Facial Injectables Market Size 2024–2034 Growth & Trends | 12.9% CAGR

Global Facial Injectable Market Size, Share & Analysis Product (Collagen & PMMA Microspheres, Hyaluronic Acid (HA), Botulinum Toxin Type A, Calcium Hydroxylapatite (CaHA), Poly-L-Lactic Acid (PLLA), Other Products), Application (Facial Line Correction, Lip Augmentation, Face Lift, Acne Scar Treatment, Lipoatrophy Treatment, Other Applications), End-use (MedSpa, Dermatology Clinics, Hospitals) Industry Regulations, Aesthetic Trends, Competitive Landscape & Forecast 2025–2034

Report Overview

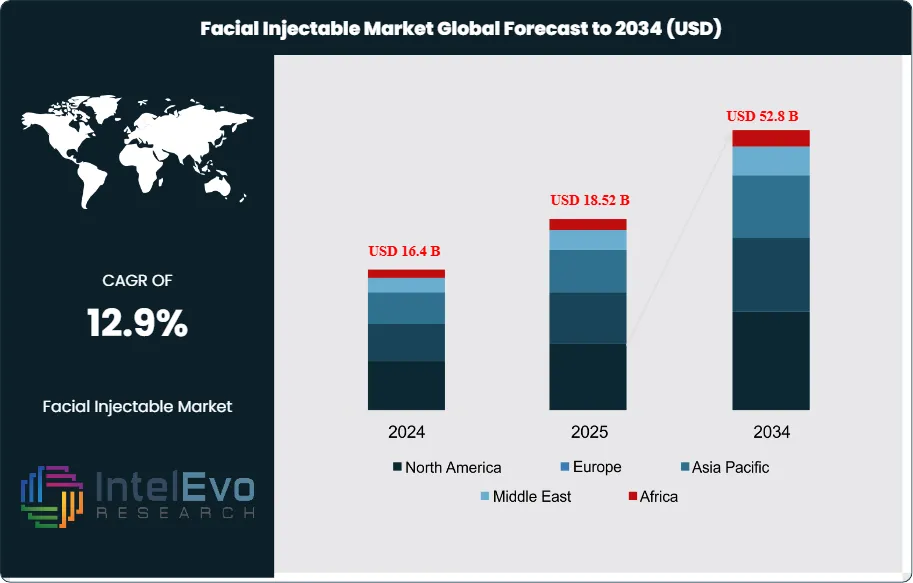

The Facial Injectables Market is valued at approximately USD 16.4 Billion in 2024 and is projected to reach nearly USD 52.8 Billion by 2034, expanding at an estimated CAGR of around 12.9% during 2025–2034. Rising adoption of minimally invasive aesthetic procedures, social-media–driven beauty trends, and the expansion of medical spas are accelerating global demand. Advancements in hyaluronic acid fillers, long-lasting neurotoxins, and collagen stimulators are reshaping treatment preferences worldwide. The next decade will mark a strong growth era as younger demographics and men increasingly enter the aesthetic treatment segment.

Get More Information about this report -

Request Free Sample ReportMarket expansion has accelerated over the past five years as minimally invasive aesthetics gain mainstream acceptance and procedure accessibility improves. Non-surgical aesthetic interventions have roughly tripled since 2012, and pandemic-era telepresence catalyzed a sustained “Zoom Boom,” keeping procedure volumes in double-digit growth through the recovery period. Category mix remains favorable: botulinum toxin accounts for an estimated 45–50% of total procedure counts, while hyaluronic acid (HA) fillers represent about 60% of filler revenues; newer biostimulators (e.g., CaHA, PLLA) are the fastest-growing subsegment, expanding at 12–14% annually from a smaller base. Core applications span nasolabial folds, lips, periorbital lines, cheek contouring, and rejuvenation of acne- or age-related atrophy, with product innovation extending duration of effect from 6–18 months depending on indication and formulation.

Demand-side drivers include rising disposable incomes, social-media influence on beauty norms, and growing male participation (now ~15% of volumes), alongside consumer preference for quick, low-downtime treatments. On the supply side, advances in cross-linking chemistry, lidocaine-containing formulations, microcannula techniques, and longer-acting neuromodulators are lifting outcomes and patient satisfaction scores. Digitalization is reshaping the care pathway: AI-enabled facial analysis, 3D imaging for treatment planning, teleconsults, and practice-management automation are compressing consult-to-treatment cycles and improving clinic throughput by an estimated 10–15%. Key headwinds include adverse-event risk requiring skilled injectors, tightening regulatory scrutiny (e.g., EU MDR post-market surveillance), counterfeit and gray-market product circulation, and macro-sensitivity given the discretionary nature of spend. Pricing competition in fragmented med-spa channels also pressures margins, partly offset by premiumization and combination protocols (toxin + filler + biostimulator).

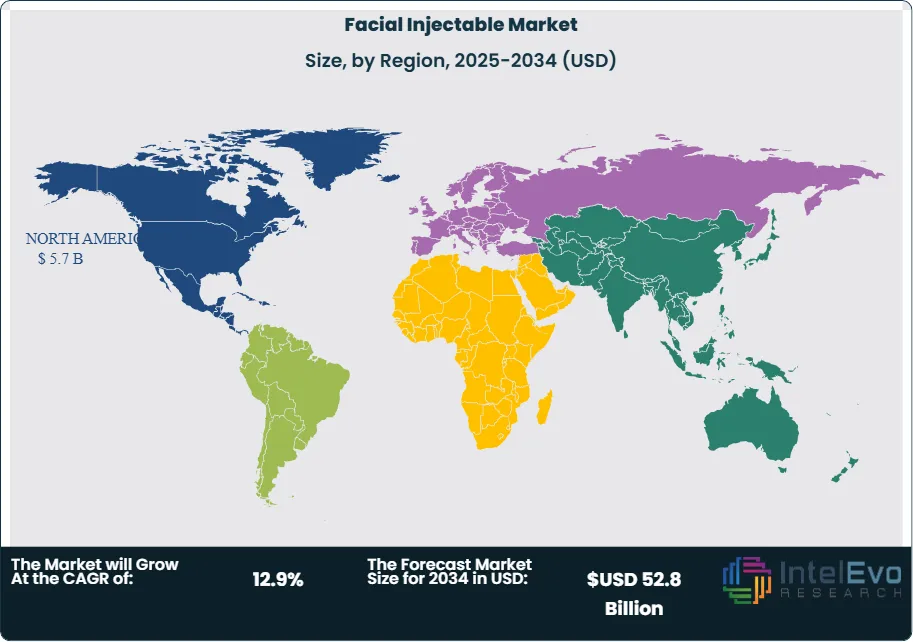

Regionally, North America leads with ~35% of global revenue on dense clinic networks and high spend per capita, while Western Europe contributes ~30% with strong adoption in the UK, Germany, and France. Asia-Pacific is the growth engine, projected at 13–15% CAGR, led by China and South Korea and underpinned by medical tourism in Thailand and Australia. Emerging hotspots include the GCC (UAE, Saudi Arabia), Brazil and Mexico in Latin America, and Tier-1/2 Indian metros. Investment opportunities are most compelling in premium HA portfolios, longer-duration toxins, biostimulators, AI-driven consultation tools, injector training ecosystems, and scaled clinic roll-ups with rigorous compliance and supply-chain controls.

Key Takeaways

- Market Growth: The global Facial Injectables market was USD 16.4 Billion in 2024 and is projected to reach USD 52.8 Billion by 2034 (12.9% CAGR), propelled by mainstreaming of minimally invasive aesthetics, social-media/telepresence effects, and expanding med-spa capacity. High procedure repeatability (often 2–3 sessions per patient annually) underpins resilient, subscription-like revenue.

- Product Type: Botulinum Toxin Type A led with 48.2% of 2024 revenue, supported by broad indications for dynamic lines and a 3–4-month retreatment cycle that drives adherence; category anchors include Allergan Aesthetics (Botox), Ipsen (Dysport), and Evolus (Jeuveau).

- Application: Facial line correction represented 34.2% of revenue in 2024, reflecting strong demand for rapid, low-downtime correction of glabellar/periorbital lines and routine maintenance protocols that bundle toxin with HA fillers.

- Driver: Non-surgical cosmetic procedures continue to outpace surgical options as consumers favor less downtime and reversibility; procedure volumes have roughly tripled since 2012, while awareness campaigns and financing options broaden access across age and gender cohorts.

- Restraint: Safety and regulatory requirements elevate operating costs and slow product cycles—serious adverse events are rare (<0.1%) but training/insurance and post-market surveillance can lift clinic cost bases by ~5–10% and delay launches by multiple quarters, particularly under EU MDR.

- Opportunity: Asia–Pacific is the growth engine, forecast to compound at ~13–15% through 2034 and potentially exceed USD 11–12 billion, led by China and South Korea and supported by medical tourism. Biostimulators (CaHA, PLLA) offer premium pricing and longer duration, expanding at an estimated 12–14% CAGR from a low base.

- Trend: Longer-duration neuromodulators (e.g., Revance’s Daxxify) extend median effect toward ~6 months versus 3–4 months for legacy toxins, raising ASPs and improving patient satisfaction. Concurrently, AI-enabled facial analysis, 3D imaging, and automated practice management are lifting conversion and clinic throughput by ~10–15%.

- Regional Analysis: North America led in 2024 with 40.5% share (USD 5.7 billion), supported by high per-capita spend and dense injector networks; Western Europe remains sizable but slower-growing. Asia–Pacific is the fastest-growing region (low-teens CAGR), while the GCC and select Latin American markets emerge as investment hotspots on rising aesthetic tourism and expanding private clinics.

Product Analysis

Botulinum Toxin Type A remains the revenue anchor in 2025, sustaining the leadership position it held with 48.2% share in 2024. Its dominance is underwritten by broad indications for dynamic lines, predictable outcomes, and high retreatment frequency (typically every 3–4 months). Innovation is shifting the mix toward longer-acting formulations—such as six-month neuromodulators—which support premium pricing and higher lifetime value per patient as adherence improves post-pandemic.

Hyaluronic Acid (HA) continues to expand at a robust pace (often ~7–9% CAGR through 2034) given its safety profile, reversibility with hyaluronidase, and versatility across lip, mid-face, and periorbital indications. HA accounts for the majority of filler procedures and roughly ~60% of filler revenues in many mature markets, with newer, highly cross-linked gels offering improved longevity and rheology for contouring. Biostimulators—CaHA and PLLA—are accelerating from a smaller base, benefiting from demand for collagen neogenesis and 12–24-month durability; double-digit growth is common where practitioner training and patient education are strong. Collagen and PMMA microspheres remain niche for select cases requiring longer persistence, while “Other Products” (e.g., combination fillers with lidocaine) focus on patient comfort and injector efficiency.

Application Analysis

Facial line correction is the largest use case and retained the leading revenue share at 34.2% in 2024, a position it is expected to maintain through the late 2020s. Sustained demand stems from immediate, visible outcomes in glabellar, forehead, and periorbital lines, with combination protocols (toxin plus HA) lifting average spend per visit and lengthening maintenance cycles.

Beyond lines, lip augmentation and mid-face volumization are gaining as younger cohorts seek subtle enhancement and symmetry, while acne-scar revision and lipoatrophy treatment expand the market’s reconstructive adjacency. Adjunct “liquid facelift” approaches that blend neuromodulators, HA, and biostimulators are improving contour and skin quality, supported by 3D imaging and AI-guided treatment planning that sharpen dosing and improve reproducibility. Collectively, these applications diversify revenue and reduce reliance on a single indication, stabilizing clinic throughput.

End-Use Analysis

MedSpas constitute the most dynamic commercial channel in 2025, capturing an estimated near-half of procedure volumes in developed markets as retail locations scale membership models, financing, and targeted marketing. Standardized protocols, bundled packages, and extended hours drive higher utilization, while digital scheduling and CRM tools compress consult-to-treatment intervals.

Dermatology clinics remain critical for complex cases, adverse-event management, and technique leadership, typically commanding higher average selling prices due to specialist skill and premium product mixes. Hospitals account for a smaller share, focused on reconstructive indications and peri-operative aesthetics; however, they play a pivotal role in training, clinical trials, and compliance, particularly under stricter post-market surveillance regimes. Across settings, operating efficiency is improving via microcannula techniques, ultrasound-guided injections, and inventory controls that lower wastage and improve margins.

Regional Analysis

North America continues to set the revenue pace, representing 40.5% of global sales in 2024 (USD 5.7 billion) and benefiting in 2025 from high per-capita spend, dense injector networks, and rapid diffusion of longer-duration neuromodulators. Repeat utilization among the 35–64 cohort, strong loyalty programs, and aggressive direct-to-consumer campaigns sustain resilience even amid macro volatility.

Asia Pacific is the fastest-growing region into 2034, led by China and South Korea and supported by medical tourism hubs in Thailand and Australia; India is on track for the highest country-level CAGR as urban middle-class consumers expand. Europe remains sizable with steady adoption in the UK, Germany, and France, though regulatory stringency can lengthen launch timelines. Latin America (Brazil, Mexico) and the Middle East & Africa (UAE, Saudi Arabia) are emerging hotspots where clinic chains, aesthetic tourism, and rising disposable incomes are unlocking double-digit growth, positioning these regions to contribute a disproportionate share of incremental global demand over the forecast horizon.

Get More Information about this report -

Request Free Sample ReportMarket Segments

Product

- Collagen & PMMA Microspheres

- Hyaluronic Acid (HA)

- Botulinum Toxin Type A

- Calcium Hydroxylapatite (CaHA)

- Poly-L-Lactic Acid (PLLA)

- Other Products

Application

- Facial Line Correction

- Lip Augmentation

- Face Lift

- Acne Scar Treatment

- Lipoatrophy Treatment

- Other Applications

End-use

- MedSpa

- Dermatology Clinics

- Hospitals

By Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 16.4 Billion |

| Forecast Revenue (2034) | USD 52.8 Billion |

| CAGR (2024-2034) | 12.9% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Product (Collagen & PMMA Microspheres, Hyaluronic Acid (HA), Botulinum Toxin Type A, Calcium Hydroxylapatite (CaHA), Poly-L-Lactic Acid (PLLA), Other Products), Application (Facial Line Correction, Lip Augmentation, Face Lift, Acne Scar Treatment, Lipoatrophy Treatment, Other Applications), End-use (MedSpa, Dermatology Clinics, Hospitals) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Allergan Aesthetics (AbbVie Inc.), Galderma S.A., Merz Pharmaceuticals GmbH, Revance Therapeutics, Inc., Ipsen Pharma, Sinclair Pharma, Prollenium Medical Technologies Inc., Suneva Medical, Inc., Teoxane Laboratories, HUONS Co., Ltd., Medytox Inc., Bloomage BioTechnology, Laboratoires Vivacy, BioPlus Co., Ltd., Croma-Pharma GmbH |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date