Esports Advertising Market Size, Trends & Forecast 2034 | 12.4% CAGR

Global Esports Advertising Market Size, Share, Analysis Report By Type(Sponsorships & Branded Content, In-Stream Ads, Programmatic & Display Ads, Interactive & Shoppable Ads), By Platform(Streaming Platforms, Esports Organizations & Teams, Social Media Channels, In-Game Advertising Networks) and By End-User Industry Region and Key Players-Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends and Forecast 2025-2034

Report Overview

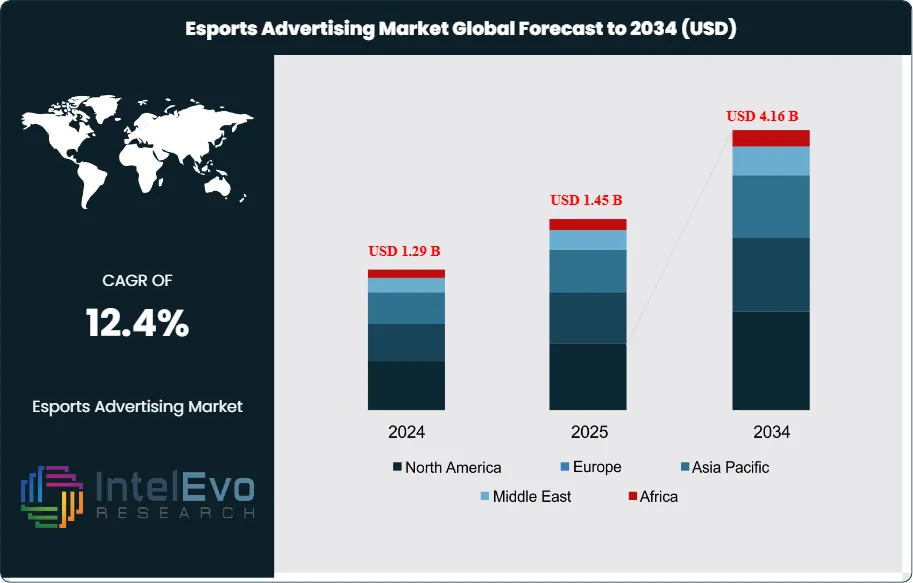

The Esports Advertising Market size is projected to reach approximately USD 4.16 Billion by 2034, up from USD 1.29 Billion in 2024, growing at a CAGR of 12.4% during the forecast period from 2025 to 2034. The market is expanding rapidly as brands increasingly leverage gaming platforms, live-streaming channels, and influencer-driven content to reach highly engaged digital audiences. The rise of in-game advertising, sponsorship deals, and branded tournaments is redefining digital marketing strategies for global brands. As esports continues to bridge entertainment, technology, and youth culture, advertisers are capitalizing on this vibrant ecosystem — making it one of the fastest-growing frontiers in digital media and interactive engagement.

Get More Information about this report -

Request Free Sample ReportAs per Analyst of Wissen Market Research “The Russia-Ukraine war and the COVID-19 pandemic have had notable impacts on the global esports advertising market. The pandemic acted as a major catalyst, accelerating digital adoption and driving record growth in esports viewership as traditional sports and live events were disrupted. Brands shifted ad budgets to digital channels, with esports emerging as a resilient and highly engaging platform for reaching global audiences. Conversely, the Russia-Ukraine conflict introduced new challenges, including the suspension of major tournaments in the region, disruptions to sponsorship deals, and increased regulatory scrutiny on cross-border advertising. Some global brands paused or restructured campaigns in affected markets, while local esports organizations faced operational and financial pressures. Despite these challenges, the overall market has demonstrated resilience, with digital innovation and global expansion offsetting regional disruptions.”

Esports advertising represents a dynamic intersection of digital entertainment, competitive gaming, and brand marketing, fundamentally transforming how companies engage with younger, tech-savvy audiences worldwide. This market encompasses sponsorships, in-stream ads, and influencer partnerships, branded content, and immersive in-game advertising across live tournaments, streaming platforms, and esports organizations. The market’s expansion is driven by the explosive growth of esports viewership, increased investment from non-endemic brands, and the integration of advanced analytics and programmatic ad technologies that enable precise audience targeting and real-time campaign optimization.

The esports advertising ecosystem is rapidly evolving, influenced by technological advancements in live streaming, augmented reality (AR), and interactive ad formats that create highly engaging brand experiences. Market growth is further accelerated by the proliferation of mobile gaming, the rise of influencer-driven content, and the global expansion of esports leagues and tournaments. The increasing comfort of brands with digital-first marketing strategies and the ability to measure ROI through detailed engagement metrics are making esports advertising a core component of modern media plans.

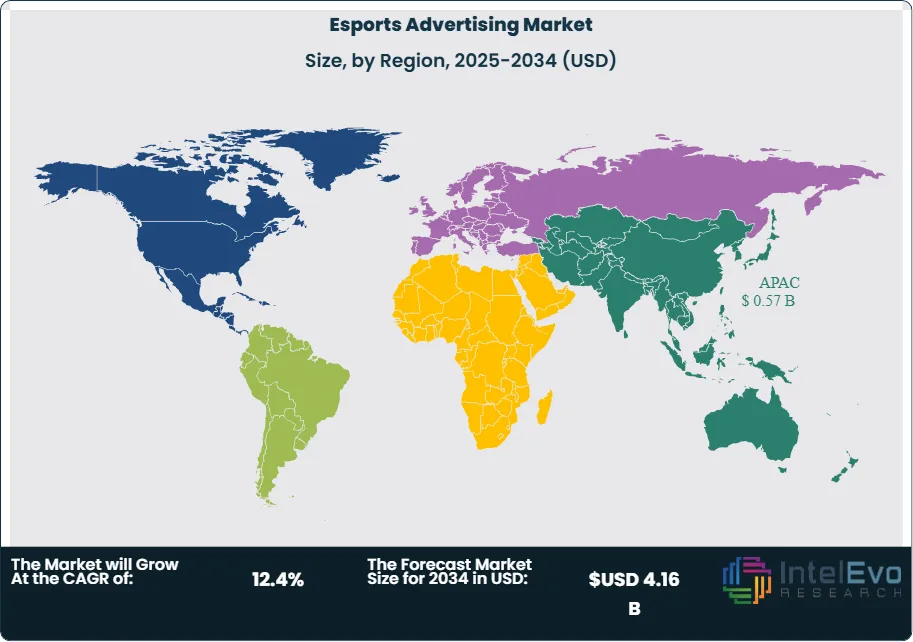

Asia Pacific leads the global esports advertising market, accounting for the largest share due to its massive gaming population, advanced digital infrastructure, and cultural acceptance of esports as mainstream entertainment. China, South Korea, and Southeast Asia are at the forefront, with North America and Europe following closely as esports organizations and media rights deals continue to scale. The market benefits from supportive regulatory frameworks, robust payment systems, and a consumer base that is highly receptive to innovative advertising formats.

Key Takeaways

- Market Growth: The Esports Advertising Market is projected to reach USD 4.16 Billion by 2034, as brands and platforms recognize the compelling ROI of engaging with esports audiences. The convergence of live streaming, influencer marketing, and digital innovation is creating sustained growth momentum across regions and sectors.

- Type Dominance: Sponsorships and branded content dominate the market, accounting for over 55% share in 2024, due to their ability to deliver authentic, high-visibility brand integration within esports events and teams.

- Platform Dominance: Streaming platforms such as Twitch, YouTube Gaming, and Huya hold the largest share, with over 60% of esports ad spend, as they provide direct access to engaged, interactive audiences.

- End-User Industry Dominance: The technology and consumer electronics sector leads end-user adoption, representing 32% of the market in 2024, followed by food & beverage (18%), apparel (15%), and automotive (10%).

- Driver: The surge in esports viewership, the rise of influencer-driven content, and the ability to deliver measurable, targeted campaigns are fueling rapid adoption. Advances in programmatic ad tech and data analytics are enabling more effective and efficient ad placements.

- Restraint: Brand safety concerns, fragmented media rights, and regulatory scrutiny present barriers to seamless campaign execution, especially for global brands navigating diverse markets.

- Opportunity: The emergence of AR/VR advertising, interactive in-game placements, and cross-platform campaigns offers significant opportunities to enhance engagement and expand reach. The growing popularity of mobile esports and regional leagues is unlocking new audiences.

- Trend: Integration of shoppable ads, real-time audience interaction, and gamified brand experiences are redefining how brands connect with esports fans. Partnerships between esports organizations and mainstream brands are accelerating market maturity.

- Regional Analysis: Asia Pacific remains the dominant region, holding 44% market share in 2024, led by China, South Korea, and Southeast Asia. North America follows with 28%, and Europe with 20%. Latin America and the Middle East & Africa are emerging markets with rising esports adoption and digital ad spend.

Type Analysis

Sponsorships and Branded Content have emerged as the cornerstone of the esports advertising market, accounting for the largest share among ad types. Their dominance is rooted in the ability to create deep, authentic connections between brands and esports communities through team partnerships, event sponsorships, and branded tournament content. These formats deliver high visibility and long-term brand association, often integrated into live broadcasts, social media, and influencer channels.

In-Stream and Programmatic Ads are gaining traction, leveraging real-time data and audience targeting to deliver personalized ad experiences during live streams and on-demand content. Interactive ad formats, such as polls, giveaways, and shoppable overlays, are increasingly popular for driving engagement and conversion.

Platform Analysis

Streaming Platforms Lead With Over 60% Market Share in Esports Advertising. Streaming platforms such as Twitch, YouTube Gaming, Huya, and Douyu have become the dominant channels for esports advertising. Their massive user bases, interactive features, and real-time engagement make them ideal environments for immersive brand integration. These platforms enable brands to reach global audiences, leverage influencer partnerships, and measure campaign performance with precision.

The strength of streaming platforms lies in their ability to blend entertainment, community, and commerce. Features like live chat, emotes, and interactive overlays create a participatory environment that enhances ad effectiveness. As esports audiences continue to grow, this segment is expected to see continued investment and innovation.

End-User Industry Analysis

Technology and Consumer Electronics lead end-user adoption, representing 32% of the market in 2024. Brands in this sector leverage esports advertising to showcase new products, drive awareness, and build credibility with digital-native consumers. Food & Beverage (XX%), apparel (XX%), and automotive (XX%) are also significant, using sponsorships and influencer partnerships to reach engaged audiences.

For brands, esports advertising offers an opportunity to access hard-to-reach demographics, particularly Gen Z and Millennials, who are less responsive to traditional media. The combination of live engagement, influencer credibility, and measurable outcomes has made esports a key channel for digital marketing investment.

Region Analysis

Asia Pacific Leads With 44% Market Share in Esports Advertising. Asia Pacific leads the global esports advertising market, commanding the largest market share due to its massive gaming population, advanced digital infrastructure, and cultural acceptance of esports as mainstream entertainment. China dominates this regional leadership through platforms like Huya and Douyu, which have established foundational models for esports advertising now being replicated globally. The region benefits from supportive regulatory frameworks, robust payment systems, and a consumer base that is highly receptive to innovative ad formats.

North America represents the second-largest market, driven by significant investments from major technology companies and established esports organizations. The region shows rapid growth as consumer behavior shifts toward interactive, digital-first entertainment. Europe follows closely, with strong growth in markets like the United Kingdom, Germany, and France, where brands are increasingly recognizing esports’ potential to differentiate their offerings and improve customer engagement.

Emerging markets in Latin America, Africa, and Southeast Asia are expected to see the most significant growth, as mobile-first internet adoption and rising esports participation create ideal conditions for advertising expansion.

Get More Information about this report -

Request Free Sample ReportKey Market Segment:

By Advertising Type

- Sponsorships & Partnerships

- In-Game Advertising

- Video Ads (Pre-Roll, Mid-Roll, Post-Roll)

- Display Advertising

- Influencer & Streamer Collaborations

- Event & Tournament Advertising

- Others (Affiliate & Merchandise Promotions)

By Platform

- PC-Based Esports

- Mobile Esports

- Console Gaming

- Cloud Gaming Platforms

- Cross-Platform Advertising Solutions

By Revenue Model

- Direct Advertising (Brand-Owned Campaigns)

- Programmatic Advertising

- Affiliate Marketing and Sponsorship Revenue

- Subscription and Paid Ad Models

By Platform

- Gaming Publishers and Developers

- Esports Teams and Organizations

- Streaming Platforms (Twitch, YouTube Gaming, Facebook Gaming)

- Brands and Advertisers

- Event Organizers and Sponsors

- Agencies and Media Buyers

By End-User Industry

- Technology & Consumer Electronics

- Food & Beverage

- Apparel

- Automotive

- Financial Services

- Others

By Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 1.45 B |

| Forecast Revenue (2034) | USD 4.16 B |

| CAGR (2025-2034) | 12.4% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Advertising Type (Sponsorships & Partnerships, In-Game Advertising, Video Ads (Pre-Roll, Mid-Roll, Post-Roll), Display Advertising, Influencer & Streamer Collaborations, Event & Tournament Advertising, Others (Affiliate & Merchandise Promotions)), By Platform (PC-Based Esports, Mobile Esports, Console Gaming, Cloud Gaming Platforms, Cross-Platform Advertising Solutions), By Revenue Model (Direct Advertising (Brand-Owned Campaigns), Programmatic Advertising, Affiliate Marketing and Sponsorship Revenue, Subscription and Paid Ad Models), By Platform (Gaming Publishers and Developers, Esports Teams and Organizations, Streaming Platforms (Twitch, YouTube Gaming, Facebook Gaming), Brands and Advertisers, Event Organizers and Sponsors, Agencies and Media Buyers, End-User Industry, Technology & Consumer Electronics , Food & Beverage , Apparel , Automotive , Financial Services, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Tencent Holdings Ltd., Activision Blizzard, Inc., Riot Games, Inc., Electronic Arts Inc., Huya Inc., Douyu International Holdings Ltd., Twitch (Amazon.com, Inc.), YouTube Gaming (Google LLC), ESL Gaming GmbH, FACEIT, NAVI (Natus Vincere), Fnatic Ltd., G2 Esports, Team Liquid, OG Esports |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date