Fly Ash Market Size, Share & Growth Analysis | APAC, US, Europe, MEA

Global Fly Ash Market Size, Share & Analysis By Product Type (Class F, Class C), By Application (Cement and Concrete, Bricks and Blocks, Road Construction, Soil Stabilization, Mining, Others) Industry Regions & Key Players – Sustainability Impact, Cost Advantages, Regulatory Drivers & Forecast 2025–2034

Report Overview

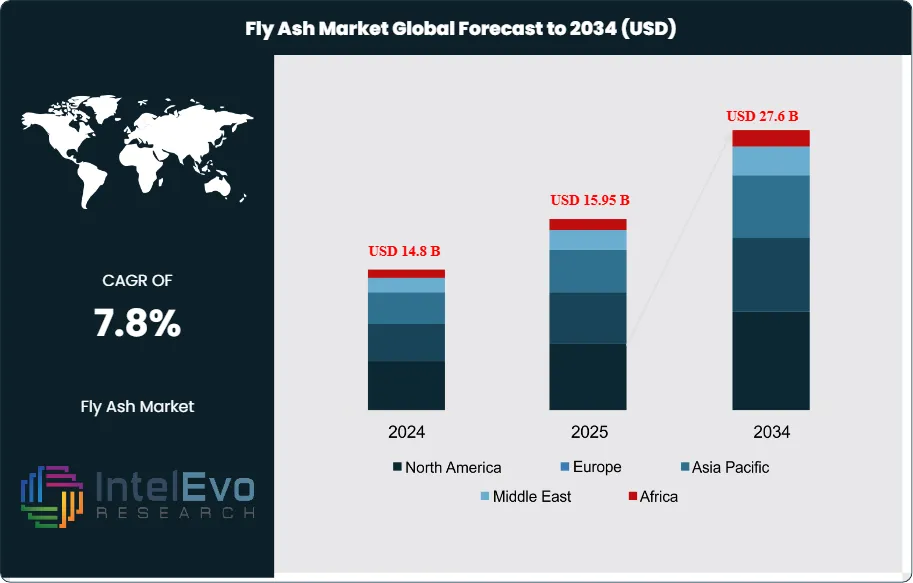

The Fly Ash Market is estimated at USD 14.8 billion in 2024 and is on track to reach roughly USD 27.6 billion by 2034, implying a compound annual growth rate of 7.8% over 2025–2034. Growing demand for sustainable construction materials and the rapid shift toward low-carbon cement alternatives are accelerating global adoption. As infrastructure expansion surges across Asia–Pacific and the Middle East, fly ash is emerging as a critical component in greener, stronger, and more cost-efficient concrete solutions.

Get More Information about this report -

Request Free Sample ReportMarket expansion is being fueled by the dual forces of construction sector growth and sustainability imperatives, which are reshaping demand dynamics across both mature and emerging economies. Historically, the use of fly ash as a supplementary cementitious material gained prominence in the late 20th century as a cost-efficient and performance-enhancing substitute for Portland cement. Over the past decade, this role has evolved, with adoption accelerating in infrastructure and housing projects where enhanced durability, reduced permeability, and carbon footprint reduction are critical.

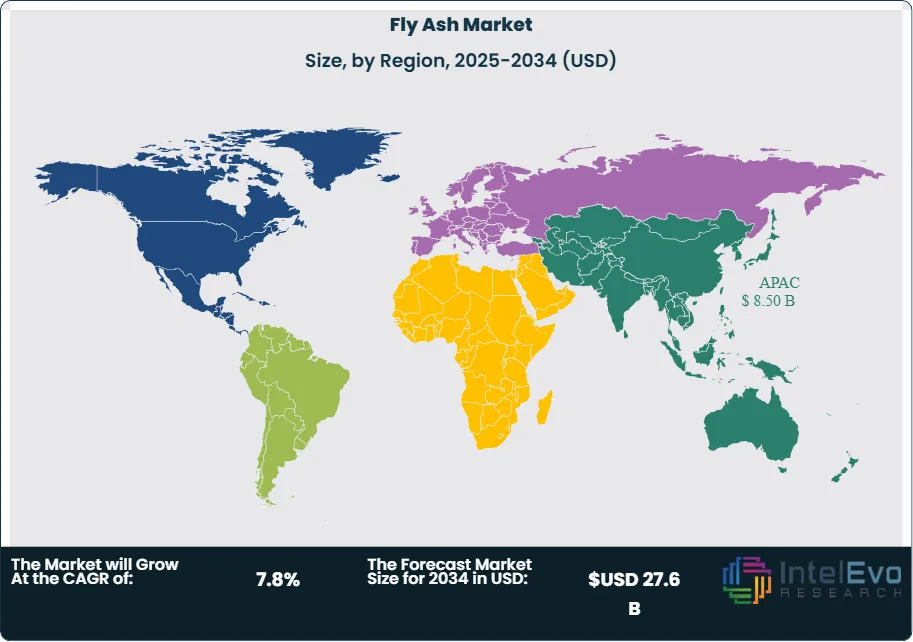

The demand-side growth drivers are most visible in the construction industry, which continues to absorb over 60% of global fly ash output through applications in concrete, blended cements, asphalt, and soil stabilization. For instance, Asia Pacific, the dominant region, accounted for USD 8.50 billion billion in 2024, representing a 57.4% share of the market, underpinned by China and India’s robust infrastructure pipelines. On the supply side, however, structural challenges persist. The ongoing global transition away from coal-based power generation threatens long-term fly ash availability, given its origin as a coal combustion byproduct. According to the International Energy Agency, global coal demand reached nearly 9 billion tons in 2024, yet as renewable energy penetration accelerates, future supply volatility is expected.

Government regulations and policies play a decisive role in shaping market opportunities. Many countries have introduced mandates or incentives to increase fly ash utilization in cement and concrete, both to reduce landfill waste and to lower carbon emissions. Yet risks remain around environmental hazards, particularly contamination of water bodies through improper disposal, which necessitates strict compliance and handling standards.

Technological innovations are helping mitigate some of these constraints. Advanced beneficiation processes, AI-driven quality monitoring, and digital platforms for material traceability are enabling the production of high-quality, standardized fly ash suitable for specialized construction needs. Additionally, emerging opportunities are arising in regions such as Latin America and parts of Africa, where urbanization and investment in green infrastructure projects are accelerating. For investors, Asia Pacific will remain the epicenter of demand, but North America and Europe present strategic niches in premium applications such as high-performance concretes and sustainable construction solutions.

Key Takeaways

- Market Growth: The global fly ash market was USD 14.8 billion in 2024 and is projected to reach USD 27.6 billion by 2034 (7.8% CAGR), adding roughly USD 12.8 billion in new value; growth is anchored in cement/concrete demand, durability gains, and decarbonization of clinker-intensive mixes.

- Product Type: Class F led in 2024 with 58.2% share (~USD 8.0 billion), favored for its pozzolanic reactivity, sulfate resistance, and suitability for high-performance and mass concrete; Class C accounted for the remaining 41.8%, concentrated near lignite/sub-bituminous coal basins.

- Application: Cement & concrete was the top application at 43.1% of 2024 revenue (~USD 5.9 billion), reflecting widespread use as a supplementary cementitious material to enhance strength, reduce permeability, and lower embodied CO₂ in infrastructure and commercial projects.

- Driver: Public and private sustainability mandates are accelerating substitution of Portland cement with SCMs; Asia Pacific’s construction upcycle and specification-driven procurement supported a 57.4% regional share in 2024 (USD 8.50 billion billion), reinforcing volume visibility for ready-mix and precast producers.

- Restraint: Coal-to-renewables transitions and thermal power retirements outside Asia are tightening fresh ash supply, elevating reliance on imports and ash harvesting; supply concentration in APAC (57.4% share) heightens logistics exposure and regional price dispersion.

- Opportunity: Beneficiation and “harvested” ash (reclaiming legacy landfilled/ponded ash) can offset supply gaps and command premiums in consistent, low-carbon mixes; capturing even 20% of the USD 12.8 billion forecasted market expansion via upgraded/reclaimed streams would create a ~USD 2.5–3.0 billion addressable niche by 2034.

- Trend: Process innovations—dry classifying, carbon burn-out, and AI-enabled quality monitoring—are improving grade consistency and enabling higher substitution rates in performance concretes; digital material passports and EPD-linked procurement are making low-CO₂ SCM blends a default in major bids.

- Regional Analysis: Asia Pacific is the clear demand center (57.4% share, USD 8.50 billion billion, 2024) and will contribute the bulk of absolute dollar growth through 2034; North America and Europe remain attractive for premium, beneficiated and reclaimed ash due to domestic plant retirements, while India and Southeast Asia are investment hotspots given multi-year infrastructure pipelines and urbanization-driven concrete intensity.

Product Analysis

Class F remained the mainstream product in 2024, accounting for an estimated 58.2% of global revenue, and it is expected to retain leadership through 2030–2035 as green building codes tighten. Its low-calcium, silica–alumina–rich chemistry enables strong pozzolanic activity, higher sulfate and alkali–silica reaction resistance, and reliable performance in marine, sulfate-rich soils, and mass-concrete pours. In 2025 and beyond, wider use of beneficiation (e.g., carbon burn-out, electrostatic separation) and AI-enabled quality control is improving consistency of Class F, supporting higher substitution rates (often 20–35% of cement, and up to 50% in ternary blends) in high-performance concrete specifications.

Class C will remain essential in geographies tied to sub-bituminous and lignite coal sources and in applications prioritizing early strength. Its self-cementing behavior supports rapid setting in precast, pavement, and cold-weather concreting, although higher alkalis and sulfates require stricter mix control for long-term durability. With fresh ash supplies tightening in North America and parts of Europe, both Class F and Class C growth increasingly depends on reclaimed (“harvested”) ash from ponds and landfills and on upgraded ash that meets ASTM/EN performance criteria—broadly keeping pace with the market’s ~6–7% CAGR outlook.

Application Analysis

Cement and concrete represented the primary outlet in 2024 (≈43.1% share) and will remain the anchor segment as public owners and private developers specify lower-carbon mixes to meet embodied-carbon targets. Fly ash improves workability and reduces heat of hydration and permeability, enabling high-performance mixes for bridges, rapid-transit systems, data centers, and industrial floors; EPD-linked procurement and digital material passports are accelerating adoption across major bids.

Secondary applications—bricks and blocks, road construction, soil stabilization, mining, and others—collectively contribute a meaningful, if smaller, share with differentiated growth profiles. Bricks/blocks benefit from lighter-weight, thermally efficient products and waste-valorization incentives; road construction and soil stabilization gain from strength and California Bearing Ratio (CBR) improvements on expansive or soft subgrades; mining leverages ash for backfill and land reclamation. From 2025 onward, these uses are set to outgrow historical averages where governments incentivize circular materials, with bricks/blocks and soil stabilization emerging as notable demand adders in South and Southeast Asia.

End-Use Analysis

Residential and commercial buildings account for the majority of fly-ash-enabled concrete consumption (together >60% in most urban markets), driven by high-rise housing, mixed-use developments, offices, healthcare, and education. Developers favor fly-ash blends for pumpability, finishability, and long-term durability, while portfolio owners target 20–30% cement replacement to meet corporate decarbonization goals and secure green certifications.

Industrial building demand—logistics warehouses, manufacturing plants, and energy and water infrastructure—forms a resilient growth pillar, supported by near-shoring, e-commerce, and utilities investment. These projects increasingly specify high-performance and mass-concrete mixes where fly ash moderates thermal gradients and cracking risk, lifting usage intensity per square meter compared with typical residential pours.

Regional Analysis

Asia Pacific is the structural demand center (≈57.4% of revenue in 2024; ~USD 8.50 billion billion) and will drive the largest absolute dollar growth through 2034 on the back of sustained urbanization in China, India, Indonesia, and Vietnam. Robust transport corridors, metro systems, and industrial parks keep cement volumes high, while policy pushes to utilize coal-combustion byproducts reduce disposal and support circular-economy targets.

North America and Europe exhibit healthy demand for premium, beneficiated, and reclaimed ash amid coal-plant retirements that constrain fresh supply. Spec-driven public works, performance-based procurement, and widespread EPD adoption underpin value growth despite tighter volumes. Latin America and the Middle East & Africa are emerging opportunity corridors: infrastructure stimulus in Brazil, Mexico, and the GCC, alongside housing deficits and industrialization, is expanding the addressable market—particularly for bricks/blocks, road bases, and soil stabilization where cost and durability advantages translate into faster adoption from 2025 onward.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Product Type

- Class F

- Class C

By Application

- Cement and Concrete

- Bricks and Blocks

- Road Construction

- Soil Stabilization

- Mining

- Others

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 14.8 B |

| Forecast Revenue (2034) | USD 27.6 B |

| CAGR (2024-2034) | 7.8% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Product Type (Class F, Class C), By Application (Cement and Concrete, Bricks and Blocks, Road Construction, Soil Stabilization, Mining, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Ash Grove Cement Company, Dirk Group, Charah Solutions, Cement Australia Holdings Pty Ltd., Boral Ltd., Lafarge Holcim Ltd., Salt River Materials Group, CEMEX S.A.B de C.V., Ashtech (India) Pvt. Ltd., Separation Technologies LLC, Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date