Digital Classroom Market Size & Share, Growth, Trends|CAGR of 14.26%

Global Digital Classroom Market Size, Share, Analysis Report By Component Type (Hardware, Software, Services) Deployment Mode (On-Premise, Cloud, Hybrid) Application Type (K-12 Education, Higher Education, Corporate Training) Industry Region & Key Players-Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends & Forecast 2025-2034

Report Overview

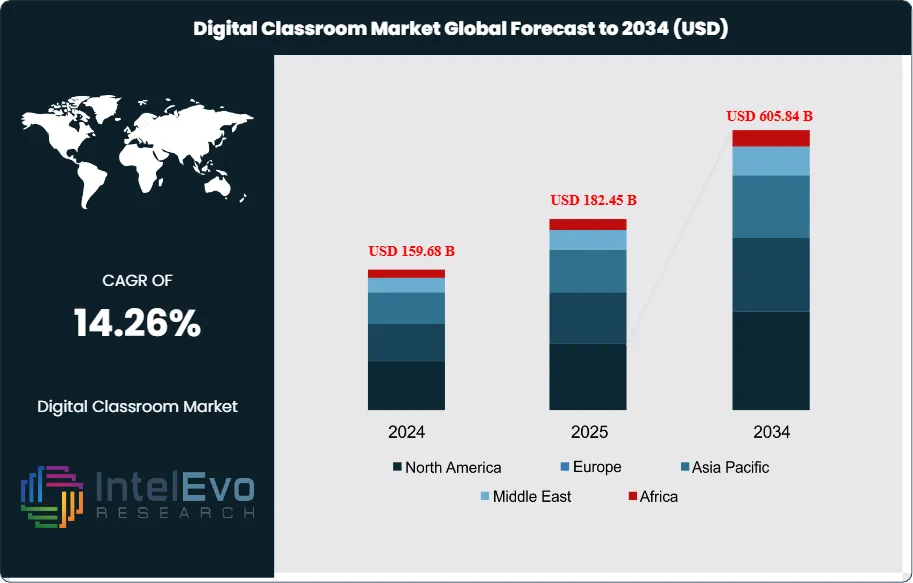

The Digital Classroom Market size is expected to be worth around USD 605.84 Billion by 2034, from USD 159.68 Billion in 2024, growing at a CAGR of 14.26% during the forecast period from 2024 to 2034. The digital classroom market encompasses comprehensive educational technology solutions that leverage digital devices, software platforms, and interactive tools to transform traditional learning environments into technology-enhanced educational spaces.

Get More Information about this report -

Request Free Sample ReportThis market includes hardware components such as interactive whiteboards, projectors, tablets, laptops, and VR/AR devices, alongside software solutions including learning management systems (LMS), collaboration tools, assessment platforms, and digital content creation applications. The ecosystem serves diverse educational segments ranging from K-12 schools and higher education institutions to corporate training environments and government educational programs, enabling personalized learning experiences, remote education capabilities, and data-driven instruction methodologies.

The digital classroom market is experiencing exponential growth driven by accelerating adoption of e-learning platforms, virtual classrooms, and government-backed digital education initiatives worldwide. Key growth catalysts include the widespread integration of artificial intelligence, augmented reality, and virtual reality technologies that create immersive and personalized learning experiences. The market benefits from increasing demand for hybrid learning models that combine traditional classroom instruction with digital tools, enabling flexible education delivery and enhanced student engagement. Additionally, rising investment in educational technology infrastructure, particularly in developing regions, is driving market expansion through improved internet connectivity, mobile device proliferation, and cloud-based educational platform adoption.

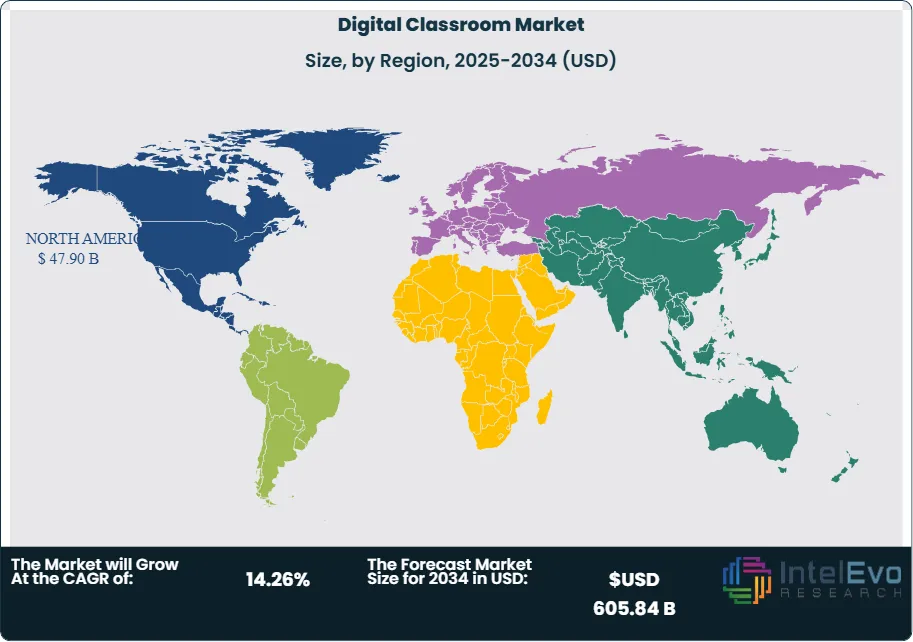

North America dominates the global digital classroom market with over 33.7% market share in 2024, generating significant revenues driven by advanced technological infrastructure and extensive digital tool integration in educational institutions. The United States leads this dominance with 68.36% share in North America, supported by substantial government and private sector investments in educational technology infrastructure. The region's leadership stems from early adoption of Industry 4.0 technologies, robust internet penetration, and comprehensive federal support for high-speed internet and device accessibility in schools. Asia-Pacific represents the fastest-growing regional market, propelled by rapid digitization initiatives, government-led digital literacy programs, and increasing smartphone and internet penetration across developing economies.

The COVID-19 pandemic fundamentally accelerated digital transformation in education, creating unprecedented demand for digital classroom solutions as institutions worldwide shifted to remote and hybrid learning models. The crisis highlighted the critical importance of technology-enabled education continuity, driving massive investments in cloud-based learning platforms, collaboration tools, and digital content delivery systems. While initial supply chain disruptions temporarily affected hardware availability, the long-term impact has been overwhelmingly positive, with educational institutions recognizing the permanent value of digital tools for enhancing learning outcomes, enabling distributed education, and building resilience against future disruptions.

Rising geopolitical tensions and trade restrictions have influenced digital classroom technology adoption patterns, with educational institutions seeking to diversify supplier relationships and reduce dependency on single-source technology providers. International sanctions and export controls on advanced technologies have created opportunities for domestic EdTech solution providers while challenging global supply chains. Additionally, increasing emphasis on data sovereignty and student privacy protection has driven demand for locally-hosted educational platforms and enhanced cybersecurity solutions that comply with regional data protection regulations.

Key Takeaways

- Market Growth: The Digital Classroom Market is expected to reach USD 605.84 Billion by 2034, fueled by the accelerated adoption of e-learning platforms, virtual classrooms, and government-supported digital education initiatives across the globe.

- Component Type Dominance: Software dominates the segment, driven by learning management systems and collaboration platform adoption.

- Deployment Mode Dominance: Cloud deployment leads the market share, primarily due to scalability, cost-effectiveness, and maintenance advantages.

- Application Type Dominance: Higher Education holds the largest share, owing to advanced technology adoption and flexible learning model demands.

- Driver: Key drivers accelerating growth include widespread e-learning adoption and government digital education initiatives, which boost market expansion through infrastructure investment and policy support.

- Restraint: Growth is hindered by high initial investment costs and cybersecurity concerns, which create challenges such as implementation barriers and data privacy risks.

- Opportunity: The market is poised for expansion due to opportunities like AI integration in educational tools and emerging market penetration, which enable personalized learning and geographic diversification.

- Trend: Emerging trends including VR/AR technology integration and 5G connectivity adoption are reshaping the market by enabling immersive learning experiences and low-latency communications.

- Regional Analysis: North America leads owing to advanced infrastructure and early technology adoption. Asia-Pacific shows high promise due to rapid digitization and government-led educational modernization initiatives.

Component Type Analysis:

Software components hold a dominant position in the educational technology market, highlighting their essential function in content delivery, learning process management, and facilitating communication between learners and instructors. This category encompasses various learning management platforms including Canvas and Blackboard, collaborative solutions like Microsoft Teams for Education and Google Classroom, and specialized educational software applications. The software segment's market leadership stems from the widespread adoption of cloud-based solutions that provide enhanced scalability, seamless automatic updates, and improved accessibility across devices and locations. Additionally, the growing incorporation of artificial intelligence and machine learning capabilities has revolutionized the sector by enabling customized learning pathways and smart content distribution systems that adapt to individual student needs and preferences.

Deployment Mode Analysis:

Cloud deployment maintains a commanding presence in the educational technology market, demonstrating a significant transformation from conventional on-premise systems to flexible, accessible platforms that lower overall operational costs and remove infrastructure management responsibilities. This cloud-based dominance reflects educational institutions' growing preference for solutions that provide seamless automatic updates, robust security measures, and comprehensive support for distance learning without requiring substantial information technology infrastructure investments.

Application Type Analysis:

Higher Education Leads With more than 50% Market Share In Digital Classroom Market. Higher education maintains a leading position within the application segment of the educational technology market, reflecting universities' and colleges' superior technology adoption capabilities and substantial capacity for infrastructure investment. This sector's prominent standing is strengthened by higher education institutions' requirements for advanced research tools, adaptable learning delivery mechanisms, and comprehensive student administration systems. The sector's dominance receives additional support from the growing demand for blended learning approaches, digital degree programs, and international student accessibility that necessitates powerful digital platforms capable of accommodating varied educational approaches and worldwide reach requirements. Universities and colleges demonstrate particular readiness to embrace innovative technologies due to their research-oriented environments and available financial resources for technological advancement.

Region Analysis:

North America Leads With over 30% Market Share In Digital Classroom Market. North America holds a commanding position in the global educational technology market, demonstrating technological leadership through sophisticated infrastructure, extensive federal and state educational funding programs, and early-stage adoption of digital learning solutions throughout K-12 and higher education systems. This regional dominance reflects the United States' substantial influence within the North American market, where advanced technological capabilities and comprehensive investment strategies have established the foundation for continued market leadership.

Asia-Pacific emerges as the most rapidly expanding regional market for educational technology, propelled by accelerated economic development, government-driven digitization programs, and increased investment in educational infrastructure across major economies including China, India, and Southeast Asian nations. The region's remarkable growth trajectory is supported by expanding internet connectivity, rising smartphone adoption rates, and growing middle-class populations actively seeking enhanced educational opportunities.

Europe maintains a substantial presence in the educational technology market through well-established educational systems, increasing government funding for digital learning initiatives, and comprehensive regulatory frameworks that promote educational technology adoption while ensuring data privacy and security compliance. The European market demonstrates consistent growth driven by digital infrastructure investments and policy support for educational innovation.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

Component Type

- Hardware

- Software

- Services

Deployment Mode

- On-Premise

- Cloud

- Hybrid

Application Type

- K-12 Education

- Higher Education

- Corporate Training

Region:

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 182.45 B |

| Forecast Revenue (2034) | USD 605.84 B |

| CAGR (2025-2034) | 14.26% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Component Type (Hardware, Software, Services) Deployment Mode (On-Premise, Cloud, Hybrid) Application Type (K-12 Education, Higher Education, Corporate Training) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Google LLC, Microsoft Corporation, Apple Inc., Instructure Inc. (Canvas), Blackboard Inc., MagicSchool, Echo360, Smart Technologies, Promethean Limited, Dell Technologies, Moodle, PowerSchool |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date