Drone Market Market Size, Trends, Share & Forecast| CAGR 14.07%

Global Drone Market Size, Share, Analysis Report Type (Fixed-wing, Single-rotor, Multi-rotor - leads, Hybrid), Technology (Remotely operated - leads, Fully autonomous, Semi-autonomous), Power Source (Hydrogen fuel cell, Battery-powered - leads, Gasoline-powered, Solar), End Use (Consumer, Military - leads, Commercial, Government & law enforcement), Region and Key Players - Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends and Forecast 2025-2034

Report Overview

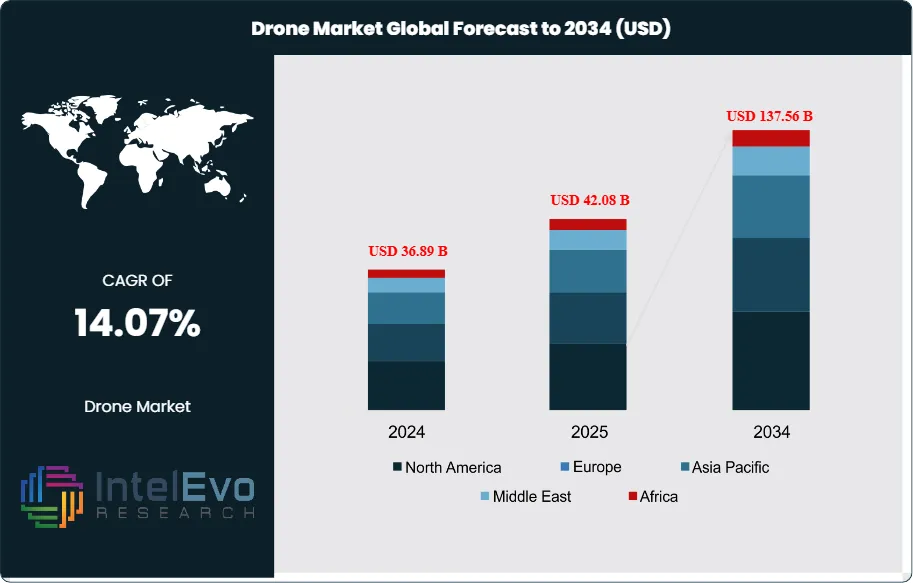

The Drone Market size is expected to be worth around USD 137.56 Billion by 2034, up from USD 36.89 Billion in 2024, growing at a CAGR of 14.07% during the forecast period from 2024 to 2034. This growth is driven by rapid adoption across defense, commercial, and industrial applications, including aerial surveillance, precision agriculture, infrastructure inspection, and last-mile delivery. Advancements in AI-enabled navigation, autonomous flight systems, and supportive regulatory frameworks are further accelerating global drone deployment, making the market a key pillar of next-generation mobility and automation.

Get More Information about this report -

Request Free Sample ReportThe global drone market represents one of the most rapidly expanding technological sectors, driven by unprecedented innovation across multiple industries and applications. The global commercial drone market size was estimated at USD 30.02 billion in 2024 and is expected to grow at a CAGR of 10.6% from 2025 to 2030. This dynamic market encompasses various unmanned aerial vehicles (UAVs) designed for diverse applications ranging from recreational photography to advanced military operations, precision agriculture, and infrastructure inspection. The market's growth trajectory is primarily influenced by technological advancements in battery life, artificial intelligence integration, enhanced payload capacities, and improved flight stability systems. Key factors affecting market expansion include regulatory frameworks evolving to accommodate commercial drone operations, increasing adoption of drone-as-a-service models, declining component costs, and growing awareness of drones' cost-effectiveness compared to traditional methods across various industries.

The market's evolution is significantly shaped by rapid technological convergence, where improvements in sensor technology, machine learning algorithms, and connectivity solutions have enabled drones to perform increasingly sophisticated tasks with greater autonomy and precision. Factors influencing market dynamics include the integration of 5G networks enabling real-time data transmission, development of beyond visual line of sight (BVLOS) capabilities, advancement in collision avoidance systems, and the emergence of swarm intelligence technologies. Additionally, the market benefits from increasing investment in research and development, growing partnerships between technology companies and end-users, expanding applications in emerging sectors such as urban air mobility, and the proliferation of drone training programs and certification courses that are creating a skilled workforce to support market growth.

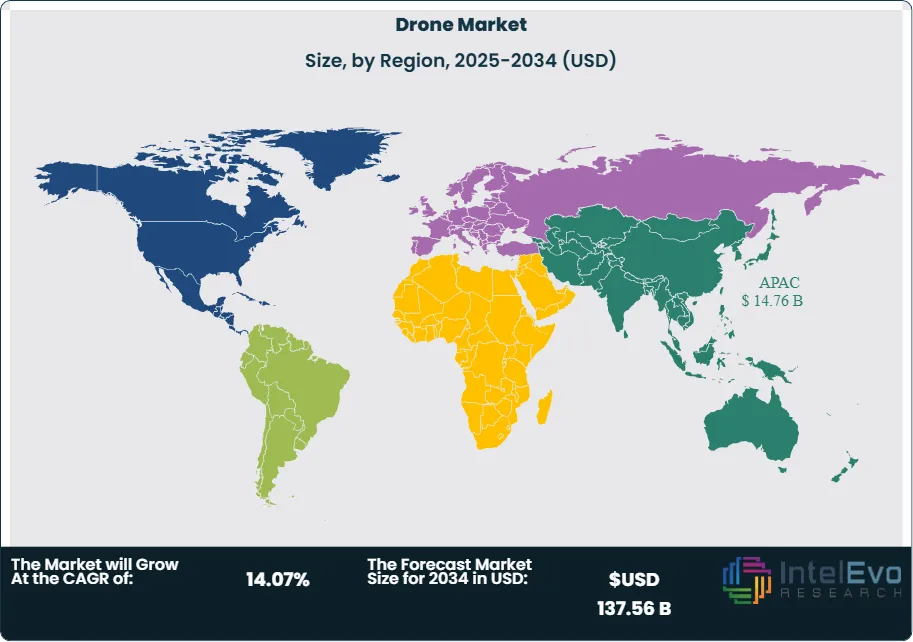

The Asia Pacific region currently dominates the global drone market, accounting for the largest market share due to significant manufacturing capabilities, particularly in China, rapid technological adoption, and substantial government investments in drone technology development. The region benefits from established supply chains, lower manufacturing costs, and strong domestic demand across various sectors including agriculture, construction, and surveillance.

The COVID-19 pandemic initially disrupted drone market growth through supply chain interruptions and reduced investment in non-essential technologies, but subsequently accelerated adoption as organizations recognized drones' value for contactless operations, delivery services, and remote monitoring capabilities. The pandemic highlighted drones' potential for healthcare applications, including medical supply delivery, crowd monitoring, and disinfection operations, leading to increased investment and regulatory support for drone integration across various sectors.

Regional conflicts between major economies and escalating trade tensions have significantly impacted the drone market, particularly affecting supply chains and technology transfer. Battery cells comprise up to one-quarter of typical small-drone costs, and 30-40% price hikes since 2024 have forced OEMs either to absorb margin compression or lift selling prices. Geopolitical tensions and rising EV demand exacerbate the shortage, while China's export curbs on key battery components have created supply constraints. Trade restrictions and tariffs on drone components have led to increased manufacturing costs, forced companies to diversify supply chains, and accelerated the development of domestic manufacturing capabilities in various regions. These tensions have particularly affected Chinese manufacturers like DJI, which face regulatory restrictions in several markets, prompting the emergence of alternative suppliers and encouraging innovation in drone technology localization efforts.

Key Takeaways

- Market Growth: The Drone Market is expected to reach USD 137.56 Billion by 2034, driven by defense modernization, commercial use cases, and technological innovation across power sources and autonomy levels.

- Type Dominance: Multi-rotor drones lead the market due to their stability, ease of use, and suitability for varied applications like aerial photography and inspection. Their modular design attracts commercial and consumer buyers alike.

- Technology Dominance: Remotely operated drones are the preferred technology segment, offering real-time control and flexibility. They remain critical in sectors that require high situational awareness and operator intervention.

- Power Source Dominance: Battery-powered drones dominate the power source category, given their environmental benefits, cost-effectiveness, and continuous improvements in energy density.

- End Use Dominance: Military end-use holds the largest share, driven by strategic investments in intelligence, surveillance, and reconnaissance missions globally.

- Driver: Rapid advancements in battery technology and AI-powered autonomous navigation are accelerating market penetration and opening new applications.

- Restraint: Strict regulatory frameworks and airspace restrictions continue to limit operational scalability in populated regions and across borders.

- Opportunity: Integration of drones into smart city infrastructure and logistics ecosystems presents lucrative growth potential, especially in last-mile delivery.

- Trend: Adoption of swarm technology and BVLOS (Beyond Visual Line of Sight) operations is gaining traction as companies push the boundaries of drone capabilities.

- Regional Analysis: Asia Pacific leads the market owing to the presence of manufacturing hubs and supportive policies. North America follows with strong defense demand, while Europe emphasizes regulation and R&D investments.

Type Analysis:

Multi-rotor drones have emerged as the most popular configuration due to their compact design and operational versatility. Unlike fixed-wing models that require runways, multi-rotors can take off and land vertically, making them ideal for urban environments. Their ability to hover precisely enables applications in aerial imaging, infrastructure inspection, and precision agriculture. Advances in payload capacity and battery life further bolster their market appeal. Commercial enterprises and public safety agencies prefer these systems for their ease of deployment and minimal training requirements, reinforcing their leading market share.

Technology Analysis:

Remotely operated drones remain the backbone of most operations, combining human oversight with technological precision. Operators can dynamically respond to environmental changes, making this segment indispensable in search and rescue, defense, and live event coverage. The reliability of real-time data transmission and control ensures safety and mission success. Despite progress in autonomous systems, regulatory frameworks still favor human-in-the-loop models for critical operations. This preference is expected to persist, especially in sensitive applications demanding accountability and rapid decision-making.

Power Source Analysis:

Battery-powered drones are the market’s mainstay, offering low maintenance, reduced emissions, and quiet operation. Continuous advancements in lithium-ion and solid-state battery technologies have improved flight duration and payload capabilities. These drones are widely adopted in consumer and commercial sectors due to cost-effectiveness and compliance with environmental standards. As battery performance improves, their dominance is expected to grow further, particularly in regions with stringent emissions regulations and sustainability goals.

End Use Analysis:

Military Leads With over 45% Market Share In Drone Market. The military segment commands the largest revenue share as nations prioritize UAV capabilities for surveillance, reconnaissance, and combat support. Defense procurement programs worldwide are integrating advanced drones to enhance situational awareness and reduce personnel risk. High-value contracts and continuous R&D investments underpin this dominance. The sector also benefits from spillover innovation in sensor miniaturization and AI, reinforcing its technological edge over other segments. With geopolitical tensions escalating, military demand is likely to remain a key growth pillar.

Region Analysis:

Asia Pacific Leads With more than 40% Market Share In Drone Market. Asia Pacific leads the global drone market, accounting for the largest market share due to its dominant manufacturing capabilities, particularly in China, which serves as the global hub for drone production and technology development. The region benefits from established supply chains, lower manufacturing costs, strong domestic demand across various sectors including agriculture, construction, and surveillance, and significant government investments in drone technology development. For instance, DJI, the Chinese tech giant, is currently the top drone manufacturer with a staggering 74.3% market share, followed by Parrot, Autel Robotics, and Ehang. China's technological leadership in drone manufacturing has positioned the Asia Pacific region as the primary supplier to global markets.

North America represents the second-largest market, driven by strong commercial adoption, advanced regulatory frameworks, and significant investment in drone technology development. The region benefits from early adoption of commercial drone applications, particularly in agriculture, construction, and public safety sectors. Europe shows substantial growth potential, particularly in agricultural applications and industrial inspection, supported by favorable regulatory environments and government initiatives promoting drone adoption. The multi-rotor segment is expected to see continued growth across all regions, driven by expanding commercial applications and technological improvements in flight control systems and payload capabilities.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

Type

- Fixed-wing

- Single-rotor

- Multi-rotor - leads

- Hybrid

Technology

- Remotely operated - leads

- Fully autonomous

- Semi-autonomous

Power Source

- Hydrogen fuel cell

- Battery-powered - leads

- Gasoline-powered

- Solar

End Use

- Consumer

- Military - leads

- Commercial

- Government & law enforcement

Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 42.08 B |

| Forecast Revenue (2034) | USD 137.56 B |

| CAGR (2025-2034) | 14.07% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Type (Fixed-wing, Single-rotor, Multi-rotor - leads, Hybrid) Technology (Remotely operated - leads, Fully autonomous, Semi-autonomous) Power Source (Hydrogen fuel cell, Battery-powered - leads, Gasoline-powered, Solar) End Use (Consumer, Military - leads, Commercial, Government & law enforcement) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | RedBird, SZ DJI Technology Inc., Aeronavics Ltd., 3DR Inc., Flyability, AgEagle Aerial Systems Inc, Airware Limited, Yuneec International, Autel Robotics, Mapbox, Teledyne FLIR LLC, Parrot Drone SAS, Skydio, Pix4D, Denel Dynamics, Delair |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date