ESO Market Skyrockets: $5.6T by 2034 with 23.05% CAGR!

Global Engineering Services Outsourcing (ESO) Market Size, Share & Analysis Report Service Type (Prototyping, System Integration, Designing, Testing) Technology/Component (Embedded Systems, Automation & Robotics, Digital Engineering/Simulation) Distribution/Delivery Model (Off-shore, Near-shore, On-shore) End User (Automotive, Aerospace & Defense , Energy & Utilities, Consumer Electronics, Semiconductors, Industrial), Region & Key Players – Segment Overview, Market Dynamics, Trends & Forecast 2025–2034

Report Overview

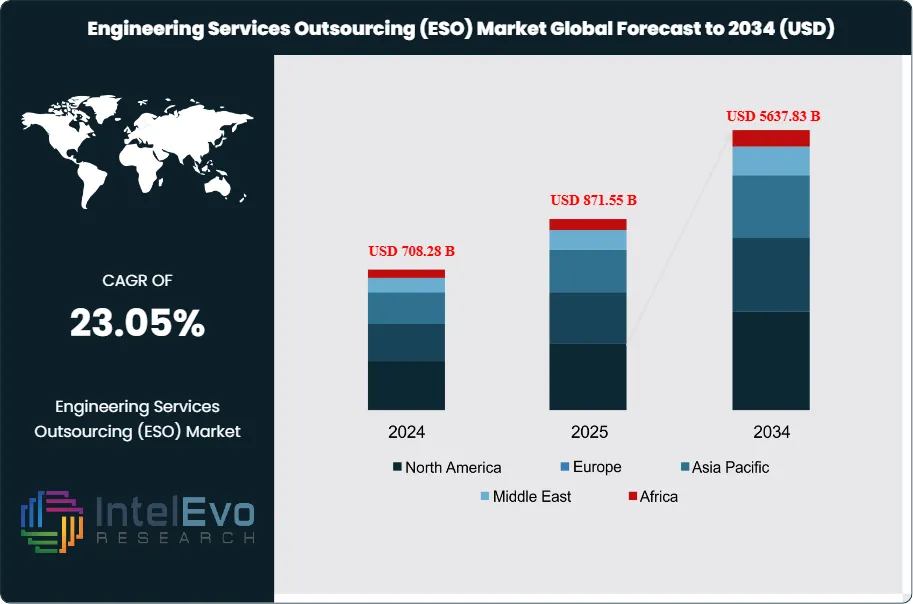

The Engineering Services Outsourcing (ESO) Market size is expected to be worth around USD 5637.83 Billion by 2034, from USD 708.28 Billion in 2024, growing at a CAGR of 23.05% during the forecast period from 2024 to 2034. The Engineering Services Outsourcing (ESO) market refers to the global practice where businesses contract specialized third-party providers to handle various engineering services, from product design and development to testing, prototyping, and system integration. The ESO model allows companies to leverage external expertise and advanced technologies while focusing on their core business activities.

Get More Information about this report -

Request Free Sample ReportThe market is experiencing robust growth, largely propelled by the increasing complexity of engineering projects, mounting cost pressures, and the need for operational efficiency. Many organizations seek ESO to benefit from reduced operational costs, improved scalability, and access to a wider pool of skilled professionals, especially in regions where engineering talent is abundant and comparatively affordable. Additionally, the growing adoption of cutting-edge digital technologies such as artificial intelligence (AI), the Internet of Things (IoT), and Digital Twins is transforming engineering processes. ESO providers, with their investment in innovative tools and specialized expertise, are enabling businesses to harness these advancements without incurring the cost of extensive in-house development.

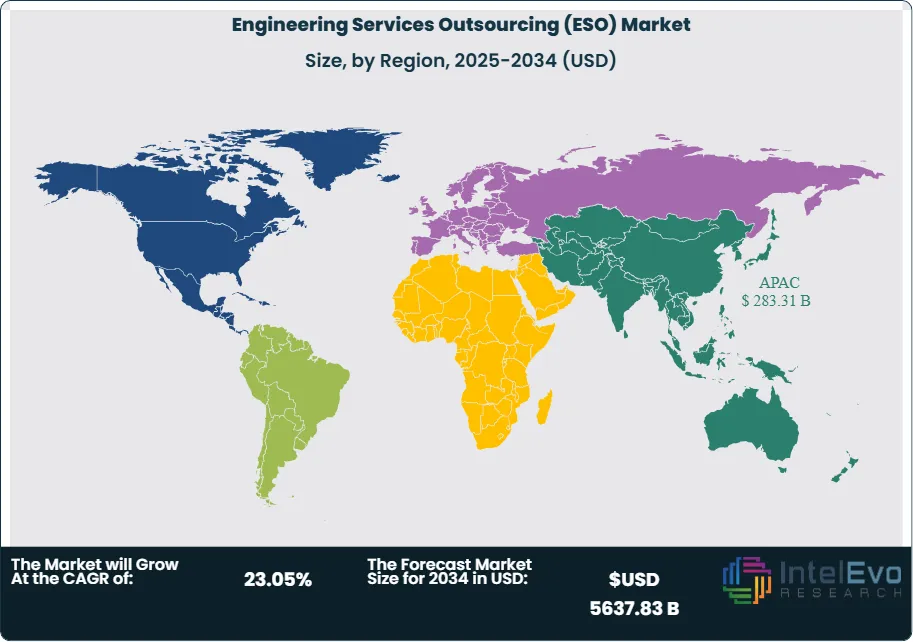

Regionally, Asia Pacific stands out as the leading hub for ESO due to its vast pool of technically skilled engineers, cost efficiencies, and strong educational infrastructure. Countries like India, China, and the Philippines have emerged as prime destinations, underscored by significant investments in digital transformation and support from local governments for science and technology initiatives. Europe follows closely, driven by the need for innovation in sectors such as automotive, aerospace, and renewable energy, alongside favourable regulatory frameworks for digital and sustainable solutions. North America maintains a mature ESO market, supported by advanced technological infrastructure and a high rate of adoption of digital engineering solutions, whereas Latin America and Eastern Europe are growing in prominence, favored for nearshoring advantages by U.S. and European clients.

The COVID-19 pandemic created a complex impact on the ESO market. While it disrupted supply chains and led to project delays in industries such as automotive and heavy manufacturing due to lockdowns and labor shortages, other sectors—particularly healthcare and pharmaceuticals—witnessed increased outsourcing demand to accelerate innovation and the development of medical solutions. The pandemic also reinforced the value of remote work and digital collaboration tools, pushing ESO providers and clients towards more agile and flexible engagement models.

Regional conflicts and the imposition of tariffs, especially between major economies, have brought new challenges to ESO. Tariffs can make outsourcing more expensive, reduce competitiveness for certain provider countries, and disrupt established trade relationships. For example, elevated U.S. tariffs on China and other Asian economies have prompted some companies to explore alternative or nearshoring destinations, such as Mexico or Eastern Europe, that offer tariff-free access and geographic proximity. As a result, outsourcing strategies are increasingly diversified, combining nearshore, offshore, and multi-hub models to maintain resilience while managing cost and risk. Providers in regions with lower tariff exposure, strong quality standards, and stable political climates have gained a relative advantage.

Trade agreements between major countries further shape the dynamics of the ESO market. Agreements promoting digital trade, harmonizing intellectual property regulation, and reducing barriers for cross-border data flows enhance the ease and appeal of outsourcing. For instance, trade deals that minimize tariffs and clarify data protection standards boost confidence for clients partnering with overseas ESO providers. In turn, this streamlined regulatory environment encourages increased investment and collaboration on high-value engineering projects, supporting further global market expansion.

Key Takeaways

- Market Growth: The Engineering Services Outsourcing (ESO) Market is expected to reach USD 5637.83 Billion by 2034, owing to rapid adoption of digital engineering technologies including AI, IoT, and digital twins.

- Service Type Dominance: Designing services lead due to heightened demand for innovation, speed, and complex product development.

- Technology/Component Dominance: Digital engineering and simulation tools are leading, bolstered by AI, IoT, and digital twin integration.

- Distribution/Delivery Model Dominance: On-shore outsourcing leads, driven by data security and alignment.

- End User Dominance: Industrial sector holds the largest share, led by Industry 4.0 transformation and smart manufacturing.

- Drivers: Digital transformation and cost optimization fuel growth through technology-led engineering and operational efficiency.

- Restraints: Data/IP security risks and fragmented vendor landscape hinder trust and service continuity.

- Opportunities: Smart city initiatives and R&D partnerships present room for niche innovation and value creation.

- Trends: Vertical specialization (EVs/semiconductors) and green engineering solutions are shaping competitive strategies.

- Regional Leader: Asia-Pacific leads owing to skilled talent pools, favorable costs, and rapid industrialization. North America, Europe, LATAM show high promise due to technology adoption, sustainability focus, and nearshoring demand.

Service Type Analysis:

Designing services spearhead growth as organizations outsource complex product development to leverage expertise in CAD, CAE, and digital prototyping. This approach accelerates cycle times, enables rapid iteration, and aligns products with digital manufacturing trends. Testing and system integration remain vital—especially as embedded software and IoT complexity rise—yet the creative and technical breadth of design services continues to make it the most sought-after segment.

Technology/Component Analysis:

Digital Engineering/Simulation Leads With over 30% Market Share In Engineering Services Outsourcing (ESO) Market: Digital engineering tools, including simulation, virtual prototyping, and AI-driven optimization, have become critical for boosting productivity and reducing failure rates in product development. Simulation-based validation and aligned digital twins offer real-time, predictive insights, helping organizations preempt errors before physical manufacturing begins. These tools allow for seamless integration of mechanical, electrical, and software disciplines.

Distribution/Delivery Model Analysis:

On-shore services claim leadership due to the heightened need for data security, compliance, and close collaboration on high-value engineering projects. Proximity enables greater agility, real-time feedback, and adherence to regional regulations. While off-shore and near-shore models remain relevant for cost and scalability, high-value, IP-sensitive projects increasingly gravitate towards on-shore execution.

End User Analysis:

The industrial sector dominates, propelled by expedited Industry 4.0 implementations, automation of legacy infrastructure, and demand for scalable, versatile engineering support. Automotive and aerospace leverage ESO for EVs, autonomous systems, and compliance-heavy development, but industrial end users persistently command the single largest share due to the diversity and volume of outsourcing engagements.

Regional Analysis:

Asia-Pacific Leads With more than 40% Market Share In Engineering Services Outsourcing (ESO) Market: The Asia-Pacific region remains the dominant force in the global Engineering Services Outsourcing (ESO) market, driven by its vast reservoir of skilled engineering professionals, cost-efficient service offerings, and rapidly expanding technological infrastructure. Key countries such as India, China, and several Southeast Asian nations continue to make significant investments in engineering education and infrastructure development, positioning themselves as attractive hubs for a growing volume of outsourcing contracts. These nations benefit from a combination of affordable labor costs and increasing expertise, making them preferred destinations for companies seeking scalable and high-quality engineering support.

Meanwhile, Europe and North America are experiencing notable growth in ESO engagements thanks to a shift towards more complex digital engineering projects and collaborative research and development partnerships. These regions place strong emphasis on stringent quality standards, regulatory compliance, and advanced technical requirements, often serving as centers for innovation and strategic oversight. Additionally, emerging markets like Eastern Europe and Latin America are gaining popularity as nearshore alternatives, prized for their industry-specific expertise and cultural or language affinities that facilitate smoother collaboration.

Get More Information about this report -

Request Free Sample ReportMarket Key Segment

Service Type

- Prototyping

- System Integration

- Designing

- Testing

- Others

Technology/Component

- Embedded Systems

- Automation & Robotics

- Digital Engineering/Simulation

- Others

Distribution/Delivery Model

- Off-shore

- Near-shore

- On-shore

End User

- Automotive

- Aerospace & Defense

- Energy & Utilities

- Consumer Electronics

- Semiconductors

- Industrial

- Others

Region:

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 871.55 B |

| Forecast Revenue (2034) | USD 5637.83 B |

| CAGR (2025-2034) | 23.05% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Service Type (Prototyping, System Integration, Designing, Testing, Others) Technology/Component (Embedded Systems, Automation & Robotics, Digital Engineering/Simulation, Others) Distribution/Delivery Model (Off-shore, Near-shore, On-shore) End User (Automotive, Aerospace & Defense , Energy & Utilities, Consumer Electronics, Semiconductors, Industrial, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | HCL Technologies, Tata Consultancy Services (TCS), Alten Group, QuEST Global, Cyient, Capgemini Engineering , L&T Technology Services, Tech Mahindra, Infosys, EPAM Systems, AKKA Technologies/RLE International |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the Engineering Services Outsourcing (ESO) Market?

Engineering Services Outsourcing (ESO) Market to hit $5.6T by 2034! Explore the 23.05% CAGR, key drivers & opportunities shaping this massive industry shift.

Who are the major players in the Engineering Services Outsourcing (ESO) Market?

HCL Technologies, Tata Consultancy Services (TCS), Alten Group, QuEST Global, Cyient, Capgemini Engineering , L&T Technology Services, Tech Mahindra, Infosys, EPAM Systems, AKKA Technologies/RLE International

Which segments covered the Engineering Services Outsourcing (ESO) Market?

Service Type (Prototyping, System Integration, Designing, Testing, Others) Technology/Component (Embedded Systems, Automation & Robotics, Digital Engineering/Simulation, Others) Distribution/Delivery Model (Off-shore, Near-shore, On-shore) End User (Automotive, Aerospace & Defense , Energy & Utilities, Consumer Electronics, Semiconductors, Industrial, Others)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Engineering Services Outsourcing (ESO) Market

Published Date : 02 Aug 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date