Facility Management Market Size | Growth Outlook & 11.2% CAGR

Global Facility Management Market Size, Share & Analysis By Type (Outsourced, In-house), By Service (Hard Service, Soft Service, Management Service), By Application (Education, Commercial, Transportation, Industrial, Government & Public, Healthcare, Retail, Others), By Deployment Industry Outlook, Smart Building Trends & Forecast 2025–2034

Report Overview

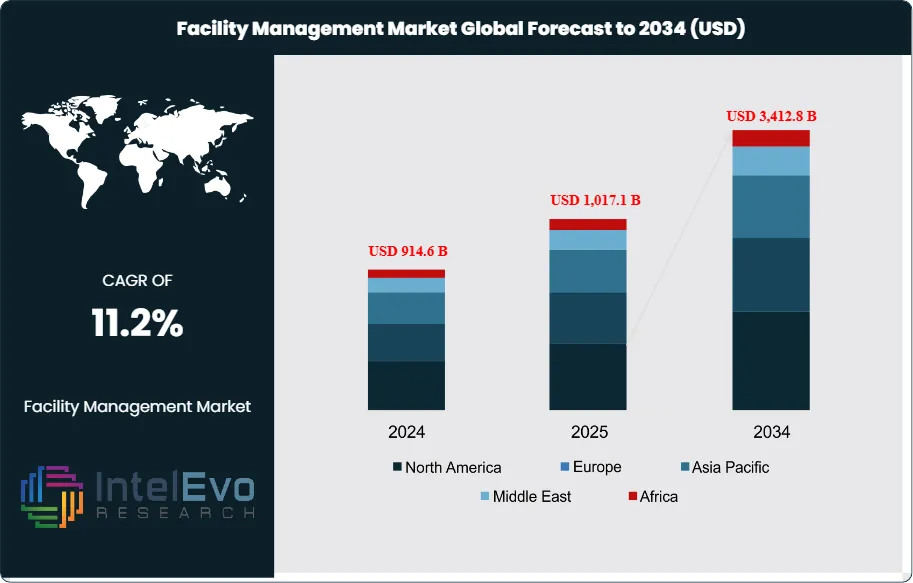

The Facility Management Market is valued at approximately USD 914.6 billion in 2024 and is projected to reach nearly USD 3,412.8 billion by 2034, expanding at a strong CAGR of about 11.2% from 2025–2034. Growth is being driven by rapid urbanization, digital building modernization, and rising demand for integrated services across commercial, industrial, and public infrastructure. As organizations prioritize energy efficiency, ESG compliance, and smart-building automation, FM solutions enabled by IoT, AI-driven maintenance, and real-time asset monitoring are gaining fast adoption. With global enterprises shifting toward outsourced facility operations and predictive management models, the sector continues trending across real estate, infrastructure, and workplace-transformation platforms.

Get More Information about this report -

Request Free Sample ReportThis strong upward trajectory underscores the market’s critical role in enabling operational efficiency, sustainability, and value creation across both public and private infrastructure ecosystems.

Historically, the facility management sector has evolved from basic maintenance and custodial services into a strategic function that integrates property strategy, space planning, compliance, energy management, and digital transformation. Asia-Pacific led the global market in 2023, commanding over 32.6% of total revenue with an estimated USD 211.5 billion, driven by rapid urbanization, infrastructure expansion, and increasing demand for integrated facility solutions across commercial and industrial spaces.

Key growth drivers include a heightened corporate focus on cost optimization and sustainability, prompting organizations to adopt facility management services that reduce energy usage, ensure regulatory compliance, and enhance occupant well-being. Technological innovation is a transformative force in the sector, with smart building systems, IoT integration, and AI-powered analytics streamlining operations and enabling predictive maintenance. For instance, smart sensors are reported to reduce energy costs by up to 20%, while data analytics tools can boost workforce productivity by a similar margin.

Despite significant growth prospects, challenges persist. These include rising labor costs, uneven technology adoption, and underutilization of facility management software—80% of users reportedly fail to leverage their platforms’ full capabilities. Moreover, 44.1% of managers cite work order tracking as time-consuming, pointing to the need for more automated, user-friendly systems.

Investor interest is rising, particularly in digital-first service providers and emerging markets where industrial growth and urban sprawl fuel demand. The recent debt funding secured by SmartCheck in April 2024 underscores the sector’s investment potential, particularly in AI-driven SaaS solutions. Regionally, Asia-Pacific remains a high-growth hotspot, while North America and Europe continue advancing in technology integration and sustainability metrics.

Looking forward, automation, augmented reality, and cloud-based platforms are expected to redefine service delivery, with 27.4% of facility managers aiming to automate repetitive tasks and 26% of manufacturing sites already leveraging AR tools. As facility management becomes increasingly data-centric, the sector is poised for a transformative decade marked by digital efficiency and scalable service models.

Key Takeaways

- Market Growth: The global Facility Management Control System (FMCS) market is projected to expand from USD 914.6 billion in 2024 to USD 3,412.8 billion by 2034, registering a robust CAGR of 11.2%. Growth is fueled by increasing demand for operational efficiency, sustainability mandates, and the integration of smart technologies in building management.

- Service Delivery Model: The Outsourced segment accounted for over 70% of total market share in 2023, driven by the need for cost optimization and access to specialized expertise across large-scale commercial and industrial facilities.

- Service Type: Hard Services, which include HVAC, electrical, and plumbing systems, led the FMCS market in 2023 with more than 40% market share, owing to the critical role these systems play in infrastructure functionality and compliance.

- End Use Industry: The Commercial sector emerged as the dominant end user, capturing over 32% of global revenue in 2023. Growth in commercial real estate, particularly in urban centers, and increasing reliance on smart building systems contributed to this leadership.

- Driver: The shift toward smart and sustainable buildings is accelerating FMCS adoption. Smart sensors and automated control systems can reduce energy costs by up to 20%, while improving operational productivity by a similar margin, according to recent industry data.

- Restraint: Despite the growth potential, technology underutilization remains a key barrier. Approximately 80% of users do not fully leverage the capabilities of their facility management software, limiting ROI and operational efficiency gains.

- Opportunity: Emerging economies in Asia-Pacific, Latin America, and the Middle East offer high-growth potential, with urbanization, industrial development, and infrastructure investment creating demand for advanced FMCS. The Asia-Pacific region alone generated USD 211.5 billion in revenue in 2023, leading the global market.

- Trend: There is a rapid uptick in the integration of AI, IoT, and augmented reality into FMCS platforms. As of 2024, 26% of manufacturing facilities have implemented AR tools, while 27.4% of managers are leveraging automation for repetitive task management, highlighting the sector’s digital transformation.

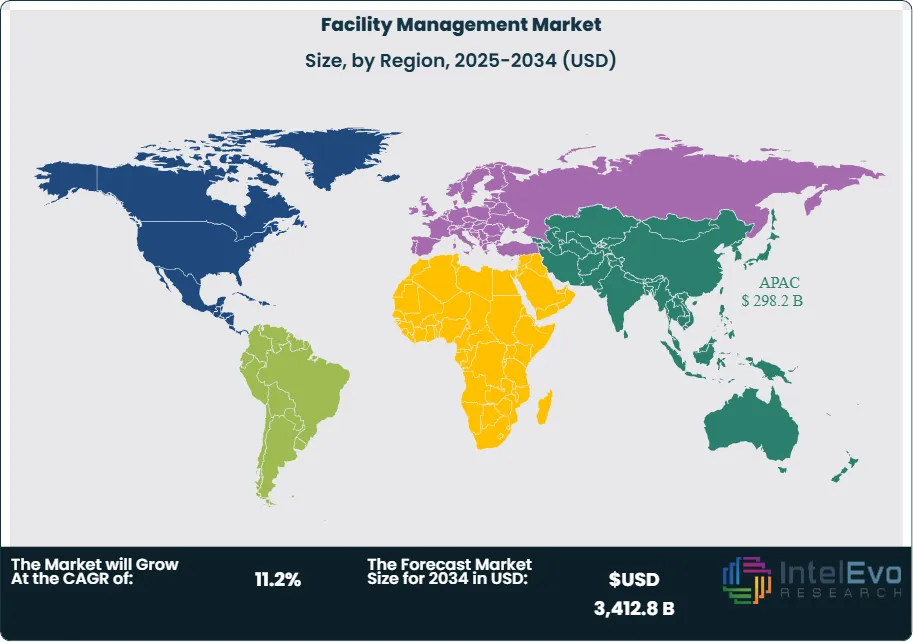

- Regional Analysis: Asia-Pacific led the market in 2023 with a 32.6% global share, followed by North America and Europe, where technology adoption and sustainability compliance are driving FMCS demand. Emerging regions like the Middle East and Africa are also poised for double-digit CAGR growth through 2033.

Type Analysis

As of 2025, the outsourced segment continues to dominate the global facility management market, accounting for over 70% of total market share. This strong preference for outsourcing is driven by organizations’ growing need to streamline operations and concentrate on core competencies. By delegating non-core functions such as maintenance, cleaning, and building operations to specialized service providers, businesses can reduce overhead and enhance strategic focus. This model has proven particularly attractive in complex environments like healthcare, commercial real estate, and education, where operational continuity and compliance are critical.

Cost-efficiency remains a central factor fueling this segment’s dominance. Outsourcing eliminates the need for capital investment in hiring, training, and maintaining in-house teams, while also enabling access to advanced technologies and best-in-class expertise. Service providers are increasingly deploying IoT-enabled devices, AI-driven diagnostics, and smart building systems to deliver predictive maintenance and data-backed performance management. This tech-driven evolution is prompting further outsourcing adoption, especially in regions undergoing digital transformation. In contrast, the in-house segment remains relevant in highly regulated industries, but its share is expected to decline steadily as outsourced models prove more scalable and agile.

Service Analysis

Hard services continue to lead the facility management market in 2025, maintaining a market share of over 40%. These services, encompassing HVAC systems, electrical infrastructure, plumbing, elevators, and structural maintenance, are indispensable for building safety, operational uptime, and regulatory compliance. The growing complexity of modern infrastructure—driven by increased building automation, energy codes, and smart system integration—necessitates expert intervention for installation, upkeep, and periodic upgrades.

Energy efficiency mandates and building performance regulations are further intensifying the demand for hard services. Many commercial and industrial buildings are undergoing retrofitting with energy-efficient HVAC and lighting systems, not only to comply with environmental standards but also to reduce long-term operational costs. Meanwhile, management services—such as asset tracking and facility performance analytics—are gaining traction due to their ability to optimize resource allocation. Soft services like janitorial work and landscaping remain essential but are increasingly bundled within integrated contracts to improve coordination and reduce administrative overhead.

Application Analysis

In 2025, the commercial sector continues to hold the largest share of the facility management market, with over 32% of global revenue. This leadership is attributed to the expanding footprint of office complexes, business parks, retail outlets, and hospitality establishments worldwide. As businesses compete on efficiency, customer experience, and sustainability, facility management has become integral to maintaining high operational standards. Complex needs in this sector—ranging from cleaning and HVAC to workspace optimization—drive the adoption of bundled service models and real-time management systems.

Technology is a pivotal enabler within this segment. The commercial application of IoT sensors, automation platforms, and AI-powered analytics enables real-time asset monitoring, energy optimization, and predictive maintenance. This not only enhances tenant satisfaction but also contributes to long-term cost savings and environmental targets. The healthcare and education segments are also witnessing rising demand for specialized FM services, driven by hygiene protocols, energy efficiency targets, and safety compliance.

By End-Use Analysis

Among end-use categories, commercial buildings represent the most significant demand center for facility management services in 2025. With sustained growth in commercial real estate—especially in urban corridors across Asia-Pacific and North America—this segment has become a key revenue generator. Commercial tenants and building owners alike are placing increasing importance on seamless facility operations to support workforce productivity, occupant comfort, and regulatory compliance.

The industrial segment is also emerging as a high-growth area, particularly as manufacturing hubs embrace Industry 4.0. These facilities require specialized FM solutions to manage complex machinery, environmental controls, and compliance with occupational safety standards. In comparison, residential buildings, while growing, command a smaller share of the market due to fragmented service demand and lower complexity. However, gated communities and high-rise developments are driving the demand for integrated residential FM in emerging economies.

Regional Analysis

In regional terms, Asia Pacific remains the global leader in the facility management market as of 2025, holding over 32.6% of global revenue, or approximately USD 225 billion. This growth is supported by rapid urbanization, infrastructure development, and increased outsourcing across sectors. Countries like China, India, and Southeast Asian nations are investing heavily in commercial real estate, manufacturing, and smart city initiatives—all of which demand comprehensive FM solutions. Regulatory frameworks around energy efficiency and building codes are also maturing, further driving formalization and professionalization of the sector.

North America continues to be a mature but innovation-driven market, where the focus is shifting toward sustainability, digital twins, and ESG-aligned facility strategies. Europe, on the other hand, is characterized by strict compliance standards, which favor bundled service contracts and technology-centric FM models. Meanwhile, Latin America and the Middle East & Africa are emerging as high-opportunity regions, registering CAGR figures above 9%, fueled by industrial expansion and government-led infrastructure modernization. These geographies are seeing a rising influx of global FM providers aiming to capture first-mover advantages.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Type

- Outsourced

- In-house

By Service

- Hard Service

- Soft Service

- Management Service

By Application

- Education

- Commercial

- Transportation

- Industrial

- Government & Public

- Healthcare

- Retail

- Others

By Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 914.6 B |

| Forecast Revenue (2034) | USD 3,412.8 B |

| CAGR (2024-2034) | 11.2% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Type (Outsourced, In-house), By Service (Hard Service, Soft Service, Management Service), By Application (Education, Commercial, Transportation, Industrial, Government & Public, Healthcare, Retail, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Sodexo Inc., Cushman & Wakefield PLC, Shine Management & Facility Services, CBRE Group Inc., ISS Facility Services Inc., Guardian Service Industries Inc., SMI Facility Services, AHI Facility Services Inc., Emeric Facility Services, Jones Lang LaSalle Incorporated, Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date