Digital Twin in Aerospace & Defense Market Size, Growth | CAGR 39.5%

Global Digital Twin in Aerospace and Defence Market Size, Share & Technology Analysis By Application (Predictive Maintenance, Design Simulation, Fleet Management, Training & Testing), By Platform (Cloud, On-Premise), By End User (Commercial Aviation, Military, Space), AI & IoT Integration, Defense Modernization Programs, Key Players, Trends & Forecast 2025–2034

Report Overview

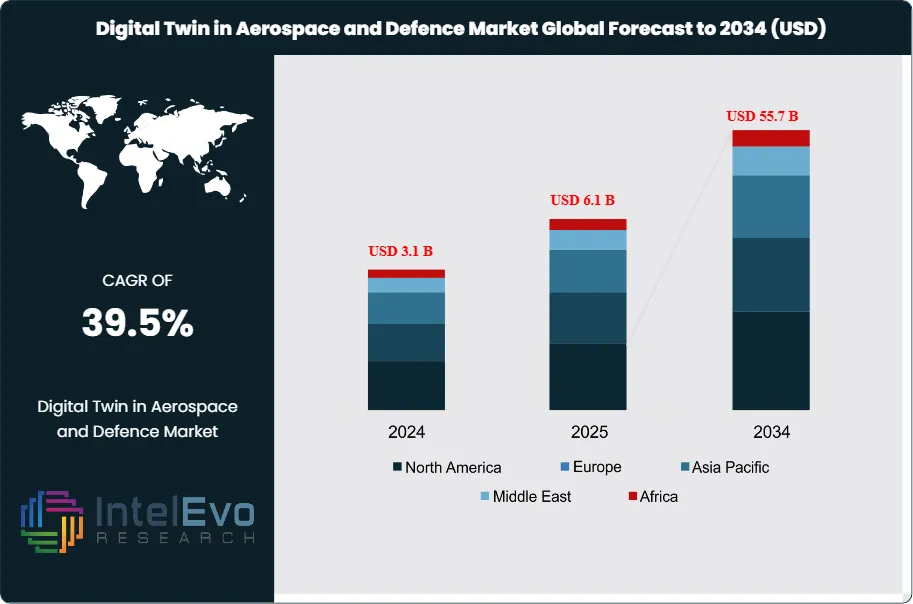

The Digital Twin in Aerospace and Defense Market is estimated at USD 3.1 billion in 2024 and is on track to reach roughly USD 55.7 billion by 2034, implying a robust compound annual growth rate (CAGR) of 39.5% over 2025–2034. This exceptional growth is being driven by rising adoption of predictive maintenance, virtual prototyping, and real-time performance monitoring across aircraft, spacecraft, and defense platforms. Governments and OEMs are increasingly leveraging digital twins to reduce lifecycle costs, improve mission readiness, and accelerate design validation. As defense modernization programs and next-generation aerospace platforms expand, digital twin technology is becoming a foundational capability rather than an optional innovation.

Get More Information about this report -

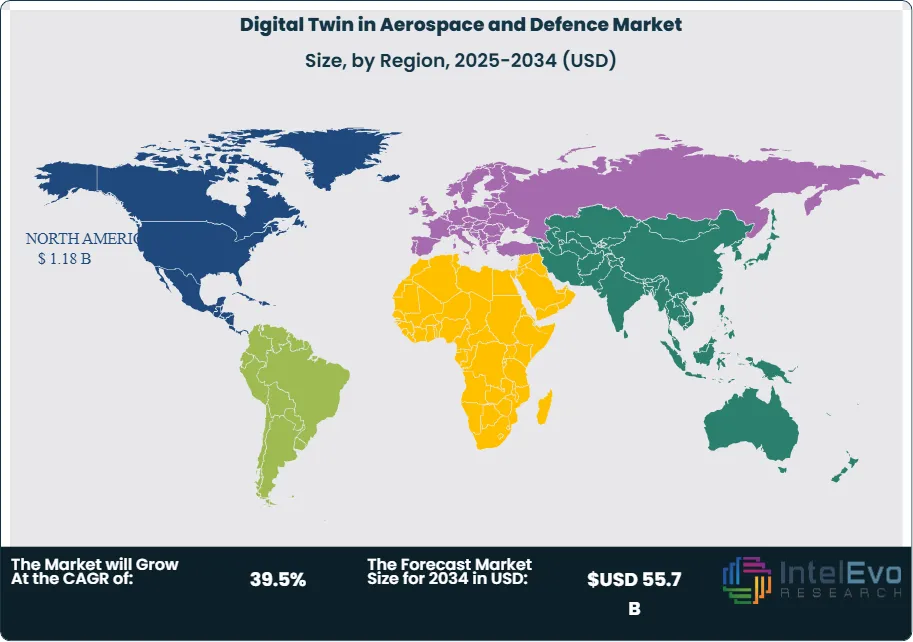

Request Free Sample ReportThis rapid expansion reflects the sector’s increasing reliance on advanced simulation and predictive modeling to manage complex systems, reduce costs, and improve operational efficiency. North America accounted for 40.7% of global revenue in 2024, valued at USD 8.85 billion, underscoring its position as the leading hub for adoption and investment.

The market has evolved from early-stage pilots to large-scale deployments as aerospace and defense organizations recognize the tangible benefits of digital twins. Historically, physical testing and maintenance cycles dominated cost structures. Today, digital twins enable real-time monitoring, predictive maintenance, and accelerated product development, reducing testing costs by up to 15% and shortening design timelines by as much as 25%. Defense agencies are extending asset lifespans and improving mission readiness, while aerospace manufacturers are applying digital twins to engines, airframes, and full aircraft systems to enhance reliability and safety.

Key growth drivers include the rising complexity of aerospace platforms, the demand for improved system reliability, and the industry-wide push for digital transformation. According to LTIMindtree, 73% of aerospace and defense organizations now maintain a long-term roadmap for digital twin adoption, up from 57% in 2021. Investment levels are rising sharply, with the sector allocating 2.7% of revenue to digital twin initiatives in 2023, a 40% increase year on year. At the same time, 78% of organizations cite technological advancements such as AI-driven modeling, automation, and advanced analytics as the primary enabler of adoption.

Regional trends highlight North America’s dominance, but Europe and Asia-Pacific are emerging as critical growth regions. European defense programs are integrating digital twins into lifecycle management, while Asia-Pacific markets are accelerating adoption in commercial aerospace manufacturing. These regions represent important investment hotspots for stakeholders seeking long-term growth opportunities.

Real-world outcomes reinforce the market’s trajectory. The U.S. Air Force saved €7.47 million by reducing wind tunnel tests for the F-22 through computational modeling, while the U.S. Navy cut aircraft development timelines by 25% using digital twin systems. With 24% of companies already applying digital twins across full lifecycle operations and another 50% planning adoption within two years, the technology is moving from experimentation to strategic necessity. By 2034, digital twins will be central to aerospace and defense competitiveness, driving efficiency, sustainability, and operational resilience.

Key Takeaways

- Market Growth: The global digital twin market in aerospace and defense is projected to expand from USD 3.1 billion in 2024 to USD 55.7 billion by 2034, reflecting a CAGR of 39.5% over 2025–2034. Growth is driven by rising demand for predictive maintenance, lifecycle management, and cost reduction in complex aerospace systems.

- Component: The component segment accounted for 52.8% of total revenue in 2024, underscoring its central role in enabling simulation, monitoring, and predictive analytics across aircraft systems and defense platforms.

- Deployment: On-premise solutions captured 64.6% of the market in 2024, reflecting the sector’s preference for localized infrastructure to safeguard sensitive defense and aerospace data.

- Driver: Digital transformation initiatives are accelerating adoption. According to LTIMindtree, 73% of aerospace and defense organizations now maintain a long-term roadmap for digital twin deployment, up from 57% in 2021.

- Restraint: High implementation costs and integration challenges remain significant barriers. Smaller enterprises face limited adoption capacity, with upfront investments often exceeding USD 5–10 million for full-scale deployment.

- Opportunity: Product design and development applications represented 25.2% of market share in 2024. This segment is expected to grow rapidly as digital twins shorten design cycles by up to 25% and reduce testing costs by 15%, creating strong returns for aerospace manufacturers.

- Trend: Adoption is shifting from pilots to enterprise-wide integration. In 2023, 24% of aerospace and defense companies used digital twins across the full product lifecycle, while another 50% planned adoption within two years, signaling rapid mainstreaming of the technology.

- Regional Analysis: North America led with 40.7% share in 2024, generating USD 8.85 billion in revenue. The U.S. market alone reached USD 0.6 billion and is forecast to grow at a CAGR of 38.2%, outpacing the global average. Europe is advancing adoption in defense programs, while Asia-Pacific is emerging as a high-growth hub in commercial aerospace manufacturing.

Type Analysis

High-performance concrete continues to dominate the advanced concrete market in 2025, supported by its superior strength, durability, and ability to withstand extreme environmental conditions. This segment is widely adopted in large-scale infrastructure and defense-related projects where structural integrity is critical. Industry estimates suggest that high-performance concrete accounts for more than 45% of total market revenues, with demand expected to grow at a CAGR of over 7% through 2030 as governments and private developers prioritize resilient construction.

Self-consolidating concrete is gaining traction due to its efficiency in reducing labor costs and improving construction speed. Its ability to flow easily into complex formworks without mechanical vibration makes it particularly attractive for high-rise buildings and precast applications. Adoption is expanding in both developed and emerging markets, with Asia Pacific showing the fastest uptake. This segment is projected to grow at a CAGR above 8% over the forecast period, driven by urbanization and the need for faster project delivery.

Other specialty concretes, including lightweight and fiber-reinforced variants, are carving out niche applications in aerospace-related facilities, industrial flooring, and sustainable construction. While their market share remains smaller, these types are expected to see steady growth as sustainability regulations tighten and demand for energy-efficient materials rises.

Application Analysis

Pavers represent one of the largest application areas, supported by rapid urban infrastructure development and public investment in smart city projects. In 2025, pavers account for nearly 35% of total demand, with growth concentrated in Asia Pacific and the Middle East. Governments in India, China, and the Gulf states are driving large-scale adoption through road modernization and airport expansion programs.

Retaining walls are another significant application, particularly in regions with challenging terrain and high urban density. The segment is expanding at a CAGR of 6.5% as cities invest in slope stabilization, flood control, and land-use optimization. North America and Europe remain key markets, with regulatory emphasis on sustainable land management practices further supporting demand.

Other applications, including precast elements for industrial and defense facilities, are gaining importance. These solutions reduce construction timelines and improve structural consistency, making them attractive for aerospace manufacturing hubs and military infrastructure projects.

End-Use Analysis

Residential construction remains the largest end-use segment, accounting for over 40% of market revenues in 2025. Rising urban populations and government-backed affordable housing programs are fueling demand, particularly in Asia Pacific and Latin America. The use of self-consolidating concrete in residential projects is expanding due to its efficiency in high-volume housing developments.

Commercial buildings represent the second-largest segment, with demand driven by office complexes, retail centers, and airport expansions. This category is expected to grow at a CAGR of 7.2% through 2030, supported by post-pandemic recovery in commercial real estate and rising investment in logistics hubs.

Industrial construction, including aerospace and defense facilities, is a smaller but high-value segment. The adoption of high-performance and specialty concretes in this category is accelerating as manufacturers prioritize durability, safety, and compliance with stringent industry standards.

Regional Analysis

North America continues to lead the global market, holding more than 38% of revenues in 2025. The region benefits from advanced construction technologies, strong investment in defense infrastructure, and a mature aerospace sector. The U.S. remains the largest contributor, with federal infrastructure programs and defense modernization initiatives driving demand.

Europe follows closely, supported by sustainability-focused regulations and large-scale infrastructure renewal projects. Countries such as Germany, France, and the UK are investing heavily in green construction materials, which is accelerating the adoption of self-consolidating and fiber-reinforced concretes.

Asia Pacific is the fastest-growing region, projected to expand at a CAGR above 8% through 2030. Rapid urbanization, large-scale housing programs, and significant investment in airports and defense facilities are fueling demand. China and India dominate regional consumption, while Southeast Asia is emerging as a new growth hub.

Latin America and the Middle East & Africa present smaller but expanding opportunities. Brazil and Mexico are investing in urban infrastructure, while Gulf states are channeling resources into mega-projects and defense-related construction. These regions are expected to see steady growth as governments diversify their economies and expand industrial capacity.

Get More Information about this report -

Request Free Sample ReportKey Market Segments

By Solution

- Component

- Process

- System

By Deployment

- Cloud

- On-premise

By Enterprise Size

- Large Enterprises

- Small and Medium Enterprises (SMEs)

By Application

- Product Design & Development

- Predictive Maintenance

- Business Optimization

- Space-Based Monitoring

- Others

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 3.1 B |

| Forecast Revenue (2034) | USD 55.7 B |

| CAGR (2024-2034) | 39.5% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Solution, Component, Process, System, By Deployment, Cloud, On-premise, By Enterprise Size, Large Enterprises, Small and Medium Enterprises (SMEs), By Application, Product Design & Development, Predictive Maintenance, Business Optimization, Space-Based Monitoring, Others |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Siemens AG, Autodesk Inc., Robert Bosch GmbH, Amazon Web Services, Inc., Dassault Systèmes, Rockwell Automation, Microsoft Corporation, General Electric, PTC Inc., SAP SE, ANSYS, Inc., ABB Group, AVEVA Group plc, Hexagon AB, Bentley Systems Inc., International Business Machines Corporation, Others |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Digital Twin in Aerospace and Defence Market

Published Date : 03 Jan 2026 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date