Fructooligosaccharide (FOS) Market Size, Trends & Forecast 2034 | 9.2% CAGR

Global Fructooligosaccharide Market Size, Share, Analysis Report By Source (Chicory, Sucrose, Form, Powder, Liquid), Application (Food & Beverages, Pharmaceuticals, Infant Formulation, Pet/Animal Feed, Dietary Supplements, Others), Region and Key Players - Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends and Forecast 2025-2034

Report Overview:

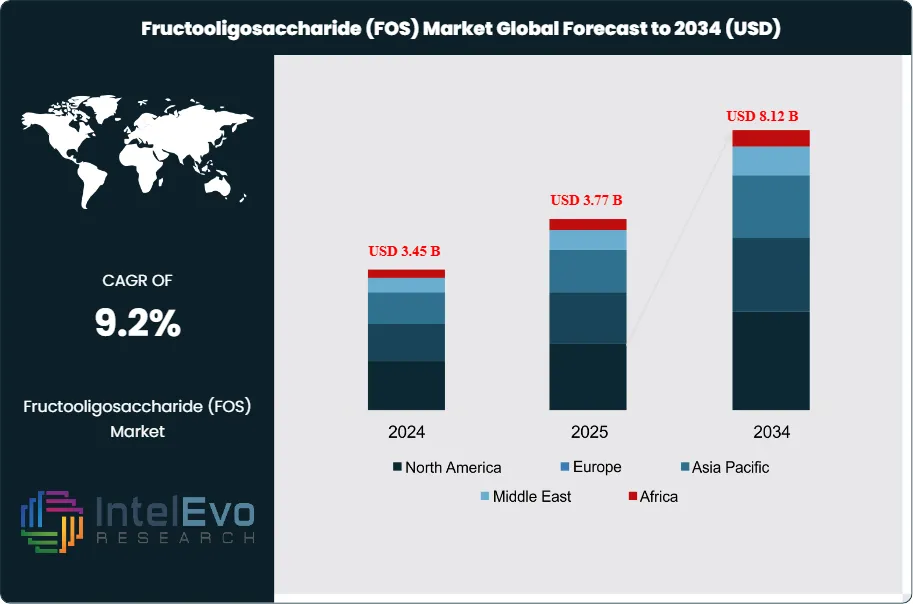

The Fructooligosaccharide (FOS) Market size is projected to reach USD 8.12 Billion by 2034, up from USD 3.45 Billion in 2024, growing at a CAGR of 9.2% during the forecast period from 2025 to 2034. Rising consumer demand for natural prebiotics, increasing awareness of gut health, and the surge in functional food and beverage applications are driving rapid growth in the FOS market. With the growing shift toward clean-label and plant-derived ingredients, the industry is witnessing strong traction among health-conscious consumers and food manufacturers alike.

Get More Information about this report -

Request Free Sample ReportFructooligosaccharides (FOS) are a type of prebiotic fiber consisting of short chains of fructose molecules. These non-digestible oligosaccharides occur naturally in certain plants, such as chicory root, onions, and garlic, and they have gained considerable attention for their health benefits, particularly for improving gut health. FOS is used primarily in functional foods, beverages, dietary supplements, and pharmaceuticals for its ability to promote the growth of beneficial gut bacteria, enhance digestive health, and boost immune function. With increasing awareness of health and wellness, the demand for FOS has surged across various applications. The global Fructooligosaccharide (FOS) market has experienced steady growth and is anticipated to continue expanding due to its natural origin, health benefits, and rising consumer preference for clean label and natural ingredients.

Poised for steady growth, driven by increasing consumer demand for prebiotics, natural health products, and functional foods. The market is witnessing strong growth in developed regions such as North America and Europe, while the Asia-Pacific region presents the highest growth opportunities. The ongoing trend toward health and wellness, coupled with increasing awareness about gut health, immune function, and the demand for natural ingredients, will continue to propel the market forward. However, market participants must address challenges such as high production costs and competition from alternative prebiotics.

The COVID-19 pandemic had a noticeable impact on the Fructooligosaccharide (FOS) market. During the pandemic, there was an increased focus on immunity, gut health, and overall wellness, leading to a surge in demand for prebiotics like FOS. With consumers becoming more health-conscious, many turned to functional foods, dietary supplements, and other wellness products to boost their immunity and digestive health during the pandemic. However, the supply chain disruptions caused by the pandemic impacted the production and distribution of FOS. Logistical challenges and restrictions on trade led to delays in the delivery of raw materials, especially those sourced from chicory, which is a primary raw material for FOS production. Despite these challenges, the overall market resilience and growing demand for prebiotic ingredients ensured that the market for FOS remained strong.

Key Takeaways:

- Market Growth: The Fructooligosaccharide (FOS) Market is expected to reach USD 8.12 Billion by 2034, growing at a robust CAGR of 9.2%, the growing middle class in these countries is driving the demand for functional foods and health-enhancing ingredients, with FOS being a popular choice.

- Source Dominance: Chicory remains the dominant source due to its natural composition and high inulin content, while sucrose-based FOS is witnessing rising demand due to its cost-effectiveness and growing industrial applications.

- Form Dominance: Powdered FOS leads the market due to its stability, longer shelf life, and ease of handling. However, the liquid segment is projected to grow steadily, driven by rising demand in beverages and liquid nutritional products.

- Application Dominance: Food & beverages dominate the market, driven by growing consumer demand for functional foods. The dietary supplements segment is expected to see significant growth due to the increasing focus on gut health and immune support.

- Driver: The growing consumer focus on digestive health and the increasing use of functional ingredients in the food & beverage industry are key drivers for the FOS market. Rising awareness of prebiotics’ role in enhancing gut microbiota is encouraging demand across multiple sectors.

- Restraint: High production costs and limited consumer awareness in emerging economies are key restraints. Additionally, inconsistent regulations across regions may limit product standardization and market penetration.

- Opportunity: Rising demand for plant-based and clean-label ingredients, combined with increased R&D in prebiotic formulations, offers vast market potential for FOS. Expanding applications in infant formula and animal nutrition also present untapped growth areas.

- Trend: The FOS market is witnessing innovation in delivery forms and formulation strategies. Collaborations and acquisitions by major players to expand their prebiotic portfolios are also a significant trend.

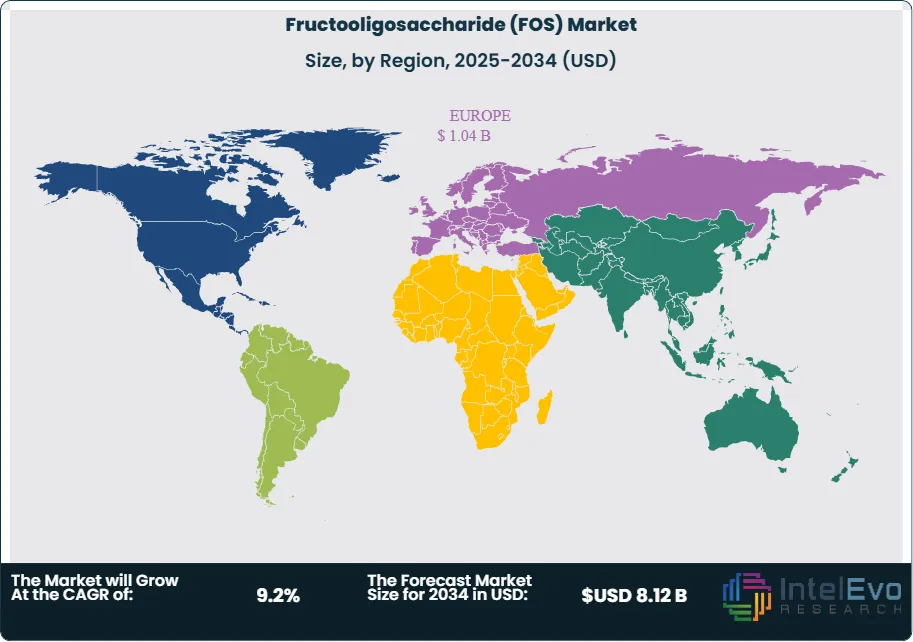

- Regional Analysis: Europe and North America lead in terms of market size due to their focus on health-conscious consumers and the increasing demand for functional foods and dietary supplements.

Source Analysis:

Chicory currently leads the market owing to its natural origin, superior inulin content, and clean-label acceptance among consumers. Its established presence in health foods and wide application range across regions gives it a competitive edge.

Sucrose-based FOS is poised for significant growth due to cost-efficiency, large-scale availability, and increasing demand from developing countries where affordability and scalability are critical. As R&D improves enzymatic yield and purity, sucrose is expected to expand its footprint across multiple industries.

Form Analysis:

Powdered FOS is widely used in functional foods, dietary supplements, infant nutrition, and bakery products due to its easy incorporation into dry formulations. Its solid form allows for superior shelf stability, simplified transportation, and longer storage without degradation. The powdered form is also preferred in regions with stringent food safety regulations as it minimizes microbial contamination risks.

Liquid FOS is gaining attention due to its solubility, prebiotic function, and sweetening ability in a wide array of beverage products, including juices, smoothies, and dairy drinks. It also acts as a viscosity enhancer in syrups and sports nutrition products. The liquid form is particularly beneficial for manufacturers seeking to avoid the dust and mixing complications of powders.

Application Analysis:

Food & Beverages Leads With more than 40% Market Share In Fructooligosaccharide (FOS) Market. The food & beverages sector remains the largest application for FOS due to the growing trend of functional foods that offer health benefits beyond basic nutrition. FOS is used in this sector as a prebiotic, sweetener, and fiber in products like dairy, juices, snack bars, and baked goods. It not only improves taste but also enhances digestive health, as FOS serves as food for beneficial gut bacteria. The increasing demand for low-calorie, sugar-free, and high-fiber food and beverage products is fueling FOS adoption.

The dietary supplements segment is experiencing significant growth due to an increased focus on gut health, immunity, and overall well-being. As more consumers adopt preventive health practices, there is a rising demand for supplements that aid in digestion, gut flora balance, and immune system support.

Region Analysis:

Europe Leads With over 30% Market Share In Fructooligosaccharide (FOS) Market. Europe and North America dominate the FOS market due to strong demand from health-conscious consumers seeking low-calorie, functional foods, and dietary supplements. In North America, the market for prebiotics like FOS has grown, particularly in the functional food, beverage, and supplement sectors. A shift toward natural ingredients, clean-label products, and digestive health solutions is contributing to increased FOS consumption. In Europe, the growing preference for plant-based, sugar-free, and fiber-enriched food products boosts the adoption of FOS. Additionally, the aging population in these regions, seeking immunity-boosting and digestive health solutions, supports market growth.

The Asia-Pacific region is expected to experience the highest growth rate in the FOS market due to the region's expanding population, rising health awareness, and increasing urbanization. Countries like China, India, and Japan are witnessing growing demand for prebiotic fibers in food, beverages, and dietary supplements.

While still a smaller market, Latin America and Middle East & Africa are witnessing gradual growth in FOS consumption.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

By Source

- Sucrose

- Chicory

- Inulin

- Other Plant Sources

By Form

- Liquid FOS

- Powder FOS

By Application

- Food & Beverages

- Dairy Products

- Bakery & Confectionery

- Beverages

- Dietary Supplements

- Animal Feed

- Pharmaceuticals

- Infant Nutrition

- Others

By End User

- Food Manufacturers

- Nutraceutical Companies

- Animal Feed Producers

- Pharmaceutical Companies

By Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 3.77 B |

| Forecast Revenue (2034) | USD 8.12 B |

| CAGR (2025-2034) | 9.2% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Source: Sucrose, Chicory, Inulin, Other Plant Sources, By Form: Liquid FOS, Powder FOS, By Application: Food & Beverages, Dietary Supplements, Animal Feed, Pharmaceuticals, Infant Nutrition, Others, By End User: Food Manufacturers, Nutraceutical Companies, Animal Feed Producers, Pharmaceutical Companies |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Tate & Lyle PLC, Beneo, Tata Chemicals, Biosynth, Brenntag SE, Meiji Holdings Co. Ltd., Cargill Incorporated, ELICITYL, Tereos Group, Galam Group, Ingredion, Jarrow Formulas Inc., New Francisco Biotechnology Corporation, Quantum Hi-Tech, Nutra Food Ingredients |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Fructooligosaccharide Market

Published Date : 30 Jun 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date