Diamond Slurry Market Size, Growth Trends & Forecast | CAGR of 8.1%

Global Diamond Slurry Market Size, Share & Precision Polishing Analysis By Type (Water-soluble diamond slurry, Oil-soluble diamond slurry), By Diamond Type (Monocrystalline, Polycrystalline, Nano), By Application (Metal, Advanced Ceramics, Semiconductor, Optics and photonics), By End-use (Electronics and Optoelectronics, Disc drivers, Power devices), CMP Technology Trends, Supply Chain Analysis, Key Producers & Forecast 2025–2034

Report Overview

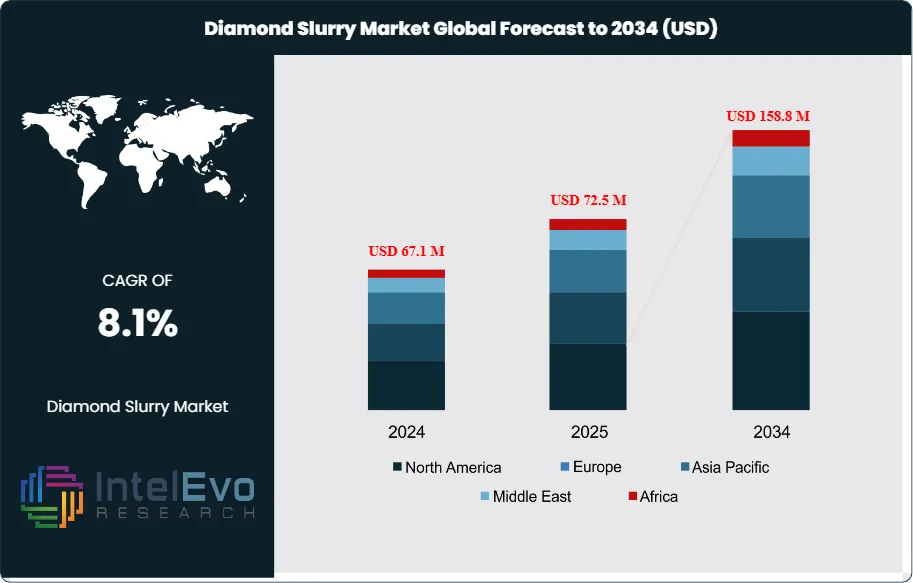

The Diamond Slurry Market is estimated at USD 72.5 million in 2025 and is projected to reach approximately USD 158.8 million by 2035, registering a compound annual growth rate (CAGR) of about 8.1% during 2026–2035. This upward revision reflects strengthening demand from semiconductor wafer polishing, optical components, and advanced ceramics manufacturing, where ultra-precision surface finishing is critical. Rising investments in semiconductor fabrication, LED substrates, and high-performance electronics are accelerating adoption of diamond slurry solutions. In parallel, ongoing process miniaturization and tighter surface roughness requirements are reinforcing the shift toward higher-purity, performance-optimized diamond slurry formulations across global manufacturing hubs.

Get More Information about this report -

Request Free Sample ReportThis steady expansion reflects the growing role of diamond slurry in high-precision polishing and grinding applications across semiconductors, optics, and advanced instrumentation. Historically, demand has been tied to the electronics and industrial manufacturing sectors, with steady growth over the past decade as miniaturization and higher performance standards have increased the need for ultra-smooth surfaces. The forecast trajectory suggests that the market will nearly double in value within ten years, supported by both technological progress and rising end-user requirements.

On the demand side, the semiconductor industry remains the largest consumer, accounting for more than 40% of global slurry usage in 2023. The push toward smaller node sizes and higher wafer yields is driving adoption of advanced polishing solutions. Optics and precision engineering also contribute significantly, with rising demand for defect-free surfaces in medical devices, aerospace components, and defense technologies. Supply-side factors include the availability of synthetic diamond powders, which now dominate production due to cost efficiency and consistency. However, volatility in raw material prices and stringent environmental regulations on chemical waste management present ongoing challenges.

Technological advancements are reshaping the market. Recent breakthroughs in photocatalysis-assisted chemical mechanical polishing (PCMP) have demonstrated the ability to reduce diamond substrate roughness from Ra 33.6 nm to Ra 2.6 nm within eight hours, a performance improvement that directly enhances product quality and throughput. Integration of hydrogen peroxide and phosphoric acid in slurry formulations under UV exposure exemplifies how chemical innovation is improving efficiency while reducing mechanical damage. Such developments are critical for industries where surface integrity directly impacts performance and reliability.

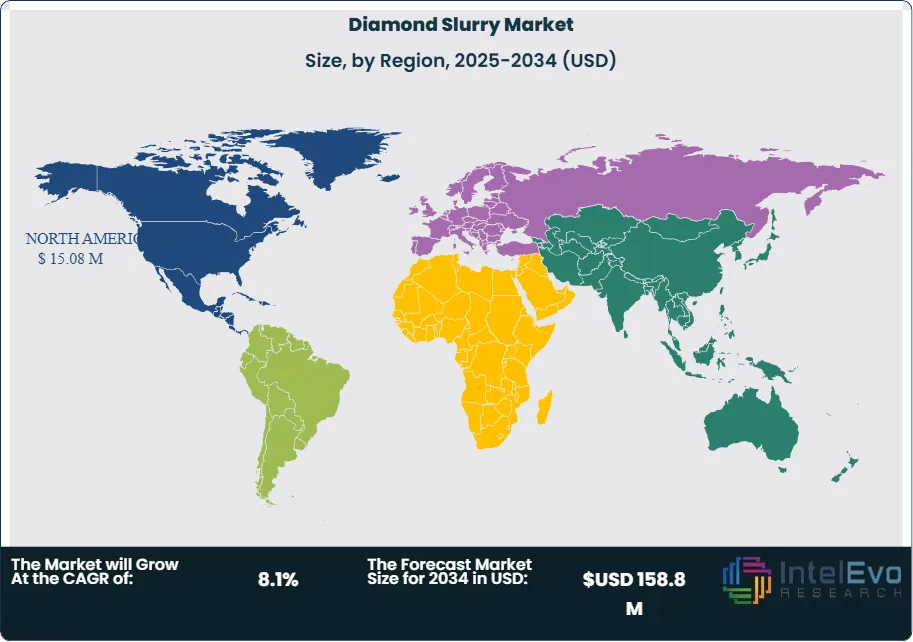

Regionally, Asia Pacific leads the market, driven by its dominant semiconductor manufacturing base in China, Taiwan, South Korea, and Japan. North America and Europe remain important due to strong aerospace and defense applications, while emerging markets in Southeast Asia are attracting new investment in electronics manufacturing. Strategic consolidation is also shaping the competitive landscape. Hyperion Materials & Technologies’ acquisition of Premium Diamond Solutions SA in 2022 expanded its European footprint and reinforced its global supply capabilities. For investors, the combination of rising semiconductor demand, ongoing R&D in slurry chemistry, and consolidation among key players signals a market with strong long-term growth potential and increasing barriers to entry.

Key Takeaways

- Market Growth: The global diamond slurry market was valued at USD 72.5 million in 2025 and is projected to reach USD 158.8 million by 2035, expanding at a CAGR of 8.1%. Growth is driven by rising demand for precision polishing in semiconductors, optics, and advanced instrumentation.

- By Type: Water-soluble diamond slurry accounted for 62.8% of global revenue in 2023. Its dominance is linked to higher compatibility with semiconductor and electronics manufacturing processes, where clean and residue-free polishing is critical.

- By Diamond Type: Polycrystalline diamond slurry held 58.9% of the market in 2023. Its superior cutting efficiency and cost-effectiveness compared to monocrystalline variants make it the preferred choice for high-volume industrial applications.

- By Application: Metal polishing represented 49.6% of total usage in 2023. Demand is concentrated in aerospace, automotive, and precision engineering, where surface integrity directly impacts component performance.

- By End User: Electronics and optoelectronics industries consumed 73.2% of global slurry volumes in 2023. The shift toward smaller semiconductor nodes and higher wafer yields continues to reinforce this segment’s leadership.

- Driver: Expanding semiconductor production capacity in Asia Pacific, particularly in China, Taiwan, and South Korea, is a key growth driver. The region’s fabs accounted for over 60% of global wafer output in 2023, directly boosting slurry consumption.

- Restraint: Environmental regulations on chemical waste management and disposal increase compliance costs. Stricter EU standards are expected to raise operational expenses by 8–10% for slurry manufacturers by 2026.

- Opportunity: Aerospace and medical device manufacturing present high-growth opportunities. Demand for defect-free surfaces in turbine blades and surgical instruments is projected to push these segments to a combined market value of USD 25 million by 2030.

- Trend: Advances in photocatalysis-assisted chemical mechanical polishing (PCMP) are reshaping slurry formulations. Recent trials reduced diamond substrate roughness from Ra 33.6 nm to Ra 2.6 nm within eight hours, improving throughput and product quality.

- Regional Analysis: Asia Pacific leads the market with the largest consumption base, supported by semiconductor and electronics manufacturing. North America held a 20.8% share in 2023, driven by aerospace and defense applications, while Southeast Asia is emerging as a new investment hub with double-digit CAGR potential through 2033.

Type Analysis

Water-soluble slurries command the market by type, accounting for a substantial 62.8% share in 2025. This dominance stems from their widespread use in precision polishing applications across the electronics, optics, and automotive sectors. Their effectiveness in creating high-quality surface finishes, combined with environmental advantages and easier cleanup, makes them the preferred choice for manufacturers adhering to stricter sustainability standards. The demand for water-soluble products is projected to grow at a compound annual growth rate (CAGR) of approximately 8.5% through 2030.

Conversely, oil-soluble diamond slurry holds a more specialized market position. It is primarily used in heavy-duty machining and grinding operations that require superior lubricity and a longer working life. While valuable for specific industrial tasks, its adoption is constrained by environmental regulations and complex handling requirements associated with oil-based products. The market is witnessing a clear and sustained movement toward water-soluble formulations as companies prioritize both performance and responsible manufacturing practices.

Application Analysis

The metal processing application represents the largest segment, comprising 49.6% of the diamond slurry market. Diamond slurries are critical for high-precision grinding and polishing of metal components in the aerospace, automotive, and heavy machinery industries. The material's ability to produce exceptionally smooth and durable surfaces improves the operational performance and lifespan of metal parts, driving its extensive use.

Other key applications are expanding rapidly alongside high-tech industries. Advanced ceramics, used in medical devices and electronics, depend on diamond slurries for achieving fine finishes. The semiconductor industry uses these slurries for essential processes like wafer planarization, where nanoscale surface smoothness is a requirement for chip fabrication. Furthermore, the optics and photonics sector relies on diamond slurries for polishing lenses and fiber optic components to ensure optimal clarity and performance, a demand that grows with the telecommunications and medical imaging fields.

End-Use Analysis

The electronics and optoelectronics industries are the principal end-users, representing a commanding 73.2% of the market. This significant share is a direct result of the stringent precision requirements in manufacturing semiconductors, LED components, and laser parts. Diamond slurries provide the high-quality surface conditions necessary for the functionality and reliability of these advanced electronic devices.

While smaller, other end-use segments remain important. In the data storage industry, diamond slurries are used for the precision finishing of disc drive components, such as read/write heads, to ensure high performance. The power devices sector also uses these slurries for producing components based on silicon carbide (SiC) and gallium nitride (GaN) substrates. The indispensable role of diamond slurry in these technology-driven fields ensures its continued market growth as industries demand ever more precise and efficient material processing solutions.

Regional Analysis

North America holds a significant 20.8% share of the global diamond slurry market. This position is supported by a robust industrial base, particularly in the aerospace and automotive sectors, and advanced materials science research. The region's focus on high-performance manufacturing creates consistent demand for precision polishing applications. Europe follows, with market growth influenced by strict environmental regulations that encourage the use of sustainable manufacturing materials like water-soluble slurries. Key industrial centers in Germany and France are expanding their automotive and optical manufacturing capacities, further boosting regional demand.

The Asia Pacific region is projected to be the fastest-growing market, with a forecasted CAGR of over 9.5%. This growth is fueled by rapid industrialization and the expansion of the electronics, semiconductor, and automotive manufacturing sectors in China, Japan, and South Korea. These industries are major consumers of diamond slurry for surface finishing processes. The Middle East, Africa, and Latin America are emerging markets with considerable growth potential. Industrial development in the GCC countries and manufacturing expansion in Brazil and Mexico are creating new opportunities for diamond slurry suppliers.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Type

- Water-soluble diamond slurry

- Oil-soluble diamond slurry

By Diamond Type

- Monocrystalline

- Polycrystalline

- Nano

By Application

- Metal

- Advanced Ceramics

- Semiconductor

- Optics and photonics

By End-use

- Electronics and Optoelectronics

- Disc drivers

- Power devices

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 72.5 M |

| Forecast Revenue (2034) | USD 158.8 M |

| CAGR (2025-2034) | 8.1% |

| Historical data | 2020-2024 |

| Base Year For Estimation | 2025 |

| Forecast Period | 2026-2035 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Type (Water-soluble diamond slurry, Oil-soluble diamond slurry), By Diamond Type (Monocrystalline, Polycrystalline, Nano), By Application (Metal, Advanced Ceramics, Semiconductor, Optics and photonics), By End-use (Electronics and Optoelectronics, Disc drivers, Power devices) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Algasan International, Hyperion Materials & Technologies, Dopa Diamond tools, Eminess Technologies, Allied Hightech Products, Inc, Mark V labs, Entegris, Henan Union Precision Material, Qual Diamond, LAM plan SA, Diamond Tool and Abrasives, Inc |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date