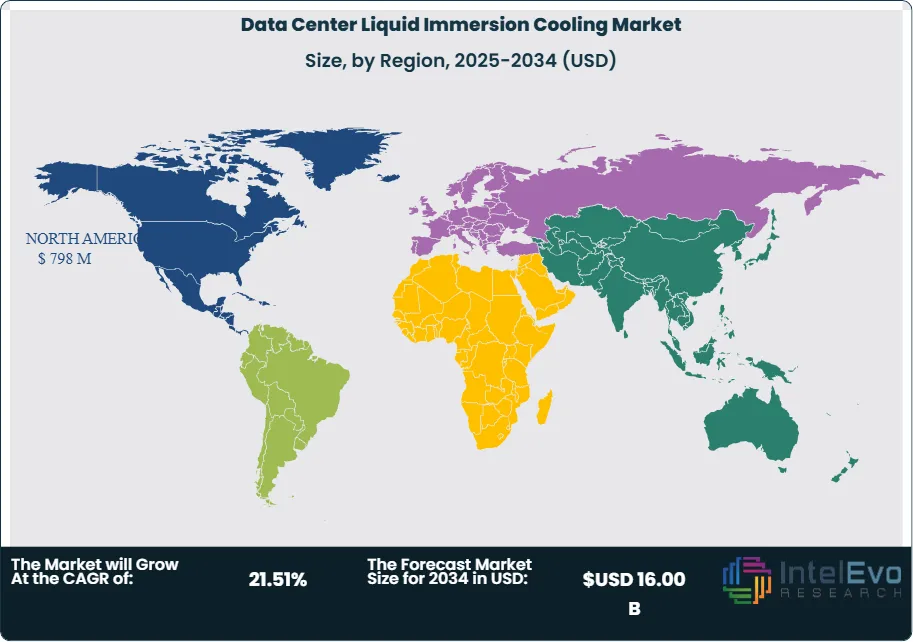

Regional dynamics show North America leading the market due to significant investments from dominant technology companies and robust regulatory support for energy-efficient solutions. Major hyperscalers like Google, Microsoft, and Amazon are at the forefront of adopting this technology for sustainability initiatives. The region benefits from innovation centers and early adoption of advanced cooling technologies.

The COVID-19 pandemic accelerated digital transformation initiatives, increasing demand for data center capacity and efficient cooling solutions. This trend continues as organizations prioritize cloud migration and digital infrastructure investments. Supply chain disruptions initially affected component availability but have since stabilized with increased local manufacturing capabilities.

Trade and geopolitical conflicts have prompted companies to diversify supply chains and increase domestic production capabilities. U.S. tariffs have encouraged manufacturers to expand local operations while continuing innovation in cooling technologies. These factors have reshaped competitive dynamics while maintaining strong market growth momentum.

Key Takeaways

- Market Growth: The Data Center Liquid Immersion Cooling Market is expected to reach USD 16.00 Billion by 2034, rapidly expanding due to the surge in hyperscale data centers, increased use of cloud services, and heightened focus on sustainable cooling solutions.

- Cooling Type Dominance: Single-phase immersion cooling leads the market due to lower costs and simpler design.

- Cooling Fluid Dominance: Deionized water dominates the market, driven by superior heat absorption capabilities.

- Data Center Type Dominance: Hyperscale data centers hold the largest share in the application segment, owing to cloud service expansion.

- End User Dominance: The IT sector leads due to its critical need for high-density, energy-efficient cooling to support AI, cloud, and big data workloads.

- Drivers: Key drivers accelerating growth include increasing AI and HPC workloads and sustainability initiatives, which boost market expansion through enhanced thermal management requirements.

- Restraints: Growth is hindered by high initial investment costs and technical complexity, which create challenges such as adoption barriers for smaller organizations.

- Opportunities: The market is poised for expansion due to opportunities like emerging markets adoption and regulatory support for energy efficiency, which enable broader technology deployment.

- Trends: Emerging trends including advanced monitoring systems and two-phase cooling adoption are reshaping the market by improving operational efficiency and thermal performance.

- Regional Leader: North America leads owing to hyperscaler investments and regulatory support. Asia-Pacific and Europe show high promise due to increasing data center construction and sustainability mandates.

Cooling Type Analysis:

Single-phase Immersion Cooling System Leads With nearly 60% Market Share In Data Center Liquid Immersion Cooling Market: Single-phase immersion cooling systems dominate this market segment due to their cost-effectiveness and simplicity compared to two-phase alternatives. These systems use a single liquid coolant that absorbs heat without phase change, making them ideal for mid-sized data centers and colocation providers seeking affordable upgrades. The technology offers lower barrier entry points with reduced capital expenditure requirements, appealing to operators transitioning from traditional air cooling. Two-phase systems, while more complex, are gaining traction for high-density applications requiring superior thermal management capabilities.

Cooling Fluid Analysis:

Deionized water leads this segment owing to its superior heat absorption properties and environmental sustainability. This fluid type offers excellent thermal efficiency while supporting regulatory mandates for reducing environmental impact. Mineral oil maintains significant market presence due to its established performance history and affordability, particularly in early adoption scenarios. Synthetic fluids represent the fastest-growing sub-segment, driven by enhanced thermal performance and material compatibility requirements in next-generation data centers handling AI and GPU workloads.

Data Center Type Analysis:

Hyperscale data centers command the largest market share within applications, driven by massive cloud service expansion and sustainability initiatives. These facilities require efficient cooling for high-density server deployments supporting global digital infrastructure. High-performance computing applications follow closely, benefiting from immersion cooling's ability to manage intense computational workloads. Cryptocurrency mining and artificial intelligence applications show rapid growth due to specialized hardware requirements generating substantial heat loads requiring advanced cooling solutions.

End User Analysis:

The IT industry is the primary driver of the liquid immersion cooling market, propelled by surging demand for high-performance computing, AI, machine learning, and cloud services. These workloads generate dense heat loads that traditional air-cooling solutions often struggle to manage effectively. Liquid immersion cooling enables denser server configurations, delivers significant energy savings, and improves operational efficiency—key priorities for hyperscale data centers and technology firms. As IT companies seek sustainable, scalable solutions to meet rising digital service requirements while keeping Power Usage Effectiveness (PUE) low, immersion cooling stands out for its ability to reliably support next-generation infrastructure.

Regional Analysis:

North America Leads With more than 35% Market Share In Data Center Liquid Immersion Cooling Market: North America maintains market leadership position, primarily driven by hyperscale data center expansion and early technology adoption. The United States dominates regional activity with major technology companies investing heavily in sustainable cooling solutions. Regulatory support for energy efficiency and established innovation ecosystems contribute to continued market dominance.

Europe represents a significant growth opportunity with increasing emphasis on sustainability mandates and data center construction. The region's focus on environmental regulations drives adoption of energy-efficient cooling technologies. Asia-Pacific emerges as the fastest-growing region, fueled by rapid digitalization and increasing data center investments across China, Japan, and India. Latin America and Middle East show promising potential as emerging markets develop digital infrastructure capabilities and seek energy-efficient solutions for growing data processing demands.

Get More Information about this report -

Request Free Sample ReportMarket Key Players

Cooling Type:

- Two-phase Immersion Cooling System

- Single-phase Immersion Cooling System

Cooling Fluid:

- Fluorocarbon-based Fluids

- Mineral Oil

- Deionized Water

- Synthetics Fluids

Data Center Type:

- Edge Data Centers

- Hyperscale Data Centers

- Colocation Data Centers

- Enterprise Data Centers

- High-Performance Computing (HPC) Data Centers

End User:

- Energy

- IT

- Entertainment & Media

- Telecom

- Retail & E-commerce

- Healthcare

- BFSI

- Others

Region:

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 2.77 B |

| Forecast Revenue (2034) | USD 16.00 B |

| CAGR (2025-2034) | 21.51% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Cooling Type (Two-phase Immersion Cooling System, Single-phase Immersion Cooling System); Cooling Fluid (Fluorocarbon-based Fluids, Mineral Oil, Deionized Water, Synthetics Fluids); Data Center Type (Edge Data Centers, Hyperscale Data Centers, Colocation Data Centers, Enterprise Data Centers, High-Performance Computing (HPC) Data Centers); End User (Energy, IT, Entertainment & Media, Telecom, Retail & E-commerce, Healthcare, BFSI, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | 3M Company, Alfa Laval AB, Asetek Group, Asperitas B.V., CoolIT Systems, DCX - The Liquid Cooling Company, Fujitsu Limited, GIGA-BYTE Technology Co., Ltd, Green Revolution Cooling Inc., Iceotope, LiquidCool Solutions, Midas Green Technologies LLC, Schneider Electric, Submer, Vertiv Group Corp. |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the Data Center Liquid Immersion Cooling Market?

The Data Center Liquid Immersion Cooling Market is projected to hit $16B by 2034 with a 21.51% CAGR. Discover the forces driving this explosive growth in data center efficiency.

Who are the major players in the Data Center Liquid Immersion Cooling Market?

3M Company, Alfa Laval AB, Asetek Group, Asperitas B.V., CoolIT Systems, DCX - The Liquid Cooling Company, Fujitsu Limited, GIGA-BYTE Technology Co., Ltd, Green Revolution Cooling Inc., Iceotope, LiquidCool Solutions, Midas Green Technologies LLC, Schneider Electric, Submer, Vertiv Group Corp.

Which segments covered the Data Center Liquid Immersion Cooling Market?

Cooling Type (Two-phase Immersion Cooling System, Single-phase Immersion Cooling System); Cooling Fluid (Fluorocarbon-based Fluids, Mineral Oil, Deionized Water, Synthetics Fluids); Data Center Type (Edge Data Centers, Hyperscale Data Centers, Colocation Data Centers, Enterprise Data Centers, High-Performance Computing (HPC) Data Centers); End User (Energy, IT, Entertainment & Media, Telecom, Retail & E-commerce, Healthcare, BFSI, Others)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Data Center Liquid Immersion Cooling Market

Published Date : 13 Aug 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date