Digital Signage in QSR Market Size, Growth Trends | CAGR of 15.5%

Global Digital Signage in Quick Service Restaurants (QSRs) Market Size, Share & Foodservice Analysis By Component (Hardware, Software, Service), By Application (Indoor Signage, Outdoor Signage), By Resolution (8K, 4K, Full High Definition (FHD), High Definition (HD), Lower than HD), By Technology (LCD, LED, OLED, Projection), By Signage Size (Below 32 Inches, 32 to 52 Inches, Above 52 Inches), Digital Ordering & POS Integration, Franchise Expansion Trends, Regional Performance, Competitive Strategies & Forecast 2025–2034

Report Overview

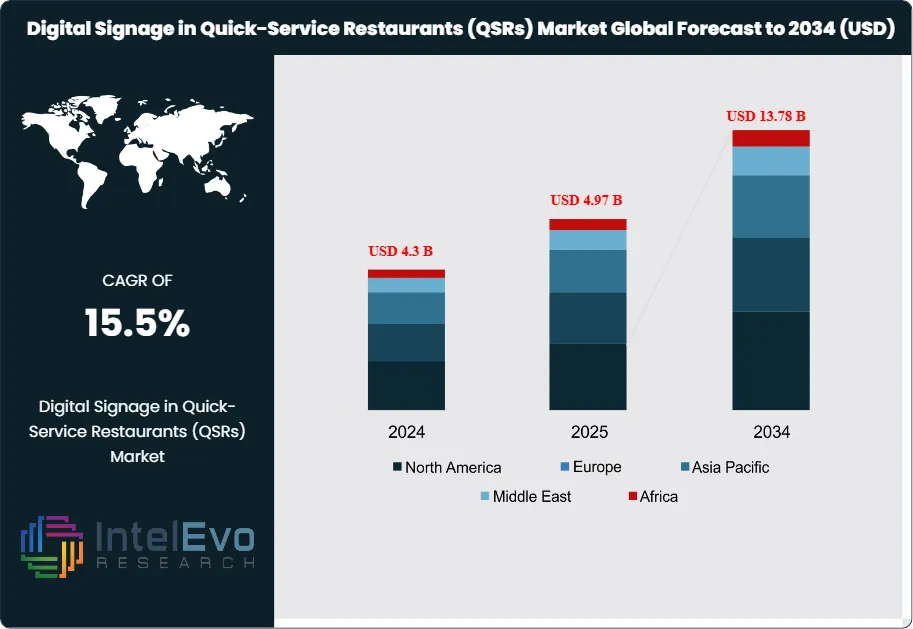

The Digital Signage Market in quick-service restaurants (QSRs) is estimated at USD 4.3 billion in 2024 and is on track to reach roughly USD 13.78 billion by 2034, implying a compound annual growth rate (CAGR) of 15.5% over 2025–2034. This rapid expansion is driven by the widespread adoption of digital menu boards, dynamic pricing, and AI-enabled content personalization across global QSR chains. Operators are increasingly leveraging digital signage to improve order accuracy, upsell high-margin items, reduce perceived wait times, and synchronize promotions across in-store, drive-thru, and self-service kiosks. The integration of analytics, POS systems, and real-time content updates is positioning digital signage as a core revenue optimization and customer experience tool in modern QSR operations.

Get More Information about this report -

Request Free Sample ReportThis expansion reflects the rapid integration of digital technologies across the restaurant sector, where operators are under pressure to enhance customer engagement, streamline operations, and reduce costs. Over the past decade, QSRs have shifted from static menu boards to interactive, real-time digital displays, with adoption accelerating as consumer expectations for personalization and convenience rise.

The market’s growth trajectory is supported by both demand-side and supply-side factors. On the demand side, customers increasingly expect tailored promotions, nutritional transparency, and seamless ordering experiences. On the supply side, QSR operators face rising labor costs and operational inefficiencies, making digital signage a cost-effective solution for menu management and targeted marketing. The ability to update content instantly across multiple locations reduces reliance on printed materials and lowers recurring expenses, while also enabling rapid adaptation to shifting consumer preferences.

Technology is a central driver of adoption. Integration with artificial intelligence and analytics allows restaurants to deliver context-specific promotions, such as time-of-day offers or location-based campaigns. Automation of menu updates, integration with mobile ordering platforms, and the use of cloud-based content management systems are further enhancing operational efficiency. As digital signage becomes more interactive, features such as touch-enabled displays and AI-driven recommendation engines are reshaping how QSRs engage with customers.

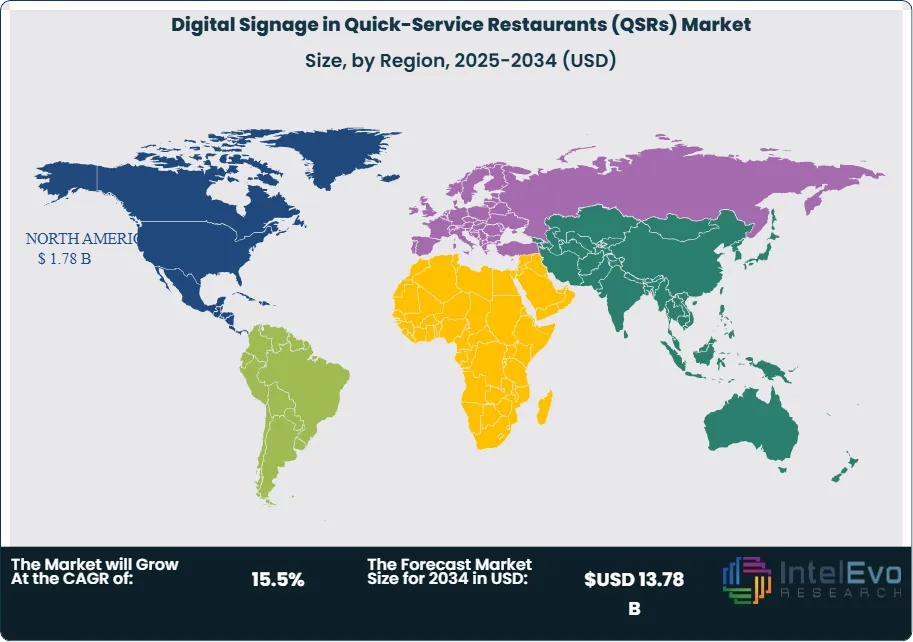

Regional performance highlights clear investment priorities. North America accounted for 41.5% of global revenue in 2024, generating USD 1.36 billion, with the United States alone contributing USD 1.09 billion. The region’s strong position is underpinned by high consumer adoption of digital ordering and the presence of leading QSR chains. Europe is expected to follow with steady growth, driven by regulatory emphasis on nutritional transparency and sustainability. Meanwhile, Asia-Pacific represents the fastest-growing opportunity, supported by urbanization, rising disposable incomes, and the rapid expansion of international QSR brands. Markets such as China and India are expected to attract significant investment as operators scale digital infrastructure to meet surging demand.

For investors and decision-makers, the sector presents a compelling case. Strong growth fundamentals, combined with the ongoing digital transformation of the restaurant industry, position digital signage as a critical enabler of competitiveness in the QSR segment.

Key Takeaways

- Market Growth: The global digital signage market in QSRs is projected to expand from USD 4.3 billion in 2024 to USD 13.78 billion by 2034, registering a CAGR of 15.5%. Growth is driven by rising demand for real-time menu updates, personalized promotions, and operational efficiency.

- Segment Dominance – Component: Hardware remains the largest revenue contributor, accounting for 48.7% of the market in 2024. Displays, media players, and mounting systems form the backbone of QSR digital signage deployments.

- Segment Dominance – Technology: LED technology leads with 51.9% market share due to its energy efficiency, brightness, and long lifespan. Adoption is accelerating as QSRs prioritize cost savings and high-visibility displays.

- Driver: Increasing consumer demand for interactive and personalized experiences is fueling adoption. Digital signage enables QSRs to deliver targeted promotions and reduce menu update costs by up to 30% compared with printed alternatives.

- Restraint: High upfront installation and integration costs remain a barrier, particularly for small and mid-sized QSR operators. Hardware and software investments can exceed USD 50,000 per location, slowing adoption in cost-sensitive markets.

- Opportunity: Asia-Pacific presents the strongest growth potential, with urbanization and QSR expansion driving double-digit adoption rates. Markets such as China and India are expected to outpace global averages, supported by rising disposable incomes and rapid digital infrastructure development.

- Trend: Demand for ultra-high-definition displays is rising, with 8K resolution capturing 38.4% of the market in 2024. Leading QSR chains are piloting AI-driven digital signage that integrates with mobile ordering and loyalty platforms to enhance customer engagement.

- Regional Analysis: North America accounted for 41.5% of global revenue in 2024, generating USD 1.36 billion, with the US alone contributing USD 1.09 billion. The region is forecast to grow at a CAGR of 12.2%. Asia-Pacific is emerging as the fastest-growing region, while Europe is advancing steadily under regulatory pressure for nutritional transparency and sustainability.

Type Analysis

High-performance concrete continues to gain traction in 2025 as construction projects demand materials that deliver superior strength and durability. Its adoption is particularly strong in infrastructure and large-scale commercial projects, where long service life and reduced maintenance costs are critical. The segment is projected to expand steadily, supported by government-backed infrastructure investments and the rising need for resilient building materials in urban centers.

Self-consolidating concrete is also witnessing strong uptake, driven by its ability to reduce labor costs and improve construction efficiency. With urban projects requiring faster turnaround times, contractors are increasingly adopting this type for complex structures and high-rise developments. Its market share is expected to grow at a CAGR of over 6% through 2030, supported by its compatibility with automation in concrete placement.

Other specialty concretes, including lightweight and fiber-reinforced variants, are carving out opportunities in niche applications such as precast elements and sustainable construction. As environmental regulations tighten, demand for eco-friendly formulations is expected to rise, positioning these alternatives as important contributors to long-term market growth.

Application Analysis

Pavers remain the largest application segment, supported by rapid urbanization and the expansion of pedestrian-friendly infrastructure. Municipal projects and residential landscaping continue to drive demand, with the segment accounting for more than 35% of total market revenues in 2025. The durability and aesthetic flexibility of concrete pavers make them a preferred choice for both public and private developments.

Retaining walls represent another significant application, particularly in regions with expanding urban sprawl and challenging topographies. The segment benefits from rising investments in flood control, soil stabilization, and highway expansion projects. With governments allocating higher budgets to climate-resilient infrastructure, retaining wall applications are forecast to grow at a steady pace through 2030.

Other applications, including precast blocks and decorative elements, are gaining momentum as architects and developers seek cost-effective solutions that combine functionality with design flexibility. This segment is expected to see incremental growth, particularly in emerging economies where construction activity is accelerating.

End-Use Analysis

Residential construction remains a key driver of demand, supported by rising urban housing needs and government-backed affordable housing programs. Concrete’s versatility and cost-effectiveness make it indispensable in this segment, which is projected to maintain a CAGR of around 5% through 2030.

Commercial buildings, including office complexes, retail centers, and hospitality projects, represent the fastest-growing end-use category. Developers are increasingly adopting high-performance and self-consolidating concrete to meet design complexity and sustainability requirements. This segment is expected to capture a growing share of the market as global commercial real estate investment rebounds post-2025.

Industrial construction, while smaller in scale, is critical for long-term growth. Warehouses, logistics hubs, and manufacturing facilities are driving demand for durable concrete solutions. With global supply chains expanding and e-commerce fueling warehouse development, this segment is expected to post consistent growth over the forecast period.

Regional Analysis

North America continues to lead the global market, supported by large-scale infrastructure renewal programs and strong adoption of advanced concrete technologies. The United States alone accounts for more than 30% of global revenues, with federal and state-level investments in highways, bridges, and urban housing driving demand.

Europe remains a mature but stable market, with growth concentrated in sustainable construction and energy-efficient building projects. Regulations promoting low-carbon materials are accelerating the adoption of advanced concrete formulations, particularly in Germany, France, and the Nordic countries.

Asia Pacific is the fastest-growing region, projected to expand at a CAGR exceeding 7% through 2030. Rapid urbanization in China, India, and Southeast Asia, coupled with large-scale infrastructure projects, is fueling demand across all concrete types and applications. Latin America and the Middle East & Africa are also emerging as important growth frontiers, supported by urban expansion, industrial development, and government-backed infrastructure initiatives.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Component

- Hardware

- Displays

- Media Players

- Projectors

- Others

- Software

- Service

- Installation Services

- Maintenance & Support Services

- Consulting Services

By Application

- Indoor Signage

- Menu boards

- Promotional displays

- Ordering kiosks

- Queue management systems

- Outdoor Signage

- Drive-thru menu boards

- Exterior promotional displays

- Directional signage

By Resolution

- 8K

- 4K

- Full High Definition (FHD)

- High Definition (HD)

- Lower than HD

By Technology

- LCD

- LED

- OLED

- Projection

By Signage Size

- Below 32 Inches

- 32 to 52 Inches

- Above 52 Inches

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 4.3 B |

| Forecast Revenue (2034) | USD 13.78 B |

| CAGR (2024-2034) | 15.5% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Component (Hardware, Software, Service), By Application (Indoor Signage, Outdoor Signage), By Resolution (8K, 4K, Full High Definition (FHD), High Definition (HD), Lower than HD), By Technology (LCD, LED, OLED, Projection), By Signage Size (Below 32 Inches, 32 to 52 Inches, Above 52 Inches) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Spectrio LLC., NEC Corporation, Moving Tactics, Samsung Electronics, Smartzone Enterprises, CrownTV, Sony Corporation, Remote Media Group Limited, Sharp Corporation, LG Electronics, Others |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Digital Signage in Quick-Service Restaurants (QSRs) Market

Published Date : 01 Jan 2026 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date