Electronic Chemicals Industry Size & Growth Outlook | CAGR 5.9%

Global Electronic Chemicals Market Size, Share, Analysis Report By Product Type (Wet Chemicals, Specialty Gases, Photoresists & Ancillaries, CMP Slurries & Polishing Materials) Application (Semiconductor Manufacturing, PCB Production, Flat Panel Display Manufacturing, Photovoltaic Cell Manufacturing) End-Use (Consumer Electronics, Automotive, Industrial, Healthcare) Industry Region & Key Players-Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends & Forecast 2025-2034

Report Overview

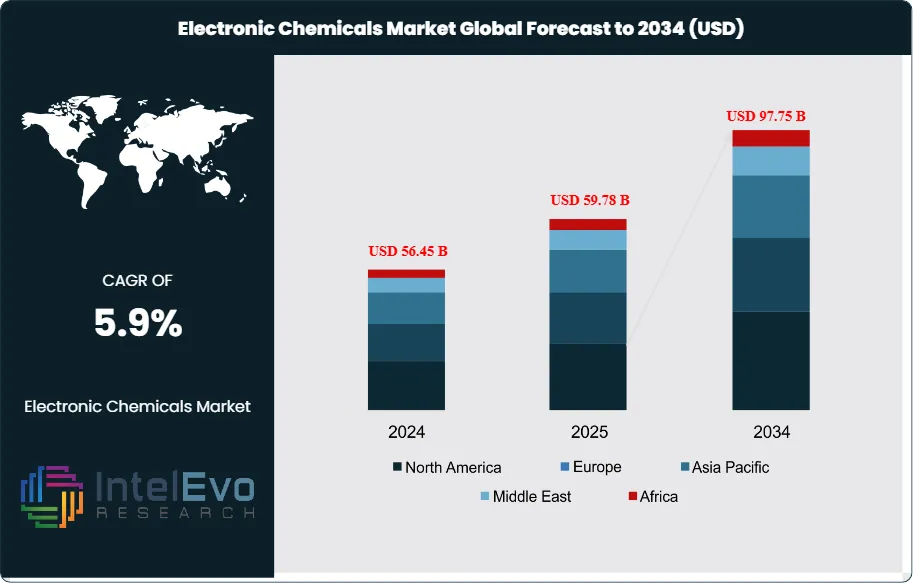

The Electronic Chemicals Market is projected to reach around USD 97.75 Billion by 2034, up from approximately USD 56.45 Billion in 2024, expanding at a CAGR of about 5.9% during the forecast period of 2025 to 2034. The market is experiencing strong growth driven by the rapid expansion of the semiconductor industry, increased adoption of advanced packaging technologies, and the rising demand for high-performance electronic components across consumer electronics, automotive, and telecommunications. With accelerating advancements in 5G infrastructure, IoT devices, and electric vehicles, the need for ultra-pure electronic-grade chemicals is expected to surge, positioning this market as a key enabler in the future of digital innovation and smart technology ecosystems.

Get More Information about this report -

Request Free Sample ReportThe electronic chemicals market forms the backbone of the modern electronics industry, encompassing a diverse range of ultra-high purity chemicals and materials essential for the manufacturing of semiconductors, printed circuit boards (PCBs), flat panel displays, photovoltaic cells, and other advanced electronic components. This market has witnessed robust growth, propelled by the rapid expansion of the semiconductor sector, the proliferation of consumer electronics, the global rollout of 5G and AI technologies, and the accelerating adoption of electric vehicles (EVs) and renewable energy systems. The integration of advanced manufacturing processes, stringent purity requirements, and digitalization has significantly elevated the role of electronic chemicals, making them indispensable to the global technology supply chain.

Several key factors are shaping the market’s trajectory, including the global race for semiconductor self-sufficiency, increasing investments in new fabrication plants (fabs), and the rising complexity of electronic devices that demand ever-higher chemical performance and purity. The market is also influenced by regulatory frameworks, environmental sustainability initiatives, and the need for resilient, localized supply chains in the wake of recent geopolitical and logistical disruptions.

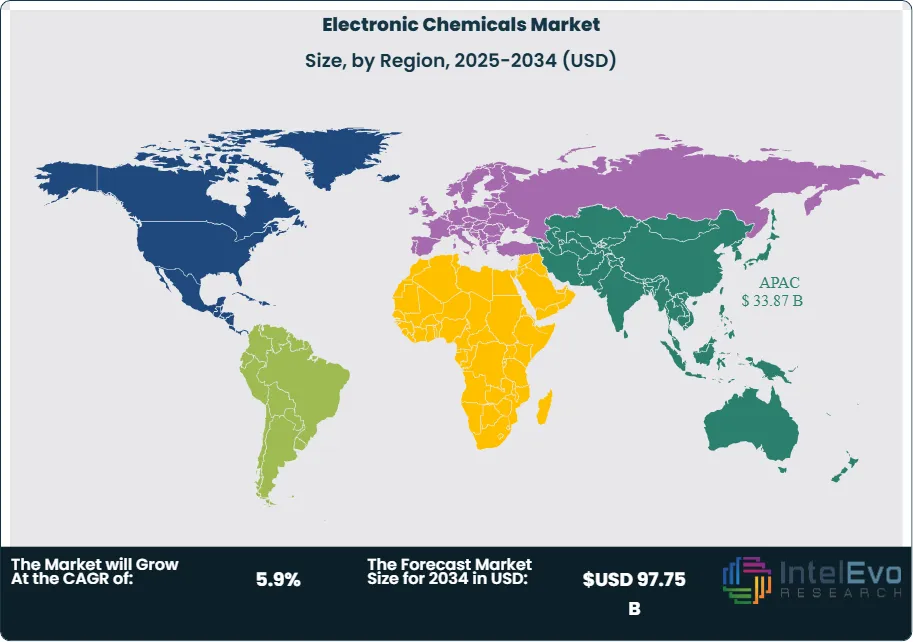

Regional analysis reveals Asia-Pacific as the dominant market, accounting for over 60% of global revenue in 2024, driven by the presence of leading semiconductor foundries, display manufacturers, and electronics assemblers in China, South Korea, Taiwan, and Japan. North America and Europe follow, with significant investments in domestic chip manufacturing and advanced materials R&D. The COVID-19 pandemic, global chip shortages, and ongoing trade tensions have underscored the strategic importance of electronic chemicals, prompting governments and industry players to prioritize supply chain security and innovation.

Key Takeaways

- Market Growth: The Global Electronic Chemicals Market is expected to reach USD 97.75 Billion by 2034, fueled by the expansion of semiconductor manufacturing, the proliferation of consumer electronics, and the adoption of advanced technologies such as 5G, AI, and EVs.

- Application Dominance: Semiconductor manufacturing remains the dominant segment, supported by the transition to advanced nodes, 3D architectures, and the growing demand for high-performance chips.

- Product Dominance: Wet chemicals and specialty gases are the most widely used product types, with photoresists and CMP slurries gaining traction in advanced fabrication processes.

- End-Use Dominance: Consumer electronics and automotive sectors are major end-users, with industrial, healthcare, and renewable energy applications on the rise.

- Driver: Technological innovation, miniaturization, and the need for ultra-high purity materials are key drivers of market adoption and differentiation.

- Restraint: Stringent environmental regulations, supply chain volatility, and high capital requirements present challenges to market growth.

- Opportunity: Expansion of semiconductor fabs in the US, Europe, and India, as well as the development of green and sustainable chemical solutions, offer lucrative opportunities.

- Trend: The shift toward ultra-high purity chemicals, digitalized manufacturing, and regionalized supply chains is reshaping the competitive landscape.

- Regional Analysis: Asia-Pacific leads in revenue and innovation, while North America and Europe focus on supply chain resilience and sustainability.

Product Type Analysis

Wet Chemicals Lead With Over 40% Market Share in the Electronic Chemicals Market. Wet chemicals—including acids (sulfuric, hydrochloric, nitric), bases (ammonium hydroxide), solvents (isopropyl alcohol, acetone), and etchants—form the cornerstone of the electronic chemicals market. These chemicals are essential for cleaning, etching, and surface preparation in semiconductor and PCB manufacturing. The segment’s leadership is reinforced by the ongoing miniaturization of devices, which demands ever-higher purity and process control. The proliferation of advanced packaging, 3D chip architectures, and new materials is driving innovation in wet chemical formulations and delivery systems.

Specialty gases, such as nitrogen, hydrogen, argon, silane, and fluorinated gases, are critical for deposition, doping, and etching processes in wafer fabrication. The rise of atomic layer deposition (ALD), extreme ultraviolet (EUV) lithography, and advanced etching techniques is boosting demand for ultra-high purity gases and gas management solutions.

Photoresists and ancillary materials are gaining traction as photolithography becomes more complex, especially with the transition to EUV and advanced patterning. Chemical-mechanical planarization (CMP) slurries and polishing materials are also seeing increased adoption in advanced node manufacturing.

Application Analysis

Semiconductor Manufacturing Dominates With Over 60% Market Share. Semiconductor manufacturing is the largest and fastest-growing application segment, accounting for more than 60% of total electronic chemicals demand in 2024. The relentless push toward smaller geometries (5nm, 3nm, and beyond), higher chip densities, and 3D integration is driving the need for new, high-performance chemical solutions. The global chip shortage and the strategic importance of semiconductors have led to unprecedented investments in new fabs across Asia, North America, and Europe.

Printed circuit board (PCB) production is the second-largest segment, supported by the growth of consumer electronics, automotive electronics, and industrial automation. Flat panel display manufacturing—including LCD, OLED, and microLED technologies—relies on electronic chemicals for cleaning, etching, and patterning. The photovoltaic (solar cell) segment is also expanding, driven by the global shift toward renewable energy and the need for high-efficiency solar modules.

End-Use Analysis

Consumer Electronics and Automotive Sectors Drive Demand. Consumer electronics—including smartphones, tablets, laptops, wearables, and smart home devices—remain the primary end-use sector, accounting for a significant share of electronic chemicals consumption. The rapid pace of innovation, shorter product lifecycles, and the integration of advanced features (AI, 5G, AR/VR) are fueling demand for high-purity materials.

The automotive sector is emerging as a major growth driver, propelled by the electrification of vehicles, the adoption of advanced driver-assistance systems (ADAS), and the integration of power electronics and sensors. Industrial applications, healthcare devices, and renewable energy systems (solar, battery storage) are also contributing to market expansion.

Region Analysis

Asia-Pacific Leads With Over 60% Market Share in the Electronic Chemicals Market. Asia-Pacific is the dominant region, accounting for more than 60% of global electronic chemicals revenue in 2024. The region’s leadership is anchored by the presence of world-class semiconductor foundries (TSMC, Samsung, SMIC), display manufacturers (BOE, LG Display), and electronics assemblers. China, South Korea, Taiwan, and Japan are the key markets, benefiting from robust supply chains, skilled labor, and government support for high-tech industries.

North America is the second-largest market, driven by the United States’ leadership in semiconductor design and recent investments in domestic chip manufacturing. The CHIPS and Science Act and similar initiatives are spurring the construction of new fabs and supporting infrastructure. Europe is a significant player, with strengths in automotive electronics, industrial automation, and specialty chemicals. The region’s focus on sustainability and regulatory compliance is driving demand for green electronic chemicals and circular economy solutions.

Latin America and the Middle East & Africa are emerging markets, with growing demand for consumer electronics, automotive components, and renewable energy systems. Investments in local electronics assembly and solar manufacturing are creating new opportunities for electronic chemical suppliers.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

Product Type

- Wet Chemicals

- Specialty Gases

- Photoresists & Ancillaries

- CMP Slurries & Polishing Materials

- Other Materials

Application

- Semiconductor Manufacturing

- PCB Production

- Flat Panel Display Manufacturing

- Photovoltaic (Solar Cell) Manufacturing

- Others

End-Use

- Consumer Electronics

- Automotive

- Industrial

- Healthcare

- Others

Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 59.78 B |

| Forecast Revenue (2034) | USD 97.75 B |

| CAGR (2025-2034) | 5.9% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Product Type: (Wet Chemicals, Specialty Gases, Photoresists & Ancillaries, CMP Slurries & Polishing Materials, Other Materials), Application: (Semiconductor Manufacturing, PCB Production, Flat Panel Display Manufacturing, Photovoltaic (Solar Cell) Manufacturing, Others), End-Use: (Consumer Electronics, Automotive, Industrial, Healthcare, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Dow Inc., BASF SE, Honeywell Intl. Inc., Air Products & Chemicals, Inc., Linde plc, Shin‑Etsu Chemical Co., Sumitomo Chemical / Sumika, FUJIFILM Electronic Materials, JSR Corporation, Merck KGaA, Cabot Microelectronics Corp., Entegris, Inc., TOK (Tokyo Ohka Kogyo), Air Liquide (Electronics), Solvay SA, Kanto Chemical Co., Hitachi Chemical (Showa Denko), Albemarle Corp., Ashland Inc., AZ Electronic Materials Plc |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date