Digital Robots Market Share,Size to Reach $382.18 Bn by 2034 | 26.62% CAGR

Global Digital Robots Market Size, Share, Forecast, Growth Analysis Report By Type Component (Software, Hardware), By Mobility (Stationary, Mobile), By End User (Professional, Personal) ndustry Region & Key Players-Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends & Forecast 2025-2034

Report Overview

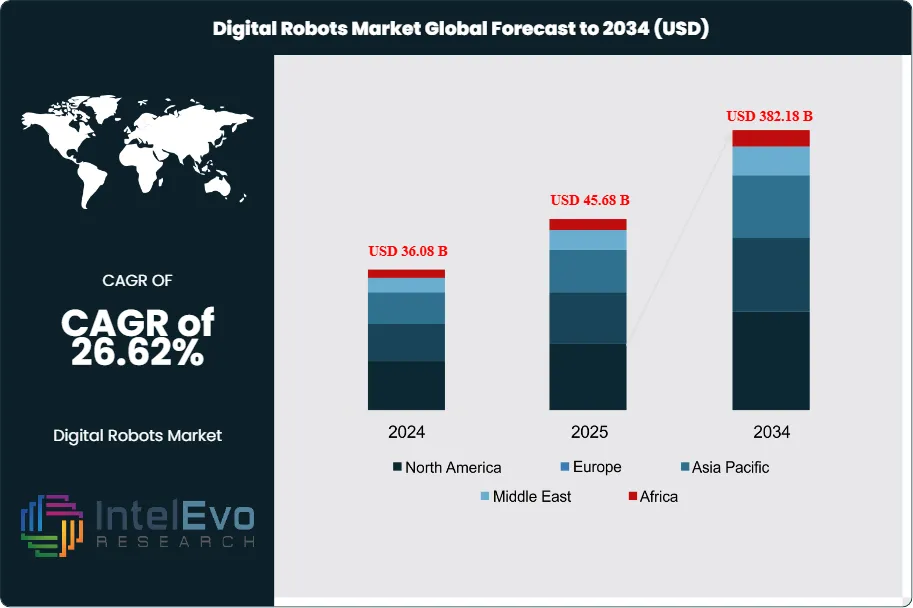

The Digital Robots Market size is expected to be worth around USD 382.18 billion by 2034, rising sharply from USD 36.08 billion in 2024, and expanding at a remarkable CAGR of 26.62% during the forecast period from 2024 to 2034. This exponential growth is driven by rapid adoption of AI-powered automation, robotic process automation (RPA), and intelligent virtual assistants across enterprises seeking operational efficiency and cost optimization. Increasing integration of digital robots with cloud platforms, generative AI, and data analytics is further accelerating deployment, positioning digital robots as a core enabler of large-scale digital transformation across industries worldwide.

Get More Information about this report -

Request Free Sample ReportThe digital robots market represents one of the most transformative technological segments in contemporary industrial and consumer landscapes, encompassing sophisticated automated systems that integrate artificial intelligence, advanced sensors, and mechanical engineering to perform complex tasks across diverse applications. The robotics market is expected to reach approximately USD 680–700 billion by 2034, rising from USD 56.57 billion in 2024, and expanding at a strong CAGR of around 26–27% during the forecast period from 2025 to 2034. This robust growth is driven by rapid advancements in machine learning and AI algorithms, declining sensor and hardware costs, enhanced computing power, and accelerating demand for automation across manufacturing, healthcare, logistics, and service industries. Key growth catalysts include the need for higher operational efficiency, solutions to global labor shortages, precision manufacturing requirements, and deeper integration of Industry 4.0 technologies enabling seamless connectivity between robotic systems, cloud platforms, and digital infrastructure.

The market dynamics are significantly influenced by technological convergence factors including the proliferation of Internet of Things (IoT) connectivity, edge computing capabilities, 5G network deployment, and advanced human-robot interaction interfaces that enhance operational versatility and user acceptance. Additionally, regulatory frameworks supporting automation adoption, government initiatives promoting digital transformation, substantial venture capital investments in robotics startups, and corporate digital modernization strategies are accelerating market penetration across traditional and emerging sectors, creating unprecedented opportunities for both established players and innovative disruptors.

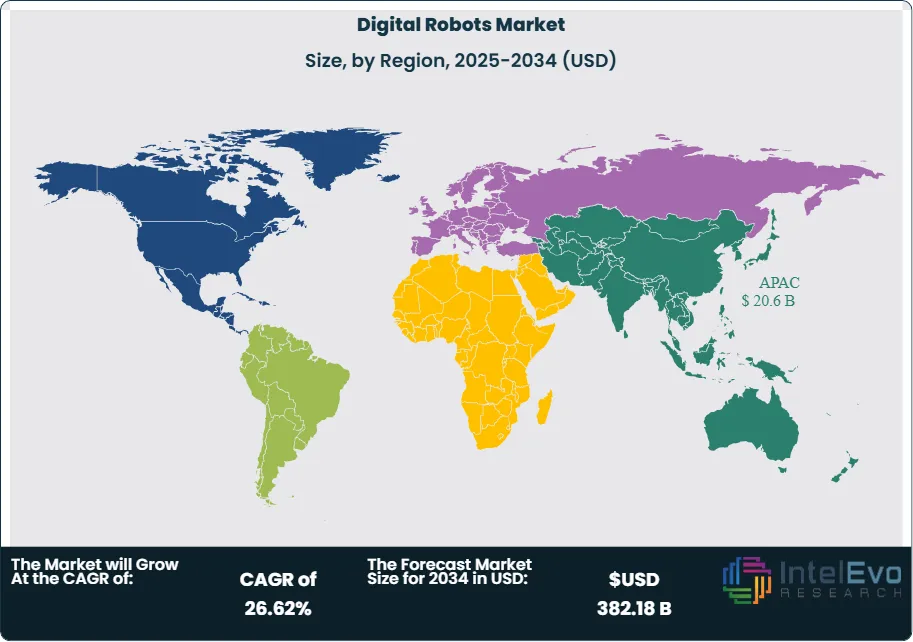

North America leads the global digital robots market, with the United States forecasted to generate the highest revenue in the robotics market in 2024, with an expected value of $784.6 billion, primarily driven by extensive adoption in manufacturing, automotive, and electronics sectors. The region benefits from robust technological infrastructure, significant research and development investments, favorable regulatory environments, and strong presence of leading robotics companies, making it the dominant market segment with substantial growth potential across industrial and service applications.

The COVID-19 pandemic accelerated digital robots market adoption as organizations sought contactless operations, supply chain resilience, and workforce safety solutions. Lockdown restrictions and social distancing requirements drove increased demand for automated systems in healthcare, logistics, sanitization, and customer service applications. While initial supply chain disruptions temporarily affected hardware production and deployment timelines, the pandemic ultimately catalyzed long-term automation strategies, with companies recognizing robotics as essential infrastructure for business continuity and operational flexibility during crisis situations.

Ongoing geopolitical tensions between major economies, particularly US-China trade disputes and technology export restrictions, have significantly impacted the digital robots market through supply chain disruptions, component shortage issues, and increased manufacturing costs. Tariffs on robotic components and semiconductor restrictions have prompted companies to diversify supply chains, establish regional manufacturing facilities, and develop alternative sourcing strategies. These trade barriers have also accelerated domestic robotics industry development in various regions, as governments prioritize technological sovereignty and reduced dependence on foreign suppliers, leading to increased local investment in robotics research, development, and manufacturing capabilities while potentially fragmenting global innovation collaboration.

Key Takeaways

- Market Growth: The Digital Robots Market is expected to reach USD 382.18 Billion by 2034, driven by macroeconomic trends of labor scarcity, technological leaps in AI, and post pandemic resilience efforts.

- Component Dominance: Hardware leads the market, driven by demand for advanced actuators, ruggedized chassis, and integrated sensor suites in industrial settings.

- Mobility Dominance: Among mobility types, mobile robots are gaining traction thanks to AGRs/AMRs in logistics, warehousing, and on site autonomous delivery.

- End User Dominance: Professional/end user segment leads, with manufacturers, logistics providers, healthcare institutions, and defense agencies heavily investing.

- Driver: Key drivers include the necessity for labor efficiency, precision, and scalable automation across sectors.

- Restraint: High upfront costs and complexity in programming/integration continue to hinder adoption especially for small and mid sized enterprises.

- Opportunity: Emergent technologies like cloud based robotics, swarm intelligence, and ROS based open ecosystems present new expansion avenues.

- Trend: The proliferation of AI driven perception systems and autonomous fleet management is revolutionizing how robots operate in complex, dynamic environments.

- Regional Analysis: North America retains the lead due to early adoption, strong R&D capability, and infrastructure; Europe and Asia Pacific continue rapid trail growth.

Component Analysis:

Hardware Leads With more than 55% Market Share In Digital Robots Market. The hardware segment maintains its dominant position in the digital robots market due to the fundamental requirement for sophisticated physical components that enable robotic functionality. This segment encompasses critical elements including advanced sensors, high-precision actuators, robust mechanical frames, powerful processing units, and specialized end-effectors that collectively determine robot performance capabilities. Manufacturing costs for premium hardware components remain substantial, reflecting the precision engineering required for reliable industrial applications. The segment benefits from continuous technological improvements in materials science, miniaturization trends, and manufacturing processes that enhance performance while gradually reducing costs. Hardware manufacturers are increasingly focusing on modular designs that enable customization for specific applications while maintaining economies of scale in production.

Mobility Analysis:

Mobile robotics represents the fastest-growing mobility segment as organizations recognize the superior flexibility and operational versatility offered by autonomous navigation systems. Unlike stationary robots limited to fixed positions, mobile platforms can adapt to changing facility layouts, perform multiple tasks across different locations, and provide scalable automation solutions that grow with business needs. Advanced navigation technologies including simultaneous localization and mapping (SLAM), computer vision systems, and artificial intelligence-driven path planning enable mobile robots to operate safely in dynamic environments alongside human workers. The segment particularly benefits from warehouse automation trends, last-mile delivery applications, and service robotics implementations where mobility is essential for effective task completion.

End User Analysis:

Professional Leads With over 75% Market Share In Digital Robots Market. Professional applications dominate the digital robots market due to the substantial return on investment achievable through precision automation in industrial, medical, and commercial environments. Professional robots typically feature advanced capabilities, enhanced reliability, and specialized functionality that justify higher price points compared to consumer alternatives. Key applications include surgical procedures, manufacturing assembly, welding operations, material handling, quality inspection, and customer service functions that require consistent performance standards. The professional segment benefits from established procurement processes, dedicated technical support infrastructure, and comprehensive training programs that facilitate successful implementation and ongoing operations across diverse industry verticals.

Region Analysis:

North America leads the global digital robots market through a combination of technological innovation, substantial capital investments, and favorable regulatory frameworks that encourage automation adoption across multiple industry sectors. Market growth in the region is being driven by widespread use of robotics in manufacturing, especially in the automotive and electronics sectors, supported by established supply chains, skilled workforce availability, and strong presence of leading robotics companies including Boston Dynamics, iRobot Corporation, and Intuitive Surgical. The region benefits from robust venture capital funding, comprehensive research and development infrastructure, and strategic government initiatives supporting advanced manufacturing and digital transformation projects.

Europe represents a significant market segment with particular strength in industrial automation, automotive manufacturing, and precision engineering applications, driven by established manufacturing heritage and stringent quality requirements. Asia-Pacific demonstrates the highest growth potential due to rapid industrialization, expanding manufacturing capabilities, increasing labor costs that favor automation adoption, and substantial government investments in robotics development. China, Japan, and South Korea lead regional adoption through comprehensive national strategies supporting robotics integration across manufacturing, service, and consumer sectors.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

Component

- Software

- Hardware

Mobility

- Stationary

- Mobile

End User

- Professional

- Personal

Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 45.68 B |

| Forecast Revenue (2034) | USD 382.18 B |

| CAGR (2025-2034) | CAGR of 26.62% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Component (Software, Hardware), Mobility (Stationary, Mobile), End User (Professional, Personal) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Boston Dynamics, iRobot Corporation, Kuka AG (Midea Group), Kawasaki Heavy Industries, Ltd., Yaskawa Electric Corporation, Fanuc Corporation, Panasonic Industry Europe GmbH, Omron Corporation, Intuitive Surgical Operations, Inc., OTC Daihen Inc. |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date