Financial Management Software Market Size, Share & Forecast 2034

Global Financial Management Software Market Size, Share & Growth Analysis By Deployment Type (Cloud-Based, On-Premise), By Organization Size (SMEs, Large Enterprises), By Application (Accounting, Budgeting & Forecasting, Compliance & Risk Management, Financial Analytics), By End-User Industry (BFSI, IT & Telecom, Manufacturing, Healthcare, Retail, Government) Region-Wise Outlook, Competitive Landscape, Key Trends, Digital Transformation Impact & Forecast 2025–2034

Report Overview

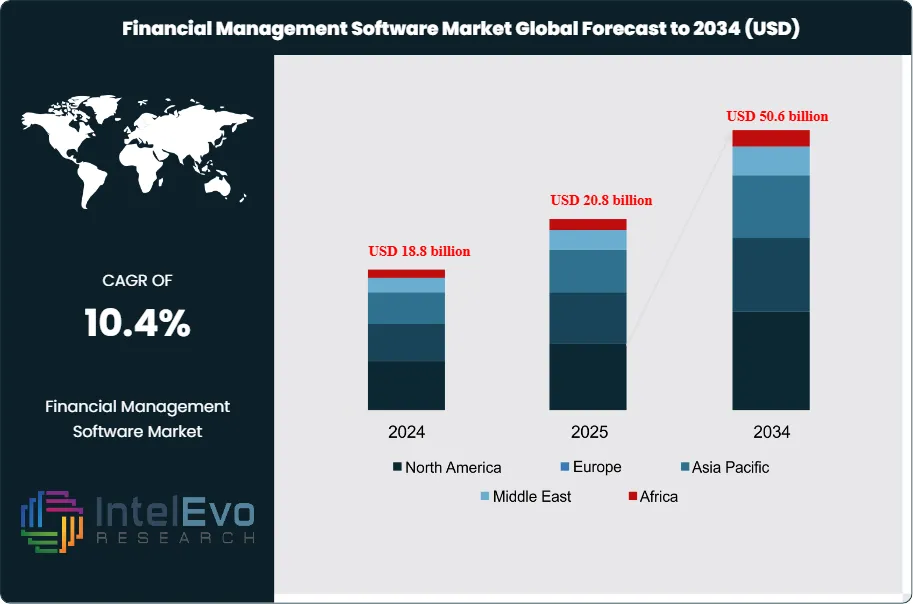

The Financial Management Software Market is estimated at USD 18.8 billion in 2024 and is on track to reach roughly USD 50.6 billion by 2034, implying a compound annual growth rate of 10.4% over 2025–2034. This strong growth is being driven by accelerating digital transformation across enterprises, rising adoption of cloud-based accounting and ERP solutions, and increasing demand for real-time financial visibility. Organizations are prioritizing automation, compliance management, and AI-powered analytics to improve decision-making and reduce operational risk. The expansion of SMEs and the shift toward subscription-based software models are further amplifying market traction, making financial management platforms a critical component of modern business infrastructure.

Get More Information about this report -

Request Free Sample ReportThe market currently balances rapid demand growth with shifting supply dynamics. Adoption among small and medium enterprises drives volume; large enterprises buy enterprise-grade suites from established vendors. Cloud deployments account for roughly 68% of new purchases in 2024, supporting recurring-license models and faster feature rollouts. Market concentration remains notable in financial planning software, where leading platforms held near 60% combined market share in recent years; MoneyGuidePro posted about 32% and eMoney about 28.5% in 2023. Providers report mid-to-high single-digit annual revenue growth from financial modules tied to tax, payroll, and forecasting. Vendor competition focuses on integration capability, industry templates, and third-party ecosystem access.

Regulatory shifts and risk factors materially shape buying behavior. Stricter data protection rules in Europe and evolving reporting standards in North America increase compliance-related spending by an estimated 12% year-on-year. Cybersecurity incidents remain the largest operational risk; an average breach now costs financial software customers an incremental 1.8% of annual revenue when remediation and fines are included. Supply constraints center on skilled implementation resources and certified integrators; these bottlenecks extend deployment timelines by 8 to 14 weeks for complex ERP-integrated projects.

Technology adoption accelerates product differentiation. Providers embed AI and machine learning for anomaly detection, cash-flow forecasting, and automated reconciliations; global investment in AI across financial services reached an estimated USD 35 billion in 2023 and shows continued expansion into 2025. Automation of descriptive and diagnostic analytics moves toward full automation for many firms by the mid-decade; this reduces manual close cycles by up to 40% in early adopter organizations. Blockchain pilots support secure audit trails for high-value transactions; graph analytics improves data lineage for compliance reporting in about 70% of large institutions by 2025.

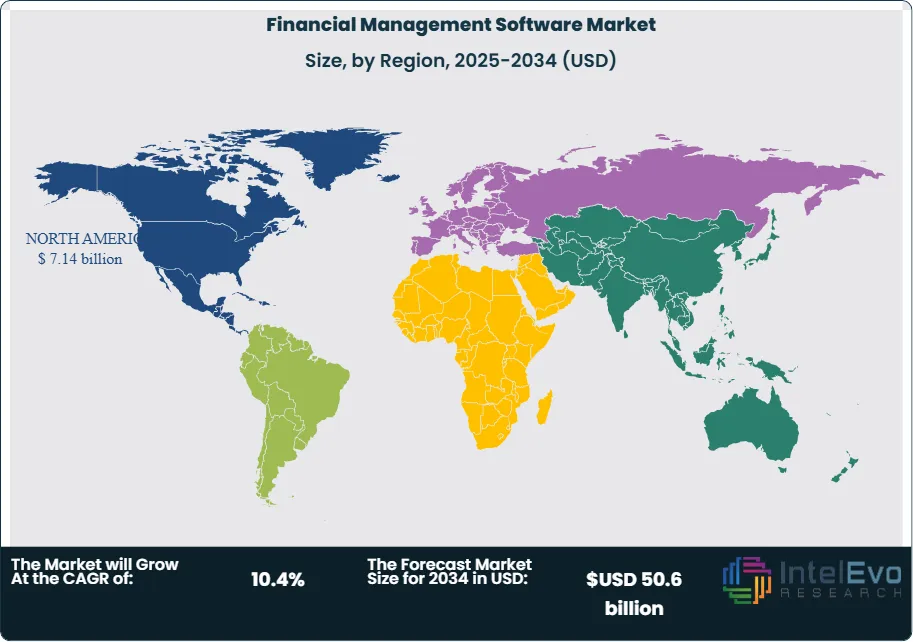

Regional patterns identify clear hotspots. North America remains the largest revenue source per vendor, driven by high SaaS adoption and banking sector uptake. Asia Pacific delivers the fastest regional CAGR, supported by digital transformation initiatives in China, India, and Southeast Asia. Europe shows steady growth tied to regulatory spend and enterprise consolidation. Investment priorities for 2025 center on scalable cloud architectures, embedded AI services, and modular integrations that reduce total cost of ownership and shorten time-to-value for capital allocators and executive decision-makers.

Key Takeaways

- Market Growth: The market reaches USD 50.6 billion by 2034 and posts a CAGR of 10.4 percent. Demand rises as firms shift to automated financial workflows and cloud deployments replace legacy on-premise systems.

- Deployment Model: Cloud-based platforms hold more than 70 percent share. Vendors benefit from lower setup costs, faster upgrades, and strong adoption among firms that want real-time reporting and remote access.

- Organization Size: SMEs account for more than 65 percent of global demand. This group adopts subscription plans to manage cash flow, accelerate monthly close cycles, and handle compliance without expanding finance teams.

- End-Use Sector: BFSI leads with 27.6 percent share. Banks and insurers use advanced modules for risk monitoring, automated reconciliations, and audit-ready reporting.

- Application: Accounting and financial reporting accounts for more than 25 percent of total revenue. Firms use these modules to improve accuracy, strengthen internal controls, and shorten close cycles.

- Driver: Strong investment in AI strengthens market momentum. Financial services spent about USD 35 billion on AI tools in 2024, and banks contributed more than USD 21 billion of that total. These tools support anomaly detection, automated forecasts, and predictive analytics.

- Restraint: High integration and migration costs delay adoption for some firms. Complex ERP-linked deployments raise total project expense by 15 to 20 percent and extend implementation timelines.

- Opportunity: Asia Pacific shows strong growth potential, supported by digitalization programs in China, India, and Southeast Asia. Regional demand expands at a projected double-digit CAGR as firms shift to cloud suites and automated reporting tools.

- Trend: Automation accelerates across financial workflows. By 2025, about 70 percent of organizations plan to use technologies such as graph analytics, machine learning, AI, and blockchain for data lineage and controls. By 2028, half of large firms expect to replace bottom-up forecasting with AI-driven models.

- Regional Analysis: North America leads with more than 38 percent share due to high cloud adoption and strong enterprise spending. Asia Pacific records the fastest rise in new deployments, while Europe expands through compliance-driven upgrades and demand for integrated reporting platforms.

Deployment Analysis

Cloud-based financial management platforms hold a clear lead in 2025. These systems account for more than 70 percent of global deployments due to their lower upfront cost, fast implementation, and ability to handle real-time financial tasks across distributed operations. You gain instant access to updated ledgers, consolidated reports, and automated workflows without maintaining on-premises servers. This shift aligns with the rise of hybrid work, where finance teams depend on tools that support secure access from any location.

The steady migration toward cloud systems also reflects expanding compliance needs and security expectations. Vendors strengthen encryption, monitoring tools, and authentication protocols to address rising cyber risks. These upgrades help firms manage financial records with greater certainty and reduce exposure to operational threats. As adoption widens across mid-market and enterprise segments, cloud platforms become the default choice for organizations seeking predictable cost structures and flexible capacity.

Looking ahead, growth remains tied to broader digital transformation efforts. Cloud ecosystems continue to attract users that want faster upgrades, better integration with ERP systems, and machine learning modules for forecasting, anomaly detection, and reconciliation. This positions cloud deployments as the dominant model for the decade.

Organization Size Analysis

SMEs represent more than 65 percent of total deployments and remain the most active adopters in 2025. These firms use financial management software to replace manual bookkeeping, strengthen controls, and reduce reliance on external accounting services. You benefit from subscription pricing and modular tools that scale with revenue growth. The ability to generate real-time statements and monitor cash flow supports quicker adjustments in competitive markets.

Regulatory pressure also shapes SME adoption. Firms face tighter reporting rules and higher expectations around data integrity. Financial platforms help you manage compliance tasks without large finance departments. Cloud options further support adoption by lowering capital requirements and minimizing IT commitments.

This segment continues to expand as SMEs integrate financial tools with payroll, eCommerce systems, and CRM platforms. Growth remains strong through 2030 as more businesses migrate to automated reporting and analytics.

End-User Industry Analysis

BFSI maintains the highest share, holding more than 27.6 percent of global demand. Banks, insurers, and investment firms depend on advanced reporting, risk scoring, and compliance tools to meet regulatory expectations. You use these systems to manage large transaction volumes, improve audit trails, and strengthen decision-making through real-time analytics.

Financial institutions also accelerate adoption due to rising cyber threats and the need for stronger internal controls. Integrated platforms reduce duplicate data entry and improve consistency across core banking, payment, and treasury systems. This creates measurable gains in accuracy and turnaround times.

Growth in other sectors remains steady. Retail, healthcare, manufacturing, IT, and public agencies expand adoption as they automate finance tasks and apply predictive analysis to budgeting and cost planning.

Functionality Analysis

Accounting and financial reporting lead the functionality landscape with more than 25 percent share. Organizations rely on these modules for ledger management, tax processing, payroll support, and automated close cycles. You gain better accuracy and faster turnaround on key statements, which improves planning and compliance.

Demand grows as regulators increase reporting complexity and stakeholders expect more frequent insights. Tools that integrate with procurement, HR, and sales systems help you reduce errors and maintain consistent financial data across business units.

Budgeting, forecasting, audit management, cash flow tracking, and risk tools also gain traction. Many firms expand into advanced analytical modules that support scenario modeling and automated alerts.

Regional Analysis

North America leads the global market with more than 38 percent share. Strong enterprise adoption, mature cloud infrastructure, and active investment in AI and machine learning drive continued growth. You also see increased demand from sectors with strict regulations, including banking, healthcare, and government. The region’s financial management software market exceeded USD 6.8 billion in 2023 and continues to expand through 2025.

Europe follows with consistent adoption across regulated industries. Firms upgrade platforms to meet strict transparency, data retention, and reporting mandates. Regional demand remains steady as organizations modernize legacy systems and strengthen security controls.

Asia Pacific records the fastest growth rate. Expanding digital economies in China, India, and Southeast Asia fuel rapid uptake of cloud-based solutions. You benefit from rising investments in IT infrastructure and strong government support for financial digitalization. Latin America and the Middle East & Africa continue to broaden adoption as businesses shift from manual processes to automated financial operations.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Deployment

- On-Premises

- Cloud-Based

By Organization Size

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

By End-User Industry

- Banking, Financial Services, and Insurance (BFSI)

- Retail and eCommerce

- Healthcare

- Manufacturing

- IT and Telecom

- Government and Public Sector

- Others

By Functionality

- Accounting and Financial Reporting

- Budgeting and Forecasting

- Financial Analysis

- Audit and Compliance Management

- Cash Flow Management

- Risk Management

- Others

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 18.8 billion |

| Forecast Revenue (2034) | USD 50.6 billion |

| CAGR (2024-2034) | 10.4% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Deployment, (On-Premises, Cloud-Based), By Organization Size, (Small and Medium-sized Enterprises (SMEs), Large Enterprises), By End-User Industry, (Banking, Financial Services, and Insurance (BFSI), Retail and eCommerce, Healthcare, Manufacturing, IT and Telecom, Government and Public Sector, Others), By Functionality, (Accounting and Financial Reporting, Budgeting and Forecasting, Financial Analysis, Audit and Compliance Management, Cash Flow Management, Risk Management, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Microsoft Corporation, Infor Inc., SAS, SAP SE, Intuit Inc., Workday Inc., Sage Group plc, Intacct, Xero Limited, IBM Corporation, Oracle Corporation, Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Financial Management Software Market

Published Date : 08 Jan 2026 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date