Fraud Detection and Prevention Market Size, Growth & Forecast 2034

Global Fraud Detection and Prevention Market Size, Share, and Growth Analysis by Component (Solutions, Services), by Technology (AI & Machine Learning, Big Data Analytics, Biometrics, Behavioral Analytics), by Deployment Mode (Cloud-Based, On-Premise), by Application (Payment Fraud, Identity Theft, Cyber Fraud, Insurance Fraud), by End User (Banking & Financial Services, Retail & E-commerce, Healthcare, Government), Regional Outlook, Competitive Landscape, Market Dynamics, Trends, and Forecast 2025–2034

Report Overview

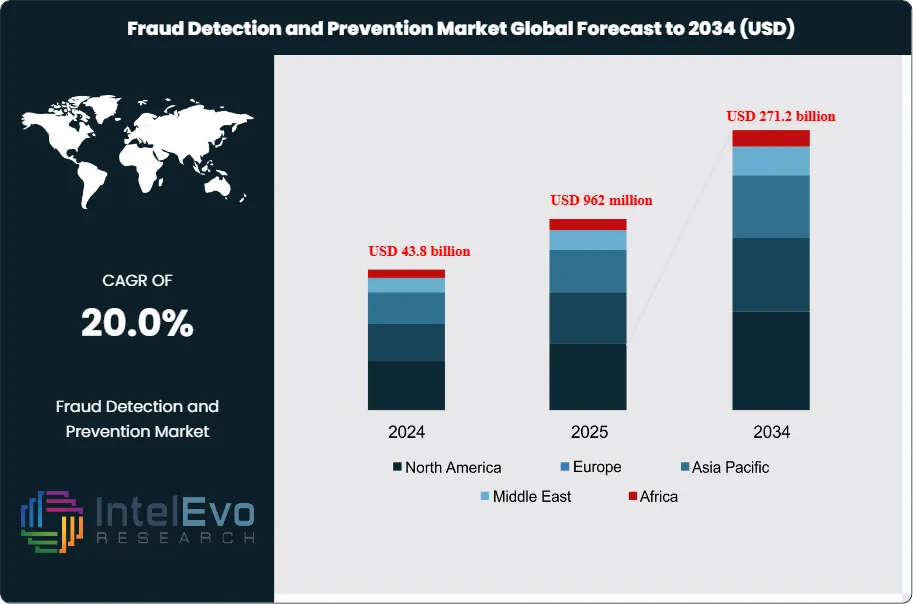

The Fraud Detection and Prevention Market is estimated at USD 43.8 billion in 2024 and is on track to reach roughly USD 271.2 billion by 2034, implying a compound annual growth rate of 20.0% over 2025–2034. This rapid expansion is driven by the surge in digital transactions, real-time payments, and e-commerce activities, which have significantly increased exposure to cyber fraud and financial crimes. Growing adoption of AI, machine learning, and behavioral analytics across banking, retail, healthcare, and government sectors is further accelerating demand. As regulatory scrutiny tightens and fraud techniques become more sophisticated, organizations are prioritizing advanced, scalable fraud prevention platforms as a core component of their digital risk management strategies.

Get More Information about this report -

Request Free Sample ReportRising digital transaction volumes, real-time payment rails, and cross-border e-commerce expand the attack surface for financial crime and drive demand for advanced fraud controls. Banks, insurers, payment processors, and fintechs account for an estimated 35% of global FDP spending, while e-commerce and retail represent about 20%, underscoring the role of high-velocity, card-not-present transactions.

On the supply side, the market is consolidating around analytics-led platforms that integrate risk scoring, identity verification, and case management. Vendors embed artificial intelligence and machine learning to screen data streams in milliseconds, lifting model hit rates by 20–30% and cutting false positives by up to 25%. Cloud deployments represent roughly 55% of new projects, supported by subscription pricing that improves affordability and speeds implementation for mid-market enterprises.

Regulation is a central growth driver. Data protection regimes, anti-money laundering directives, and real-time payment rules in North America, Europe, and Asia-Pacific mandate stronger transaction monitoring and customer due diligence. Non-compliance can trigger penalties that reach 3–4% of annual revenue in some jurisdictions, strengthening the case for modern FDP investment. At the same time, stricter privacy rules and data-localization requirements increase integration complexity and push vendors to offer regional data residency, privacy-by-design analytics, and explainable AI.

Risk dynamics remain fluid as fraudsters use automation, deepfakes, and synthetic identities. Account takeover, first-party fraud, and application fraud in digital lending and BNPL channels grow at double-digit rates, forcing institutions to refresh detection models often and link identity proofing with transaction monitoring. Implementation challenges persist, including model governance, integration with legacy cores, and shortages of analytics talent, which can delay enterprise-wide rollouts.

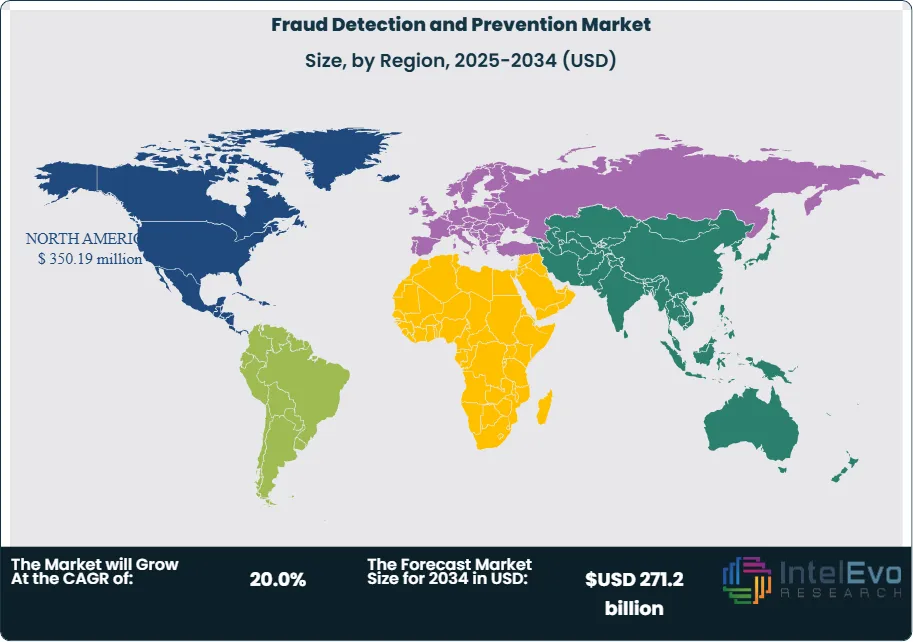

Regionally, North America contributes 35% of FDP revenue, supported by mature card markets and strong enforcement, while Europe holds 27% with a focus on authentication and AML compliance. Asia-Pacific is the fastest-growing region, with an expected CAGR above 23% as mobile payments and super-app ecosystems drive investment in scalable, cloud-native FDP platforms. Emerging hotspots in Latin America, the Middle East, and Africa adopt fraud-as-a-service and shared-utility models to spread costs and gain access to advanced analytics capabilities.

Key Takeaways

- Market Growth: The Fraud Detection and Prevention (FDP) market grows from USD 43.8 billion in 2024 to USD 271.2 billion by 2034, reflecting a 20.0% CAGR, 2024-2034.

- Segment Dominance : Solutions such as fraud analytics, governance, risk and compliance, and authentication systems command 66.1% market share, 2023. Vendors in this segment deepen functionality and integration to defend this 66.1% share, 2023.

- Segment Dominance: Payment fraud leads FDP use cases with 47.5% share, 2023 as online banking, e-commerce, and digital wallets accelerate exposure.

- Driver: Rising transaction volumes in BFSI and digital commerce drive a 20.0% CAGR, 2024-2034 in FDP spending as institutions seek to protect high-value flows.

- Restraint: High upfront and integration costs limit adoption among small and mid-sized enterprises, leading to estimated: 0.8 billion USD, 2024 in postponed FDP investments.

- Opportunity: Cloud-native and modular FDP platforms unlock estimated: 5.0 billion USD, 2024 in incremental opportunity, particularly for subscription-based offerings to mid-market firms.

- Trend: Large enterprises account for 72.8% of FDP adoption, 2023, while the BFSI sector holds 27.6% share, 2023, showing a trend toward complex, enterprise-wide risk architectures.

- Regional Analysis: North America leads with 43.1% market share, 2023, supported by mature digital infrastructure and strong regulatory oversight. Asia-Pacific and other emerging regions track an estimated: 22.0% CAGR, 2024-2034 as digital payment volumes grow.

By Component

The market in 2025 continues to show a strong shift toward solution-based platforms as enterprises respond to rising fraud risk across digital channels. Solutions account for more than 66 percent of global spending in 2024 and maintain the largest share in 2025 as organizations prioritize fraud analytics, governance, risk and compliance systems, and identity authentication tools. These platforms support real-time analysis, automated case management, and identity assurance, which are now baseline requirements for financial institutions and large enterprises facing high transaction volumes.

Demand for solutions accelerates as fraud patterns grow more complex. Companies deploy machine learning engines and behavioral analytics to reduce false positives and identify hidden anomalies in data streams. Adoption increases across banking, telecom, healthcare, and retail as firms transition from manual review processes to automated models that improve detection accuracy. Authentication systems also gain importance, especially as biometric verification and multi-factor authentication become standard in regulated industries.

Service providers expand their roles as enterprises seek support for implementation, threat monitoring, and compliance management. Managed services report double-digit growth in 2025 as companies pursue continuous monitoring without expanding in-house teams. Professional services remain essential for architecture design, regulatory alignment, and model calibration. Together, services complement core solutions and enable organizations to operate fraud programs with higher efficiency.

By Application

Payment fraud continues to hold the largest application share, maintaining more than 47 percent of deployments in 2024 and 2025. Growth aligns with rapid expansion in e-commerce, instant payments, and digital wallets across Asia Pacific, North America, and Europe. The rise of unauthorized transactions and card-not-present fraud pressures banks and merchants to adopt real-time screening tools. AI-enabled scoring models and transaction risk engines help institutions detect suspicious activity within milliseconds.

Money laundering monitoring advances quickly as financial regulators strengthen enforcement activity. Banks invest in compliance analytics to meet tighter AML obligations and reduce audit penalties. Identity theft also expands as attackers exploit stolen credentials and synthetic identities. This increases demand for identity analytics, biometric verification, and device intelligence across telecom, insurance, and digital finance platforms.

Other applications such as account takeover detection and insider risk monitoring gain traction as enterprises digitize workflows. Organizations use event correlation, access monitoring, and user-behavior analytics to reduce internal vulnerabilities. Broadening application areas indicate a strategic shift from isolated fraud prevention to enterprise-wide risk programs.

By Enterprise Size

Large enterprises remain the primary adopters, representing more than 72 percent of global spending in 2024 and retaining dominance through 2025. Their scale, regulatory exposure, and distributed operations create a critical need for advanced fraud systems. These organizations process high-volume transactions and require machine learning engines, cloud-based analytics, and automated compliance platforms to support real-time decisioning. They also manage complex IT environments, which makes integrated fraud architectures essential.

Small and medium enterprises show rising adoption in 2025 as cloud platforms reduce deployment costs. SMEs increasingly adopt subscription-based FDP tools tailored for e-commerce, fintech, and digital service providers. Growth is strongest in Southeast Asia, Latin America, and the Middle East, where online retail expansion increases exposure to fraud. Even with this momentum, SMEs continue to face budget constraints and limited in-house expertise, which slows adoption in highly regulated segments.

Overall, enterprise size dictates technology maturity. Large enterprises lead deployments of predictive analytics and behavioral biometrics, while SMEs focus on practical, cloud-native options that offer faster onboarding and lower complexity.

By End-Use Industry

The BFSI sector remains the largest end-use segment, with more than 27 percent market share in 2024 and stable growth in 2025. Banks and insurers continue to invest heavily in crime monitoring, identity validation, and transaction analytics as fraud threats increase with digital banking adoption. Telecom operators strengthen authentication and account security to reduce SIM-based fraud and protect subscriber data.

Healthcare providers grow adoption in response to rising medical identity theft, insurance fraud, and patient data breaches. Retail and e-commerce firms invest in AI-driven fraud scoring to manage increasing online transaction volumes. Governments expand use of FDP systems to secure public benefits programs and protect citizen data from identity misuse.

Manufacturing and industrial firms show steady adoption as connected devices and remote operations expand. As operational technology environments become targets for fraudulent access and data manipulation, cybersecurity and fraud teams coordinate their monitoring strategies more closely.

By Region

North America maintains its leadership with more than 43 percent of global revenue in 2024, supported by mature digital payments infrastructure, strong regulatory supervision, and high adoption among banks and large enterprises. U.S. institutions continue to implement advanced analytics and authentication technologies to reduce financial and reputational risks. Canada expands investment in compliance-focused platforms that align with PIPEDA and AML regulations.

Europe shows stable demand as financial institutions adapt to PSD2 requirements and strengthen strong customer authentication. The region’s focus on data protection and cross-border financial security drives broader use of identity analytics and AML platforms. Asia Pacific delivers the fastest growth in 2025, propelled by rapid expansion of digital wallets, super apps, and real-time payment systems in India, China, and Southeast Asia.

Latin America and the Middle East and Africa report rising adoption as fintech ecosystems scale. Markets such as Brazil, Mexico, the United Arab Emirates, and South Africa introduce fraud controls to support online banking, government payments, and expanding e-commerce activities. Growing digital participation across these regions accelerates investment in cloud-based fraud platforms that provide rapid detection and regulatory alignment.

Get More Information about this report -

Request Free Sample ReportKey Market Segments

Component

- Solutions

- Fraud Analytics

- Governance, Risk, and Compliance

- Authentication

- Services

- Managed Services

- Professional Services

Application

- Payment Fraud

- Money Laundering

- Identity Theft

- Other Applications

Enterprise Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

End-Use Industry

- IT & Telecommunications

- BFSI

- Healthcare

- Retail & E-commerce

- Manufacturing

- Government

- Other End-Use Industries

Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 43.8 billion |

| Forecast Revenue (2034) | USD 271.2 billion |

| CAGR (2024-2034) | 20.0% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Component, Solutions, Fraud Analytics, Governance, Risk, and Compliance, Authentication, Services, Managed Services, Professional Services, Application, Payment Fraud, Money Laundering, Identity Theft, Other Applications, Enterprise Size, Large Enterprises, Small & Medium Enterprises (SMEs), End-Use Industry, IT & Telecommunications, BFSI, Healthcare, Retail & E-commerce, Manufacturing, Government, Other End-Use Industries |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | NICE Systems Ltd., Experian plc, RSA Security LLC, FICO, IBM Corporation, ACI Worldwide Inc., LexisNexis, SAP SE, Software AG, Fiserv, Inc., SAS Institute Inc., Oracle Corporation, Other Key Players, |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Fraud Detection and Prevention Market

Published Date : 09 Jan 2026 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date