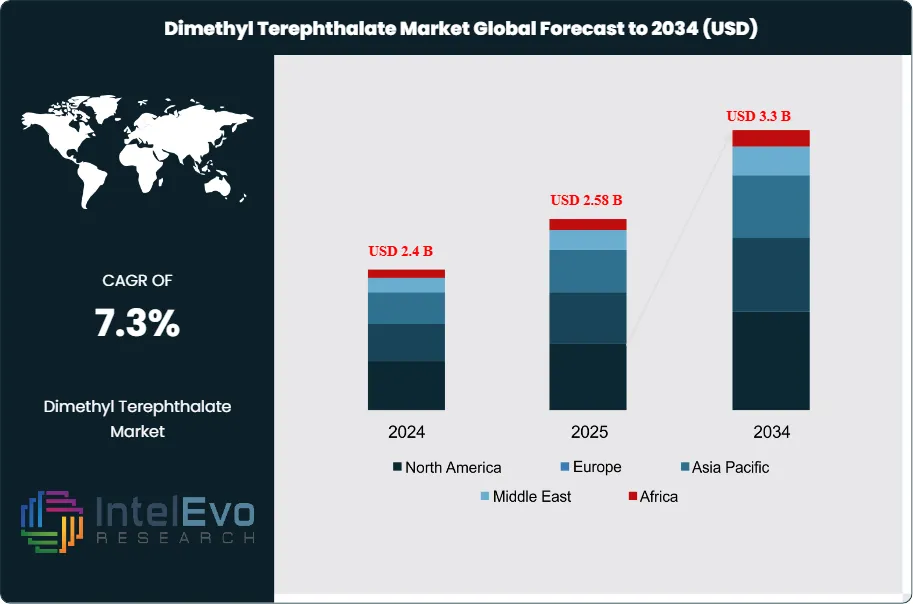

Dimethyl Terephthalate (DMT) Market to Hit $3.3B by 2034 | 7.3% CAGR

Global Dimethyl Terephthalate Market Size, Share & Analysis By Form (Solid, Liquid), By Application (Polyester Fibers, PET Resins, Films), By End-Use Industry (Packaging, Textiles), Industry Regions & Key Players – Capacity Expansion & Forecast 2025–2034

Report Overview

The Dimethyl Terephthalate (DMT) market is estimated at USD 2.4 billion in 2024 and is on track to reach roughly USD 3.3 billion by 2034, implying a compound annual growth rate of 7.3% over 2025–2034. Growing demand for high-performance polymers, PET resins, and polyester fibers continues to push DMT consumption across packaging, automotive, and textile applications. The shift toward lightweight materials and sustainable packaging solutions is further strengthening long-term market traction. As global manufacturing scales and recycling technologies mature, DMT is expected to play a pivotal role in next-generation material innovation.

Get More Information about this report -

Request Free Sample ReportDMT remains an essential intermediate in polyester production, particularly for polyethylene terephthalate (PET), polybutylene terephthalate (PBT), and polytrimethylene terephthalate (PTT). Demand has steadily expanded as manufacturers seek stable, high-yield feedstocks for large-scale polyester output. Volumes have grown in parallel with increased PET usage in beverage packaging and textile fiber manufacturing. In 2024, PET accounted for over 60% of total DMT consumption globally. Asia Pacific continues to lead demand, with China and India expanding domestic polyester capacity to support export-driven textile sectors. Southeast Asia has seen a 9% year-on-year rise in PET resin imports, reinforcing regional reliance on DMT-based production chains. Europe and North America remain stable demand centers, supported by investments in PET bottle recycling and closed-loop polymer systems.

DMT’s role in circular material flows is also expanding. As of 2025, chemical recycling facilities using DMT as a recovery intermediate have scaled operations in Germany, Japan, and South Korea. These processes convert post-consumer PET waste into reusable feedstocks, with DMT acting as a bridge between plastic recovery and virgin-equivalent production. In this application, DMT helps reduce reliance on fossil-derived inputs, addressing regulatory and investor pressure on carbon intensity and waste mitigation. Production technology is also evolving. Plants utilizing liquid-phase oxidation methods have improved yield efficiency by 7–9% over the last three years, lowering unit production costs. However, risks remain. DMT in powdered form poses an ignition hazard, and handling standards remain inconsistent in emerging manufacturing zones. Additionally, price volatility in paraxylene—the core input for DMT—continues to affect cost structures.

On the demand side, polyester films produced using DMT have gained traction in medical imaging, electronics, and industrial coatings. In 2025, specialty polyester films are expected to generate over USD 280 million in DMT-related consumption, driven by rising procurement from diagnostic equipment makers and flexible circuit manufacturers. Global trade flows also reflect growing strategic interest. The Middle East has increased its DMT exports to Asia by 12% in volume since 2023, filling regional supply gaps and diversifying beyond crude-linked exports. Overall, sustained demand from PET packaging, fiber production, and closed-loop chemical recycling will remain central to market growth over the next decade.

Key Takeaways

- Market Growth: The global Dimethyl Terephthalate (DMT) market was valued at USD 2.4 billion in 2024 and is projected to reach USD 233 billion by 2034, growing at a CAGR of 7.3%. Growth is driven by sustained demand for polyester-based applications in textiles, packaging, and engineered plastics.

- By Form: Solid DMT holds the largest market share at 71.2%, supported by its stability in handling, ease of storage, and dominant use in polyester fiber and resin production processes.

- By Application: Polyester fibers lead the application segment with a 47.7% share, reflecting high-volume consumption in apparel, home textiles, nonwovens, and technical fabrics.

- Driver: Rising global demand for PET packaging and polyester textiles is fueling upstream DMT consumption. The PET industry alone contributed to over 60% of DMT demand in 2024.

- Restraint: Price volatility in paraxylene, a core feedstock for DMT, continues to challenge production cost stability. Supply disruptions and raw material inflation directly affect profit margins for mid-tier producers.

- Opportunity: Chemical recycling of PET using DMT as an intermediate offers a scalable route to circular production. Emerging capacity in Japan, South Korea, and parts of Europe is expected to boost DMT demand in sustainable polymer manufacturing.

- Trend: Technological upgrades in oxidation and esterification processes have increased DMT yield by up to 9% since 2022. This efficiency gain supports lower production costs and aligns with energy reduction targets across global manufacturing sites.

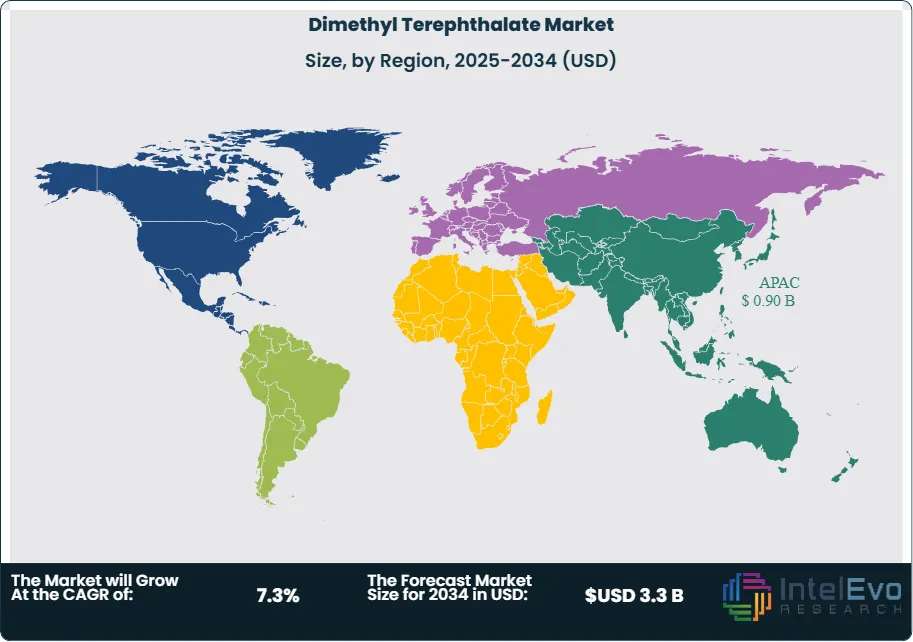

- Regional Analysis: Asia Pacific dominates the global market with a 37.4% share, driven by large-scale polyester production in China, India, and Southeast Asia. The region benefits from growing demand in textiles, automotive parts, and electronic films.

Form Analysis

Dimethyl Terephthalate (DMT) is commercially produced in two forms: solid and liquid. As of 2024, the solid form accounted for approximately 71.2% of the global market share. This dominance is attributed to its stability in ambient conditions, ease of handling during transport and storage, and suitability for high-volume industrial processes. Solid DMT is widely used in the production of polyethylene terephthalate (PET) resins, polyester fibers, and films—core inputs for industries such as textiles, packaging, and automotive components.

The liquid form, while used in select downstream applications requiring faster reaction times or specialized blending, remains a niche segment due to its sensitivity to storage conditions and higher handling requirements. With the continued expansion of polyester manufacturing across Asia and the Middle East, demand for solid DMT is expected to grow steadily through 2030, particularly in regions prioritizing integrated and cost-effective production infrastructure.

Application Analysis

Polyester fibers represent the largest application segment for DMT, holding a 47.7% share in 2024. This leadership is driven by the continued global demand for synthetic textiles used in apparel, furnishings, nonwovens, and industrial fabrics. Emerging economies—particularly China, India, and Vietnam—have scaled up fiber production capacity to meet export demand and serve growing domestic markets. Additionally, fast fashion, cost efficiency, and performance benefits such as durability and low maintenance continue to support the use of polyester over natural fibers in multiple end-use sectors.

Beyond fiber, DMT is a key input in polyester films and PET resins. Polyester films are widely used in electronics, medical imaging, and flexible packaging, while PET resins dominate the beverage packaging sector. Polybutylene terephthalate (PBT), a smaller application segment, is gaining ground in the automotive and electronics industries due to its thermal and mechanical properties. As downstream industries evolve toward recyclable and performance-based materials, demand across all DMT-based applications is expected to remain strong, with polyester fiber retaining the highest consumption share through the forecast period.

Regional Analysis

Asia Pacific continues to lead the global DMT market, accounting for 37.4% of global revenue in 2024. China remains the largest producer and consumer, supported by extensive polyester manufacturing capacity and competitive feedstock sourcing. India is scaling up rapidly, bolstered by policy initiatives such as the Production-Linked Incentive (PLI) scheme targeting textile and petrochemical industries. These developments have strengthened the region’s position as a key supplier to both domestic and export markets.

In parallel, Southeast Asian economies—including Vietnam, Indonesia, and Thailand—are attracting new investments as global companies diversify supply chains to reduce exposure to rising input costs and geopolitical risks in China. Cost advantages, infrastructure upgrades, and trade-friendly policies are contributing to the region’s attractiveness as a base for DMT production and downstream applications.

Meanwhile, Japan and South Korea are advancing the market for bio-based and low-emission DMT through government-backed R&D and environmental compliance programs. This dual focus on volume-driven output and sustainable alternatives positions Asia Pacific as the core growth engine for the global DMT market in both conventional and emerging applications.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Form

- Solid

- Liquid

By Application

- Polyester Fibers

- Polyester Film

- PET Resins

- Polybutylene Terephthalate

- Others

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 2.4 B |

| Forecast Revenue (2034) | USD 3.3 B |

| CAGR (2024-2034) | 7.3% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Form (Solid, Liquid), By Application (Polyester Fibers, Polyester Film, PET Resins, Polybutylene Terephthalate, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | SK chemicals, Kishida Chemical Co., Ltd, OAO Mogilevkhimvolokno, Eastman Chemical Company, Sarna Chemicals PVT. LTD, KANTO CHEMICAL CO., INC., OXXYNOVA GmbH, Fiber Intermediate Products Company, Connect Chemicals, SASA, Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Dimethyl Terephthalate Market

Published Date : 12 Dec 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date