Enterprise Data Management Market Size | 12.4% CAGR Growth

Global Enterprise Data Management Market Size, Share & Analysis By Component (Software, Services, Professional Services, Managed Services), By Deployment Mode (Cloud-Based, On-Premise), By Enterprise Size (Large Enterprises, Small & Medium Enterprises (SMEs)), By End-Use Industry (IT & Telecommunications, BFSI, Healthcare, Manufacturing, Retail & Consumer Goods, Government, Other End-Use Industries), By Industry Vertical Industry Regions & Key Players – Digital Transformation & Forecast 2025–2034

Report Overview

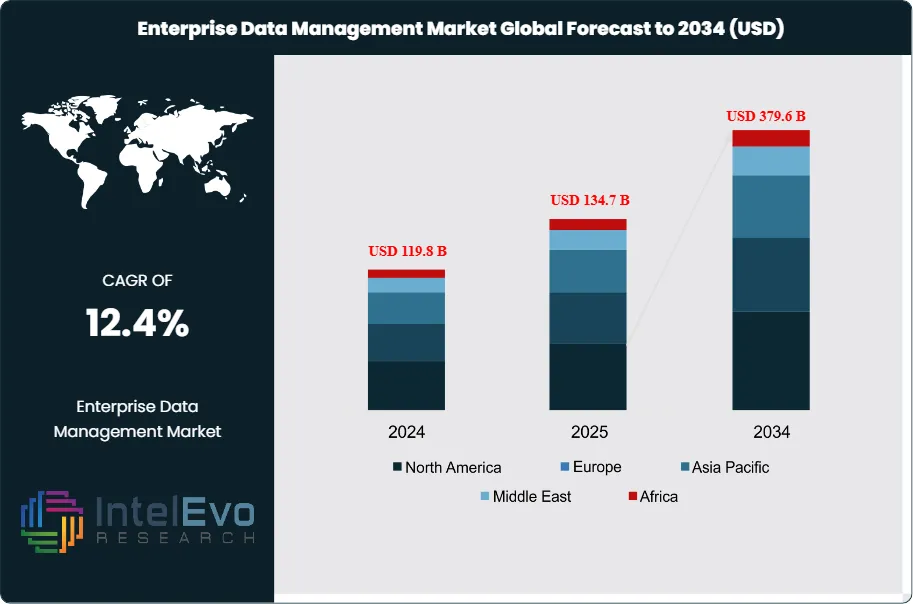

The Enterprise Data Management (EDM) Market is valued at approximately USD 119.8 billion in 2024 and is projected to reach nearly USD 379.6 billion by 2034, expanding at a robust CAGR of about 12.4% from 2025–2034. This surge is fueled by the explosive rise of unstructured and real-time data, rapid cloud migration, and the integration of AI-driven governance and automation tools. As enterprises modernize legacy infrastructures to support analytics, cybersecurity, and regulatory compliance, EDM is increasingly becoming the backbone of digital transformation. With data mesh architectures, autonomous data-quality engines, and hybrid cloud platforms gaining momentum, the market continues trending strongly across global IT, AI, finance, and enterprise-tech ecosystems.

Get More Information about this report -

Request Free Sample ReportThe EDM market has transitioned from a supportive IT function to a core strategic pillar as data emerges as a critical enterprise asset. From a valuation of USD 97.5 billion in 2023, the sector has demonstrated consistent year-over-year growth, reflecting the surge in data volumes, complexity, and strategic relevance. Organizations across industries are increasingly recognizing the competitive advantage of accurate, accessible, and integrated data, driving investments in robust EDM platforms and services.

This momentum is being fueled by several converging factors. The rapid adoption of data-intensive technologies—including artificial intelligence (AI), machine learning (ML), and advanced analytics—has elevated the need for structured, real-time data environments. Moreover, tightening regulatory mandates around data governance, privacy, and compliance (such as GDPR, CCPA, and HIPAA) are compelling enterprises to prioritize data management infrastructure. Simultaneously, the shift toward cloud-based architecture and the rise of hybrid data ecosystems are reshaping how companies manage, store, and secure enterprise information.

Despite the strong growth trajectory, challenges persist. Many organizations continue to struggle with integrating EDM systems into legacy infrastructures, managing fragmented data silos, and maintaining data quality at scale. Additionally, balancing open data access with cybersecurity and compliance remains a critical concern for stakeholders, particularly in regulated industries like healthcare, finance, and government.

On the innovation front, vendors are embedding automation, AI-driven data mapping, metadata management, and self-service data tools into EDM solutions to improve usability and scalability. The push toward “data fabric” and “data mesh” architectures is further enabling decentralized data ownership while preserving enterprise-wide governance, signaling a shift in how businesses conceptualize and operationalize data management.

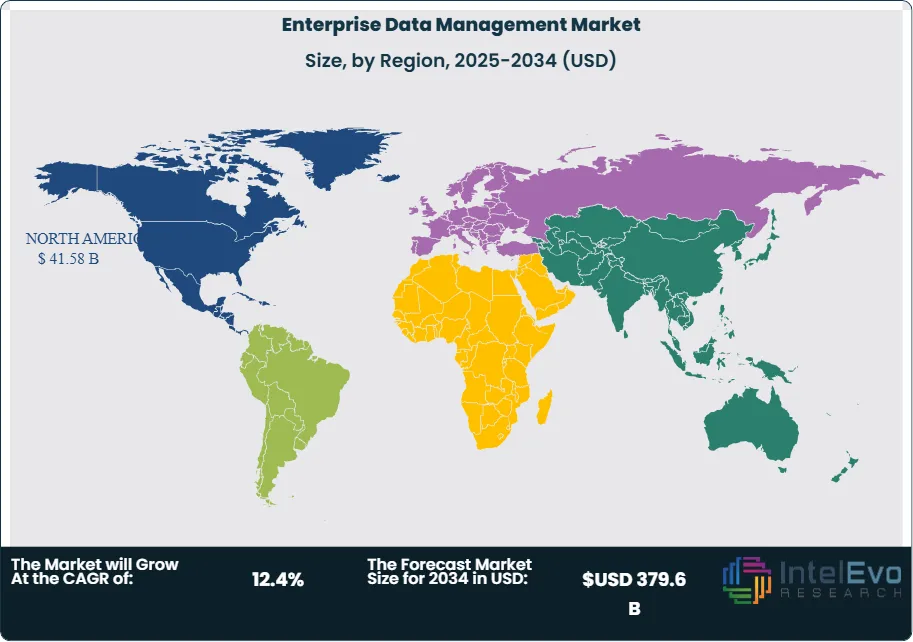

Regionally, North America leads the market due to early technology adoption and stringent compliance standards, while Asia Pacific is rapidly emerging as a high-growth hub, driven by digital transformation across manufacturing, BFSI, and telecom sectors. As data continues to fuel enterprise innovation and strategic planning, EDM is poised to remain a foundational investment across global business landscapes.

Key Takeaways

- Market Growth: The global Enterprise Data Management (EDM) market is projected to grow from USD 119.8 billion in 2024 to USD 379.6 billion by 2034, registering a robust CAGR of 12.4%. Growth is driven by increased regulatory compliance needs, rising volumes of enterprise data, and the proliferation of AI and machine learning technologies.

- By Component: Software solutions dominated the EDM market in 2023, accounting for over 77.9% of total revenue. This is attributed to high demand for integrated data platforms that enable data accuracy, consistency, governance, and real-time accessibility across enterprise systems.

- By Deployment Mode: The cloud-based deployment segment led the market with a 58.4% share in 2023, favored for its scalability, cost efficiency, and faster implementation. Adoption continues to accelerate, particularly among data-driven organizations undergoing digital transformation.

- Driver: Regulatory mandates such as GDPR, HIPAA, and CCPA are compelling enterprises to prioritize data governance and transparency. Simultaneously, the shift toward AI-enabled analytics and predictive decision-making tools is reinforcing the need for robust data infrastructure.

- Restraint: Integration with legacy IT systems remains a critical barrier, often causing delays in implementation and inflating total cost of ownership. Data quality issues and fragmented silos further limit the full potential of EDM deployment, especially in traditional industries.

- Opportunity: Small and Medium Enterprises (SMEs) represent a fast-growing opportunity segment, with adoption of EDM solutions rising due to the availability of cost-effective, cloud-native platforms. Vendors targeting the SME segment stand to benefit from rising data complexity and digital maturity in this sector.

- Trend: The emergence of data fabric and data mesh architectures is reshaping enterprise data strategies, enabling decentralized data ownership with centralized governance. Leading vendors are embedding AI/ML-driven automation into EDM tools to support real-time data discovery and compliance management.

- Regional Analysis: North America remains the largest market, holding over 34.7% share in 2023, driven by early technology adoption and stringent data regulations. Asia Pacific is the fastest-growing region, supported by rapid digitalization, expanding IT infrastructure, and increased investments in data governance across BFSI, telecom, and manufacturing sectors.

Component Analysis

As of 2025, software solutions continue to lead the global Enterprise Data Management (EDM) market, accounting for over 77.9% of total revenue. This dominance reflects the growing need for integrated platforms capable of consolidating, managing, and securing complex data environments across global enterprises. Solutions such as master data management, metadata management, and real-time analytics are increasingly being adopted to support business agility, regulatory compliance, and intelligent decision-making. The push toward digital transformation, particularly in sectors like BFSI, healthcare, and telecommunications, has further reinforced the central role of software in enterprise data strategies.

On the services side, the market is divided into Professional Services and Managed Services, both of which are experiencing steady growth. Professional Services—including consulting, implementation, and system integration—are critical for complex, enterprise-scale deployments where tailored configurations are needed to align EDM frameworks with operational goals. Meanwhile, Managed Services are gaining traction, particularly among SMEs and mid-sized firms seeking cost-effective, scalable solutions. These services offer ongoing system support, performance monitoring, and security oversight, reducing the need for in-house technical resources while ensuring data infrastructure reliability. Together, services and software form a complementary ecosystem driving the holistic adoption of EDM across diverse organizational environments.

Deployment Analysis

Cloud-based EDM solutions have gained considerable momentum, securing a 58.4% share of the market in 2023 and continuing their upward trajectory through 2025. Businesses are increasingly attracted to the scalability, flexibility, and cost-efficiency of cloud platforms, which enable real-time data access, rapid deployment, and seamless integration with other enterprise systems. For organizations prioritizing agility, cloud deployment allows for faster upgrades and more responsive data management environments, a necessity in today’s fast-moving digital economy. As a result, cloud-native EDM platforms are becoming the go-to choice for data-driven companies, particularly in retail, IT, and financial services.

However, on-premise deployment retains relevance—particularly among large enterprises and regulated industries such as finance, defense, and healthcare. These organizations prioritize full control over their data infrastructure, citing security, latency, and compliance as key decision factors. While the on-premise model involves higher upfront investments in infrastructure and personnel, it provides unmatched data sovereignty and customizability. That said, as hybrid models and secure cloud architectures become more sophisticated, the balance is slowly tipping toward the cloud, with many organizations embracing hybrid deployment strategies to meet performance and governance requirements concurrently.

Enterprise Size Analysis

Large enterprises continue to dominate the EDM market, capturing over 69.5% of global revenue in 2023, and maintaining a strong lead through 2025. These organizations generate massive volumes of structured and unstructured data across distributed systems and geographies. For them, enterprise-grade EDM solutions are essential for compliance management, cross-functional analytics, customer intelligence, and risk mitigation. Their scale and financial capacity enable investments in advanced tools like AI-powered data catalogs, automated lineage tracking, and real-time governance platforms. Moreover, the increasing integration of data strategies with broader digital transformation agendas keeps EDM a top-tier priority among Fortune 1000 firms.

Conversely, Small and Medium Enterprises (SMEs) represent a high-growth segment, driven by the democratization of cloud-based EDM tools. As SMEs scale and confront more complex operational data challenges, they are increasingly investing in affordable, modular platforms that offer flexibility without the burden of heavy infrastructure. Vendors targeting this segment are capitalizing on demand by offering simplified pricing models, self-service platforms, and rapid deployment capabilities. With data fast becoming a critical lever for growth, SMEs are closing the capability gap and contributing to the broader market expansion, particularly in emerging economies and digitally maturing industries.

End-Use Analysis

In terms of end-use verticals, the IT & Telecommunications sector led the EDM market with a 27.2% share in 2023, underpinned by its inherent dependence on high-volume, real-time data exchange. In 2025, the sector continues to invest heavily in robust EDM solutions to support next-gen network operations, customer analytics, and service personalization. The explosive growth of IoT, 5G, and cloud-native applications further necessitates sophisticated data governance and integration tools.

The BFSI sector follows closely, where EDM is critical to ensuring data security, regulatory compliance, and personalized financial services. With institutions increasingly shifting to digital platforms and adopting open banking models, high-precision data management is a non-negotiable capability. Similarly, the healthcare industry is expanding its use of EDM tools to manage EHRs, comply with data protection regulations like HIPAA, and support outcomes-based care.

Other sectors, including manufacturing, retail & consumer goods, and government, are ramping up adoption as they pursue operational efficiency, supply chain optimization, and citizen service improvements. Retailers leverage EDM for real-time inventory insights and customer segmentation, while government entities use it for secure, integrated data platforms that support policy planning, public services, and crisis management.

Get More Information about this report -

Request Free Sample ReportRegional Analysis

North America continues to lead the global EDM market, holding over 34.7% share in 2023, with the U.S. accounting for the majority. This dominance is sustained by a mature technology ecosystem, early adoption of cloud and AI, and regulatory frameworks that compel high standards of data governance. Major corporations across IT, finance, and healthcare anchor the region's demand for sophisticated, scalable EDM platforms.

Europe remains a strong contributor, supported by stringent privacy laws such as the General Data Protection Regulation (GDPR). The region's emphasis on data ethics, secure processing, and digital sovereignty has driven enterprises to adopt advanced EDM tools. Countries like Germany, France, and the UK are at the forefront of enterprise data strategy implementation, particularly in manufacturing, automotive, and banking.

The Asia Pacific region is the fastest-growing, fueled by rapid digitization across China, India, and Southeast Asia. A burgeoning SME sector, aggressive cloud adoption, and government-led digital economy initiatives are driving the need for scalable and affordable data management solutions. Meanwhile, Latin America and the Middle East & Africa are witnessing growing awareness of the strategic value of data, with early adoption seen in banking, energy, and public administration. As digital infrastructure in these regions continues to mature, their contributions to the global EDM landscape are expected to accelerate.

Market Key Segments

By Component

- Software

- Services

- Professional Services

- Managed Services

By Deployment Mode

- Cloud-Based

- On-Premise

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By End-Use Industry

- IT & Telecommunications

- BFSI

- Healthcare

- Manufacturing

- Retail & Consumer Goods

- Government

- Other End-Use Industries

By Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 119.8 B |

| Forecast Revenue (2034) | USD 379.6 B |

| CAGR (2024-2034) | 12.4% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Component, Software, Services, Professional Services, Managed Services, By Deployment Mode, Cloud-Based, On-Premise, By Enterprise Size, Large Enterprises, Small & Medium Enterprises (SMEs), By End-Use Industry, IT & Telecommunications, BFSI, Healthcare, Manufacturing, Retail & Consumer Goods, Government, Other End-Use Industries |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Teradata Corporation, Broadcom Inc., Solix Technologies, Inc., Microsoft Corporation, Informatica, Oracle Corporation, Cloudera, Inc., IBM Corporation, LTIMindtree Limited, SAP SE, SAS Institute Inc., Amazon Web Services, Inc., Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Enterprise Data Management Market

Published Date : 05 Dec 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date