Driver Alert System Market, Growth Outlook | 13.9% CAGR

Global Driver Alert System Market Size, Share & Analysis By Vehicle Type (Passenger Vehicles, Commercial Vehicles, Electric Vehicles (EVs), Autonomous Vehicles), By Component (Sensors, Software & Algorithms, Control Units/ECUs, Display Units, Warning/Alert Systems), By Technology Type (Lane Departure Warning (LDW), Lane Keeping Assist (LKA), Forward Collision Warning (FCW), Automatic Emergency Braking (AEB), Blind Spot Detection (BSD), Driver Attention Monitoring, Pedestrian Detection, Traffic Sign Recognition, Adaptive Cruise Control (ACC), Drowsiness/Fatigue Detection, Collision Avoidance System) Industry Outlook, Regulatory Mandates & Forecast 2025–2034

Report Overview

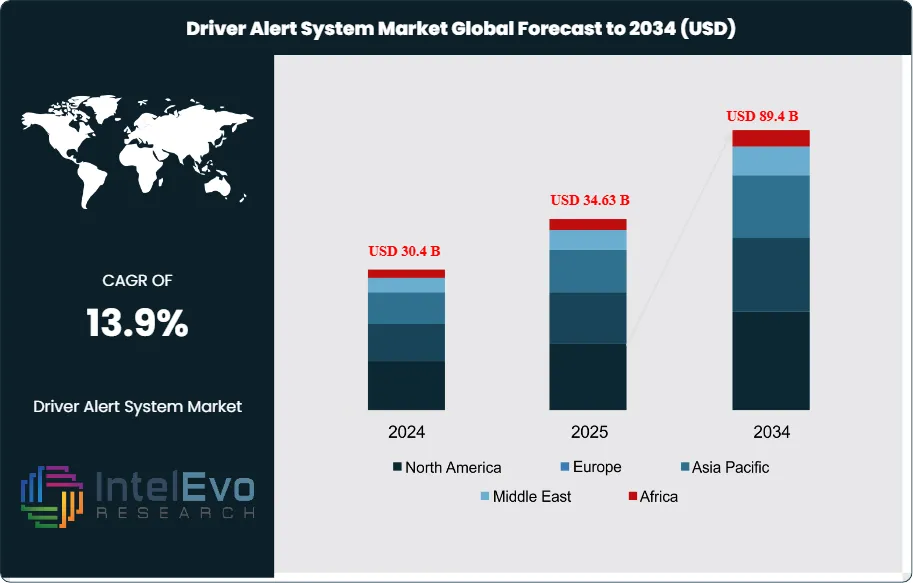

The Driver Alert System market is estimated at USD 30.4 billion in 2024 and is on track to reach approximately USD 89.4 billion by 2034, implying a robust compound annual growth rate of 13.9% over 2025–2034. Rising concerns over road fatalities, fatigue-related accidents, and distracted driving are accelerating global adoption across passenger vehicles, commercial fleets, and autonomous driving platforms. With governments enforcing ADAS mandates and automakers integrating AI-driven safety features, demand is scaling faster than expected.

Get More Information about this report -

Request Free Sample ReportThe surge in connected-car technologies, facial recognition–based drowsiness detection, and real-time telematics alerts is transforming driver safety into a must-have feature rather than an optional add-on. Social awareness campaigns, insurance incentives, and fleet safety compliance are further amplifying market momentum, positioning driver alert systems as a critical pillar of next-generation automotive safety.

This growth reflects rising safety standards and growing regulatory pressure across the automotive industry. The market has expanded significantly over the past decade, supported by stricter road safety mandates and growing awareness of the risks associated with driver fatigue and distraction. As advanced driver assistance systems (ADAS) become standard in many new vehicles, demand for technologies like lane departure warnings, fatigue monitoring, and distraction detection continues to rise. These features are increasingly viewed as essential rather than optional, especially in mid- to high-end vehicle segments.

A key driver behind this trend is the global push to reduce traffic accidents linked to human error. According to the World Health Organization, more than 90% of road accidents are caused by driver-related factors. Driver alert systems directly address this challenge by monitoring driver behavior in real time and providing early warnings. Regulatory developments are also shaping the market. For example, the European Union’s General Safety Regulation mandates fatigue detection systems in all new cars sold from mid-2024. Similar mandates are under review in North America and parts of Asia.

On the supply side, ongoing investments in automotive AI, computer vision, and sensor technologies are enabling more accurate and responsive alert systems. Leading automotive OEMs and Tier 1 suppliers are integrating driver monitoring solutions with other ADAS components to enhance overall vehicle safety performance. In addition, improvements in system affordability are making these technologies more accessible for mass-market vehicles.

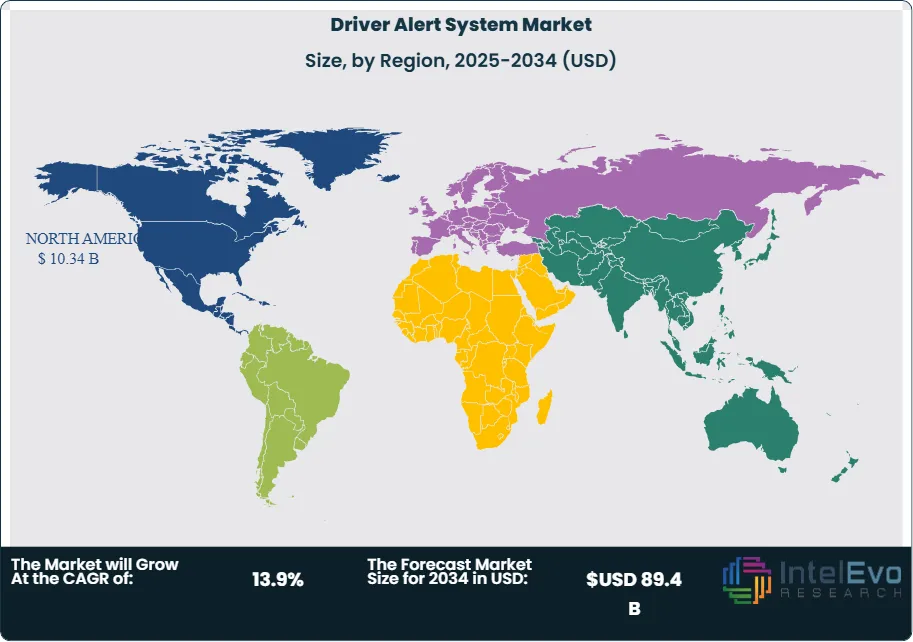

Regionally, Europe and North America lead adoption due to early regulation and mature automotive infrastructure. However, Asia Pacific is expected to post the fastest growth, fueled by rising vehicle sales, urbanization, and government-backed road safety initiatives in China and India. Emerging markets in Latin America and Africa also offer long-term opportunities as safety standards improve.

Investor attention is shifting toward companies developing modular, software-driven solutions that allow flexible integration across vehicle platforms. As safety becomes a competitive differentiator, the adoption of driver alert systems is set to accelerate further across global markets.

Key Takeaways

- Market Growth: The global Driver Alert System market reached USD 30.4 billion in 2024 and is projected to grow to USD 89.4 billion by 2034, registering a CAGR of 13.9%. Growth is driven by rising safety regulations and increasing integration of ADAS features across vehicle classes.

- Vehicle Type: Passenger Vehicles accounted for over 65% of total market revenue in 2024, fueled by strong demand for in-vehicle safety features in mid- and high-end models across developed markets.

- Component: Sensors led the component segment in 2024, contributing more than 40% of market share. Their real-time monitoring capabilities make them essential in fatigue detection and lane departure warning systems.

- Technology: Lane Departure Warning (LDW) systems held the largest share in 2024 at approximately 38%, owing to their proven effectiveness in reducing collision risks from unintentional lane shifts.

- Driver: Mandatory safety regulations, such as the European Union’s 2024 requirement for fatigue detection systems in all new vehicles, are accelerating adoption and reshaping OEM safety strategies globally.

- Restraint: High system costs and integration complexity, particularly in low-cost vehicles, continue to limit adoption in price-sensitive markets, especially across Southeast Asia and parts of Africa.

- Opportunity: Asia Pacific presents strong expansion potential, with China and India expected to post CAGRs above 13% through 2034. Rising vehicle production and government-backed safety programs are key enablers.

- Trend: Automakers are integrating AI-based driver monitoring systems. For instance, companies like Bosch and Continental are rolling out camera-based in-cabin solutions that track driver eye movement and attention levels.

- Regional Analysis: North America led the market in 2024 with a 34% revenue share, supported by established safety mandates and ADAS adoption. However, Asia Pacific is set to outpace all regions in growth through 2034, driven by expanding automotive manufacturing and regulatory alignment.

Vehicle Type Analysis

Passenger vehicles remain the dominant force in the global driver alert system market, accounting for the largest share in 2025. Their widespread adoption is supported by growing consumer demand for safety features and regulatory pressure to reduce traffic accidents. Automakers continue to integrate systems such as lane departure warning, adaptive cruise control, and driver attention monitoring into new models, responding to rising expectations around in-vehicle safety. The segment's growth is also supported by increased vehicle production, particularly in emerging economies, where consumer awareness of road safety is on the rise.

Commercial vehicles and heavy-duty trucks represent a smaller, but steadily growing segment. The adoption of driver alert systems in these vehicles is being driven by fleet operators seeking to reduce liability and protect assets. Features like forward collision warning and blind spot detection are becoming more common in long-haul and logistics fleets. Meanwhile, electric vehicles (EVs) are gaining traction in the market, as manufacturers include driver alert systems to meet both safety regulations and customer expectations for advanced technology. Autonomous vehicles, though still in development and testing phases, incorporate these systems as part of broader ADAS frameworks, supporting safety redundancies during transitional driving periods.

Component Analysis

Sensors remain the most critical and commercially dominant component in driver alert systems, accounting for more than 40% of market value in 2025. Their real-time detection capabilities enable core functionalities such as collision avoidance, lane keeping, and pedestrian detection. The market has seen significant investment in radar, camera-based, and LIDAR sensor technologies, with companies like Bosch and Denso advancing sensor performance and reducing costs.

Software and algorithms form the intelligence layer of these systems, interpreting sensor inputs and making rapid decisions based on predefined parameters and AI models. Their role is growing as manufacturers seek to enhance system accuracy and responsiveness. Control units, including ECUs, manage data flow and system operations, ensuring synchronization across various safety subsystems. Display units and alert mechanisms complete the ecosystem by communicating actionable feedback to the driver, through visual, audible, or haptic signals. These components are essential in closing the safety loop and enabling effective driver intervention.

Technology Type Analysis

Lane Departure Warning (LDW) continues to lead the technology segment, with over 35% market share in 2025. Its widespread implementation is driven by its effectiveness in reducing accidents related to unintentional lane drifting. LDW has become a baseline requirement in many regions, particularly in passenger vehicles, and is being included in new vehicle platforms across all price segments.

Forward Collision Warning (FCW) and Automatic Emergency Braking (AEB) are gaining ground, especially in urban driving environments where rear-end collisions are more common. AEB adoption is growing rapidly due to its ability to automatically reduce vehicle speed, helping prevent accidents without driver input. Blind Spot Detection (BSD) is seeing strong adoption in larger vehicles and commercial fleets, where side visibility is a persistent challenge. Meanwhile, newer technologies like Driver Attention Monitoring and Drowsiness Detection are gaining traction, though mostly in premium models or as optional packages. These solutions are expected to grow significantly as AI integration and regulatory frameworks evolve.

Regional Analysis

North America continues to lead the global driver alert system market in 2025, accounting for approximately 34% of global revenue. Strong regulatory enforcement, including National Highway Traffic Safety Administration (NHTSA) mandates, has accelerated system integration across vehicle classes. Automakers like General Motors and Ford have embedded these technologies into their core product strategies, while Tesla continues to drive the adoption of sensor-based safety systems across its EV lineup.

Europe remains a mature and regulated market, driven by the EU’s General Safety Regulation which requires advanced safety features, including driver alert systems, in all new vehicles starting in 2024. Germany, France, and Sweden are among the regional leaders. In Asia Pacific, the market is expanding at a faster CAGR—expected to exceed 13% through 2030—driven by rising vehicle production, regulatory tightening in China and India, and increasing local competition among automakers. Latin America and the Middle East & Africa are in the early stages of adoption. Brazil, Mexico, the UAE, and South Africa are showing gradual growth as governments introduce safety requirements and consumer demand for advanced safety features rises.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Heavy-Duty Trucks

- Buses

- Electric Vehicles (EVs)

- Autonomous Vehicles

By Component

- Sensors

- Software & Algorithms

- Control Units/ECUs

- Display Units

- Warning/Alert Systems

By Technology Type

- Lane Departure Warning (LDW)

- Lane Keeping Assist (LKA)

- Forward Collision Warning (FCW)

- Automatic Emergency Braking (AEB)

- Blind Spot Detection (BSD)

- Driver Attention Monitoring

- Pedestrian Detection

- Traffic Sign Recognition

- Adaptive Cruise Control (ACC)

- Drowsiness/Fatigue Detection

- Collision Avoidance System

By Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 30.4 B |

| Forecast Revenue (2034) | USD 89.4 B |

| CAGR (2024-2034) | 13.9% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Vehicle Type (Passenger Vehicles, Commercial Vehicles, Electric Vehicles (EVs), Autonomous Vehicles), By Component (Sensors, Software & Algorithms, Control Units/ECUs, Display Units, Warning/Alert Systems), By Technology Type (Lane Departure Warning (LDW), Lane Keeping Assist (LKA), Forward Collision Warning (FCW), Automatic Emergency Braking (AEB), Blind Spot Detection (BSD), Driver Attention Monitoring, Pedestrian Detection, Traffic Sign Recognition, Adaptive Cruise Control (ACC), Drowsiness/Fatigue Detection, Collision Avoidance System) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | ZF Friedrichshafen AG, Harman International (Samsung Electronics), Aptiv PLC, Texas Instruments, Bosch Group, Valeo SA, Mobileye (Intel Corporation), Autoliv Inc., Omron Corporation, Magna International Inc., Denso Corporation, Continental AG, Delphi Technologies |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date