E-Scooter Rental Apps Market Size, Trends & Forecast 2034 | 18.9% CAGR

Global E-scooter Rental Apps Market Size, Share, Analysis Report By Business Model (Docked, Dockless), By Vehicle Type (Electric Kick Scooters, Electric Bicycles, Electric Mopeds), By Service Type, (Subscription, Pay-as-you-go), By End-User (Business, Individual) Industry Region and Key Players-Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends and Forecast 2025-2034

Report Overview

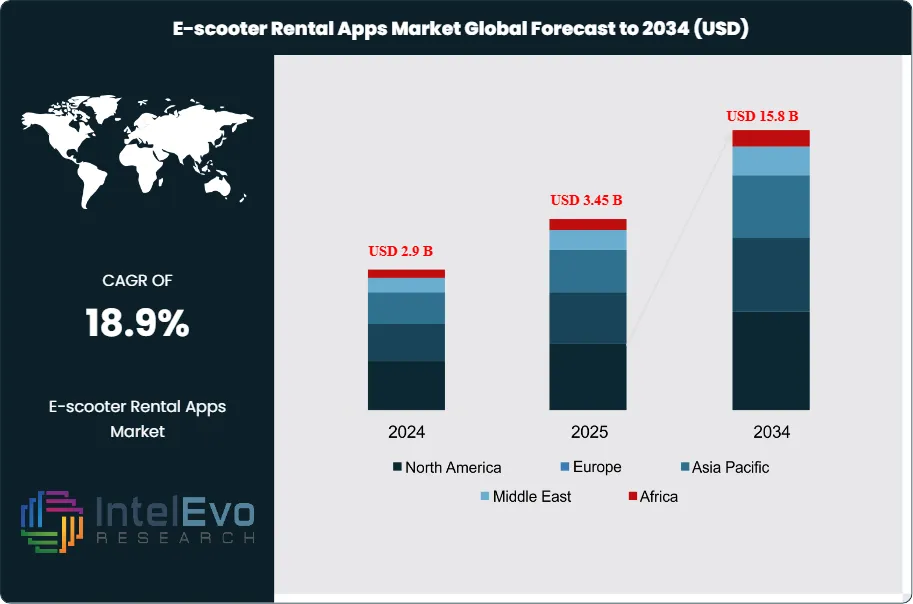

The E-scooter Rental Apps Market is projected to be worth approximately USD 15.8 billion by 2034, up from USD 2.9 billion in 2024, growing at a CAGR of 18.9% during the forecast period from 2025 to 2034. This growth is fueled by the rising demand for eco-friendly urban mobility solutions, government initiatives supporting clean transportation, and the increasing integration of IoT and AI-based fleet management systems. With urban congestion and environmental awareness driving micro-mobility adoption, e-scooter rental apps are revolutionizing last-mile connectivity and promoting a sustainable future in transportation.

Get More Information about this report -

Request Free Sample ReportThe E-scooter rental apps market has emerged as a transformative force in urban transportation, combining sustainability, convenience, and technological innovation. E-scooter rental services are mobility solutions that allow users to access electric scooters via a smartphone app for short trips or commuting.

These services operate on varied business models, such as docked systems—where scooters must be returned to specific stations—and dockless models that offer greater flexibility in parking. Key factors driving this market include the growing demand for micro-mobility solutions in congested urban areas, increasing fuel prices, and a global shift towards carbon-neutral transportation. The rising penetration of smartphones and mobile payments further facilitates seamless user experiences, while integrated IoT tracking ensures operational efficiency and vehicle security.

Regulatory support in many metropolitan areas also fuels market expansion. Governments across Asia Pacific and Europe have introduced subsidies, grants, and dedicated lanes for e-scooters, enabling higher adoption. However, the market faces challenges, such as vandalism of dockless units and the need for frequent charging and maintenance. Despite these hurdles, leading companies—including Bird Rides, Lime, Tier Mobility, and Voi Technology—are heavily investing in fleet expansion and software improvements to gain competitive advantage.

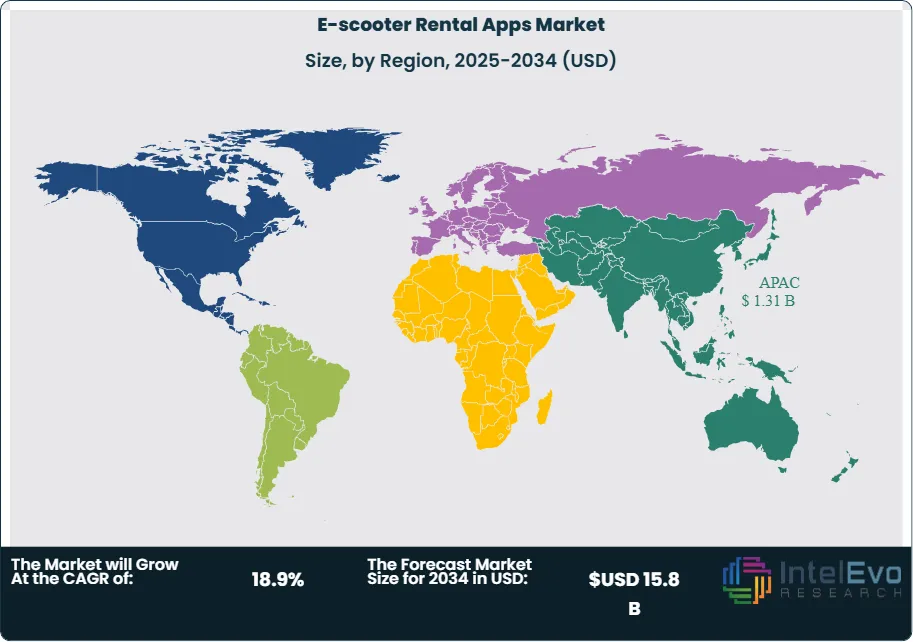

Regional analysis shows that Asia Pacific leads the market, driven by dense urban populations, rising environmental concerns, and widespread smartphone penetration. Cities such as Beijing, Seoul, and Singapore have implemented supportive policies encouraging shared e-mobility solutions. In contrast, North America and Europe have also experienced strong growth due to sustainability targets and an emphasis on reducing traffic congestion, but adoption rates vary based on city regulations.

COVID-19 significantly impacted the e-scooter rental apps market. The initial lockdowns disrupted operations, halted rides, and forced companies to reduce their fleets temporarily. However, as restrictions eased, micro-mobility emerged as a preferred mode of transport due to concerns over crowded public transit. Many providers introduced contactless payment and sanitation protocols, accelerating the recovery of ridership levels in late 2020 and 2021.

Regional conflicts and tariffs have indirectly affected the e-scooter rental sector. Trade tensions between the US and China, along with tariffs on lithium-ion batteries and electronic components, increased procurement costs. Additionally, geopolitical disputes in Europe created uncertainty in supply chains for vehicle components. Companies have responded by localizing manufacturing and diversifying suppliers to reduce dependency on any single region. These factors have introduced volatility in pricing and deployment schedules but have also encouraged innovation in battery sourcing and modular design to mitigate risks.

Key Takeaways

- Market Growth: The E-scooter Rental Apps Market is expected to reach USD 15.8 Billion by 2034, due to increasing demand for cost-effective, green transportation. Technological advancements in fleet management and battery efficiency further support this growth.

- Business Model Dominance: The docked model dominates in regions where regulations favor organized parking. It reduces operational losses, improves asset security, and integrates well with public transport.

- Vehicle Type Dominance: Electric mopeds are favored for their speed, comfort, and ability to cover longer urban distances. They attract business and daily commuters over casual users.

- Service Type Dominance: This pricing model offers flexibility and low upfront commitment, making it the top choice for occasional and new users across demographics.

- End-User Dominance: Individual users form the backbone of the market. Their demand for fast, affordable urban transport drives most rentals, especially during peak hours.

- Driver: Urbanization, high traffic congestion, and demand for green transport are primary drivers. Governments and users alike are turning to e-scooters as an efficient alternative.

- Restraint: Operational inefficiencies, theft, and inconsistent regulations across cities present challenges for large-scale deployments.

- Opportunity: Untapped markets in emerging economies and demand for integrated urban mobility present lucrative expansion opportunities.

- Trend: AI-driven fleet optimization, swappable batteries, and integration of scooters into multi-modal apps are redefining the micro-mobility landscape.

- Regional Analysis: Asia Pacific leads in adoption, followed by Europe and North America. Docked scooters and electric mopeds are likely to see the fastest growth.

Business Model Analysis:

Docked models have become the preferred system in metropolitan cities aiming for regulated micro-mobility ecosystems. Unlike dockless systems, docked scooters are picked up and returned at fixed locations, ensuring orderly parking and reducing urban clutter. These systems are often supported by local governments through funding or public-private partnerships.

The docked model also lowers the risk of theft and vandalism and simplifies maintenance and charging logistics, thereby reducing overheads. For operators, docked systems provide better data analytics on user patterns and fleet distribution. Their integration into metro and bus stations enhances first- and last-mile connectivity, appealing to regular commuters. As cities impose stricter parking regulations, the docked segment is expected to remain dominant in densely populated regions.

Vehicle Type Analysis:

Electric Mopeds Leads With more than 55% Market Share In E-scooter Rental Apps Market. Electric mopeds offer a comfortable, high-speed, and longer-range alternative to kick scooters and bicycles. Their sturdy frame, dual-seat design, and higher battery capacity make them suitable for longer commutes and even delivery services. Urban professionals prefer mopeds for their comfort, weather protection, and ability to navigate traffic efficiently.

Companies like Gogoro and Revel Transit have focused on moped-based fleets to cater to business commuters and city dwellers with longer travel needs. These vehicles also feature safety technologies such as helmet cases, turn signals, and GPS tracking. With cities aiming to replace cars for short-to-mid-range trips, mopeds are positioned to become central to fleet portfolios.

Service Type Analysis:

The pay-as-you-go model is the most widely used payment scheme, allowing users to pay per minute or ride without long-term commitment. This model provides maximum flexibility and attracts new users who are trying out e-scooters for the first time. It is also preferred by tourists and occasional riders who need transport only for specific tasks or errands.

From an operational standpoint, this model generates frequent but lower revenue per user, offset by higher user volumes. Market leaders such as Bird and Lime have scaled this model successfully by offering competitive rates and seamless app integration. With continued urban mobility digitization, pay-as-you-go will likely remain the default mode across most markets.

End-User Analysis:

Individual riders dominate the e-scooter rental customer base. Whether commuting to work, visiting nearby locations, or running errands, individuals rely on e-scooters for fast and affordable travel. Their usage patterns are influenced by weather, city layout, and scooter availability. The rise in flexible work arrangements, gig economy growth, and on-demand delivery services further increases reliance on individual-use scooters. With continued improvements in mobile app UX, vehicle accessibility, and real-time tracking, the individual segment is expected to grow rapidly, particularly in emerging markets where cost-effective personal transport is essential.

Region Analysis:

Asia Pacific Leads With over 45% Market Share In E-scooter Rental Apps Market. Asia Pacific dominates the e-scooter rental apps market, driven by its dense urban population, rapid urbanization, and proactive government policies. China, in particular, has heavily invested in electric vehicle infrastructure and subsidized micro-mobility startups. Countries like India, Vietnam, and Indonesia offer massive growth potential due to smartphone penetration and increasing fuel costs. Companies such as Beam Mobility and Neuron are leveraging regional demand with affordable models and tailored operations.

Europe follows as a close contender, where environmental sustainability and urban mobility initiatives are key market enablers. France, Germany, and the Nordics have welcomed e-scooter deployments with favorable regulations and dedicated infrastructure. North America’s adoption remains strong but uneven—while cities like San Francisco and Austin are major hubs, regulatory uncertainty across states slows growth.

Future growth segments include electric mopeds and docked models, especially in Asia and Europe, where governments are pushing for structured deployment. Subscription models may also rise in popularity in North America and Europe as users seek bundled services.

Get More Information about this report -

Request Free Sample ReportMarket Key Segment

By Vehicle Type

- Standard E-Scooters

- Foldable E-Scooters

- Off-Road E-Scooters

- Shared Electric Scooters

By Battery Type

- Sealed Lead Acid (SLA)

- Lithium-Ion (Li-ion)

- Others (Nickel-Metal Hydride, etc.)

By Application

- Daily Commute

- Leisure & Tourism

- Last-Mile Connectivity

- Corporate Mobility Services

By Business Model

- Free-Floating (Dockless)

- Station-Based

- Subscription-Based

By Service Type

- Subscription

- Pay-as-you-go

By End User

- Individual Consumers

- Corporate Users

- Government & Municipalities

- Universities and Campuses

By Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 3.45 B |

| Forecast Revenue (2034) | USD 15.8 B |

| CAGR (2025-2034) | 18.9% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Vehicle Type (Standard E-Scooters, Foldable E-Scooters, Off-Road E-Scooters, Shared Electric Scooters), By Battery Type (Sealed Lead Acid (SLA), Lithium-Ion (Li-ion), Others (Nickel-Metal Hydride, etc.)), By Application, Daily Commute (Leisure & Tourism, Last-Mile Connectivity, Corporate Mobility Services), By Business Model (Free-Floating (Dockless), Station-Based, Subscription-Based), By Service Type (Subscription, Pay-as-you-go), By End User (Individual Consumers, Corporate Users, Government & Municipalities, Universities and Campuses) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Bird Rides, Inc., Dott, Neutron Holdings, Inc., Lime, Spin, Inc., Gogoro Inc., Voi Technology AB, Revel Transit, Inc., Tier Mobility GmbH, Dott BV, Beam Mobility Holdings Pte Ltd, Bolt Technology OÜ, Scoot Networks, Inc., Neuron Mobility Pty Ltd, Helbiz, Inc., Skip Transportation, Inc., Circ Mobility GmbH, Wind Mobility GmbH, Grin Technologies, Inc. |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

E-scooter Rental Apps Market

Published Date : 11 Jul 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date