FinFET Technology Market Growth & Semiconductor Trends| 28.1% CAGR

Global FinFET Technology Market Size, Share & Analysis By Node Size/Technology (7nm, 5nm, 3nm), By Application (Processors, Memory, SoCs), By End-User Industry Regions & Key Players – Advanced Semiconductor Trends & Forecast 2025–2034

Report Overview

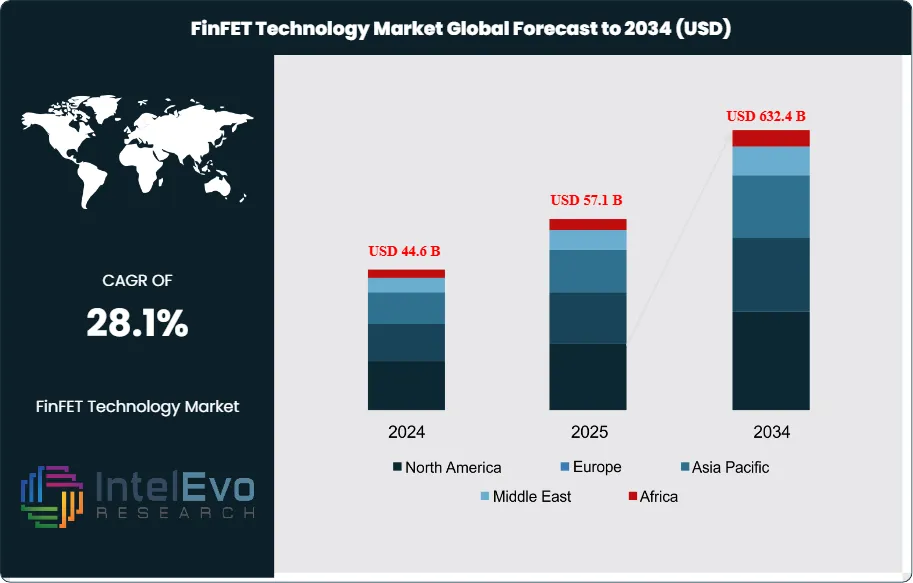

The FinFET Technology market is valued at USD 44.6 billion in 2024 and is projected to reach approximately USD 632.4 billion by 2034, reflecting a powerful CAGR of about 28.1% during 2025–2034. Demand is accelerating as FinFET architectures become the backbone of high-performance computing, 5G infrastructure, AI processors, and advanced automotive electronics. As semiconductor nodes scale toward 3nm and beyond, FinFET continues to dominate due to its superior power efficiency, switching speed, and leakage control. With chipmakers investing aggressively in next-generation foundry expansions and design innovation, FinFET remains central to the global semiconductor roadmap.

Get More Information about this report -

Request Free Sample ReportFinFET, or Fin Field Effect Transistor, has reshaped semiconductor architecture with its three-dimensional design, enabling higher current density, faster switching speeds, and significantly reduced leakage compared to traditional planar transistors. This structural advantage has made FinFET a critical technology in advanced chip manufacturing, particularly at nodes below 7 nm, where power efficiency and thermal performance are increasingly decisive.

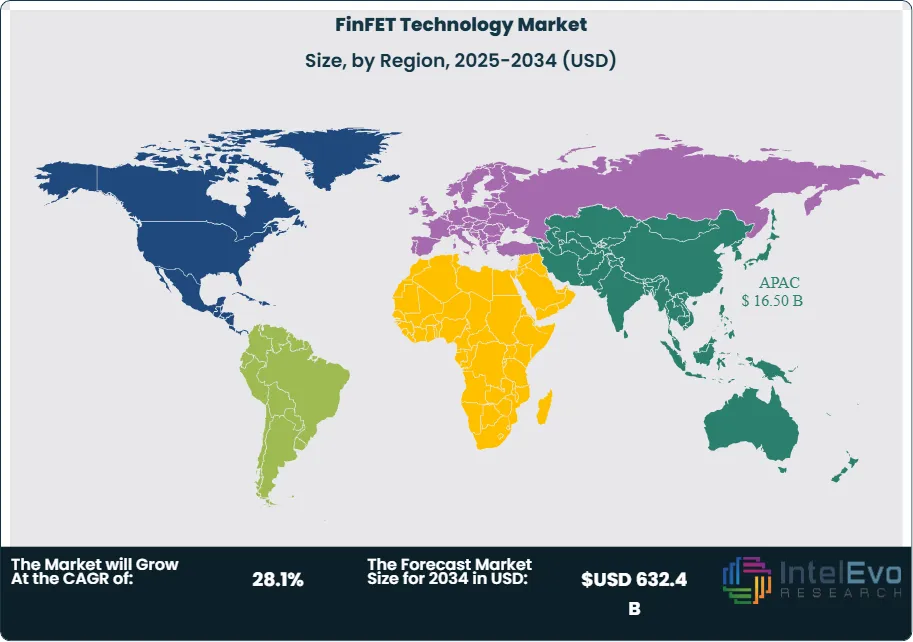

In 2023, the Asia-Pacific region led global FinFET market revenue, generating approximately USD 13.4 billion and accounting for over 37% of total market share. Growth in the region is anchored by strong demand from foundries and integrated device manufacturers (IDMs) in China, Taiwan, and South Korea, supported by dense manufacturing ecosystems and robust capital investment.

On the demand side, smartphone manufacturers and hyperscale data center operators remain key adopters of FinFET technology. Rising requirements for AI workloads, advanced gaming, and high-frequency trading have driven increased investment in FinFET-based processors. As a result, FinFET-enabled chips now power more than 80% of flagship mobile devices, reflecting rapid design wins among top-tier original equipment manufacturers (OEMs).

From a supply perspective, leading fabrication facilities are expanding FinFET production using extreme ultraviolet (EUV) lithography and advanced packaging techniques to meet accelerating demand. However, the capital-intensive nature of FinFET manufacturing continues to pose challenges. Equipment costs increased by 14% year-over-year in 2024, while delivery delays have introduced additional risks to fab expansion timelines.

The transition to smaller process nodes has also increased design complexity and extended time-to-market. To address these constraints, semiconductor firms are increasingly deploying AI-assisted electronic design automation (EDA) tools and digital twins to enhance yield predictability and accelerate validation cycles, improving overall operational efficiency.

Regulatory pressures remain a persistent concern, particularly in cross-border technology trade between the United States and China, which continues to affect supply chain resilience and export strategies. Despite these headwinds, research and development investment remains robust. In 2025, aggregate R&D spending by the top five FinFET IP providers exceeded USD 6.3 billion, with a strong focus on process optimization, thermal efficiency, and defect reduction.

Europe and North America are expanding their involvement through national semiconductor strategies and incentives, aiming to strengthen domestic capabilities. Nevertheless, the Asia-Pacific region continues to dominate as the primary manufacturing hub, benefiting from integrated production capacity, established supply chains, and a deep talent pool.

Looking ahead, sustained demand from high-performance computing, automotive AI, and 5G infrastructure is expected to reinforce the importance of FinFET technology. As a result, FinFET is set to remain a foundational element of the global semiconductor roadmap well into the next decade.

Key Takeaways

- Market Growth: The global FinFET Technology market was valued at USD 44.6 billion in 2024 and is projected to reach USD 632.4 billion by 2034, registering a strong CAGR of 28.1% from 2025 to 2034. Growth is driven by demand for energy-efficient, high-performance processors in consumer electronics, data centers, and AI workloads.

- Technology Node: 10nm technology led the FinFET market in 2023, accounting for over 25% of global revenue. Its balance between power efficiency and manufacturing scalability makes it a preferred node for premium smartphones and advanced SoCs.

- Application: Consumer electronics held a dominant 52% share in 2023, fueled by widespread adoption of FinFET chips in flagship smartphones, gaming consoles, and personal computing devices. Major OEMs rely on FinFET-based processors to support intensive workloads and extended battery life.

- Driver: Rising demand for AI-capable processors and edge computing devices is accelerating FinFET adoption. Over 80% of premium smartphones released in 2025 now use FinFET-based chipsets, reflecting the technology’s relevance in high-performance mobile computing.

- Restraint: High capital expenditure and process complexity remain key constraints. In 2025, average equipment costs for FinFET-capable fabs increased by 14%, adding pressure to profit margins and limiting entry for smaller foundries.

- Opportunity: The medical device and automotive AI sectors present untapped opportunities for FinFET growth. Automotive-grade FinFET chips are expected to grow at a CAGR above 30% through 2030, driven by ADAS and real-time data processing needs.

- Trend: Foundries are integrating EUV lithography and AI-assisted design tools to streamline FinFET production. In 2025, leading chipmakers reported a 22% reduction in design-to-tapeout cycle time using AI-enhanced EDA workflows.

- Regional Analysis: Asia-Pacific led the global market in 2023 with a 37% revenue share, supported by foundry capacity in China, Taiwan, and South Korea. While North America and Europe are scaling production via national semiconductor strategies, APAC remains the hub for advanced node manufacturing.

Technology Analysis

As of 2025, 10nm FinFET technology holds a central role in global semiconductor production, accounting for over 25% of total FinFET market revenue. Its position reflects both technical maturity and commercial scalability. The 10nm process node offers a balance between energy efficiency, performance, and manufacturing cost, making it well-suited for mainstream adoption in high-performance computing, smartphones, and edge AI devices. While more advanced nodes such as 7nm and 5nm are gaining traction, they remain cost-intensive and technically complex for mass deployment outside tier-one fabs.

The 10nm node continues to serve as a stable workhorse across multiple product categories, particularly where OEMs require reliable yields and volume production. Its transistor density supports dense logic integration without significantly compromising power consumption, which is critical for mobile applications and portable consumer electronics. Additionally, for chipmakers managing cost-performance trade-offs, 10nm remains a strategic midpoint. As design complexity increases at smaller geometries, 10nm FinFET maintains relevance by offering predictable manufacturing outcomes and faster time-to-market, especially for mid-to-high-end processors and system-on-chip platforms.

End-User Industry Analysis

In 2025, consumer electronics continues to lead FinFET technology adoption, contributing more than 52% of total end-user demand. This dominance stems from the integration of FinFET-based processors in smartphones, tablets, wearables, and portable computing devices. The need for high-speed processing, improved thermal control, and extended battery life makes FinFET the preferred architecture among OEMs aiming to deliver feature-rich, energy-efficient products. Flagship smartphones launched this year from leading brands rely almost exclusively on FinFET nodes below 10nm for application processors and AI accelerators.

Beyond mobile, the expansion of connected devices and IoT ecosystems is amplifying the role of FinFET in smart wearables, home automation systems, and embedded electronics. These devices require compact, power-efficient chips capable of continuous operation without thermal throttling or excessive drain on limited power sources. In parallel, consumer demand for AI-supported features such as voice recognition, facial authentication, and intelligent image processing is increasing the computational workload on edge devices, further reinforcing FinFET’s utility. As OEMs compete on performance-per-watt metrics, FinFET’s ability to combine speed with power efficiency secures its position in the segment. Looking ahead, as 5G-enabled devices and AI-native form factors become standard, FinFET technology will remain integral to product innovation in the consumer space.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Technology

- 10nm

- 22nm

- 20nm

- 16nm

- 14nm

- 7nm

- 5nm and Below

By End-User Industry

- Consumer Electronics

- Automotive

- Healthcare

- Industrial

- Other End-Users

By Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 44.6 B |

| Forecast Revenue (2034) | USD 632.4 B |

| CAGR (2024-2034) | 28.1% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Technology (10nm, 22nm, 20nm, 16nm, 14nm, 7nm, 5nm and Below), By End-User Industry (Consumer Electronics, Automotive, Healthcare, Industrial, Other End-Users) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | TOSHIBA CORPORATION, Intel Corporation, Renesas Electronics Corporation, Samsung Electronics, Xilinx Inc., United Microelectronics Corporation, Infineon Technologies AG, Qualcomm Technologies, Inc., Texas Instruments Incorporated, Robert Bosch GmbH, Semiconductor Manufacturing International Corp, GlobalFoundries Inc., Taiwan Semiconductor Manufacturing Company Limited, Others |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date