EdTech for Early Childhood Market Size, Share & Forecast 2034

Global EdTech for Early Childhood Market Size, Share & Growth Analysis By Product Type (Learning Apps, Interactive Games, Digital Content, AI-Based Platforms), By Deployment Mode (Cloud-Based, On-Premise), By End User (Preschools, Daycare Centers, Parents & Home Learning), By Device Type (Tablets, Smartphones, PCs), By Region & Key Players – Industry Trends, Market Dynamics, Investment Opportunities & Forecast 2025–2034

Report Overview

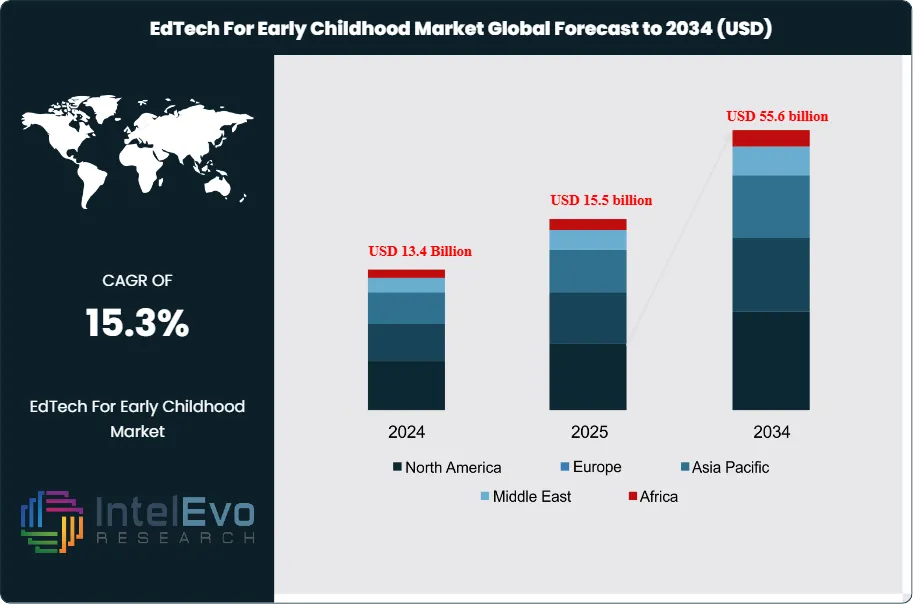

The EdTech for Early Childhood Market is estimated at USD 13.4 billion in 2024 and is on track to reach roughly USD 55.6 billion by 2034, implying a compound annual growth rate (CAGR) of 15.3% over 2025–2034. This strong growth is driven by rising adoption of digital learning tools in preschools and early-grade education, increasing parental focus on foundational skill development, and expanding access to tablets and smart devices among young learners. Government initiatives supporting early education digitization and the integration of AI-powered, gamified, and personalized learning platforms are further accelerating market momentum.

Get More Information about this report -

Request Free Sample ReportEducational technology for early learners integrates interactive applications, digital storytelling tools, and online games into structured curricula and home-based learning. These solutions target core skills in literacy, numeracy, problem-solving, and socio-emotional development, while enabling educators and parents to monitor progress in real time. The market spans content providers, platform operators, device manufacturers, and connectivity players that together create an increasingly data-rich learning ecosystem.

Demand accelerates as stakeholders recognize that high-quality early childhood education shapes long-term academic and economic outcomes. Parents in both developed and emerging economies show rising willingness to pay for premium digital content, while schools and preschools prioritize hybrid and blended learning models. The surge in connected devices and broadband penetration expands access, yet also intensifies competition, pushing vendors to differentiate through adaptive learning, language localization, and age-appropriate design. The broader EdTech environment reinforces this trajectory, with the corporate EdTech segment valued at about USD 27.5 billion and K–12 usage increasing by close to 99% since 2020, while more than 70% of higher education institutions plan new online undergraduate programs.

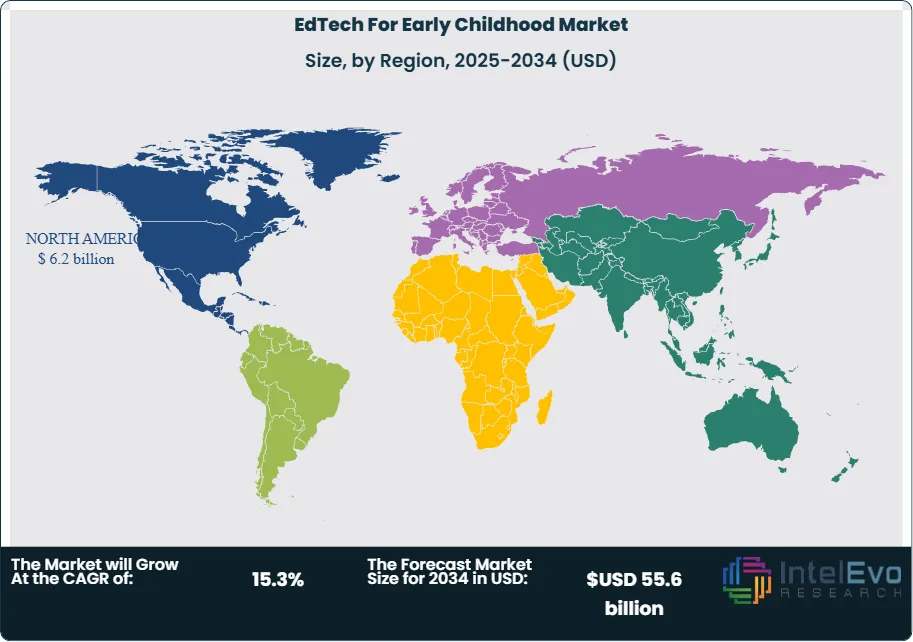

North America remains the largest regional market, generating about USD 6.2 billion in 2024 and accounting for roughly 46.7% of global revenue, supported by high digital infrastructure, strong household spending, and supportive public funding for early years programs. Europe follows with robust regulatory backing for digital inclusion, while Asia Pacific emerges as the fastest-growing region, with double-digit adoption rates in China, India, and Southeast Asia as governments expand connectivity and parents increase discretionary education spending. Emerging markets in Latin America and the Middle East also gain traction as mobile-first models lower entry barriers.

Technology acts as both a growth engine and a source of risk. Artificial intelligence and machine learning enable adaptive pathways that tailor content to the learner’s pace and provide analytics to teachers and caregivers. At the same time, regulators tighten oversight on child data privacy, screen time, and content quality, raising compliance costs and favoring scale players with robust governance frameworks. Market risk also includes widening digital divides, uneven purchasing power, and exposure to macroeconomic cycles that can delay institutional procurement.

Investment interest remains strong as digital products scale efficiently, carry high gross margins, and lend themselves to subscription and freemium models. Suppliers that combine rigorous pedagogy, AI-enabled personalization, and partnerships with schools and governments are positioned to capture share as penetration deepens across both mature and emerging markets.

Key Takeaways

- Market Growth: The global EdTech for Early Childhood market stands at 13.4 billion USD, 2024 and is projected to reach 55.6 billion USD, 2034, reflecting a 15.3% CAGR over 2025-2034. This expansion signals sustained budget allocation toward digital tools for early learning across public and private channels.

- Segment Dominance: The Nursery Schools segment leads the market with a 37.2% share, 2024, anchored in structured integration of digital content into early learning curricula. This share equates to estimated: 5.0 billion USD, 2024, underscoring its strategic priority for solution providers.

- Segment Dominance: The Preschoolers (3–5 years) segment holds more than 53.6% of global revenue, 2024, making it the core age group for EdTech for Early Childhood adoption. The Montessori segment also commands over 32.5% share, 2024, positioning pedagogy-focused platforms as high-value niches within the broader market.

- Driver: Rising reliance on private and fee-based early education drives digital adoption, with the Private segment capturing more than 57.2% market share, 2024. This purchasing power concentration supports premium, subscription-based platforms targeting families and institutions with estimated: 8.0 billion USD, 2024 in addressable spend.

- Restraint: Gaps in device access, connectivity, and educator digital readiness constrain penetration, particularly outside tier-1 urban centers. Under-served regions represent an estimated: 30.0% of potential demand, 2024, limiting near-term scale for fully digital models.

- Opportunity: Vendors can unlock significant upside by tailoring AI-enabled, curriculum-aligned solutions for the dominant Preschoolers segment, which holds 53.6% share, 2024. Adaptive and analytics-driven offerings for this cohort could translate into estimated: 20.0 billion USD, 2034 in high-margin recurring revenue.

- Trend: The U.S. market, valued at 5.0 billion USD, 2024, is set to grow at a 16.2% CAGR over 2024-2034, signaling rapid scaling of digital-first early learning models. This pattern confirms a broader shift toward data-informed, platform-based engagement across early childhood settings.

- Regional Analysis: North America leads with more than 46.7% share and about 6.2 billion USD in revenue, 2024, driven by high digital infrastructure and strong private expenditure. Asia Pacific and other emerging regions trail but represent estimated: 25.0% of global revenue, 2024, with faster growth trajectories as connectivity and income levels rise.

By Type of Childcare

The childcare landscape continues to shift in 2025 as digital learning tools become a standard part of early education. Nursery schools retain the largest share of activity, accounting for more than 37 percent of market demand in 2024. These institutions serve a wide base of children between ages 1 and 5, which positions them as primary adopters of structured EdTech programs. Your organization will notice that demand increases most rapidly where early learning outcomes carry strong parental priority and where attendance rates remain high across urban and semi-urban settings.

Parents continue to direct significant spending toward digital tools that support social, emotional and cognitive development. This demand accelerates uptake among nursery schools as they add app-based learning, interactive content and progress-tracking platforms. Funding from governments and private operators strengthens this shift. Many institutions now invest in IT infrastructure to support tablet-based learning, literacy platforms and early numeracy modules.

Preschools and kindergarten schools show steady adoption as well, although with varied pace depending on local income levels and institutional budgets. Other childcare settings, including childcare centers, continue to integrate targeted learning modules, often focusing on language, early STEM and motor-skills development. As more providers seek structured digital programs, you will see this segment continue to expand across 2025 to 2030.

By Curriculum

Curriculum preferences influence technology choices across early learning environments. Montessori-aligned programs account for more than 32 percent of digital adoption in 2024. Their emphasis on self-paced learning and hands-on activities aligns with platforms designed to guide children through tasks independently. Parents who prefer activity-based formats adopt these tools rapidly, which supports strong market continuity through 2025.

Demand for Reggio Emilia, Waldorf, play-based and academic programs is also increasing. These formats benefit from digital content that supports open exploration, storytelling, collaborative tasks and structured skill progression. Providers design platforms that track developmental milestones and offer content suited to varied learning styles. This helps educators adjust lesson plans and identify areas where children need additional support.

Hybrid curricula gain traction as schools combine physical materials with digital extensions. Tablets, interactive boards and activity apps supplement worksheets and physical manipulatives. This integrated approach is expected to expand across 2025 as institutions look for consistent ways to monitor progress and maintain instructional alignment across classrooms.

By Age Group

Preschoolers between ages 3 and 5 represent the largest user group for early childhood EdTech, holding more than 53 percent of market activity in 2024. This age group responds strongly to interactive visuals, audio support and short learning modules. You will see high adoption of literacy and numeracy apps, motor-skills games and language-development platforms that match their developmental pace.

Toddlers between ages 1 and 2 adopt digital tools at a slower rate but remain an important expanding segment. Parents use music apps, sensory-focused content and simple exploratory games to supplement early development. Early elementary students between ages 6 and 12 use more structured programs that focus on reading fluency, problem-solving and foundational STEM concepts. Growth in this group increases as schools standardize blended learning models.

Rising comfort with mobile devices continues to push household usage. Tablets remain the preferred device for most parents because of portability and ease of control. As more households integrate digital learning into daily routines, usage patterns will become more consistent across regions through 2030.

By Ownership Structure

Private organizations hold the largest share of early childhood EdTech activity, accounting for more than 57 percent of the market in 2024. Your teams will observe that private operators move quickly to introduce new platforms and update content, which allows them to address shifts in parental expectations. Subscription models, freemium apps and bundled learning packages support broad adoption across households and schools.

Public institutions continue to expand their digital initiatives, particularly in countries that invest in early education reform. Governments allocate portions of their education budgets to infrastructure upgrades, teacher training and standardized learning platforms. Non-profit organizations focus on underserved regions by deploying low-cost tools or offering community-based access to early learning content.

Private providers also form partnerships with schools and curriculum developers at a faster pace than public institutions. These collaborations help standardize content and improve access to structured modules that can be monitored across classrooms.

By Region

North America retains its lead in early childhood EdTech, holding more than 46 percent of global market share and generating about USD 6.2 billion in 2024. High digital readiness, early adoption of learning platforms and strong household spending support continued growth through 2030. The United States remains the largest contributor due to consistent investment in early learning and rising demand for personalized instruction.

Europe maintains steady adoption, led by Germany, the United Kingdom and the Nordic countries. Regulatory support for early education and high broadband penetration help accelerate uptake. Asia Pacific shows the fastest growth, driven by expanding middle-income populations in China, India and Southeast Asia. Rising enrollment in early education and increasing mobile usage contribute to rapid expansion.

Latin America and the Middle East and Africa expand gradually as governments pursue digital learning initiatives. Improvements in connectivity and ongoing private participation will support uptake through the next five years. Emerging markets in these regions represent key opportunities for affordable, mobile-first solutions designed for early learners.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Type of Childcare

- Nursery Schools

- Preschools

- Kindergarten Schools

- Others (Childcare Centers, etc.)

By Curriculum

- Montessori

- Reggio Emilia

- Waldorf

- Play-based

- Academic

- Others

By Age Group

- Toddlers (1-2 years)

- Preschoolers (3-5 years)

- Early Elementary (6-12 years)

By Ownership Structure

- Private

- Public

- Non-Profit

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 13.4 Billion |

| Forecast Revenue (2034) | USD 55.6 billion |

| CAGR (2024-2034) | 15.3% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Type of Childcare, Nursery Schools, Preschools, Kindergarten Schools, Others (Childcare Centers, etc.), By Curriculum, Montessori, Reggio Emilia, Waldorf, Play-based, Academic, Others, By Age Group, Toddlers (1-2 years), Preschoolers (3-5 years), Early Elementary (6-12 years), By Ownership Structure, Private, Public, Non-Profit |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | La Petite Academy, KinderCare Education, Goddard Schools, Montessori Schools, Children’s Discovery Centers, Kiddie Academy, Gymboree, Primrose Schools, Bright Path Early Learning, Learning Tree International, Bright Horizons Family Solutions, Montessori Children’s House, The Learning Experience, Tutor Time, KinderCare, Others |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

EdTech For Early Childhood Market

Published Date : 09 Jan 2026 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date