Europe Laboratory Furniture Market Size, Share, Drivers | CAGR 7.38%

Europe Laboratory Furniture Market Size, Share, Analysis Report By Product Type (Laboratory Benches & Tables, Storage Cabinets & Shelving, Fume Hoods & Safety Cabinets, Laboratory Stools & Chairs, Accessories), By Application (Medical Laboratories, R&D Centers, Educational Institutions, Industrial Laboratories), By Material (Wood, Stainless Steel, Laminate/Phenolic Resin, Plastic/Polypropylene) Region and Key Players - Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends and Forecast 2025-2034

Report Overview:

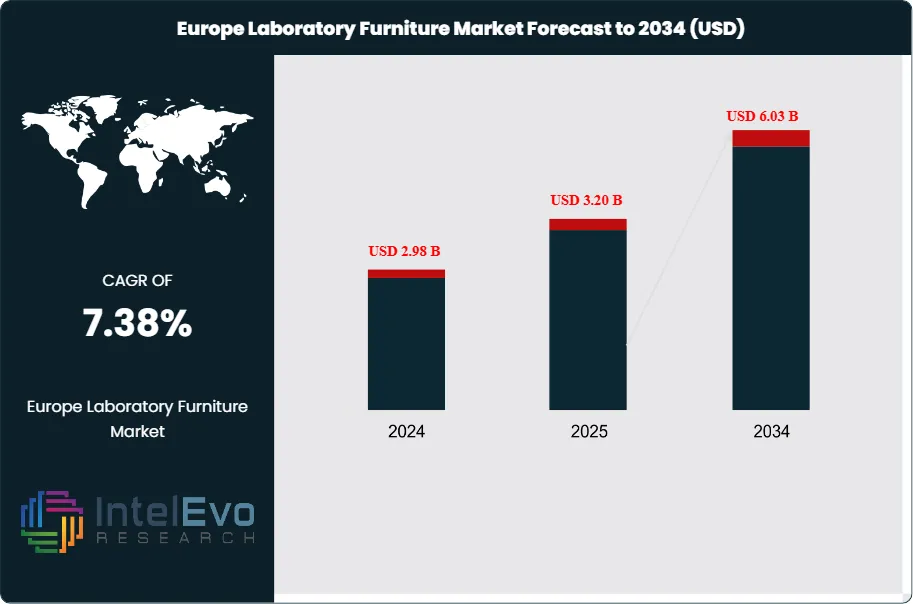

The Europe Laboratory Furniture Market was valued at approximately USD 2.98 billion in 2024 and is projected to reach nearly USD 6.03 billion by 2034, supported by sustained investments in pharmaceutical R&D, biotechnology expansion, and modernization of research and academic laboratory infrastructure across the region. Based on the stated growth trajectory, the market size for 2025 is estimated at approximately USD 3.20 billion. From 2025 onward, the market is expected to expand at a compound annual growth rate (CAGR) of approximately 7.38% during 2025–2034, ultimately reaching around USD 6.03 billion by 2034.

Get More Information about this report -

Request Free Sample ReportThe Europe Laboratory Furniture Market is a well-established and competitive industry. It benefits from a long-standing tradition of scientific excellence, strong healthcare systems, and substantial investments in research and development (R&D). The market places a high priority on quality, ergonomics, and meeting strict national and European Union (EU) regulations. Europe serves as a global center for pharmaceutical, biotechnology, and academic research, which creates ongoing demand for advanced, durable, and high-tech laboratory furniture.

The European market holds a significant share of the global laboratory furniture market, ranking second after North America. The market is expected to grow steadily, fueled by new laboratory construction projects and the need to renovate and modernize existing facilities. The rise of modular furniture systems and smart lab technologies is a notable trend, reflecting a regional interest in flexible and efficient workspaces that can meet changing research needs.

Key Takeaways

- Market Growth: The Europe Laboratory Furniture Market is expected to maintain a healthy growth trajectory, fueled by consistent investments in scientific research, healthcare, and education.

- Application Dominance: Medical laboratories and R&D centers are the leading application segments, with strong demand from the pharmaceutical and biotechnology industries.

- Product Trends: A shift towards modular and flexible furniture systems, along with a high demand for safety-critical products like fume hoods, is a defining trend.

- Material Trends: The market is driven by a preference for high-quality, durable materials such as stainless steel and phenolic resin, which are compliant with strict safety and hygiene standards.

- Driver: High levels of R&D funding, a well-established pharmaceutical sector, and stringent safety and environmental regulations are major growth catalysts.

- Restraint: The high initial cost of specialized, custom-built furniture and the complexities of navigating diverse national and EU regulations can be challenging.

- Opportunity: The increasing focus on cleanroom applications, smart lab technology integration, and sustainable "green lab" initiatives offers significant growth opportunities.

- Trend: The market is moving towards ergonomic, user-centric designs and the adoption of technologically integrated furniture to improve efficiency and safety.

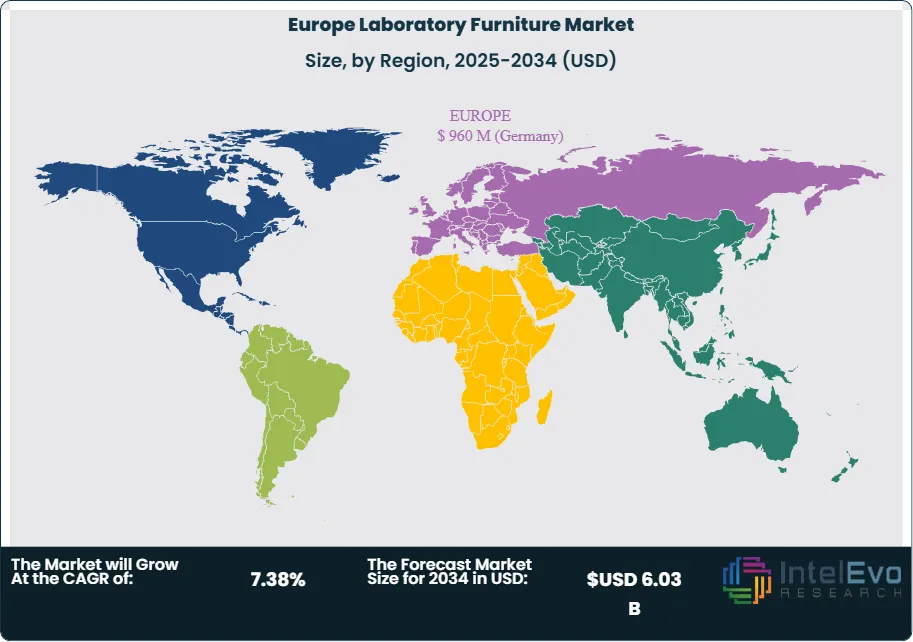

- Regional Analysis: Germany is a dominant market, known for its high-quality manufacturing, while other key countries like France, the UK, and Italy also contribute significantly to market expansion.

Product Type Analysis:

The fume hoods and safety cabinets segment is a key growth area in the European market. The strict regulations, including Good Manufacturing Practice (GMP) and Good Laboratory Practice (GLP) standards, make using certified safety equipment essential for any lab handling hazardous materials. This creates a steady demand for these products. Additionally, the need for more flexibility in research spaces is driving the use of modular laboratory benches and tables, which can be easily reconfigured and make better use of space.

Material Analysis:

Europe's laboratory furniture market shows a clear preference for high-quality, durable materials. Stainless steel is a crucial material, especially in pharmaceutical and clinical labs, because its non-porous surface is easy to clean and resistant to chemical corrosion. Phenolic resin is also common for countertops, appreciated for its durability and performance under tough lab conditions. The market is increasingly leaning towards sustainable materials and eco-friendly manufacturing processes to align with the EU's goals for a circular economy.

Application Analysis:

The analysis of laboratory furniture applications in Europe reveals a strong and established market, with clearly defined segments. Medical laboratories and the broader pharmaceutical R&D sector are the main applications, supported by a long history of innovation in pharmaceuticals and a solid healthcare system. The strict regulations and quality standards, like GMP and GLP, make certified, high-quality furniture essential for these applications, ensuring ongoing demand for specialized products like fume hoods and cleanroom furniture. Educational institutions, especially universities and research institutes, are another significant application, as they continuously work to modernize and expand their scientific research and teaching facilities. The trend toward interdisciplinary research also increases the need for modular and adaptable furniture in these academic settings. Furthermore, industrial laboratories in areas such as automotive, chemicals, and food science continue to represent a stable market for specialized lab furniture.

Regional Analysis:

Germany holds a leading position in the European laboratory furniture market, known for its manufacturing quality and technological innovation. The country’s strong pharmaceutical and chemical industries, along with substantial funding for academic research, make it a primary market. Other important markets include the UK, notable for its vibrant life sciences sector, and France and Italy, which host significant research and industrial bases. The Nordic countries are emerging as key players due to their focus on sustainability and high-tech R&D.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

By Product Type

- Laboratory Benches & Tables

- Storage Cabinets & Shelving

- Fume Hoods & Safety Cabinets

- Laboratory Stools & Chairs

- Accessories

By Application

- Medical Laboratories

- Research & Development (R&D) Centers

- Educational Institutions

- Industrial Laboratories

By Material

- Wood

- Stainless Steel

- Laminate/Phenolic Resin

- Plastic/Polypropylene

By Region

- Germany

- France

- UK

- Spain

- Italy

| Report Attribute | Details |

| Market size (2025) | USD 3.20 B |

| Forecast Revenue (2034) | USD 6.03 B |

| CAGR (2025-2034) | 7.38% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Product Type (Laboratory Benches & Tables, Storage Cabinets & Shelving, Fume Hoods & Safety Cabinets, Laboratory Stools & Chairs, Accessories), By Application (Medical Laboratories, Research & Development (R&D) Centers, Educational Institutions, Industrial Laboratories), By Material (Wood, Stainless Steel, Laminate/Phenolic Resin, Plastic/Polypropylene) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Kewaunee Scientific Corp., Waldner, Thermo Fisher Scientific, Labconco, Asecos gmbh, Aakar Scientific Pvt. Ltd. (India-based), Esco Group (Singapore-based), Yamato Scientific Co., Ltd. (Japan-based), Kewaunee Scientific Corp., Mott Manufacturing, Hemco Corporation, Diversified Woodcrafts, NuAire, Lab Furniture Manufacturers Middle East LLC, PSA Laboratory Furniture, LabGuard India Pvt. Ltd., LOC Scientific, Modular Lab Systems FZE, Asec Solutions, Artech Lab Furniture, Lab Tech Middle East, Intech Laboratory Solutions, TMI Systems Design Corporation |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the Europe Laboratory Furniture Market?

Europe laboratory furniture market is projected to grow from USD 2.98B in 2024 to USD 6.03B by 2034, at a CAGR of 7.38%. Explore drivers, trends, & growth opportunities.

Who are the major players in the Europe Laboratory Furniture Market?

Kewaunee Scientific Corp., Waldner, Thermo Fisher Scientific, Labconco, Asecos gmbh, Aakar Scientific Pvt. Ltd. (India-based), Esco Group (Singapore-based), Yamato Scientific Co., Ltd. (Japan-based), Kewaunee Scientific Corp., Mott Manufacturing, Hemco Corporation, Diversified Woodcrafts, NuAire, Lab Furniture Manufacturers Middle East LLC, PSA Laboratory Furniture, LabGuard India Pvt. Ltd., LOC Scientific, Modular Lab Systems FZE, Asec Solutions, Artech Lab Furniture, Lab Tech Middle East, Intech Laboratory Solutions, TMI Systems Design Corporation

Which segments covered the Europe Laboratory Furniture Market?

By Product Type (Laboratory Benches & Tables, Storage Cabinets & Shelving, Fume Hoods & Safety Cabinets, Laboratory Stools & Chairs, Accessories), By Application (Medical Laboratories, Research & Development (R&D) Centers, Educational Institutions, Industrial Laboratories), By Material (Wood, Stainless Steel, Laminate/Phenolic Resin, Plastic/Polypropylene)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Europe Laboratory Furniture Market

Published Date : 15 Aug 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date