Forestry Software Market Size & Share, Growth, Trends|CAGR of 10.39%

Global Forestry Software Market Size, Share, Analysis Report By Component Type (Software, Services) Technology Type (Geospatial, Cut-to-Length, Fire Detection) Deployment Type (On-Premises, Cloud Deployment) Application Type (Forest Inventory & Monitoring, Logging Management, Mapwork Harvester, Inventory & Logistics Management, Others) Industry Region & Key Players-Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends & Forecast 2025-2034

Report Overview

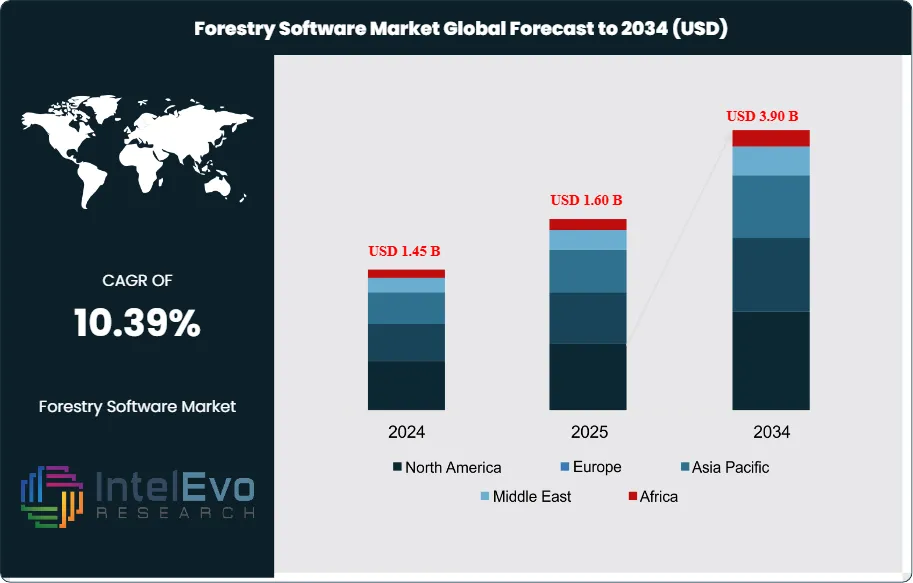

The Forestry Software Market size is expected to be worth around USD 3.90 Billion by 2034, from USD 1.45 Billion in 2024, growing at a CAGR of 10.39% during the forecast period from 2024 to 2034. The forestry software market encompasses comprehensive digital solutions designed to optimize forest management operations, including timber inventory tracking, harvesting management, geospatial mapping, and compliance monitoring.

Get More Information about this report -

Request Free Sample ReportThese software platforms enable forestry professionals to streamline workflows, enhance productivity, and ensure sustainable resource allocation across global forest ecosystems. The market serves diverse stakeholders including government agencies, forestry companies, timberland owners, pulp and paper industries, and consulting firms, providing integrated tools for forecasting, contract management, and regulatory compliance.

The forestry software market is experiencing robust growth driven by increasing digitalization of forestry operations and rising demand for sustainable forest management practices. Key growth catalysts include the integration of advanced technologies such as artificial intelligence, GIS mapping, remote sensing, and IoT devices that enhance operational efficiency and data-driven decision-making capabilities. The growing emphasis on environmental compliance and carbon credit tracking is pushing organizations to adopt sophisticated software solutions for accurate monitoring and reporting. Additionally, the shift toward cloud-based deployment models is accelerating market adoption by offering scalable, cost-effective solutions accessible from remote locations.

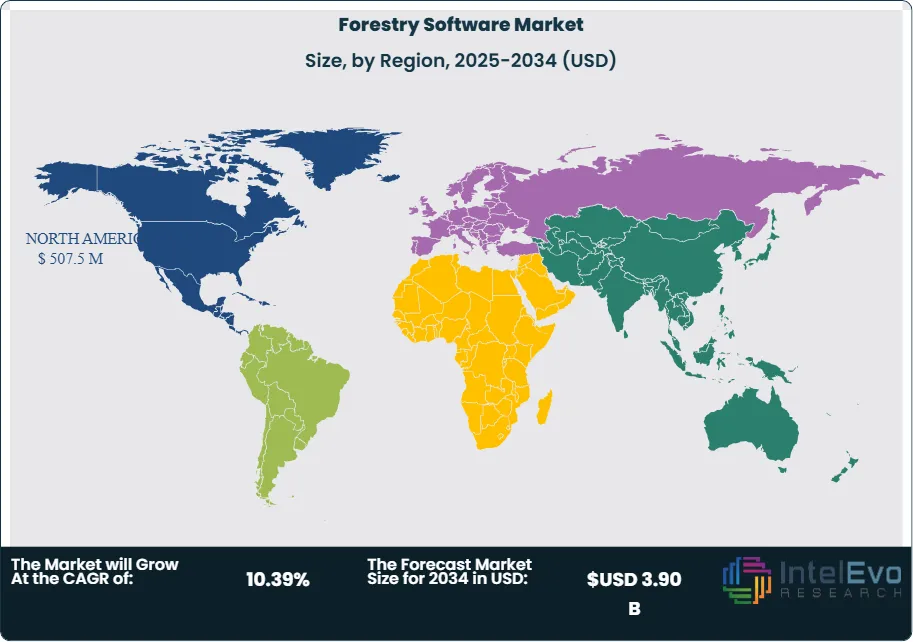

North America dominates the global forestry software market, this leadership position stems from early adoption of advanced technologies, established forestry infrastructure, and strong regulatory frameworks promoting digital transformation in forest management operations. The Asia-Pacific region represents the fastest-growing market segment, driven by increased investment from major players and growing awareness of forestry software benefits in countries like China and India. Europe maintains a significant market presence due to stringent environmental regulations and mature forestry sectors, while emerging markets in Latin America and Africa show promising growth potential.

The COVID-19 pandemic accelerated digital transformation initiatives across the forestry industry, as organizations sought remote-capable solutions to maintain operations during lockdowns and social distancing measures. The pandemic highlighted the importance of cloud-based forestry software platforms that enable distributed teams to collaborate effectively and access critical data from any location. While initial supply chain disruptions temporarily slowed market growth, the long-term impact has been positive, with increased recognition of digital tools' value in ensuring business continuity and operational resilience.

Trade tensions and geopolitical conflicts have influenced the forestry software market through supply chain complexities and regional technology adoption patterns. Export restrictions on advanced technologies have prompted some regions to develop indigenous software solutions, creating opportunities for local market players. Additionally, sustainability regulations driven by international climate agreements are pushing global adoption of forestry software for carbon accounting and environmental monitoring, creating standardized demand across different geopolitical regions.

Key Takeaways

- Market Growth: The Forestry Software Market is expected to reach USD 3.90 Billion by 2034, fueled by digital transformation initiatives and the growing need for sustainable forest management solutions.

- Component Type Dominance: Software components dominate the market share, driven by essential role in daily forest management operations.

- Technology Dominance: Geospatial technology leads the technology segment, primarily due to essential mapping and monitoring capabilities for forest management operations.

- Deployment Type Dominance: Cloud-based solutions lead the deployment segment due to scalability, accessibility, and cost-effectiveness.

- Application Dominance: Forest Inventory & Monitoring holds the largest share in the application segment, owing to critical need for resource tracking.

- Driver: Key drivers accelerating growth include increasing demand for sustainable forestry practices and technological advancements in AI and cloud computing, which boost market expansion through enhanced operational efficiency and data analytics capabilities.

- Restraint: Growth is hindered by high initial investment costs and lack of skilled workforce, which create challenges such as implementation barriers and reduced adoption rates among smaller organizations.

- Opportunity: The market is poised for expansion due to opportunities like emerging market penetration and advanced technology integration, which enable geographic diversification and enhanced functionality.

- Trend: Emerging trends including cloud migration and AI integration are reshaping the market by improving accessibility and enabling predictive analytics for forest management.

- Regional Analysis: North America leads owing to early technology adoption and established forestry infrastructure. Asia-Pacific shows high promise due to increased investment and growing technology awareness.

Component Type Analysis:

Software components play a pivotal role in modern forest management, emerging as the most influential segment within the industry. These specialized applications are integral to the daily operations of forest managers, offering comprehensive solutions for key tasks such as inventory tracking, harvest planning, regulatory compliance, and strategic resource allocation. The importance of this segment is further magnified by ongoing innovations in technology, including the integration of Geographic Information Systems (GIS), the use of remote sensing tools, and the application of advanced data analytics. These technological enhancements not only streamline operational workflows but also significantly improve the precision and reliability of decision-making processes, ultimately contributing to more sustainable and efficient forest management practices.

Technology Analysis:

Geospatial technology stands at the forefront of technological advancements in forest management, largely due to its indispensable capabilities in mapping, monitoring, and spatial analysis. This technology enables forestry professionals to visualize complex landscapes, assess forest conditions, and track changes in land use with a high degree of accuracy. By providing detailed geographic data, geospatial tools support critical tasks such as planning harvests, identifying high-risk areas for deforestation or fire, and evaluating the health and distribution of forest resources. The ability to integrate satellite imagery, aerial data, and GPS systems further enhances decision-making, allowing for more proactive and informed forest stewardship. As the need for sustainable and data-driven forestry practices grows, geospatial technology continues to serve as a vital asset in managing and preserving forest ecosystems effectively.

Deployment Type Analysis:

Cloud-based deployment has emerged as the preferred model in the forestry sector, signaling a significant transformation from conventional on-premises systems to more agile, scalable, and accessible digital platforms. This shift aligns with the industry's growing demand for real-time access to data, seamless collaboration across teams, and flexible deployment options that cater to the needs of geographically dispersed operations. By leveraging cloud technology, forestry organizations can manage resources remotely, streamline communication, and reduce the infrastructure and maintenance costs associated with traditional systems. Additionally, cloud platforms enhance data security, enable automatic updates, and support integration with other digital tools, making them an essential component in the modernization and efficiency of forest management practices.

Application Analysis:

Forest Inventory & Monitoring Leads With more than 20% Market Share In Forestry Software Market. Forest Inventory and Monitoring applications hold a central position in modern forestry, highlighting their essential role in tracking resources and ensuring regulatory adherence. These applications form the foundation of sustainable forest management by enabling precise monitoring of timber reserves, documenting harvesting operations, and maintaining compliance with evolving environmental standards. Their importance continues to grow as regulatory bodies demand more transparent and detailed reporting, while forest stakeholders place greater emphasis on responsible and sustainable resource utilization. By providing accurate data and real-time insights, these tools support informed decision-making and long-term planning, ultimately fostering accountability and ecological stewardship across forestry operations.

Region Analysis:

North America Leads With over 35% Market Share In Forestry Software Market. North America continues to lead the global forestry software market, a position supported by its well-established forestry infrastructure, widespread adoption of advanced digital technologies, and robust regulatory systems that prioritize sustainable forest management. The region's proactive approach to integrating software solutions into forest operations—ranging from planning and inventory tracking to compliance and analytics—has set a benchmark for other markets. In particular, the United States has emerged as a major contributor to this leadership, with a dynamic market characterized by continuous innovation and a strong focus on environmental stewardship.

Meanwhile, the Asia-Pacific region is emerging as the fastest-growing market for forestry software, propelled by rising investment from global technology providers and growing recognition of digital solutions' role in enhancing forest management. Rapid urbanization, environmental challenges, and heightened government focus on conservation have encouraged countries such as China and India to accelerate their adoption of smart forestry technologies. These nations are increasingly implementing digital tools to meet stricter environmental regulations, improve resource planning, and promote sustainable development.

Europe also holds a prominent position in the forestry software landscape. Its mature forestry industry, combined with rigorous environmental standards and monitoring requirements, has fueled consistent demand for advanced software platforms. European countries continue to rely on high-performance solutions for compliance reporting, ecological assessment, and long-term forest planning, further solidifying the region's role as a key player in the global market.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

Component Type

- Software

- Services

Technology Type

- Geospatial

- Cut-to-Length

- Fire Detection

Deployment Type

- On-Premises

- Cloud Deployment

Application Type

- Forest Inventory & Monitoring

- Logging Management

- Mapwork Harvester

- Inventory & Logistics Management

- Other Applications

Region:

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 1.60 B |

| Forecast Revenue (2034) | USD 3.90 B |

| CAGR (2025-2034) | 10.39% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Component Type (Software, Services) Technology Type (Geospatial, Cut-to-Length, Fire Detection) Deployment Type (On-Premises, Cloud Deployment) Application Type (Forest Inventory & Monitoring, Logging Management, Mapwork Harvester, Inventory & Logistics Management, Other Applications) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Trimble Inc., Esri, ATLAS Technology, Forest Metrix, TimberSmart, Plan-itGEO, Field Data Solutions, Creative Information Systems, Davey Resource Group (DRG), Remsoft |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the Forestry Software Market?

Forestry Software Market to reach USD 3.90 Billion by 2034, growing at 10.39% CAGR from 2024, driven by digital forestry, automation, and sustainable forest management.

Who are the major players in the Forestry Software Market?

Trimble Inc., Esri, ATLAS Technology, Forest Metrix, TimberSmart, Plan-itGEO, Field Data Solutions, Creative Information Systems, Davey Resource Group (DRG), Remsoft

Which segments covered the Forestry Software Market?

Component Type (Software, Services) Technology Type (Geospatial, Cut-to-Length, Fire Detection) Deployment Type (On-Premises, Cloud Deployment) Application Type (Forest Inventory & Monitoring, Logging Management, Mapwork Harvester, Inventory & Logistics Management, Other Applications)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date