Electrohydraulic Actuator Market Size | 4.9% CAGR Growth

Global Electrohydraulic Actuator Market Size, Share & Analysis By Product (Control Electrohydraulic Actuator, Switch Electrohydraulic Actuator), By Application (Oil and Gas, Power, Industrial, Other Applications), By End Use (Industrial Building, Commercial Building, Residential Building ), Industry Overview, Performance Advantages, Integration Trends & Forecast 2025–2034

Report Overview

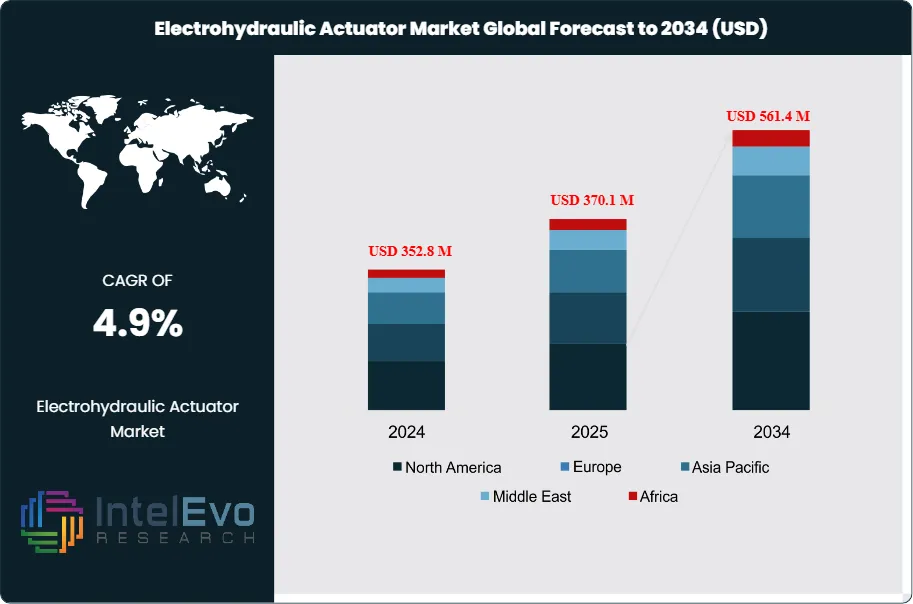

The Electrohydraulic Actuator Market is valued at approximately USD 352.8 million in 2024 and is projected to reach nearly USD 561.4 million by 2034, growing at a steady CAGR of about 4.9% from 2025–2034. This expansion is driven by increasing automation in oil & gas, power generation, marine, and heavy industrial applications, where high force output and precise control are mission-critical. As industries upgrade legacy pneumatic systems to energy-efficient electrohydraulic alternatives, demand is gaining consistent traction worldwide. With digital monitoring, smart valve control, and Industry 4.0–enabled actuators becoming mainstream, the segment is trending across engineering, automation, and industrial innovation platforms.

Get More Information about this report -

Request Free Sample ReportThis moderate yet consistent growth reflects the rising demand for high-precision motion control solutions across critical sectors such as aerospace, automotive, energy, and smart manufacturing. Electrohydraulic actuators (EHAs) combine the robust force delivery of hydraulics with the precision of electronic control, enabling enhanced performance in applications where traditional electric or purely hydraulic systems fall short. The market has witnessed a steady evolution, driven by the broader industrial shift toward automation, digitization, and predictive maintenance—trends that have redefined performance expectations in motion control technologies.

From a demand-side perspective, the surge in automated production systems and intelligent manufacturing infrastructure is propelling adoption, particularly in developed economies and technologically advanced industries. The aerospace and defense sector remains a key end user, leveraging EHAs for flight control systems and military equipment, while automotive OEMs increasingly employ them in testing systems and electric vehicle (EV) development. On the supply side, manufacturers are responding with compact, integrated, and more energy-efficient designs, minimizing fluid leakage risks and extending operational lifecycles.

Technological innovation remains central to market expansion. Integration of EHAs with IoT and AI-powered diagnostic tools is gaining momentum, offering enhanced monitoring, fault detection, and system optimization capabilities. Digital twins and automation software are also being incorporated to streamline control algorithms and reduce system downtime.

Regionally, North America and Europe dominate the market due to early industrial adoption, stringent safety regulations, and defense investments. However, Asia-Pacific is emerging as a high-potential growth hub, particularly in China, Japan, and South Korea, where large-scale industrial automation projects and EV manufacturing are accelerating EHA deployment. Emerging economies in Southeast Asia and Latin America are also drawing investor attention due to favorable policy frameworks and infrastructure modernization efforts.

Despite growth opportunities, the market faces challenges related to high initial costs, complex integration, and maintenance expertise. However, as system designs evolve and digital solutions mature, EHAs are expected to play an increasingly strategic role in next-generation industrial and mobility platforms.

Key Takeaways

- Market Growth: The global Electrohydraulic Actuator Market was valued at USD 352.8 million in 2024 and is projected to reach USD 561.4 million by 2034, expanding at a CAGR of 4.9% over the forecast period. Growth is primarily driven by rising automation in manufacturing, aerospace advancements, and demand for high-precision actuation systems.

- Product Type: Control Electrohydraulic Actuators accounted for a dominant 71.3% market share in 2023, driven by their widespread use in precision control systems across aerospace, industrial machinery, and defense applications.

- Application: The Industrial segment led the market in 2023 with a 35.2% revenue share, supported by increased deployment of electrohydraulic systems in automated manufacturing lines, process industries, and testing equipment.

- Driver: The growing emphasis on energy efficiency and predictive maintenance in industrial systems is accelerating EHA adoption, particularly in smart factories where digital monitoring can reduce downtime and extend equipment lifespan.

- Restraint: High initial costs and integration complexity pose a barrier to adoption, especially among small- and medium-sized enterprises lacking in-house technical expertise for hybrid actuation systems.

- Opportunity: The Asia-Pacific region offers strong growth potential, with rising demand from electric vehicle manufacturing, industrial automation, and aerospace development; the regional market is expected to grow at a CAGR exceeding the global average over 2024–2033.

- Trend: The integration of EHAs with IoT-enabled condition monitoring and AI-based diagnostics is reshaping system reliability and lifecycle management, with major manufacturers investing in smart actuator platforms to enable real-time performance analytics.

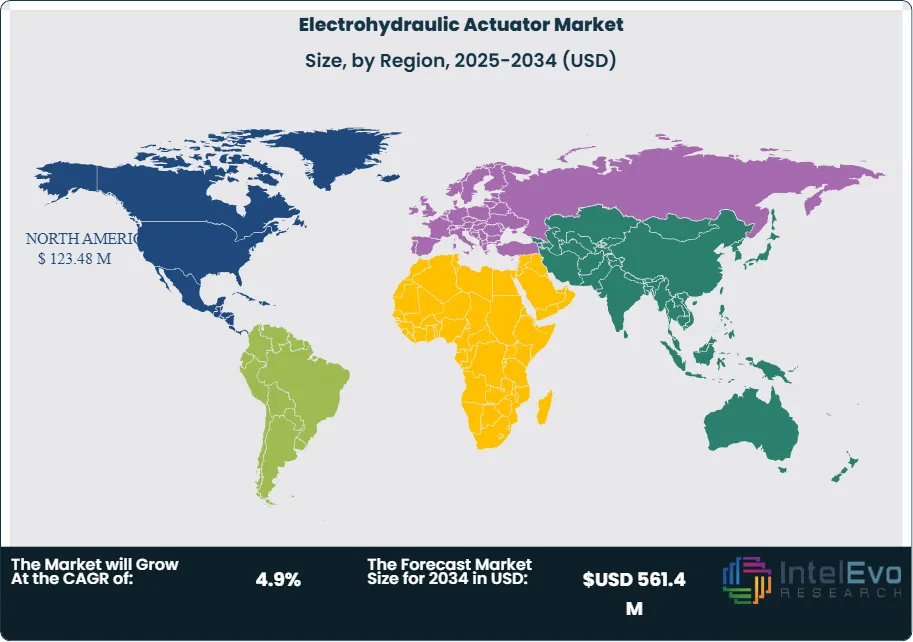

- Regional Analysis: North America led the global market with a 35.3% share in 2023, generating USD 117.9 million in revenue, attributed to strong aerospace and defense spending. Meanwhile, Asia-Pacific is emerging as the fastest-growing region, fueled by large-scale industrial investments in China, India, and Southeast Asia.

Type Analysis

As of 2025, Control Electrohydraulic Actuators continue to dominate the global electrohydraulic actuator market, accounting for over 70% of the total market share. These actuators are widely adopted in industries where continuous and precise control is essential—such as power generation, oil and gas, aerospace, and advanced manufacturing. Their ability to deliver high-force output with fine-tuned accuracy makes them indispensable in mission-critical systems, especially those involving automated process control under variable operating conditions. Their dominance also reflects growing end-user demand for actuation solutions that minimize downtime and increase operational efficiency.

Meanwhile, Switch Electrohydraulic Actuators, though occupying a smaller market portion, hold a vital niche in applications that prioritize rapid, binary positioning in harsh or outdoor environments. Commonly deployed in water treatment facilities, heavy machinery, and infrastructure equipment, these actuators are valued for their reliability, low maintenance, and rugged design. With increasing investments in infrastructure resilience and municipal automation systems, this segment is expected to see gradual but steady growth through 2030, particularly in developing economies focused on utility modernization.

Together, these product categories highlight a market where technological specialization and performance differentiation are key to value creation. As digitalization accelerates and industries shift toward predictive maintenance and intelligent actuation systems, the demand for sophisticated control actuators is projected to expand significantly, driving further innovation and supplier competition.

Application Analysis

In 2025, Industrial applications lead the electrohydraulic actuator market, accounting for approximately 35% of the total revenue share. This segment benefits from widespread deployment across metal fabrication, machinery automation, robotics, and process industries. Electrohydraulic actuators in these environments are essential for achieving high-precision motion, force control, and adaptability in complex, repetitive operations. With Industry 4.0 adoption rising globally, manufacturers are integrating these systems into smart production lines to improve throughput, efficiency, and data-driven maintenance.

Other major application segments include Oil & Gas and Power Generation, where actuators operate under severe pressure, temperature, and environmental constraints. In these sectors, EHAs are critical for valve control, drilling systems, and safety mechanisms, particularly in offshore rigs and thermal power plants. Their superior torque output and fail-safe configurations offer a reliable solution where mechanical redundancy is necessary.

As sectors increasingly automate legacy systems and adopt digital control architectures, the demand for electrohydraulic actuation across diverse applications is anticipated to rise. In particular, industrial users are expected to lead future demand, driving product innovation in remote diagnostics, system integration, and energy efficiency.

End-Use Analysis

By end-use, the Industrial Building segment represents the most significant share of the electrohydraulic actuator market in 2025, supported by increasing investment in manufacturing facilities, logistics centers, and energy infrastructure. Automation and real-time system control are now integral to operational strategy in sectors such as steel, cement, chemical processing, and renewable energy. Electrohydraulic systems are deployed to manage mechanical processes with precision while offering the durability required for demanding industrial conditions.

The Commercial Building segment is also witnessing increased adoption, particularly in smart infrastructure projects that require responsive actuation for systems such as HVAC, lift controls, and structural automation. Smart city initiatives in urban centers worldwide are fueling this trend, integrating EHAs into intelligent building frameworks to optimize energy use and mechanical performance.

The Residential Building segment, while smaller, shows emerging opportunities—especially in high-end construction and luxury housing where automation of utilities and structural elements is becoming a differentiator. Though still niche, the potential for growth exists as smart home ecosystems continue to evolve and as EHAs become more compact and affordable.

Regional Analysis

In regional terms, North America remains the largest market for electrohydraulic actuators in 2025, holding over 35% of global revenue share, with the United States contributing the majority. The region’s leadership is attributed to strong adoption across aerospace, defense, oil and gas, and advanced manufacturing. Government-backed initiatives for industrial automation, coupled with high R&D investments, further bolster the region’s position as a technological frontrunner in actuator development.

Europe follows closely, driven by regulatory requirements for energy efficiency and safety in industrial systems. Germany, France, and the UK are key markets, supported by a well-established base of automotive and aerospace OEMs. The region’s focus on sustainability and precision engineering continues to push demand for high-performance electrohydraulic solutions.

Meanwhile, Asia Pacific is the fastest-growing region, with China and India emerging as industrial powerhouses. Rising infrastructure spending, electric vehicle production, and smart manufacturing initiatives are accelerating the adoption of EHAs across sectors. The region’s market is expected to grow at a CAGR exceeding the global average through 2030, making it a strategic focus for global suppliers.

Latin America and the Middle East & Africa exhibit steady growth, primarily driven by investments in oil and gas, water infrastructure, and industrial modernization. While smaller in market size, both regions present long-term opportunities due to increasing automation adoption and infrastructure expansion.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Product

- Control Electrohydraulic Actuator

- Switch Electrohydraulic Actuator

By Application

- Oil and Gas

- Power

- Industrial

- Other Applications

By End Use

- Industrial Building

- Commercial Building

- Residential Building

By Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 352.8 M |

| Forecast Revenue (2034) | USD 561.4 M |

| CAGR (2024-2034) | 4.9% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Product (Control Electrohydraulic Actuator, Switch Electrohydraulic Actuator), By Application (Oil and Gas, Power, Industrial, Other Applications), By End Use (Industrial Building, Commercial Building, Residential Building ) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Wipro Infrastructure Engineering, Rexa, LLC, Atos Spa, Moog Inc., Bosch Rexroth AG, Oilgear, Parker Hannifin Corporation, IMI Precision Engineering, Eaton Corporation, Rotork plc, Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Electrohydraulic Actuator Market

Published Date : 04 Dec 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date