Digital Manufacturing Market Size, Share & Forecast 2034 | 10.4% CAGR

Global Digital Manufacturing Market Size, Share, Analysis Report By Component Type (Software Solutions (PLM, CAD/CAM, MES, Digital Twins), Hardware (Robotics, 3D Printers, IoT Devices), Services (Consulting, Integration, Support)) End-User (Automotive, Aerospace, Electronics, Healthcare, Others) Industry Region & Key Players-Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends & Forecast 2025-2034

Report Overview:

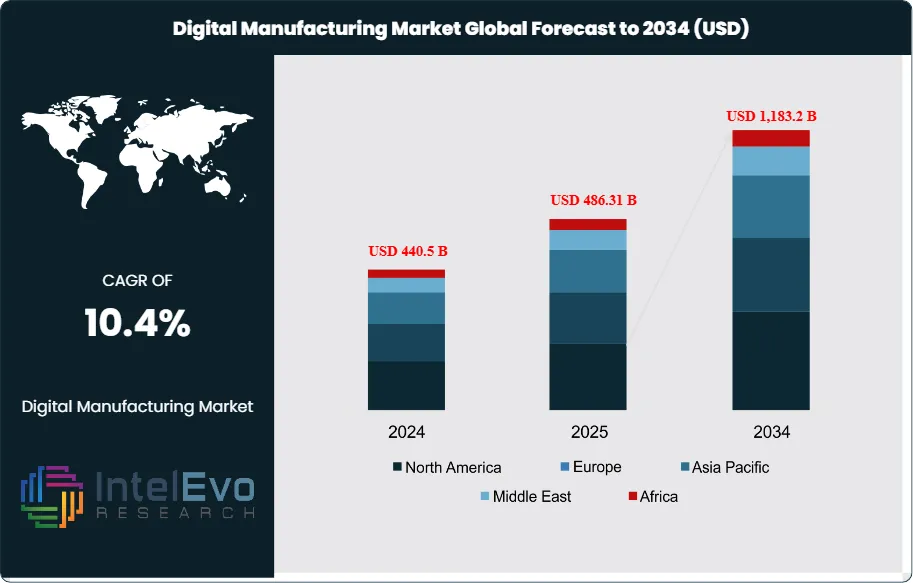

The Digital Manufacturing Market size is expected to be worth around USD 1,183.2 Billion by 2034, from USD 440.5 Billion in 2024, growing at a CAGR of 10.4% during the forecast period from 2024 to 2034. The digital manufacturing market represents a transformative segment within the industrial automation and smart technology ecosystem, focusing on the seamless integration of digital twins, artificial intelligence (AI), the Internet of Things (IoT), robotics, and advanced analytics to optimize manufacturing processes across industries.

Get More Information about this report -

Request Free Sample ReportThe market’s rapid growth is driven by the increasing adoption of Industry 4.0, the rising need for real-time data-driven decision-making, and the demand for cost-efficient, flexible, and sustainable manufacturing operations. Digital manufacturing enables companies to enhance production efficiency, minimize downtime, and accelerate innovation by leveraging predictive analytics, simulation modeling, and connected systems.

Several key factors are shaping the market trajectory, including the expansion of smart factories, increasing demand for cloud-based and edge-computing solutions, and the shift toward sustainable production methods. The integration of digital twins and AI-powered automation is allowing manufacturers to simulate and optimize production environments virtually, reducing material wastage and operational risks. Moreover, post-pandemic recovery has accelerated investments in digital infrastructure as companies seek resilience, agility, and remote operational capabilities.

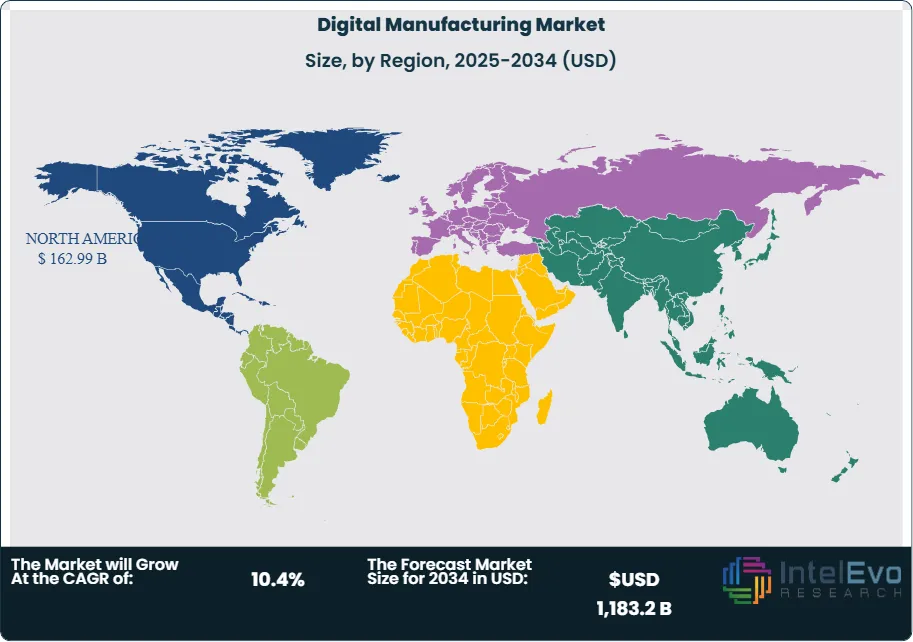

Regional analysis reveals North America as the leading market, capturing around 35–37% share in 2024, supported by advanced technological infrastructure, early adoption of smart factory solutions, and strong presence of leading automation players. Europe follows closely, emphasizing sustainability, innovation, and regulatory compliance in industrial automation. Meanwhile, the Asia-Pacific region is emerging as the fastest-growing market, fueled by large-scale industrialization, government-backed digitalization initiatives, and the growing manufacturing base in countries like China, India, Japan, and South Korea.

The COVID-19 pandemic initially disrupted global manufacturing operations; however, it served as a catalyst for digital transformation. Manufacturers increasingly invested in automation, remote monitoring, and predictive maintenance solutions to mitigate supply chain risks and workforce limitations. The crisis underscored the strategic importance of digital manufacturing in ensuring business continuity and adaptability.

Geopolitical tensions, trade realignments, and fluctuating raw material costs have also impacted the digital manufacturing landscape, driving companies to adopt smart sourcing, localized production, and AI-based forecasting tools. These changes are fostering a more resilient and technologically advanced global manufacturing ecosystem.

Key Takeaways:

- Market Growth: The Digital Manufacturing Market is expected to reach USD 1,183.2 Billion by 2034, driven by industrial digitalization, real-time analytics, and automation.

- Technology Leadership: Digital Twin and IoT solutions dominate, enabling virtual simulation, performance optimization, and predictive maintenance across industries.

- Application Dominance: The automotive and aerospace sectors lead market adoption due to their demand for precision, speed, and innovation in product design and assembly.

- Platform Trend: Cloud-based digital manufacturing platforms are gaining traction due to scalability, flexibility, and cost-effectiveness, supporting SMEs and large enterprises alike.

- Driver: Increased adoption of AI, robotics, and connected sensors to enhance production efficiency, sustainability, and quality control.

- Restraint: High implementation costs and cybersecurity vulnerabilities pose significant challenges to small and mid-sized manufacturers.

- Opportunity: Expansion in emerging economies such as India and Southeast Asia, supported by government initiatives for smart manufacturing and digital infrastructure.

- Trend: Growing integration of 5G, augmented reality (AR), and blockchain for enhanced connectivity, transparency, and automation in production workflows.

- Regional Analysis: North America leads the market, followed by Europe, while Asia-Pacific exhibits the fastest growth due to rapid industrial digitalization.

Technology Analysis:

Digital Twin technology leads the global digital manufacturing market, accounting for a significant share due to its ability to simulate, monitor, and optimize production processes in real-time. By creating virtual replicas of physical assets, manufacturers can predict equipment failures, minimize downtime, and enhance efficiency. The integration of Artificial Intelligence (AI), Industrial Internet of Things (IIoT), and cloud-based analytics has accelerated adoption across industries. Robotics and additive manufacturing technologies are also gaining momentum, enabling faster prototyping and customization. The convergence of 5G connectivity, automation, and real-time analytics continues to redefine the manufacturing landscape, paving the way for hyperconnected, intelligent production systems that improve flexibility and scalability across industries.

Application Analysis:

The automotive and aerospace sectors dominate the digital manufacturing market, driven by the demand for precision engineering, smart automation, and advanced material design. Automotive manufacturers are adopting digital twins and robotics to enhance assembly line efficiency and reduce time-to-market for new models. In aerospace, simulation-driven design and predictive maintenance are helping optimize aircraft production and lifecycle management. The electronics and healthcare sectors are emerging as key growth contributors, leveraging digital manufacturing for high-volume production and quality assurance. The growing emphasis on energy-efficient and sustainable production methods further propels digital transformation across applications, positioning digital manufacturing as the backbone of next-generation industrial innovation.

End-User Industry Analysis:

Manufacturing, automotive, and aerospace industries represent the largest end-user segments in the digital manufacturing market, collectively driving more than half of total market revenue. The automotive sector relies heavily on digital platforms for design automation, supply chain coordination, and real-time production monitoring. Aerospace manufacturers leverage digital simulation to test performance and compliance under virtual conditions, reducing physical testing costs. Additionally, the healthcare, consumer electronics, and energy sectors are rapidly adopting digital manufacturing to enhance precision, traceability, and operational efficiency. The rising demand for connected and sustainable production systems among small and mid-sized enterprises (SMEs) further expands adoption across diverse end-user verticals.

Regional Analysis:

North America dominates the global digital manufacturing market with approximately 36–38% share in 2024, supported by a mature industrial base and advanced technological infrastructure. The United States leads adoption, fueled by large-scale investments in Industry 4.0, automation, and smart factories. Europe follows closely, driven by regulatory support for sustainability and strong adoption in Germany, the UK, and France. Asia-Pacific is the fastest-growing region, led by China, Japan, India, and South Korea, where rapid industrialization and digital transformation initiatives are reshaping manufacturing ecosystems. Meanwhile, Latin America and the Middle East & Africa are emerging markets with growing interest in cloud manufacturing and industrial IoT integration.

Get More Information about this report -

Request Free Sample ReportMarket Segmentation

By Technology:

- Digital Twin

- Computer-Aided Design (CAD)

- Industrial IoT (IIoT)

- Additive Manufacturing (3D Printing)

- Augmented & Virtual Reality (AR/VR)

- Cloud-based Manufacturing Solutions

By Application:

- Product Design and Prototyping

- Process Optimization

- Predictive Maintenance

- Quality Control and Inspection

- Supply Chain Management

By End-User Industry:

- Automotive

- Aerospace & Defense

- Electronics & Semiconductor

- Healthcare & Medical Devices

- Energy & Power

- Industrial Machinery

By Region:

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 486.31 B |

| Forecast Revenue (2034) | USD 1,183.2 B |

| CAGR (2025-2034) | 10.4% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Technology (Digital Twin, Computer-Aided Design (CAD), Industrial IoT (IIoT), Additive Manufacturing (3D Printing), Augmented & Virtual Reality (AR/VR), Cloud-based Manufacturing Solutions), By Application (Product Design and Prototyping, Process Optimization, Predictive Maintenance, Quality Control and Inspection, Supply Chain Management), By End-User Industry (Automotive, Aerospace & Defense, Electronics & Semiconductor, Healthcare & Medical Devices, Energy & Power, Industrial Machinery) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Siemens AG, Dassault Systèmes SE, Autodesk Inc., PTC Inc., Honeywell International Inc., General Electric (GE), Rockwell Automation, Inc., SAP SE, ABB Ltd., Bosch Rexroth AG, IBM Corporation, Oracle Corporation, ANSYS, Inc., Hexagon AB, Schneider Electric SE, Mitsubishi Electric Corporation, Siemens Energy, Fujitsu Limited, Dassault Aviation, Emerson Electric Co. |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Digital Manufacturing Market

Published Date : 15 Jul 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date