Europe Generative AI in Testing Market Size, Trend | CAGR 34.21%

Europe Generative AI in Testing Market Size, Share, Analysis Report Component (Software, Services), Deployment (Cloud, On-premises, Hybrid), Application (Automated Test Case Generation, Intelligent Test Data Creation, AI-Powered Test Maintenance, Predictive Quality Analytics, Technology, NL-to-Test, Agentic Orchestration, Vision & Model-Based UI Understanding, Retrieval-Augmented Testing, Test-Data Generators), Organization Size (Large Enterprises, SMEs), End Use (IT & Telecom, BFSI, Healthcare & Life Sciences, Retail & eCommerce, Manufacturing & Industrial, Public Sector & Education) Region and Key Players - Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends and Forecast 2025-2034

Report Overview

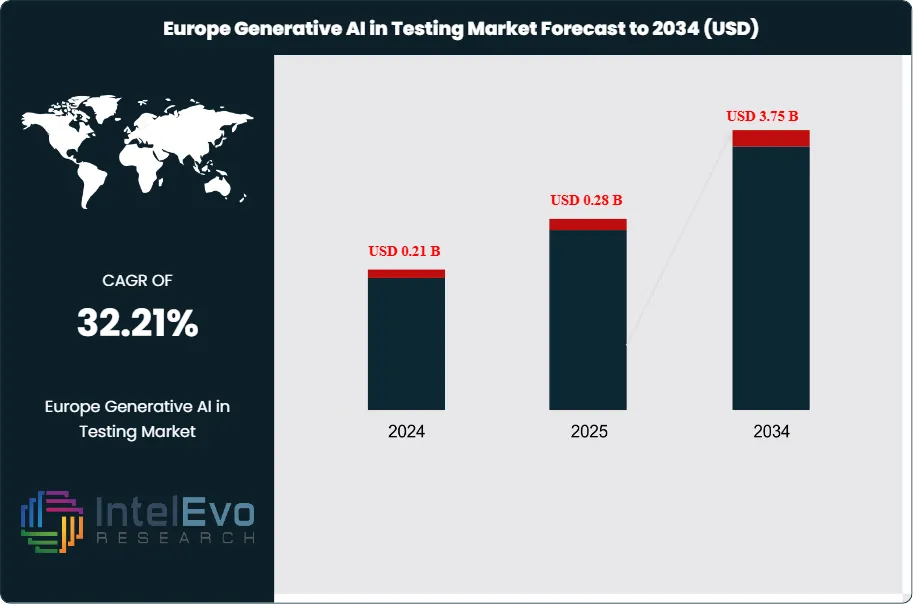

The Europe Generative AI in Testing Market was valued at approximately USD 0.21 billion in 2024 and is projected to reach nearly USD 3.75 billion by 2034, driven by accelerating adoption of AI-powered automation in software quality assurance, DevOps pipelines, and enterprise application testing across the region. Based on the stated growth trajectory, the market size for 2025 is estimated at approximately USD 0.28 billion. From 2025 onward, the market is expected to expand at a compound annual growth rate (CAGR) of approximately 34.21% during 2025–2034, ultimately reaching around USD 3.75 billion by 2034.

Get More Information about this report -

Request Free Sample ReportGrowth in Europe is driven by the focus on data privacy compliance, explainable AI models, and adoption in specific sectors, especially in regulated industries like banking, healthcare, and public administration. In terms of components, software platforms make up about 70.5% of the market in 2024. This demand comes from the need for integrated toolchains that fit well into existing Agile and CI/CD environments. Regarding deployment, cloud delivery holds around 77.9% of the market. This reflects Europe's ongoing shift towards public-cloud and hybrid setups. However, the preference for local data hosting and sovereign cloud arrangements, influenced by GDPR, tempers this transition.

Test-case generation is the leading application segment, accounting for about 28.6% in 2024. Teams increasingly use natural language to create executable test workflows to keep up with fast sprint cycles while lowering manual authoring workloads. Among end-use industries, IT and Telecom make up the largest segment at approximately 32.7%. BFSI and healthcare follow closely due to their strict compliance requirements.

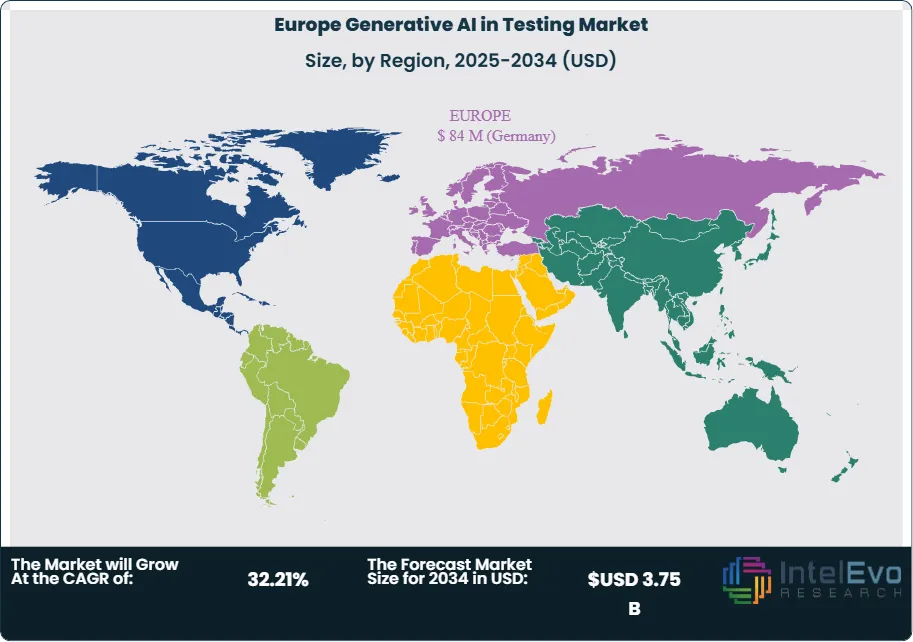

Regional adoption varies. Northern and Western Europe, particularly the UK, Germany, France, and the Nordics, lead in enterprise-grade deployments. They benefit from mature DevOps cultures and significant investment in automation. Southern and Eastern Europe are narrowing the gap through partner-led projects and cloud-first modernization efforts in sectors like manufacturing, retail, and public services.

Within teams, the operating model reflects global changes. Self-healing test flows, synthetic test data with GDPR safeguards, risk-based regression targeting, and audit-ready governance have moved into production from pilot phases. European companies are especially focused on explain ability. They ensure that generated test assets can be traced, validated, and version-controlled for both internal and regulatory review. Hybrid cloud strategies are common. Companies use elastic cloud resources for quick scaling alongside on-premises execution for sensitive data. In terms of end-use, Europe’s highest adoption is in sectors where quality assurance, compliance, and release frequency are critical—finance, healthcare, telecom, and government services. Product innovation is increasingly centered on copilot-assisted authoring, agent-driven orchestration, and policy-as-code governance. This approach ensures that AI-generated outputs meet both technical and legal standards.

Key Takeaways

- Regional Growth: From USD 0.21B (2024) to USD 3.75B (2034), at a 34.21% CAGR, as Generative AI in testing scales across regulated and privacy-conscious sectors.

- Component (Software): ~70.5% share in 2024, showing preference for platform-led solutions integrated into DevOps toolchains.

- Deployment (Cloud): ~77.9% share, with strong momentum for hybrid cloud and sovereign cloud solutions to meet GDPR requirements.

- Application (Test Case Generation): ~28.6% share in 2024, providing the clearest short-term payoff in productivity and coverage.

- End Use (IT & Telecom): ~32.7% share, aligned with high-complexity service environments requiring continuous testing.

- Driver: Privacy-safe synthetic data, explainable AI in testing, and risk-focused regression are accelerating adoption.

- Restraint: Strict data residency, interoperability with legacy systems, and higher compliance audit workloads can slow scaling.

- Opportunity: High-value in BFSI, healthcare, and government sectors that require secure, auditable, and compliant testing flows.

- Trend: Copilot-enabled authoring with governance gates; agentic orchestration spanning UI, API, and data preparation in a single execution pass.

- Region: Northern & Western Europe lead in enterprise adoption; Southern & Eastern Europe accelerate via partner-led rollouts.

Component Analysis

In Europe, the Generative AI in Testing market is primarily driven by software solutions. These solutions hold the largest share because they automate complex testing tasks like generating test cases, maintaining systems, and detecting potential defects. Companies are investing in platforms that work smoothly with existing DevOps pipelines and support tools like Git, Jenkins, and Jira. These platforms are increasingly designed to comply with GDPR and ensure data accuracy, especially in sensitive sectors. Services, though they have a smaller market share, play a crucial role. They cover integration, model fine-tuning, governance frameworks, and training for QA teams. Service providers are also helping to develop hybrid deployment strategies for industries with strict data residency requirements. The combination of strong software platforms and valuable services is speeding up adoption across European markets, particularly in Germany, France, and the UK.

Deployment Analysis

Cloud deployment leads Europe’s Generative AI in Testing market due to its scalability, quick setup, and access to the latest AI model updates without needing heavy investments in infrastructure. Public and hybrid cloud models are favored by tech-driven companies in the UK, Germany, and the Netherlands. These models support cross-border collaboration while ensuring compliance with EU data protection laws. However, on-premises and private cloud deployments remain important in regulated industries like banking, healthcare, and government, where sensitive data must stay within national or company-controlled infrastructure. In countries like France and Switzerland, private cloud adoption is growing due to concerns about cybersecurity and data sovereignty. Many companies are choosing a hybrid approach, using the cloud for AI model training and analytics while conducting critical tests in secure, private settings. This balanced strategy is becoming the main deployment trend across Europe.

Application Analysis

In Europe, test case generation is the top application for Generative AI in Testing. It greatly reduces the time needed to create, run, and maintain test scripts. Organizations in innovative sectors like automotive and aerospace are using AI to simulate complex user scenarios and validate key systems. Self-healing test automation is becoming more popular in industries with frequent user interface changes, such as retail and e-commerce, minimizing disruptions during software updates. Predictive analytics for detecting defects is also increasing, particularly in the BFSI sector, where early identification of issues lowers downtime and financial risk. Synthetic data generation is especially valuable for privacy-sensitive testing under GDPR, allowing safe simulation of real-world data without exposing personal details. Overall, diversifying applications is helping European companies cut costs, improve accuracy, and speed up release cycles while remaining compliant with local regulations.

End-Use Industry Analysis

The IT and telecom sector is the largest user of Generative AI in Testing across Europe, driven by rapid 5G rollouts, digital transformation, and the need for ongoing deployment cycles. BFSI is another major sector, where AI-driven testing ensures strong cybersecurity, compliance with regulations, and continuous customer service. The automotive industry, especially in Germany, France, and Italy, uses generative AI to test embedded software in connected and self-driving vehicles. Healthcare providers and medical device manufacturers are implementing AI testing for clinical software, patient portals, and IoT-enabled devices, ensuring accuracy within strict compliance guidelines. The public sector and education are also starting to adopt these technologies to update digital services and academic platforms. Manufacturing, energy, and retail sectors are experimenting with AI-driven testing for predictive maintenance, supply chain automation, and optimizing e-commerce, respectively. This wide adoption across industries highlights the flexibility and value of generative AI in various European markets.

Regional Analysis

Europe’s Generative AI in Testing market is experiencing strong growth due to digital transformation in many industries and the EU’s push for AI adoption through initiatives like the Artificial Intelligence Act. The UK, Germany, and France are leading in adoption thanks to established IT ecosystems, large budgets, and strong R&D capabilities. Germany’s automotive sector, the UK’s fintech industry, and France’s aerospace and defense programs are significant sources of market demand. Nordic countries are becoming early adopters in public services and telecom infrastructure, using AI to enhance efficiency and security. Meanwhile, Eastern Europe is quickly adopting these technologies in outsourced software development centers, particularly in Poland and Romania. Regulatory factors, such as GDPR compliance and requirements for AI transparency, are influencing deployment models and testing frameworks. Overall, Europe is becoming a key center for innovation, regulation, and diverse applications of AI-powered testing solutions.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

Component

• Software

• Services

Deployment

• Cloud

• On-premises / Private Cloud

• Hybrid

Application

• Automated Test Case Generation

• Intelligent Test Data Creation (Synthetic)

• AI-Powered Test Maintenance (Self-Healing)

• Predictive Quality Analytics

Technology / Approach

• NL-to-Test (Code-LLMs, Copilot-style)

• Agentic Orchestration (multi-step workflows)

• Vision & Model-Based UI Understanding

• Retrieval-Augmented Testing (RAG for requirements/coverage)

• Test-Data Generators (tabular, time-series, anonymization)

Organization Size

• Large Enterprises

• SMEs

End Use

• IT & Telecom

• BFSI

• Healthcare & Life Sciences

• Retail & eCommerce

• Manufacturing & Industrial

• Public Sector & Education

Europe

• Germany

• France

• UK

• Spain

• Italy

| Report Attribute | Details |

| Market size (2025) | USD 0.28 B |

| Forecast Revenue (2034) | USD 3.75 B |

| CAGR (2025-2034) | 32.21% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Component (Software, Services), Deployment (Cloud, On-premises / Private Cloud, Hybrid), Application (Automated Test Case Generation, Intelligent Test Data Creation (Synthetic), AI-Powered Test Maintenance (Self-Healing), Predictive Quality Analytics, Technology / Approach, NL-to-Test (Code-LLMs, Copilot-style), Agentic Orchestration (multi-step workflows), Vision & Model-Based UI Understanding, Retrieval-Augmented Testing (RAG for requirements/coverage), Test-Data Generators (tabular, time-series, anonymization)), Organization Size (Large Enterprises, SMEs), End Use (IT & Telecom, BFSI, Healthcare & Life Sciences, Retail & eCommerce, Manufacturing & Industrial, Public Sector & Education) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Tricentis, Keysight (Eggplant), Applitools, Functionize, Parasoft, SmartBear, Mabl, Katalon, Sauce Labs, BrowserStack, LambdaTest, OpenText (Micro Focus), IBM, Microsoft, TestSigma, Diffblue |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the Europe Generative AI in Testing Market?

Europe Generative AI in Testing market is set to rise from USD 0.21B in 2024 to USD 3.75B by 2034, growing at a CAGR of 34.21%. Explore drivers, trends and opportunities.

Who are the major players in the Europe Generative AI in Testing Market?

Tricentis, Keysight (Eggplant), Applitools, Functionize, Parasoft, SmartBear, Mabl, Katalon, Sauce Labs, BrowserStack, LambdaTest, OpenText (Micro Focus), IBM, Microsoft, TestSigma, Diffblue

Which segments covered the Europe Generative AI in Testing Market?

Component (Software, Services), Deployment (Cloud, On-premises / Private Cloud, Hybrid), Application (Automated Test Case Generation, Intelligent Test Data Creation (Synthetic), AI-Powered Test Maintenance (Self-Healing), Predictive Quality Analytics, Technology / Approach, NL-to-Test (Code-LLMs, Copilot-style), Agentic Orchestration (multi-step workflows), Vision & Model-Based UI Understanding, Retrieval-Augmented Testing (RAG for requirements/coverage), Test-Data Generators (tabular, time-series, anonymization)), Organization Size (Large Enterprises, SMEs), End Use (IT & Telecom, BFSI, Healthcare & Life Sciences, Retail & eCommerce, Manufacturing & Industrial, Public Sector & Education)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Europe Generative AI in Testing Market

Published Date : 20 Aug 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date