Global Ferric Citrate Market to Hit $1.85B by 2034 | CAGR 7.3%

Global Ferric Citrate Market Size, Share & Analysis Report By Application (Pharmaceuticals, Food & Nutritional Supplements, Water Treatment, Animal Feed & Agriculture), Grade (Pharmaceutical, Food), Form (Powder, Granules, Solution), End User (Hospitals, Water Treatment Plants, F&B Manufacturers, Agriculture Enterprises, Research Institutions), Distribution Channel, Regional Insights, Key Players, Trends & Forecast 2025-2034

Report Overview

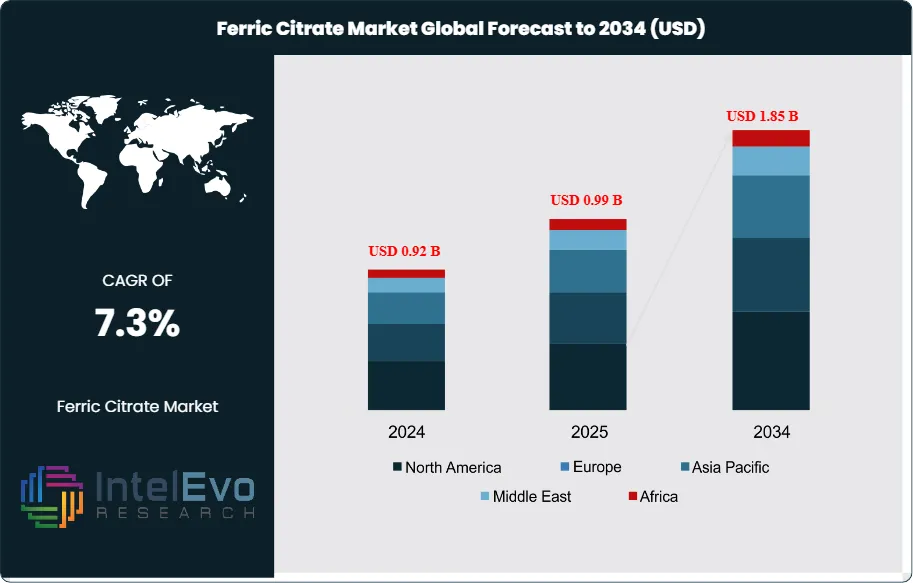

The Global Ferric Citrate Market size is expected to be worth around USD 1.85 Billion by 2034, up from USD 0.92 Billion in 2024, growing at a CAGR of 7.3% during the forecast period from 2024 to 2034. Ferric citrate is an iron-based compound formed by the reaction of ferric ions with citric acid. It is widely used as a phosphate binder in the treatment of chronic kidney disease (CKD), as an iron supplement, and as a coagulating agent in water treatment. Its applications also extend to food fortification and animal nutrition, making it a versatile ingredient across multiple industries. The growth of the global ferric citrate market is primarily driven by the rising prevalence of chronic kidney disease and related disorders, which has increased the demand for effective phosphate binders and iron supplements. Additionally, the growing need for clean water and stringent regulations on water quality are boosting the use of ferric citrate in municipal and industrial water treatment processes.

Get More Information about this report -

Request Free Sample ReportExpanding applications in food and beverage fortification, aimed at combating iron deficiency in developing regions, further support market growth. Technological advancements in pharmaceutical formulations and increased awareness of the benefits of iron supplementation are also contributing to the market’s expansion. The ferric citrate market can be segmented by application, form, end user, and distribution channel. By application, pharmaceuticals dominate due to the compound’s use in CKD management, followed by water treatment, food & beverage, and animal feed. In terms of form, ferric citrate is available as powder, granules, and solution, each catering to specific industry needs. End users include hospitals and clinics, water treatment plants, food manufacturers, and agricultural enterprises. Distribution channels range from direct sales to distributors and online platforms, reflecting the diverse demand base.

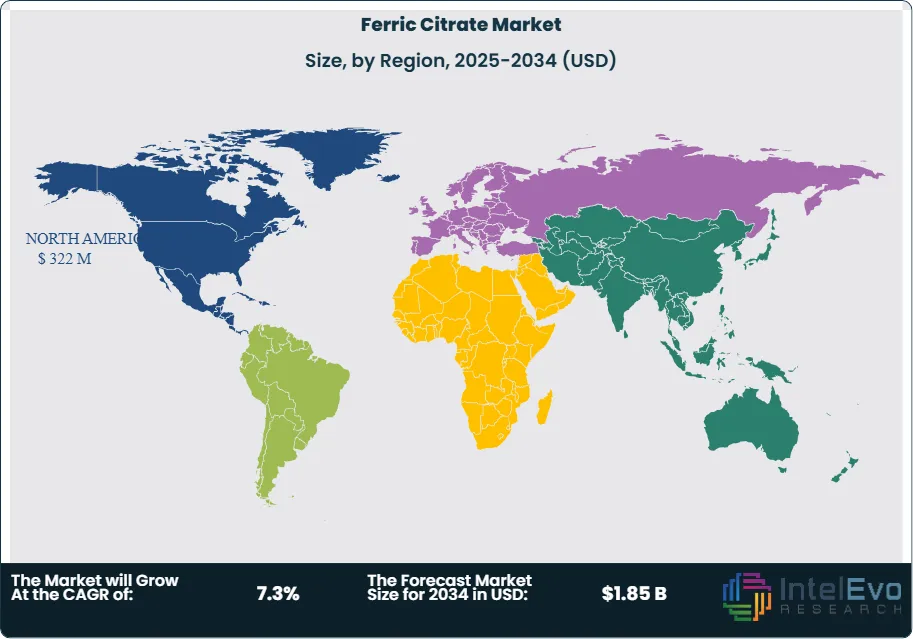

Regionally, North America leads the ferric citrate market, supported by advanced healthcare infrastructure, high CKD prevalence, and strict water quality regulations. Europe follows closely, with significant demand in both pharmaceuticals and food fortification. The Asia-Pacific region is expected to witness the fastest growth, driven by rising healthcare awareness, expanding water treatment infrastructure, and government initiatives to address nutritional deficiencies in countries like China and India. Latin America and the Middle East & Africa are also experiencing steady growth, fueled by improving healthcare access and investments in water purification.

The COVID-19 pandemic had a mixed impact on the ferric citrate market. While disruptions in the global supply chain and reduced elective medical procedures temporarily slowed pharmaceutical demand, the heightened focus on health and nutrition during the pandemic increased the uptake of iron supplements and fortified foods. The water treatment segment remained resilient, as the need for clean water and sanitation became even more critical during the health crisis.

Geopolitical tensions and evolving trade policies have influenced the ferric citrate market, particularly through supply chain disruptions and fluctuations in raw material prices. Regulatory changes, such as stricter environmental and pharmaceutical standards, have created both challenges and opportunities for market players. Additionally, data localization and cross-border trade restrictions in some regions have prompted companies to adapt their sourcing and distribution strategies, while government initiatives to improve public health and water quality continue to drive long-term demand.

Key Takeaways

- Market Growth: The Global Ferric Citrate Market is projected to reach USD 1.85 Billion by 2034, fueled by rising demand in pharmaceuticals, water treatment, and food fortification, with a CAGR of 7.3% from 2024 to 2034.

- Application Dominance: The pharmaceutical segment leads the market, driven by the widespread use of ferric citrate as a phosphate binder and iron supplement for chronic kidney disease (CKD) patients.

- Form Dominance: Powdered ferric citrate holds the largest share due to its ease of handling, solubility, and suitability for pharmaceutical and water treatment applications.

- End User Dominance: Hospitals and clinics are the primary end users, especially in developed regions, while water treatment plants and food manufacturers represent growing segments.

- Regional Analysis: North America dominates the market, supported by advanced healthcare infrastructure and high CKD prevalence. Asia-Pacific is the fastest-growing region, propelled by expanding healthcare access, water treatment initiatives, and nutritional programs in countries like China and India.

- Drivers: Key drivers include the increasing prevalence of CKD, stringent water quality regulations, rising awareness of iron deficiency, and technological advancements in pharmaceutical formulations.

- Restraints: Market growth is restrained by stringent regulatory approval processes, price fluctuations of raw materials, and supply chain disruptions.

- Opportunities: Emerging opportunities lie in expanding applications for animal feed and agriculture, growing demand for iron-fortified foods, and increased investments in water purification infrastructure in developing regions.

- Trends: Notable trends include the shift toward sustainable water treatment chemicals, personalized medicine, and the development of innovative ferric citrate formulations for broader therapeutic and nutritional uses.

Application Analysis

The pharmaceuticals segment is the dominant force in the global ferric citrate market, accounting for approximately 55–60% of total market share. This leadership is primarily due to ferric citrate’s critical role as a phosphate binder in the management of chronic kidney disease (CKD), where it is widely prescribed to control hyperphosphatemia. The segment’s growth is further propelled by the increasing global prevalence of CKD, especially among aging populations, and the expanding use of oral iron supplements. Water treatment is the second-largest application, making up about 20–25% of the market, as ferric citrate is highly effective in coagulation and the removal of heavy metals and phosphates from municipal and industrial water supplies. The food and beverage segment, which utilizes ferric citrate as an iron fortification agent and acidity regulator, holds around 10–12% of the market, with demand rising in developing countries to address widespread iron deficiency. Meanwhile, the animal feed and agriculture segment is emerging, currently representing 5–8% of the market, as the compound is increasingly used to enhance animal health and crop productivity.

Form Analysis

Powdered ferric citrate is the most widely used form, capturing nearly 60% of the market share, thanks to its ease of handling, high solubility, and suitability for pharmaceutical and water treatment applications. Granular ferric citrate, preferred in industrial settings for its controlled release and dosing convenience, accounts for about 25% of the market. The solution form, which is gaining popularity in food and beverage applications due to its uniform mixing and stability, makes up the remaining 15%.

Region Analysis

North America leads the global ferric citrate market, holding about 35% of the total share, driven by high CKD prevalence, advanced healthcare infrastructure, and stringent water quality regulations. The United States is a particularly strong market due to early adoption of ferric citrate-based therapies and water treatment technologies. Europe follows with a 25% share, supported by robust demand in pharmaceuticals and food fortification, as well as regulatory backing for iron supplementation and water quality standards. The Asia-Pacific region is the fastest-growing, currently accounting for 25–28% of the market, fueled by rising healthcare awareness, expanding water treatment infrastructure, and increasing food fortification initiatives in countries like China and India. Latin America and the Middle East & Africa are smaller but steadily growing markets, together making up the remaining 12–15%, supported by improving healthcare access, government initiatives for water purification, and efforts to combat iron deficiency.

Get More Information about this report -

Request Free Sample Report

Key Market Segment

Application

- Pharmaceuticals

- Food & Nutritional Supplements

- Water Treatment

- Animal Feed & Agriculture

- Others

Grade

- Pharmaceutical Grade

- Food Grade

- Other Grades (industrial, reagent)

Form

- Powder

- Granules

- Solution (liquid)

End User

- Hospitals & Clinics

- Water Treatment Plants (municipal, industrial)

- Food & Beverage Manufacturers

- Animal Husbandry & Agriculture Enterprises

- Research Institutions

Distribution Channel

- Direct Sales

- Distributors & Wholesalers

- Online Retail

Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 0.92 B |

| Forecast Revenue (2034) | 1.85 B |

| CAGR (2024-2034) | 7.3% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Application (Pharmaceuticals, Food & Nutritional Supplements, Water Treatment, Animal Feed & Agriculture, Others), Grade (Pharmaceutical Grade, Food Grade, Other Grades)), Form (Powder, Granules, Solution), End User (Hospitals & Clinics, Water Treatment Plants, Food & Beverage Manufacturers, Animal Husbandry & Agriculture Enterprises, Research Institutions), Distribution Channel (Direct Sales, Distributors & Wholesalers, Online Retail) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Keryx Biopharmaceuticals, Inc. (now part of Akebia Therapeutics, Inc.), Panion & BF Biotech Inc., Shandong Lunan Chemical Technology Co., Ltd., Ferro Corporation, Nantong Feiyu Fine Chemical Co., Ltd., Jost Chemical Co., Nantong Tianshi Medicine Technology Co., Ltd., Ruipu Biological Engineering Co., Ltd., Dr. Paul Lohmann GmbH & Co. KGaA, Nantong Jiangtian Chemical Co., Ltd. |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date