Dry-Cast Concrete and Masonry Market Size, Share & Growth | 8.9% CAGR

Global Dry-Cast Concrete and Masonry Market Size, Share & Analysis By Type (High-performance Concrete, Self-consolidating Concrete, Other Types), By Application (Pavers, Retaining Walls, Other Applications), By End-Use (Residential Building, Commercial Building, Industrial Building), Industry Supply Chain, Cost Trends, Competitive Landscape & Forecast 2025–2034

Report Overview

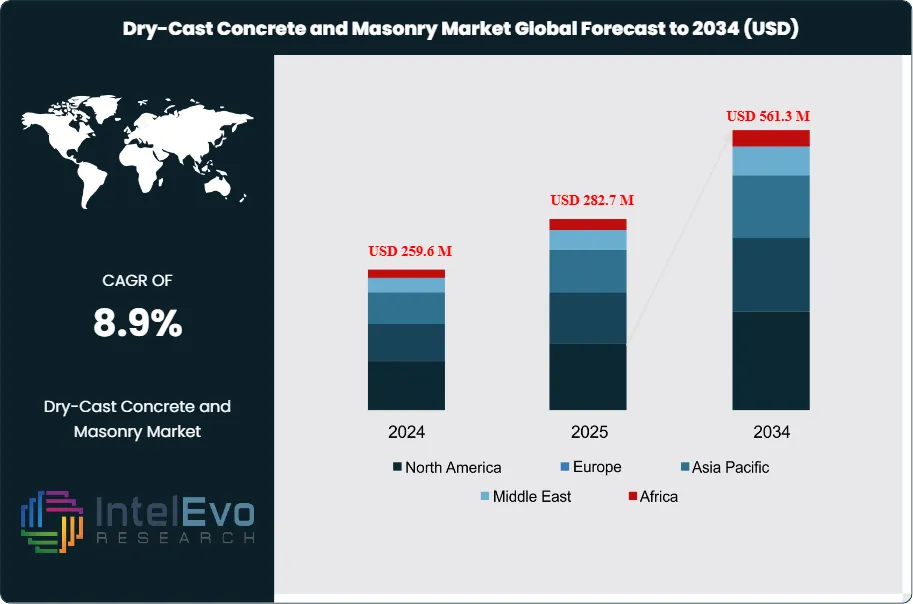

The Dry-Cast Concrete and Masonry Market is projected to grow from USD 259.6 Million in 2024 to approximately USD 561.3 Million by 2034, expanding at a CAGR of around 8.9% during 2025–2034. Rising adoption of automation, AI-driven design tools, and prefabrication techniques is transforming modern construction processes. The increasing focus on sustainable infrastructure and eco-friendly building materials is driving widespread adoption of dry-cast products. Manufacturers integrating digital design workflows and energy-efficient production systems are gaining a strong competitive advantage in the evolving global construction landscape. This driven by the growing demand for sustainable and high-strength construction materials, offering strategic opportunities for precast manufacturers, infrastructure developers, and real estate investors.

Get More Information about this report -

Request Free Sample ReportThe market is undergoing steady expansion as urbanization, infrastructure upgrades, and the global push for resource-efficient construction practices continue to accelerate adoption. Dry-cast concrete—commonly referred to as zero-slump or stiff concrete—distinguishes itself from traditional mixes through its minimal water content, producing a dense, rigid composition with reduced flowability. This unique characteristic makes it particularly well-suited for precast applications requiring dimensional precision and long-term durability. Similarly, dry-cast masonry units, including blocks and bricks, are manufactured through comparable methods, resulting in compact and structurally resilient products that meet modern building requirements.

Key growth drivers include increasing investment in urban infrastructure, rising population-driven housing demand, and the emphasis on eco-friendly building solutions that reduce water consumption and environmental footprint. Governments and private developers are prioritizing durable materials that align with green building certifications, further strengthening the case for dry-cast products. However, challenges such as high capital costs for advanced equipment, reliance on cement with its associated carbon emissions, and the need for specialized technical expertise may restrict wider adoption in cost-sensitive markets.

Technological advancements are reshaping the competitive landscape. Integration of AI-enabled mix optimization, automated casting machinery, and digital platforms such as BIM and digital twins are enhancing efficiency, scalability, and design flexibility. These innovations are not only improving production processes but also enabling greater collaboration among stakeholders, reducing errors, and shortening project delivery timelines.

Regionally, Asia-Pacific continues to dominate the market, supported by rapid urbanization, government-backed infrastructure projects, and strong demand for affordable housing across China, India, and Southeast Asia. North America and Europe are also key contributors, driven by sustainability mandates, modular construction adoption, and redevelopment of aging infrastructure. Emerging opportunities in the Middle East and Africa, where infrastructure and housing demand remain strong, further highlight the global growth potential.

Overall, the dry-cast concrete and masonry market is well-positioned for long-term growth, with sustainability imperatives, digital integration, and urban development serving as the primary engines of expansion. Industry participants who strategically align with these trends are expected to gain a competitive edge in the decade ahead.

Key Takeaways

- Market Size: The Dry-Cast Concrete and Masonry Market, measuring USD 259.6 Million in 2024, is projected to be USD 561.3 Million by 2034, growing at 8.9% CAGR during 2025–2034. It is boosted by rapid urbanization, construction activities, and higher adoption of sustainable building material usage.

- Product Type: High-performance concrete captured 51.5% of revenues in 2022 because it is more durable, has less maintenance, and is used in large projects like vast infrastructure projects where strength and durability matter the most.

- End Use: Residential construction contributed to 48% of the world market in 2022 and is expected to expand at 8.3% CAGR. Strong residential demand, particularly in emerging markets, is encouraging developers and policymakers to choose affordable and sustainable dry-cast products.

- Driver: Increasing emphasis on sustainable construction practices and water-saving technologies is propelling adoption, and dry-cast concrete is compatible with green building certifications and regulatory requirements.

- Restraints: The sector is under the influence of restraints due to large carbon footprints of cement production and volatile supply chains of raw materials, raising costs and creating uncertainty for manufacturers.

- Opportunity: Prefabrication and modularity are opening up new possibilities for growth, as quick assembly, consistency of dimension, and labor efficiency can be achieved with dry-cast products—key requisites for urban megaprojects and smart city projects.

- Trends: Greater emphasis on aesthetically adaptable masonry products mimicking natural stone is reshaping consumer preferences. Likewise, the production processes are being revolutionized by robotics, AI-based mix optimization, and automation.

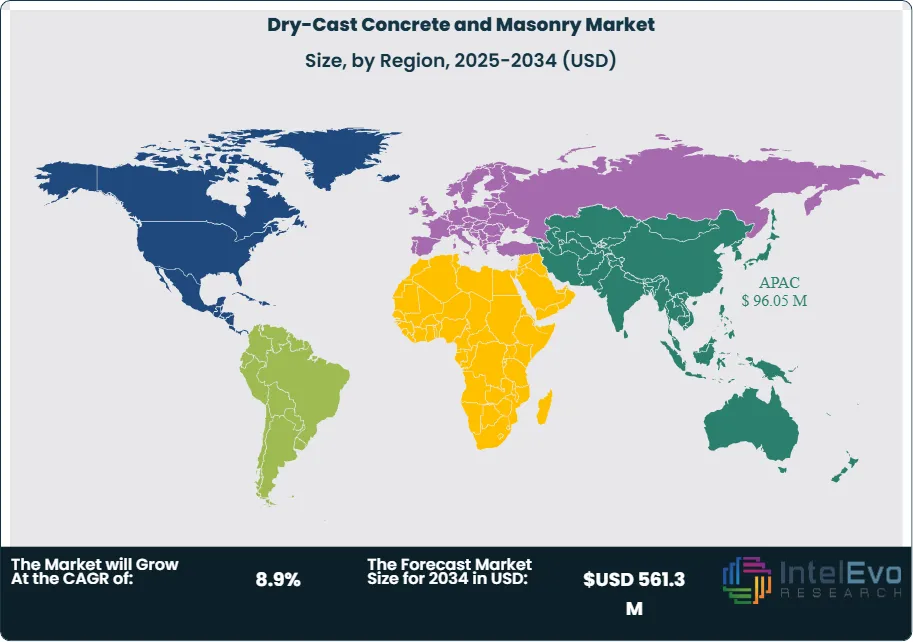

- Regional Analysis: Asia-Pacific topped the market with 36.7% revenue share in 2022 through massive infrastructure investments in China and India. North America is also steadily growing at 7.5% growth, through residential, commercial, and industrial construction, while Europe continues to proceed under challenging sustainability mandates.

Application Analysis

The dry-cast concrete and masonry market, when segmented by application, is categorized into pavers, retaining walls, and other uses. Among these, the “other applications” category continues to dominate in 2025, holding the largest share and expected to sustain an annual growth rate of around 8% through 2035. This dominance is attributed to the versatility and durability of dry-cast products in infrastructure development, spanning diverse areas such as water management systems, transportation networks, landscaping solutions, and specialized construction projects. Their ability to withstand high loads and deliver long service life positions them as preferred materials for large-scale infrastructure.

The pavers segment represents a significant and steadily expanding share, accounting for approximately one-fifth of global revenue. Growing urbanization and the development of pedestrian-friendly urban spaces are fueling demand for pavers in roadways, sidewalks, plazas, and recreational spaces. Their functional strength, combined with aesthetic appeal, has made them a material of choice for city planners and municipal authorities. As smart city projects advance and governments continue investing in resilient public infrastructure, the demand for pavers is expected to remain on a steady upward trajectory.

End-Use Analysis

Dry-cast concrete and masonry products find widespread adoption across residential, commercial, and industrial construction. In 2025, the residential building segment remains the leading end-use category, capturing close to half of the global share. It is also anticipated to record the fastest growth, with a CAGR exceeding 8% over the next decade. Factors such as ongoing urban migration, rising housing demand, and the growth of affordable and mid-range housing projects are fueling expansion. Real estate developers are increasingly turning to dry-cast products for their precision, quick installation, and cost efficiency, making them well-suited for high-volume residential construction.

The commercial building segment holds the second-largest share, supported by expanding urban economies and the rising need for office spaces, retail complexes, and hospitality facilities. As cities invest in modern infrastructure, the use of dry-cast masonry in commercial projects is becoming more prominent due to its high structural reliability and low maintenance requirements. Meanwhile, the industrial segment, though smaller, is witnessing stable demand, particularly in logistics facilities, manufacturing plants, and warehouses, where strength and durability are critical.

Regional Analysis

Asia-Pacific (APAC) continues to represent the most significant regional market, commanding more than one-third of global revenue in 2025. This leadership is underpinned by rapid urbanization, expanding megacities, and large-scale infrastructure investments in countries such as China, India, and Southeast Asian nations. The region’s focus on affordable housing, coupled with major government-backed infrastructure programs, positions it as a critical growth hub for dry-cast concrete and masonry manufacturers.

North America is expected to record a steady growth rate of around 7.5% through the forecast period. The region benefits from a well-established construction sector and rising demand for sustainable, durable building materials. Investments in residential housing, coupled with the modernization of commercial and industrial facilities, are reinforcing demand across the U.S. and Canada. Europe, while more mature, is also experiencing incremental growth driven by sustainability mandates, energy-efficient construction practices, and urban redevelopment projects. Collectively, these regions reflect a balanced global outlook, where APAC remains the growth engine while developed economies continue to provide stable demand.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Type

- High-performance Concrete

- Self-consolidating Concrete

- Other Types

By Application

- Pavers

- Retaining Walls

- Other Applications

By End-Use

- Residential Building

- Commercial Building

- Industrial Building

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 259.6 M |

| Forecast Revenue (2034) | USD 561.3 M |

| CAGR (2024-2034) | 8.9% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Type (High-performance Concrete, Self-consolidating Concrete, Other Types), By Application (Pavers, Retaining Walls, Other Applications), By End-Use (Residential Building, Commercial Building, Industrial Building) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Wieser Concrete, Mutual Materials Co., Con Cast Pipe Inc., CRH plc, Solidia Technologies, Basalite Building Products LLC, E.L. Paving Products, Unilock, Sika AG, Rochester Cement Products, Inc., Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Dry-Cast Concrete and Masonry Market

Published Date : 12 Nov 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date