Enhanced Oil Recovery (EOR) Market size, Forecast | CAGR 6.5%

Global Enhanced Oil Recovery (EOR) Market Size, Share & Analysis Report by Technology (Thermal EOR – Steam Injection, In-situ Combustion; Chemical EOR – Polymer, Surfactant, Alkaline Flooding; Gas Injection – CO₂, Nitrogen, Hydrocarbon; Hybrid & Emerging – Microbial, Nanotech, Smart Water), Application (Onshore, Offshore), Service Provider (Oilfield Services, IOCs, Tech & Digital Vendors), Region & Key Players – Industry Overview, Dynamics, Trends & Forecast 2025–2034

Report Overview

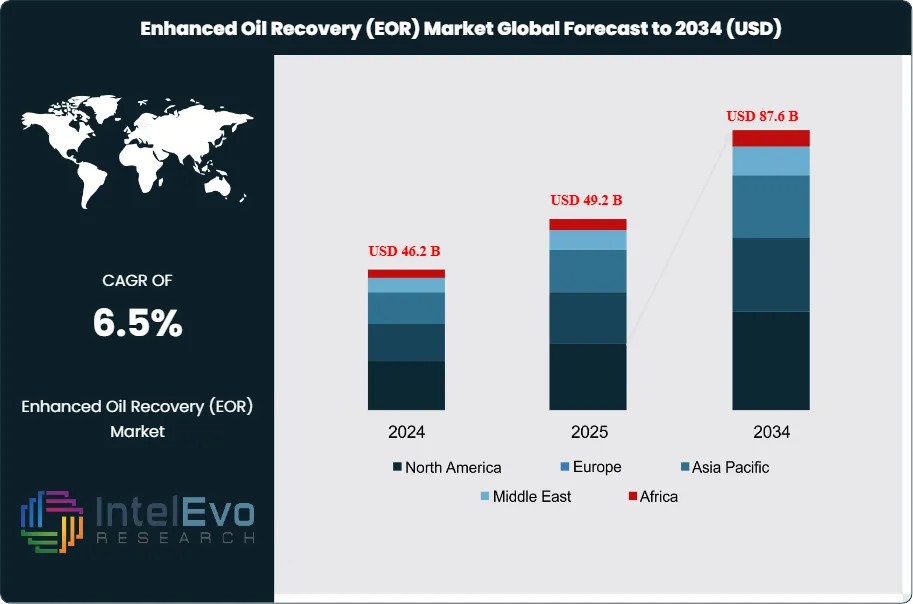

The Enhanced Oil Recovery (EOR) Market size is expected to be worth around USD 87.6 Billion by 2034, up from USD 46.2 Billion in 2024, growing at a CAGR of 6.5% during the forecast period from 2024 to 2034. The enhanced oil recovery market encompasses a broad range of advanced technologies and processes designed to extract additional crude oil from mature and declining oil fields beyond what is possible through primary and secondary recovery methods.

Get More Information about this report -

Request Free Sample ReportEOR techniques—including thermal, chemical, and gas injection methods—are deployed to increase reservoir pressure, alter fluid properties, and improve oil mobility, thereby maximizing hydrocarbon recovery and extending the productive life of oil assets. The EOR market is a critical segment of the global oil and gas industry, supporting energy security, resource optimization, and the economic viability of aging fields.

The EOR market is experiencing robust growth driven by the depletion of conventional oil reserves, the need to maximize output from existing fields, and the rising demand for energy worldwide. Key growth catalysts include technological advancements in EOR processes, the expansion of CO₂-EOR projects, and supportive government policies aimed at increasing domestic oil production and reducing import dependency. The market benefits from ongoing R&D investments, digitalization, and the integration of advanced reservoir modeling, monitoring, and automation technologies.

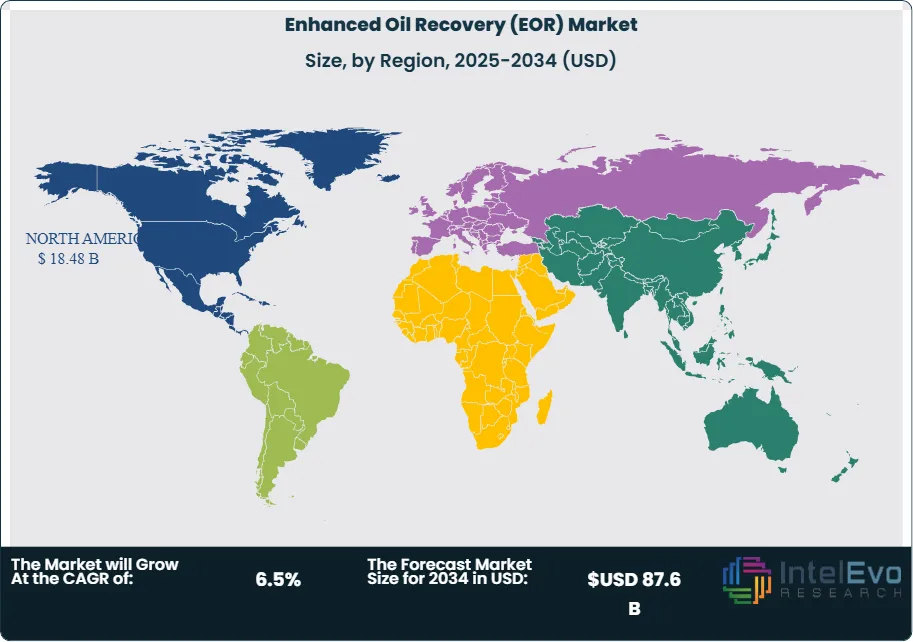

North America dominates the global EOR market, with leadership stemming from a mature oil and gas sector, significant investment in CO₂-EOR, and a strong presence of leading oilfield service providers. The Middle East and Asia-Pacific represent the fastest-growing regional markets, driven by large untapped reserves, government initiatives, and increasing adoption of advanced recovery techniques.

The COVID-19 pandemic temporarily disrupted EOR project timelines and investments due to oil price volatility and operational constraints. However, the market has rebounded as oil prices stabilized, and operators renewed their focus on maximizing recovery, improving efficiency, and reducing the carbon footprint of oil production.

Rising concerns about environmental sustainability, carbon management, and regulatory compliance have significantly influenced the EOR market, creating opportunities for providers to differentiate through low-carbon EOR solutions, CO₂ sequestration, and integration with carbon capture, utilization, and storage (CCUS) projects. The market is also witnessing increased demand for digital EOR, real-time reservoir monitoring, and data-driven optimization.

Key Takeaways

- Market Growth: The Enhanced Oil Recovery Market is expected to reach USD 87.6 Billion by 2034, fueled by the depletion of conventional reserves, technological innovation, and the need to maximize output from mature fields.

- Technology Dominance: Thermal EOR remains the dominant technology, but chemical and gas injection (especially CO₂-EOR) are growing rapidly due to their effectiveness and environmental benefits.

- Application Dominance: Onshore fields account for the majority of EOR projects, but offshore EOR is expanding as operators seek to maximize recovery from deepwater assets.

- Service Provider Dominance: Oilfield service companies and integrated oil & gas majors lead the market, but technology providers and digital solution vendors are capturing share through innovation.

- Driver: Key drivers accelerating growth include the need for energy security, the economic imperative to maximize recovery, and supportive government policies and incentives.

- Restraint: Growth is hindered by high capital and operational costs, technical complexity, and environmental and regulatory challenges.

- Opportunity: The market is poised for expansion due to opportunities like CO₂-EOR, digital EOR, and the integration of EOR with CCUS for low-carbon oil production.

- Trend: Emerging trends including digitalization, real-time monitoring, and the convergence of EOR and carbon management are reshaping the market by enabling new business models and sustainability strategies.

- Regional Analysis: North America leads owing to advanced infrastructure and CO₂-EOR projects. The Middle East and Asia-Pacific show high promise due to large reserves and government support.

Technology Analysis

Thermal EOR Leads, But Chemical and Gas Injection Are Surging: Thermal EOR—including steam injection, cyclic steam stimulation (CSS), and in-situ combustion—remains the cornerstone of the global EOR market. These methods are widely used in heavy oil and bitumen reservoirs, particularly in North America (Canada’s oil sands) and parts of Asia. Thermal EOR increases reservoir temperature, reduces oil viscosity, and improves flow, enabling the recovery of otherwise immobile hydrocarbons.

Chemical EOR (polymer flooding, surfactant flooding, alkaline flooding) is gaining traction, especially in fields with challenging reservoir conditions. Chemical methods improve sweep efficiency, alter interfacial tension, and mobilize trapped oil. Ongoing R&D is focused on developing cost-effective, environmentally friendly chemicals and optimizing injection strategies.

Gas injection EOR—especially CO₂-EOR—is the fastest-growing segment, driven by its dual benefits of enhanced recovery and carbon sequestration. CO₂-EOR is widely adopted in North America and is expanding in the Middle East and Asia-Pacific. Nitrogen and hydrocarbon gas injection are also used in specific reservoir settings.

Hybrid and emerging EOR technologies, such as microbial EOR, nanotechnology, and smart water flooding, are being piloted to address unique reservoir challenges and improve recovery factors.

Application Analysis

Onshore Fields Dominate, Offshore EOR Expands: Onshore oil fields account for the majority of EOR projects, benefiting from easier access, lower operational costs, and a large base of mature reservoirs. North America, China, and the Middle East are leading regions for onshore EOR deployment, with projects ranging from thermal and chemical to CO₂ injection.

Offshore EOR is a growing segment, as operators seek to maximize recovery from deepwater and ultra-deepwater assets. Offshore EOR presents unique technical and economic challenges, including high costs, complex logistics, and harsh environments. However, advances in subsea processing, remote monitoring, and digital twin technologies are enabling the expansion of EOR in offshore settings, particularly in the North Sea, Gulf of Mexico, and Southeast Asia.

Service Provider Analysis

Oilfield Service Companies and Majors Lead, Technology Providers Innovate: Oilfield service companies (Schlumberger, Halliburton, Baker Hughes) and integrated oil & gas majors (ExxonMobil, Shell, Chevron) are the primary providers of EOR solutions, leveraging their expertise, infrastructure, and global reach. These companies offer end-to-end EOR services, including reservoir evaluation, process design, chemical supply, injection operations, and monitoring.

Technology providers and digital solution vendors are capturing market share by offering advanced reservoir modeling, simulation, and real-time monitoring tools. The integration of AI, machine learning, and IoT is enabling data-driven optimization, predictive maintenance, and enhanced decision-making.

Collaboration between operators, service companies, research institutions, and government agencies is increasing, with joint ventures and public-private partnerships focused on technology development, pilot projects, and knowledge sharing.

Region Analysis

North America Leads, Middle East and Asia-Pacific Are Fastest-Growing: North America dominates the global EOR market, accounting for over 40% of market share in 2024. The region benefits from a mature oil and gas sector, extensive CO₂-EOR infrastructure, and supportive government policies. The United States is the global leader in CO₂-EOR, with hundreds of active projects and a well-developed CO₂ supply and transportation network.

The Middle East is the fastest-growing region, driven by large, mature reservoirs, government investment, and the adoption of advanced EOR techniques to sustain production and extend field life. Countries such as Saudi Arabia, Oman, and the UAE are investing in thermal, chemical, and gas injection projects, as well as pilot programs for emerging technologies.

Asia-Pacific is experiencing rapid growth, propelled by rising energy demand, large untapped reserves, and government initiatives to boost domestic production. China, Indonesia, and India are leading markets, with a focus on both onshore and offshore EOR deployment.

Latin America and Africa are emerging markets, with growing interest in EOR to maximize recovery from mature fields and support economic development. Investments in local capacity, technology transfer, and regulatory modernization are unlocking new opportunities.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

Technology

- Thermal EOR (Steam Injection, In-situ Combustion)

- Chemical EOR (Polymer, Surfactant, Alkaline Flooding)

- Gas Injection EOR (CO₂, Nitrogen, Hydrocarbon Gas)

- Hybrid & Emerging EOR (Microbial, Nanotechnology, Smart Water)

Application

- Onshore Fields

- Offshore Fields

Service Provider

- Oilfield Service Companies

- Integrated Oil & Gas Majors

- Technology Providers

- Digital Solution Vendors

Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 49.2 B |

| Forecast Revenue (2034) | USD 87.6 B |

| CAGR (2025-2034) | 6.5% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Technology (Thermal EOR (Steam Injection, In-situ Combustion), Chemical EOR (Polymer, Surfactant, Alkaline Flooding), Gas Injection EOR (CO₂, Nitrogen, Hydrocarbon Gas), Hybrid & Emerging EOR (Microbial, Nanotechnology, Smart Water)), Application (Onshore Fields, Offshore Fields), Service Provider (Oilfield Service Companies, Integrated Oil & Gas Majors, Technology Providers, Digital Solution Vendors) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Chevron Corporation, ExxonMobil Corporation, Royal Dutch Shell Plc, BP Plc, ConocoPhillips, TotalEnergies SE, Occidental Petroleum Corporation, PetroChina Company Limited, Saudi Aramco, CNPC (China National Petroleum Corporation), Statoil ASA (Equinor), Petrobras (Petróleo Brasileiro S.A.), ONGC (Oil and Natural Gas Corporation), Lukoil, Eni S.p.A., Schlumberger Limited, Baker Hughes, Halliburton Company, Weatherford International, Core Laboratories |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Enhanced Oil Recovery (EOR) Market

Published Date : 05 Aug 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date