Europe Liquid Sugar Market Size, Share & Growth Forecast | 3.7% CAGR

Europe Liquid Sugar Market Size, Share & Analysis By Product Type (Liquid Sucrose, Fructose Syrup, Glucose Syrup, Inverted Sugar Syrup, Mixed Syrups), By Form (Organic, Conventional), By Source (Sugarcane, Sugar Beet, Others), By Application (Dairy, Beverages, Bakery, Confectionary, Ice Cream, Confiture & Fruit Spreads), By Distribution Channel, By Country Industry Overview, Pricing Trends, Regulatory Impact & Forecast 2025–2034

Report Overview

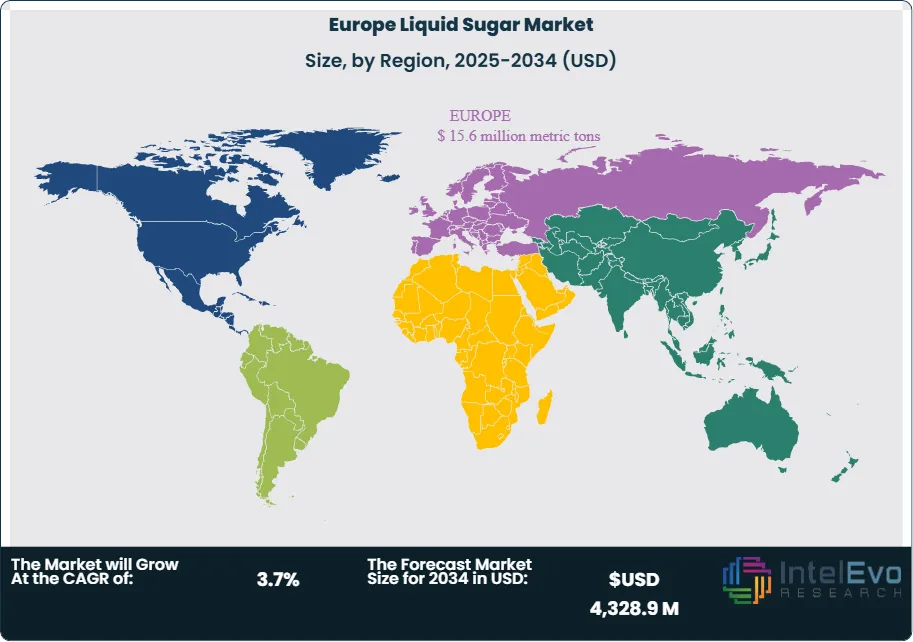

The Europe Liquid Sugar Market is projected to grow from USD 2,984.7 Million in 2024 to approximately USD 4,328.9 Million by 2034, expanding at a CAGR of around 3.7% during 2025–2034. Growing demand from the food & beverage industry, particularly in bakery, dairy, and confectionery products, is driving steady market expansion in Europe. The shift toward ready-to-drink beverages and flavored syrups is further increasing consumption across retail and commercial channels. Rising adoption of standardized, high-quality liquid sweeteners in industrial food processing is shaping long-term growth opportunities. This trajectory underscores the critical role liquid sugar plays in the food and beverage industry, particularly within Europe’s highly developed processed food sector.

-Size-by-Region.png.png)

Liquid sugar, a concentrated syrup created by dissolving sucrose, glucose, or fructose in water, has become indispensable across diverse applications including beverages, bakery, confectionery, and dairy. Its key advantage lies in offering consistent sweetness, superior solubility, and enhanced product stability, making it an essential ingredient for large-scale food and beverage manufacturing. Among end-use sectors, the beverage industry represents the largest demand driver, where liquid sugar is integral to the production of soft drinks, flavored waters, juices, and ready-to-drink products.

The market’s growth is also being propelled by rising consumer demand for convenience foods amid fast-paced lifestyles across Europe. This has led to an increased reliance on processed and packaged products, in which liquid sugar is widely utilized for flavor consistency and extended shelf life. At the same time, a shift toward natural and organic ingredients is driving innovation, with manufacturers introducing reduced-calorie and organic liquid sugar variants to address the health-conscious consumer segment.

Europe’s strong production capacity further reinforces market stability. According to the USDA, the region’s sugar production for 2023/24 is estimated at 15.6 million metric tons, ensuring supply security while sustaining Europe’s position as a global leader in sugar markets. Concurrently, policy frameworks such as the EU Renewable Energy Directive II (RED II) and initiatives under the Circular Bio-based Europe Joint Undertaking (CBE JU) are encouraging bio-based innovation and sustainability practices, creating indirect growth opportunities for sugar-derived solutions including biofuels.

Despite increasing public scrutiny on sugar consumption due to health concerns, demand remains resilient, with studies highlighting an average soft drink intake of 43 grams per day across the region. This balance of strong consumption patterns, substantial production, and regulatory emphasis on sustainability positions the European liquid sugar market for measured but durable growth. For stakeholders, the years ahead will demand strategic investments in product innovation, compliance, and sustainable sourcing to capture growth opportunities in an evolving regulatory and consumer landscape.

Key Takeaways

- Market Growth: The Europe liquid sugar market was valued at USD 2,984.7 Million in 2024 and is projected to reach USD 4,328.9 Million by 2034, growing at a CAGR of 3.7% between 2025–2034, driven by high demand from the beverage sector and the rising consumption of processed foods.

- Product Type: Liquid sucrose remains the dominant product category, holding 33.4% of the market, due to its versatility and widespread use across beverages, bakery, and confectionery applications.

- Form Preference: Conventional liquid sugar accounted for 83.4% of total sales, reflecting its cost efficiency and established supply chain presence compared to organic alternatives, which are still emerging.

- Source: Sugarcane-derived liquid sugar leads with a 53.2% share, supported by stable agricultural output and competitive production costs across key European suppliers.

- Application: The beverage industry is the largest consumer segment, representing 34.5% of total demand, as liquid sugar is indispensable in the production of soft drinks, juices, and flavored water.

- Distribution Channel: Direct sales captured 60% of the market, highlighting the importance of bulk procurement by large-scale food and beverage manufacturers.

- Driver: Increasing demand for convenience foods and ready-to-drink beverages is accelerating the adoption of liquid sugar across multiple product categories.

- Restraint: Growing consumer concerns over sugar intake and tightening EU health regulations may constrain long-term growth by encouraging reduced-sugar formulations.

- Opportunity: Rising interest in organic and reduced-calorie liquid sugars presents a key growth opportunity, particularly among health-conscious and premium product consumers.

- Trend: The market is witnessing a shift toward sustainable and bio-based sugar solutions, aligned with EU renewable energy and bioeconomy initiatives, creating avenues for innovation in sugar-derived products.

- Regional Analysis: Western Europe remains the largest market due to high consumption of beverages and processed foods, while Eastern Europe and APAC imports represent emerging demand hubs supported by lifestyle changes and urbanization.

Product Type

As of 2025, liquid sucrose continues to represent the largest product category in Europe’s liquid sugar market, accounting for approximately 33.4% of total consumption. Its dominance stems from its versatility across food and beverage applications, where it delivers sweetness without altering product texture or stability. This makes it the go-to choice for manufacturers of soft drinks, baked goods, and dairy products.

Glucose syrup, holding nearly 26.1% of the market, ranks as the second most utilized product type. Its ability to prevent crystallization and improve mouthfeel has made it particularly valuable in confectionery, bakery, and beverage formulations. Fructose syrup, with a market share of 20.5%, benefits from its higher relative sweetness, making it popular in reduced-calorie and specialty diet products. Meanwhile, inverted sugar syrup and mixed syrups—at 11.6% and 8.4% respectively—serve niche applications where solubility, moisture retention, or specific flavor outcomes are critical.

The product mix demonstrates how liquid sugar types are strategically selected based on functional benefits, from enhancing shelf life to supporting dietary trends such as low-calorie offerings.

Form

The market remains heavily weighted toward conventional liquid sugar, which accounts for nearly 83.4% of sales in 2025. Its wide availability, competitive pricing, and robust supply chains make it indispensable for large-scale manufacturers. Food and beverage processors rely on it for bulk formulations where consistency, cost efficiency, and reliability outweigh premium considerations.

By contrast, organic liquid sugar, though holding only 16.6% share, is expanding rapidly as consumer awareness of health and sustainability grows. Driven by EU-certified farming standards and labeling regulations, organic options have gained traction in premium bakery, beverages, and artisanal products. Consumers are increasingly willing to pay a premium for organic alternatives perceived as healthier and more environmentally responsible.

This division highlights the dual nature of the market: mass-scale industrial demand favoring conventional sugars, alongside a fast-emerging niche of eco-conscious and health-driven buyers.

Source

Sugarcane continues to dominate as the primary raw material, contributing 53.2% of Europe’s liquid sugar production in 2025. Its efficiency in terms of sugar yield per hectare and well-established refining infrastructure underpin its market leadership.

Sugar beet, which represents 39.6% of production, plays an equally strategic role, particularly in colder northern and central European countries such as Germany, France, and Poland. Supported by EU agricultural policy frameworks, sugar beet has become integral to Europe’s food security and domestic supply.

The remaining 7.2% comprises alternative sources, including coconut, date sugar, and corn-based syrups. These niche categories are increasingly sought after in gourmet and specialty health markets, reflecting consumer experimentation with non-traditional sweeteners.

Application

The beverage sector leads all applications, capturing 34.5% of liquid sugar demand in 2025. Its solubility, stability, and ability to blend seamlessly make it indispensable in carbonated drinks, juices, alcoholic beverages, and flavored waters.

Bakery (22.3%) and confectionery (18.2%) follow closely, where liquid sugar plays a functional role in moisture retention, texture enhancement, and crystallization control—key to product quality and shelf life. Dairy and ice cream applications (15.6%) benefit from its flavoring and consistency, while confiture and fruit spreads (9.4%) rely on liquid sugar for improved preservation and flavor intensity.

This broad application spectrum demonstrates liquid sugar’s versatility as both a sweetener and a functional ingredient across Europe’s processed food industries.

Distribution Channel

Direct sales dominate distribution, making up nearly 60% of the European market in 2025. Large-scale processors and beverage producers favor this channel for bulk purchases, customized formulations, and supply reliability.

Retail sales, at 40%, remain critical for smaller businesses, artisanal producers, and households. Growth in this channel is being driven by specialty food outlets, e-commerce platforms, and demand for premium or organic liquid sugars. Online channels, in particular, have expanded the reach of niche suppliers catering to consumers experimenting with gourmet cooking and health-focused alternatives.

Region

Europe exhibits a diverse regional landscape for liquid sugar. Western Europe leads overall consumption due to high beverage demand, well-established food processing industries, and significant sugar beet cultivation. Eastern Europe is emerging as a growing market, supported by rising incomes and increasing adoption of packaged and processed foods.

The region’s strong production base—estimated at 15.6 million metric tons of sugar for 2023/24—not only sustains domestic demand but also supports Europe’s role as a significant player in global sugar trade.

Get More Information about this report -

Request Free Sample ReportKey Market Segments

By Product Type

- Liquid Sucrose

- Fructose Syrup

- Glucose Syrup

- Inverted Sugar Syrup

- Mixed Syrups

By Form

- Organic

- Conventional

By Source

- Sugarcane

- Sugar Beet

- Others

By Application

- Dairy

- Beverages

- Bakery

- Confectionary

- Ice Cream

- Confiture & Fruit Spreads

By Distribution Channel

- Direct Sales

- Retail Sales

Key Regions

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

| Report Attribute | Details |

| Market size (2024) | USD 2,984.7 M |

| Forecast Revenue (2034) | USD 4,328.9 M |

| CAGR (2024-2034) | 3.7% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Product Type (Liquid Sucrose, Fructose Syrup, Glucose Syrup, Inverted Sugar Syrup, Mixed Syrups), By Form (Organic, Conventional), By Source (Sugarcane, Sugar Beet, Others), By Application (Dairy, Beverages, Bakery, Confectionary, Ice Cream, Confiture & Fruit Spreads), By Distribution Channel (Direct Sales, Retail Sales) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Archer Daniels Midland Company, Associated British Foods Plc, Boettger Gruppe, Cargill Incorporated, Cristal Union, Galam Group, Kent Foods Limited, Louis Dreyfus Company B.V., Nordzucker AG, Roquette Frères, Sedamyl Group, Sucroliq S.A.P.I DE C.V., Südzucker AG, Nordzucker AG, Sugar Australia Company Ltd, Synova, Tereos, Toyo Sugar Refining Co. Ltd, Zukan S.L.U. |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the Europe Liquid Sugar Market?

The Europe Liquid Sugar Market is expected to grow from USD 2,984.7 Million in 2024 to USD 4,328.9 Million by 2034, at a CAGR of 3.7%. Rising demand from bakery, beverages, dairy, and confectionery sectors is driving steady adoption of standardized liquid sweeteners across industrial and commercial applications.

Who are the major players in the Europe Liquid Sugar Market?

Archer Daniels Midland Company, Associated British Foods Plc, Boettger Gruppe, Cargill Incorporated, Cristal Union, Galam Group, Kent Foods Limited, Louis Dreyfus Company B.V., Nordzucker AG, Roquette Frères, Sedamyl Group, Sucroliq S.A.P.I DE C.V., Südzucker AG, Nordzucker AG, Sugar Australia Company Ltd, Synova, Tereos, Toyo Sugar Refining Co. Ltd, Zukan S.L.U.

Which segments covered the Europe Liquid Sugar Market?

By Product Type (Liquid Sucrose, Fructose Syrup, Glucose Syrup, Inverted Sugar Syrup, Mixed Syrups), By Form (Organic, Conventional), By Source (Sugarcane, Sugar Beet, Others), By Application (Dairy, Beverages, Bakery, Confectionary, Ice Cream, Confiture & Fruit Spreads), By Distribution Channel (Direct Sales, Retail Sales)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date