Engineering Design Software Market Size | CAGR 12.4% (2025–2034)

Global Engineering Design Software Market Size, Share & Industry Analysis By Software Type (CAD, CAE, CAM, PLM), By Deployment (Cloud, On-Premise), By Application (Automotive, Aerospace, Construction, Electronics), Digital Twin & AI Integration, Competitive Landscape, Regional Insights, Innovation Trends & Forecast 2025–2034

Report Overview

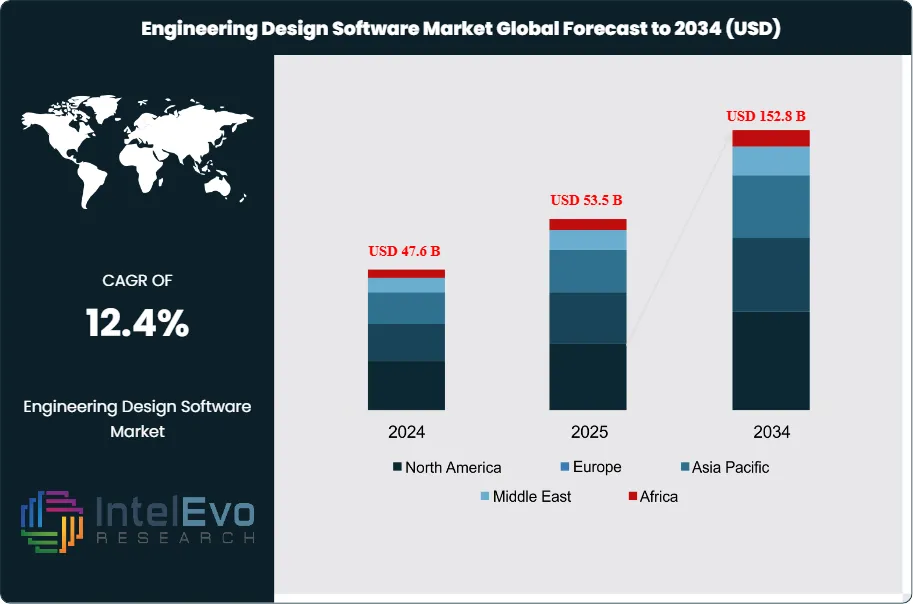

The Engineering Design Software Market is estimated at USD 47.6 billion in 2024 and is projected to reach approximately USD 152.8 billion by 2034, registering a compound annual growth rate (CAGR) of about 12.4% during 2025–2034. This sustained expansion is driven by accelerating adoption of cloud-based CAD/CAE platforms, AI-enabled generative design, and digital twin technologies across automotive, aerospace, construction, and electronics industries. Enterprises are increasingly leveraging simulation-driven workflows to shorten development cycles, reduce physical prototyping costs, and meet stricter sustainability and compliance requirements. As product complexity rises and time-to-market pressures intensify, engineering design software is becoming a mission-critical investment, supporting long-term demand growth across both developed and emerging markets.

Get More Information about this report -

Request Free Sample ReportThis expansion reflects a structural shift in how industries design, test, and deliver products, with software now central to engineering workflows across automotive, aerospace, construction, energy, and manufacturing. Historical growth has been steady, but the past five years have marked an acceleration as digitalization, cloud adoption, and advanced modeling tools became mainstream. The market’s trajectory indicates that software will increasingly replace traditional design processes, reducing costs and compressing product development cycles.

Demand-side drivers remain strong. The rise of additive manufacturing and 3D printing has created new requirements for precision modeling tools, while industries under pressure to shorten time-to-market are investing in simulation and digital twin capabilities. Cloud-based platforms are gaining traction, with adoption rates exceeding 40% among large enterprises in 2023, as they enable real-time collaboration and remote access. On the supply side, vendors are expanding subscription-based licensing models, which accounted for more than 60% of revenues in 2022, ensuring recurring income streams and broader accessibility. However, challenges persist. High upfront training costs, integration complexity with legacy systems, and cybersecurity risks in cloud deployments remain barriers for small and mid-sized firms.

Technology is reshaping adoption patterns. Artificial intelligence is being embedded into design platforms to automate repetitive tasks and improve accuracy. Simulation-driven design is reducing the need for physical prototypes, cutting development costs by up to 30% in some industries. The integration of generative design tools is enabling engineers to evaluate thousands of design permutations in minutes, supporting sustainability goals by minimizing material use and energy consumption.

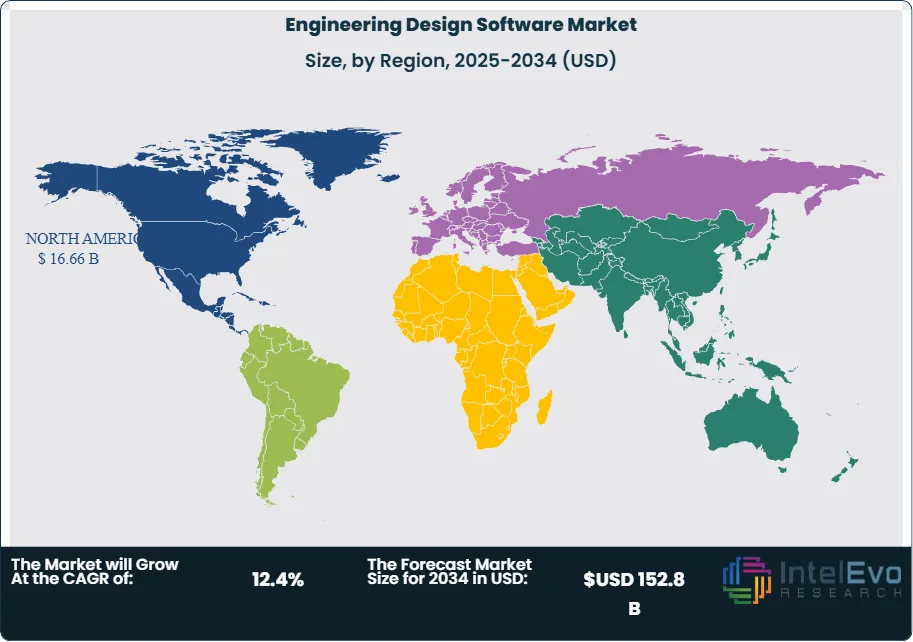

Regionally, North America leads the market with over 35% share in 2022, supported by strong adoption in aerospace and defense. Europe follows closely, driven by automotive and industrial applications, while Asia-Pacific is the fastest-growing region, projected to expand at over 15% CAGR through 2032 due to rapid industrialization and government-backed digital manufacturing initiatives in China and India. For investors, Asia-Pacific and cloud-based engineering platforms represent the most attractive growth opportunities, while established markets in North America and Europe will continue to generate stable returns through enterprise upgrades and advanced simulation adoption.

Key Takeaways

- Market Growth: The global engineering design software market was valued at USD 47.6 billion in 2024 and is projected to reach USD 152.8 billion by 2034, expanding at a CAGR of 12.4%. Growth is driven by rising demand for digital product development, 3D modeling, and cloud-based collaboration tools.

- Product Type: Computer-Aided Design (CAD) software accounted for over 40% of total revenues in 2022, supported by its widespread use in automotive, aerospace, and construction. Simulation and analysis tools are gaining share, projected to grow at 14% CAGR through 2032.

- Deployment Model: Cloud-based platforms represented nearly 38% of the market in 2022 and are expected to surpass 55% by 2032. Enterprises are shifting to subscription-based SaaS models for real-time collaboration and cost efficiency.

- Driver: The adoption of 3D printing and additive manufacturing is accelerating demand for precision design tools. Over 70% of large manufacturers in North America reported integrating 3D design software into prototyping workflows by 2023.

- Restraint: High implementation and training costs remain a barrier for small and mid-sized enterprises. Initial deployment can increase IT budgets by 15–20%, slowing adoption in cost-sensitive markets.

- Opportunity: Asia-Pacific is the fastest-growing region, forecast to expand at over 15% CAGR through 2032. Government-backed digital manufacturing initiatives in China and India are creating strong demand for cloud-enabled engineering platforms.

- Trend: Artificial intelligence and generative design are reshaping workflows. Leading vendors such as Autodesk and Siemens are embedding AI to automate repetitive tasks, with early adopters reporting up to 30% reductions in design cycle times.

- Regional Analysis: North America held a 35% revenue share in 2022, driven by aerospace and defense applications. Europe followed with strong adoption in automotive and industrial sectors. Asia-Pacific is emerging as the key investment hotspot, while Latin America and the Middle East are expected to see steady adoption in construction and energy projects.

Type Analysis

Computer-Aided Design (CAD) continues to represent the largest share of the engineering design software market in 2025, accounting for more than 40% of total revenues. Its dominance is supported by widespread use across automotive, aerospace, construction, and manufacturing, where precision and speed are critical. CAD enables engineers to create and refine detailed 2D and 3D models, reducing reliance on physical prototypes and lowering development costs by up to 25% in some industries.

Electronic Design Automation (EDA) software is gaining traction, particularly in electronics and semiconductor manufacturing. With global semiconductor revenues projected to surpass USD 700 billion by 2030, demand for EDA tools is expanding at a CAGR above 13%. These platforms support circuit design, verification, and testing, making them essential for companies competing in high-performance computing, telecommunications, and consumer electronics. The segment’s growth is reinforced by rising investment in chip design capabilities in Asia-Pacific and the United States.

The market is also seeing growth in specialized design tools that integrate simulation, generative design, and AI-driven automation. These solutions are increasingly adopted by enterprises seeking to accelerate product development cycles and improve sustainability outcomes. Vendors are embedding AI into design workflows, enabling engineers to evaluate thousands of design permutations in minutes, which is reshaping how products are conceptualized and tested.

Application Analysis

Industry facilities remain the largest application segment, representing over 50% of global revenues in 2024. Manufacturing, aerospace, and automotive companies rely heavily on engineering design software to streamline production, reduce errors, and improve efficiency. In manufacturing, digital twins and simulation-driven design are now standard, with adoption rates exceeding 60% among large enterprises.

Infrastructure applications are expanding rapidly, supported by global investments in smart cities and sustainable construction. Building Information Modeling (BIM) integration has become a key driver, with more than 70% of large construction firms in Europe and North America adopting BIM-enabled design platforms. These tools allow for real-time collaboration between architects, engineers, and contractors, reducing project delays and cost overruns.

The growing complexity of infrastructure projects, particularly in Asia-Pacific and the Middle East, is fueling demand for advanced design solutions. Governments are mandating digital design standards for public projects, further accelerating adoption. This trend positions infrastructure as one of the fastest-growing application areas through 2032.

End-Use Analysis

Commercial buildings represent the largest end-use segment, accounting for nearly 40% of total demand in 2024. Engineering design software is widely used in office complexes, retail spaces, and institutional projects, where precision and compliance with sustainability standards are critical. The rise of green building certifications has further increased reliance on digital design platforms.

Residential construction is also expanding, particularly in emerging economies where urbanization is accelerating. In India and Southeast Asia, demand for affordable housing is driving adoption of design software that supports modular construction and prefabrication. These tools help reduce costs and shorten project timelines, making them attractive for large-scale housing initiatives.

Industrial buildings, including factories, warehouses, and logistics hubs, are projected to grow at over 14% CAGR through 2032. The expansion of e-commerce and global supply chains is fueling demand for advanced facility design, with companies investing in digital twins and simulation to optimize layouts and improve operational efficiency.

Regional Analysis

North America remains the largest regional market, holding a 35% share in 2024. The United States leads adoption, supported by strong demand in aerospace, defense, and high-tech manufacturing. The presence of major vendors such as Autodesk, PTC, and Ansys further reinforces the region’s position.

Europe follows closely, with Germany, France, and the United Kingdom driving adoption in automotive and industrial applications. The European Union’s emphasis on sustainability and digital transformation is accelerating the use of BIM and simulation-driven design across construction and infrastructure projects.

Asia-Pacific is the fastest-growing region, forecast to expand at over 15% CAGR through 2032. China and India are leading this growth, supported by large-scale infrastructure investments and government-backed digital manufacturing initiatives. Japan and South Korea are also key markets, particularly in electronics and automotive design. Latin America and the Middle East & Africa are emerging markets, with adoption concentrated in construction, energy, and industrial projects. These regions present long-term opportunities as digital transformation initiatives gain momentum.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Type

- Computer-Aided Design

- Electronic Design Automation Software

By Application

- Industry Facilities

- Infrastructure

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 47.6 B |

| Forecast Revenue (2034) | USD 152.8 B |

| CAGR (2024-2034) | 12.4% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Type (Computer-Aided Design, Electronic Design Automation Software), By Application (Industry Facilities, Infrastructure) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Autodesk, IBM, Dassault Systèmes (CATIA, SOLIDWORKS), Siemens Digital Industries Software (NX, Solid Edge), PTC Inc. (Creo), Bentley Systems, ANSYS, Inc., Hexagon AB (MSC Software, HxGN), AVEVA Group, Altair Engineering, Trimble Inc. |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Engineering Design Software Market

Published Date : 30 Dec 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date