Fruit & Vegetable Juice Market Size, Growth & Forecast | 8.7% CAGR

Global Fruit and Vegetable Juice Market Size, Share & Analysis By Product Type (Fruit & Vegetable Blend, Fruit Juices, Vegetable Juices), By Type (Regular Juice, Low-Sugar, Fortified), By Distribution Channel (Convenience Stores, Supermarkets/Hypermarkets, Online, Other Distribution Channels), Health & Wellness Trends, Clean-Label Demand, Regional Insights & Forecast 2025–2034

Report Overview

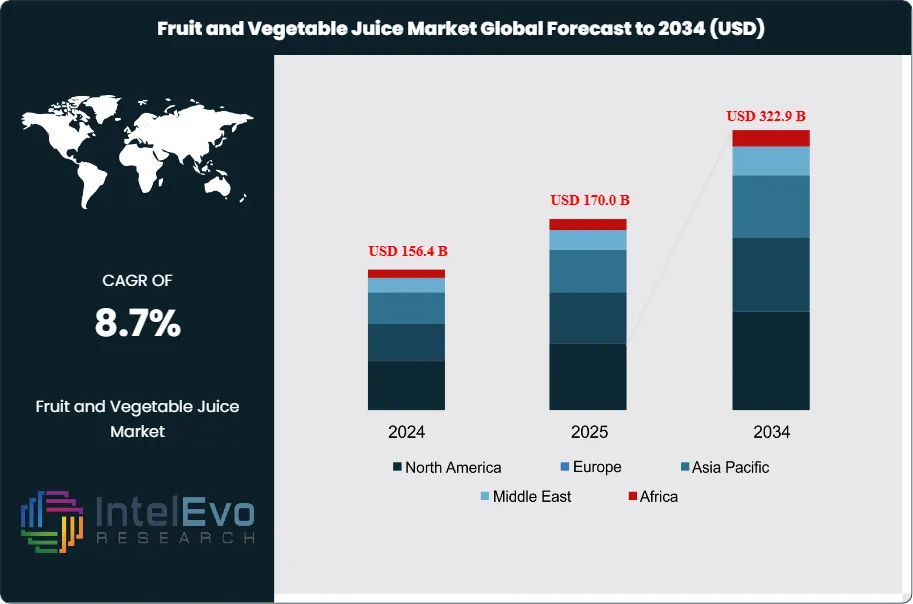

The Fruit and Vegetable Juice Market is valued at approximately USD 156.4 billion in 2024 and is projected to reach nearly USD 322.9 billion by 2034, expanding at a CAGR of around 8.7% during 2025–2034. Rising health consciousness, functional juice innovations, and the surge in cold-pressed, organic, and immunity-boosting blends are reshaping category demand worldwide. Consumers are increasingly shifting from sugary carbonated drinks to natural, nutrient-dense juice formats, driving strong retail momentum. Clean-label formulations, premium fruit blends, and convenient on-the-go packaging are becoming major growth accelerators, making this one of the most vibrant segments in the global beverages market.

Get More Information about this report -

Request Free Sample ReportFollowing a steady recovery from pandemic-era channel disruptions, the category has shifted from volume-led to value-led growth as consumers’ trade up to not-from-concentrate (NFC), cold-pressed, and functional blends. Historically, demand expanded at approximately 4–5% CAGR between 2018 and 2024, but the forecast period is characterized by premiumization and healthier formulation trends that lift average selling prices and expand margins.

On the demand side, rising health consciousness, the mainstreaming of “5-a-day” nutrition, and the search for immune and gut-health benefits are propelling double-digit growth in functional SKUs; products fortified with vitamins, probiotics, or fiber are projected to outpace the total market by 300–500 basis points.

Supply-side drivers include improved year-round availability via diversified sourcing and cold-chain investments, while recurring challenges stem from agricultural yield volatility, climate-related shocks in citrus and apple harvests, and tightening sugar and labeling regulations. Sugar taxes and front-of-pack nutrition schemes, now active or proposed in more than 40 markets, are accelerating reformulation toward low/no-added-sugar lines, which are growing at an estimated 8–9% annually.

Technology is reshaping product quality and route-to-market: high-pressure processing (HPP) and advanced aseptic lines extend shelf life without compromising flavor, with processing costs declining an estimated 15–20% over five years; AI-enabled demand forecasting and precision agriculture improve raw-material planning and reduce waste; and digital traceability elevates provenance as a purchase cue. Notably, e-commerce and quick-commerce together account for an estimated 10–12% of retail juice sales in leading urban markets, compounding at >15% as basket sizes shift online.

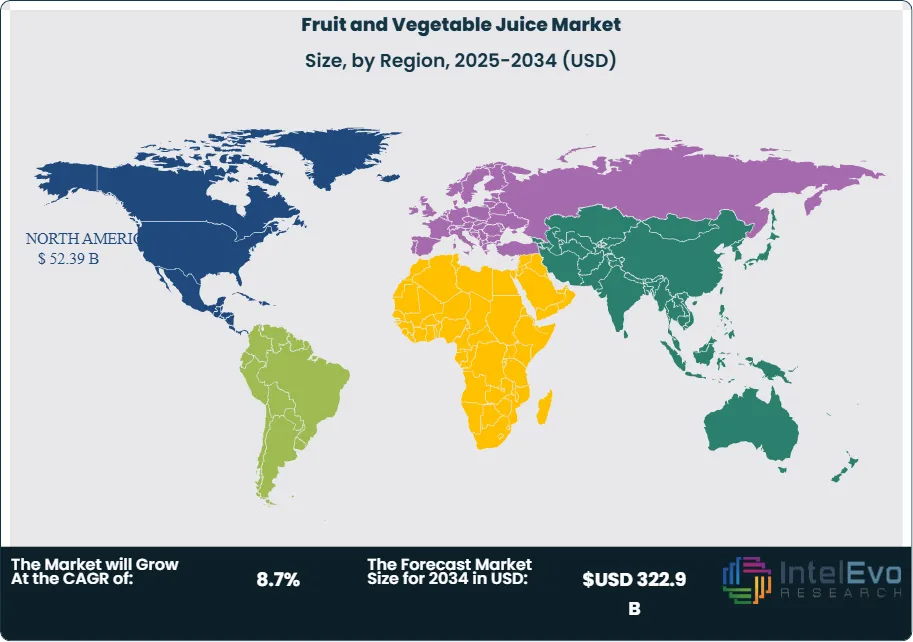

Regionally, North America and Western Europe remain high-value, regulation-intensive markets with stable 3–4% growth, while Asia Pacific is the clear volume and growth engine, projected at 8–9% CAGR on the back of urbanization, modern trade expansion, and rising middle-class incomes in China, India, and Southeast Asia. Latin America offers strategic citrus supply advantages and growing domestic consumption, and the Gulf states are emerging premium import hubs. Investment hotspots include HPP-enabled premium brands, NFC and vegetable-forward blends, recyclable lightweight PET and carton packaging, and omnichannel platforms targeting Tier-2/3 cities across Asia.

Key Takeaways

- Market Growth: The global Fruit & Vegetable Juice market is projected to reach USD 322.9 billion by 2034, up from USD 156.4 billion in 2024, reflecting a 8.7% CAGR driven by health-and-wellness positioning, premiumization (NFC, cold-pressed), and wider modern retail access.

- Segment Dominance – Product Type: Fruit juices led with a 62.3% revenue share in 2024, underpinned by orange and apple lines from majors such as Tropicana Brands Group and Coca-Cola’s Minute Maid/Simply; vegetable and blended juices comprise the remaining ~37.7%, gaining traction for lower sugar profiles and functional nutrition.

- Segment Dominance – Distribution Channel: Supermarkets/Hypermarkets accounted for 52.3% of sales in 2024 due to assortment breadth and promotions, while online grocery and DTC together are estimated at ~10–12% of category sales in leading urban markets and compounding >15% annually.

- Driver: Rising health consciousness and “food as medicine” behaviors are accelerating uptake of fortified SKUs (vitamins, probiotics, fiber), which are outpacing the total market by an estimated 300–500 bps, supported by clean-label claims and cold-chain availability.

- Restraint: Agricultural yield volatility and climate-related shocks in citrus and apple supply elevate input costs and price dispersion; in poor harvest years, raw commodity spikes of 20–30% can compress margins and trigger selective price increases or pack-size reductions.

- Opportunity: Asia Pacific is the clear growth engine, expected to expand at ~8–9% CAGR, supported by urbanization, rising mid-income consumption in China, India, and Southeast Asia, and modern trade penetration—likely contributing >40% of absolute global revenue growth to 2034.

- Trend: High-pressure processing (HPP) and advanced aseptic filling are scaling, enabling longer shelf life without preservatives; processing efficiencies have lowered per-liter costs by ~15–20% over five years, catalyzing premium cold-pressed launches from players like Suja and Innocent.

- Regional Analysis: North America held 33.5% of global revenue in 2024, with steady 3–4% growth amid sugar-reduction and functional trends; Western Europe remains regulation-intensive but premium-oriented; Asia Pacific leads in volume and growth; GCC markets emerge as premium import hubs, while Latin America offers strategic citrus sourcing alongside improving domestic demand.

Product Type Analysis

Fruit juices remain the anchor category, holding an estimated 62.3% share in 2024 and retaining leadership through 2025 on the strength of orange and apple lines from scaled brands and private labels. While volumes are steady, the value mix is shifting toward not-from-concentrate (NFC) and cold-pressed SKUs, lifting average selling prices and supporting mid-single-digit growth even in mature markets.

Vegetable juices are smaller in absolute terms but are expanding faster as consumers seek lower-sugar, nutrient-dense options; carrot, beet, and tomato ranges are projected to grow at roughly 7–8% CAGR through 2030, supported by HPP and aseptic processing that enhance freshness without preservatives. Fruit-and-vegetable blends are emerging as a sweet spot, marrying palatability with function (e.g., apple–carrot–ginger); this subcategory is expected to outpace the total market by 200–300 bps as immunity, gut health, and energy claims resonate with urban, on-the-go consumers.

Type Analysis

Regular juice accounted for just over 53% of sales in 2024 and will remain the volume workhorse, particularly in family multipacks and foodservice. Nonetheless, its share is expected to edge down to ~49–50% by 2030 as policy (sugar taxes, front-of-pack labels) and retailer targets for sugar reduction redirect growth to reformulated lines.

Low-sugar (no-added-sugar/low-calorie) juices are the fastest-growing type, projected at ~8–9% CAGR through 2030 on the back of NFC bases, fruit-and-veg blends, and natural sweeteners. Fortified juices—enriched with vitamins, fiber, electrolytes, or probiotics—are scaling as “food-as-medicine” gains traction; this segment is expected to approach a ~20–22% share by 2030, with functional SKUs typically commanding 10–20% price premiums and higher repeat rates.

Distribution Channel Analysis

Supermarkets/Hypermarkets captured ~52.3% of category sales in 2024 and will remain the primary purchasing venue through 2025, aided by breadth of assortment, private-label expansion, and end-cap promotions. Retailers are also allocating more chilled space to NFC and HPP ranges, improving trial and trading consumers up from ambient cartons.

Convenience stores leverage single-serve and immediate-consumption missions, sustaining a ~20–22% share, particularly for 250–350 ml PET and can formats tied to breakfast and snacking occasions. Online (e-grocery, quick-commerce, and DTC subscriptions) accounts for an estimated 10–12% of sales in leading urban markets and is compounding >15% annually, supported by basket bundling, scheduled delivery, and discovery of premium niche brands. Specialty and health stores, cafés, and local markets (Other channels) provide incremental reach for artisanal and functional SKUs despite lower overall share.

Regional Analysis

North America led with ~33.5% revenue share in 2024 and is expected to post steady 3–4% value growth through 2030, driven by premiumization (NFC, cold-pressed) and functional fortification. Europe remains a high-value, regulation-intensive market; sugar and labeling rules are accelerating reformulation and supporting higher-margin lines, though overall growth is moderate at ~2–3% amid mature per-capita consumption.

Asia Pacific is the clear growth engine, projected at ~8–9% CAGR as modern trade expands in China, India, and Southeast Asia, supported by rising middle-income households and rapid e-commerce adoption; the region is likely to contribute >40% of absolute global growth through 2030. Latin America combines strategic citrus supply with improving domestic demand (5–6% CAGR), while the Middle East & Africa, led by GCC import hubs and urbanizing African metros, is expected to grow ~6–7%, favoring premium imports and ambient formats where cold-chain is limited.

Get More Information about this report -

Request Free Sample ReportKey Market Segmentation

By Product Type

- Fruit & Vegetable Blend

- Fruit Juices

- Vegetable Juices

By Type

- Regular Juice

- Low-Sugar

- Fortified

By Distribution Channel

- Convenience Stores

- Supermarkets/Hypermarkets

- Online

- Other Distribution Channels

By Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 156.4 B |

| Forecast Revenue (2034) | USD 322.9 B |

| CAGR (2024-2034) | 8.7% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Product Type (Fruit & Vegetable Blend, Fruit Juices, Vegetable Juices), By Type (Regular Juice, Low-Sugar, Fortified), By Distribution Channel (Convenience Stores, Supermarkets/Hypermarkets, Online, Other Distribution Channels) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Welch Foods, Inc., Citrus World Inc., The Kraft Heinz Company, Fresh Del Monte Produce, Ocean Spray Cranberries, Inc., Campbell Soup Company, PepsiCo Inc., Keurig Dr Pepper Inc., Nestle S.A., Reed’s, Inc., Del Monte Foods, Eckes-Granini Group, Dr. Pepper Snapple Group, The Coca-Cola Company |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Fruit and Vegetable Juice Market

Published Date : 25 Nov 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date