Digital Commerce Market Size, Share | CAGR of 15.98%

Global Digital Commerce Market Size, Share & Analysis Report by Payment (Cash, Card, Cryptocurrency, Digital Wallets, Bank Transfers), Component (Solutions, Services), Browsing Medium (Mobile & Tablets, Desktop/Laptop), Business Type (B2C, B2B), Vertical (BFSI, Media & Entertainment, Manufacturing, Healthcare & Pharma, Automotive, Retail & Household Goods, Others), Region & Key Players – Segment Overview, Market Dynamics, Trends & Forecast 2025–2034

Report Overview

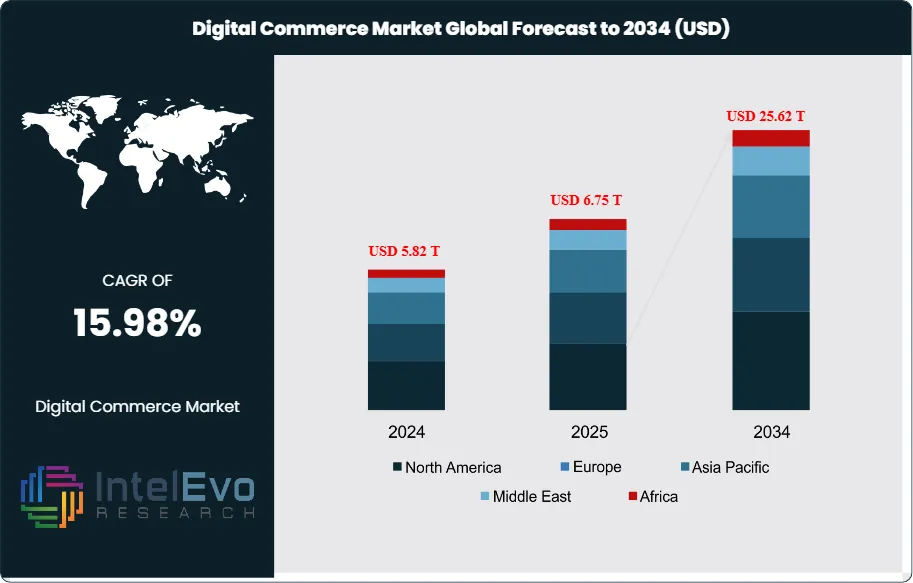

The Digital Commerce Market size is expected to be worth around USD 25.62 trillion by 2034, rising from USD 5.82 trillion in 2024, and expanding at a CAGR of 15.98% during the forecast period from 2024 to 2034. This rapid expansion is driven by the acceleration of mobile commerce, social commerce, and omnichannel retail strategies across both developed and emerging economies. Advances in AI-powered personalization, embedded payments, and cross-border e-commerce platforms are further transforming consumer buying behavior, positioning digital commerce as a core engine of global retail and service sector growth.

Get More Information about this report -

Request Free Sample ReportThe digital commerce market encompasses all online transactions involving the buying and selling of goods and services through digital platforms, including business-to-consumer (B2C), business-to-business (B2B), consumer-to-consumer (C2C), and business-to-government (B2G) models. This comprehensive market includes e-commerce platforms, digital payment systems, mobile commerce applications, social commerce, and emerging technologies that facilitate online transactions.

The digital commerce ecosystem is experiencing unprecedented growth driven by technological advancement, changing consumer behaviors, and global digitalization trends. Key growth accelerators include artificial intelligence integration for personalized shopping experiences, improved digital payment infrastructure, enhanced mobile commerce capabilities, and the proliferation of social commerce platforms. The integration of emerging technologies such as augmented reality, voice commerce, and blockchain security is reshaping how consumers interact with digital commerce platforms.

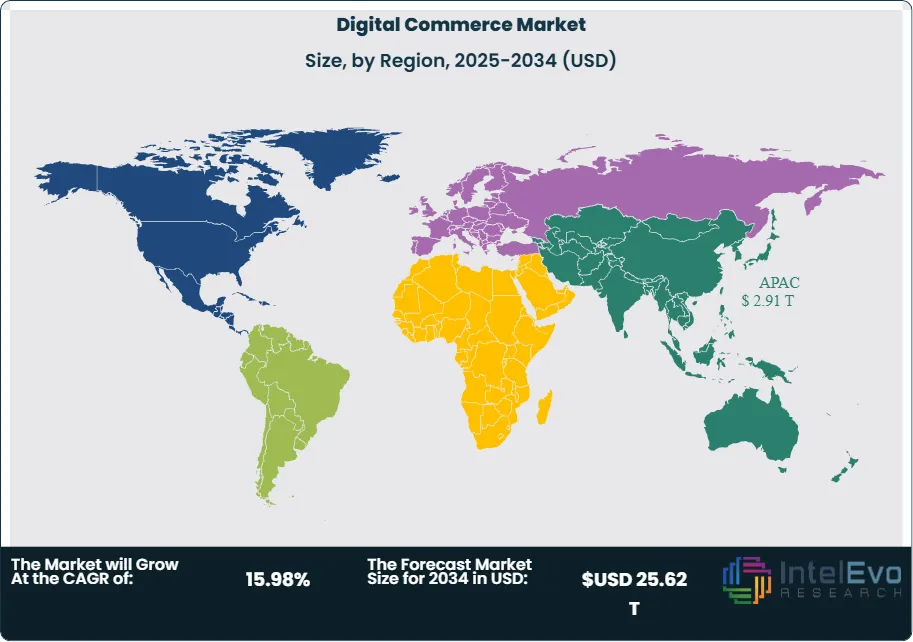

The Asia-Pacific region dominates digital commerce due to advanced technology, favorable demographics, and strong government support. China leads globally with platforms like Alibaba and Pinduoduo, backed by robust logistics and payment systems. High mobile broadband penetration and next-gen networks fuel mobile commerce, especially in Indonesia and Thailand. Meanwhile, North America excels in enterprise e-commerce and cross-border trade, while Europe emphasizes sustainable practices and strict data privacy standards.

The COVID-19 pandemic served as a significant catalyst for digital commerce adoption, accelerating trends that were already in motion. Lockdowns and social distancing measures forced consumers to shift from traditional retail to online platforms, resulting in permanent behavioral changes. Many businesses rapidly adopted digital commerce solutions to maintain operations, leading to increased market penetration and the emergence of new business models focused on contactless transactions and remote commerce.

Ongoing geopolitical tensions and trade disputes have influenced digital commerce market dynamics, particularly affecting cross-border e-commerce operations. Supply chain disruptions have accelerated the adoption of digital commerce solutions as businesses seek alternative distribution channels. Trade restrictions have led to the emergence of regional digital commerce champions, while data privacy regulations across different jurisdictions continue to shape how digital commerce platforms operate globally.

Key Takeaways

- Market Growth: The 3D bioprinting for organ regeneration market is expected to reach USD 25.62 Trillion by 2034, fueled by technological advancement, evolving consumer behaviors, and accelerating global digitalization initiatives across all market segments.

- Payment Dominance: Digital wallets lead the payment segment due to their enhanced security features and seamless integration capabilities that enable rapid transaction processing for B2B commerce.

- Component Dominance: The solution component dominates because it provides comprehensive, integrated platforms that address multiple business needs simultaneously, offering greater value than standalone services.

- Browsing Medium Dominance: Mobile and tablet browsing leads due to increasing demand for on-the-go procurement capabilities and flexible access requirements for modern business users.

- Business Type Dominance: B2B transactions naturally dominate in the B2B e-commerce market context, representing the core focus of enterprise procurement activities and complex supply chain relationships.

- Industry Vertical Dominance: The automotive industry leads due to its complex supply chain requirements and high-value component procurement needs that drive digital transformation adoption.

- Drivers: Key drivers accelerating growth include internet penetration expansion and mobile commerce adoption, which boost market expansion through improved accessibility and user experience.

- Restraints: Growth is hindered by cybersecurity concerns and digital divide challenges, which create barriers such as consumer trust issues and limited access in developing regions.

- Opportunities: The market is poised for expansion due to opportunities like AI-driven personalization and social commerce integration, which enable enhanced customer experiences and new revenue streams.

- Trends: Emerging trends including voice commerce and augmented reality shopping are reshaping the market by creating immersive and convenient shopping experiences.

- Regional Analysis: Asia-Pacific leads the global digital commerce market through unparalleled digital transformation initiatives, extensive smartphone penetration, and comprehensive government support for financial inclusion and e-commerce development.

Payment Analysis:

The payment landscape in B2B e-commerce reflects evolving financial technology adoption patterns and security considerations. Digital wallets have emerged as the preferred method due to their ability to streamline payment processes while maintaining robust security protocols. Their dominance stems from features like automated recurring payments, multi-currency support, and advanced fraud protection mechanisms that address enterprise-level requirements. Traditional payment methods like card payments and bank transfers remain significant but face challenges in meeting the speed and flexibility demands of modern B2B transactions. The emergence of cryptocurrency payments represents future potential, though current adoption remains limited due to regulatory uncertainty and volatility concerns that make businesses cautious about cryptocurrency integration.

Component Analysis:

The component segmentation reveals a clear preference for comprehensive solution-based approaches over fragmented service offerings. Solutions lead because they provide end-to-end capabilities including procurement management, supplier integration, analytics, and workflow automation through unified platforms. This integrated approach eliminates the complexity of managing multiple vendor relationships and ensures seamless data flow across business processes. Services, while important for specialized requirements and customization needs, represent a smaller market share as businesses increasingly seek platforms that can handle their entire e-commerce ecosystem. The solution-centric trend reflects enterprises' desire to reduce operational complexity while maximizing functionality and return on investment through comprehensive digital transformation initiatives.

Browsing Medium Analysis:

Mobile and Tablets Leads With more than 60% Market Share In Digital Commerce Market: The browsing medium landscape demonstrates the fundamental shift toward mobile-first business operations and flexible work environments. Mobile and tablet dominance reflects modern procurement professionals' need for on-the-go access to supplier catalogs, order management systems, and approval workflows. This trend has been accelerated by remote work adoption and the demand for real-time decision-making capabilities regardless of location. Desktop and laptop usage remains important for complex procurement tasks requiring detailed analysis, bulk ordering, and comprehensive reporting functions. However, the mobile-first approach has driven platform developers to create responsive interfaces that maintain full functionality across devices, ensuring that critical business operations can be conducted efficiently through any medium while preserving user experience quality.

Business Type Analysis:

The business type segmentation naturally favors B2B transactions within the B2B e-commerce market context, representing the core ecosystem of enterprise procurement, supply chain management, and inter-business relationships. B2B dominance stems from higher transaction values, complex approval workflows, and specialized requirements that characterize business purchasing behavior. These transactions involve bulk ordering, customized pricing structures, extended payment terms, and sophisticated integration needs that distinguish them from consumer commerce.

Industry Vertical Analysis:

The automotive industry's leadership in B2B e-commerce adoption reflects its sophisticated supply chain requirements and early digital transformation initiatives. Automotive manufacturers and suppliers operate complex networks requiring precise component sourcing, quality certifications, just-in-time inventory management, and global supplier coordination that make e-commerce platforms essential for operational efficiency. The industry's emphasis on cost optimization, regulatory compliance, and production scheduling drives demand for advanced platform capabilities including real-time inventory tracking, automated ordering systems, and integrated quality management.

Regional Analysis

Asia-Pacific Leads With over 50% Market Share In Digital Commerce Market: The Asia-Pacific region's digital commerce supremacy stems from a convergence of technological advancement, demographic advantages, and strategic governmental initiatives that have created an exceptionally fertile environment for e-commerce expansion. China serves as the undisputed regional leader, generating the largest share of global e-commerce sales through homegrown technology giants like Alibaba and Pinduoduo, which have developed sophisticated logistics ecosystems and payment platforms specifically tailored to regional consumer preferences and behaviors. The region benefits from superior technological infrastructure, with widespread mobile broadband access significantly exceeding global averages and extensive deployment of next-generation networks that enable seamless mobile commerce experiences. Mobile devices dominate web traffic generation across the region, with countries like Indonesia and Thailand achieving exceptionally high mobile usage rates that have fundamentally transformed consumer engagement with digital platforms.

North America maintains significant market presence through established technology infrastructure and high consumer spending power, with the United States leading in enterprise e-commerce solutions and cross-border trade capabilities. Europe demonstrates strong growth in sustainable e-commerce practices and regulatory compliance, with countries like Germany and the United Kingdom driving innovation in green logistics and data privacy standards.

Latin America represents an emerging market with rapid mobile adoption and increasing internet penetration. Middle East and Africa exhibit significant potential for digital commerce expansion, driven by young populations and increasing smartphone adoption rates, though infrastructure development and regulatory frameworks remain key factors for realizing this potential.

Get More Information about this report -

Request Free Sample ReportMarket Key Players

Payment:

- Cash Payments

- Card Payments

- Crypto Currency

- Digital Wallets

- Bank Transfers

Component:

- Services

- Solution

Browsing Medium:

- Mobile and Tablets

- Desktop/laptop

Business Type:

- Business to Consumer (B2C)

- Business to Business (B2B)

Industry Vertical:

- BFSI

- Media & entertainment

- Manufacturing

- Healthcare and pharmaceuticals

- Automotive

- Retail Household goods

- Others

Region:

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 6.75 T |

| Forecast Revenue (2034) | USD 25.62 T |

| CAGR (2025-2034) | 15.98% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Payment (Cash Payments, Card Payments, Crypto Currency, Digital Wallets, Bank Transfers), Component (Services, Solution), Browsing Medium (Mobile and Tablets, Desktop/laptop), Business Type (Business to Consumer (B2C), Business to Business (B2B)), Industry Vertical (BFSI, Media & entertainment, Manufacturing, Healthcare and pharmaceuticals, Automotive, Retail Household goods, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Alibaba Group Holding Limited, Walmart, Inc., Amazon.com, Inc., Best Buy, The Home Depot, eBay, Inc., Shopify, Inc., JD.com, Inc., Otto GmbH & Co, Rakuten, Inc. |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the Digital Commerce Market?

Explore the booming Digital Commerce Market, projected to grow from USD 5.82 Trillion in 2024 to USD 25.62 Trillion by 2034, at a CAGR of 15.98%. Key trends & insights inside.

Who are the major players in the Digital Commerce Market?

Alibaba Group Holding Limited, Walmart, Inc., Amazon.com, Inc., Best Buy, The Home Depot, eBay, Inc., Shopify, Inc., JD.com, Inc., Otto GmbH & Co, Rakuten, Inc.

Which segments covered the Digital Commerce Market?

Payment (Cash Payments, Card Payments, Crypto Currency, Digital Wallets, Bank Transfers), Component (Services, Solution), Browsing Medium (Mobile and Tablets, Desktop/laptop), Business Type (Business to Consumer (B2C), Business to Business (B2B)), Industry Vertical (BFSI, Media & entertainment, Manufacturing, Healthcare and pharmaceuticals, Automotive, Retail Household goods, Others)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date