GameFi Market Size & Share, Growth, Trends | CAGR of 6.5%

Global GameFi Market Size, Share, Analysis Report By Product Type (Move-to-Earn Games, Metaverse-Based Games, Play-to-Earn (P2E) Games) Technology Component (NFTs, Smart Contracts, Blockchain Infrastructure) Distribution Channel (Centralized Exchanges, Independent App Stores, Online Marketplaces/DApps) End User (Gaming Guilds, Investors/Speculators, Gamers) Industry Region & Key Players-Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends & Forecast 2025-2034

Report Overview

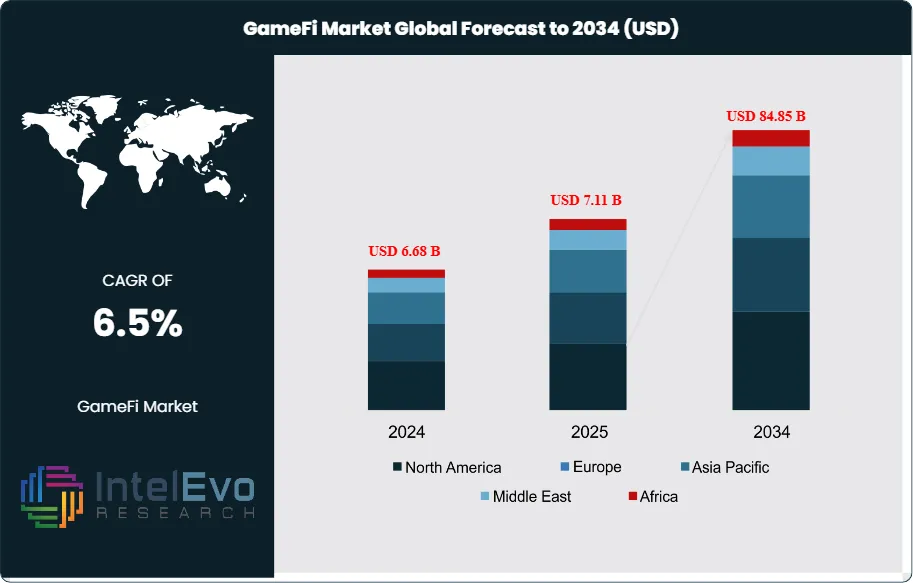

The GameFi Market size is expected to be worth around USD 84.85 billion by 2034, rising from USD 6.68 billion in 2024, and expanding at a CAGR of 6.5% during the forecast period from 2024 to 2034. This growth is supported by the increasing adoption of blockchain-based gaming, play-to-earn (P2E) models, and NFT-driven digital asset ownership among global gamers. Advancements in Web3 infrastructure, integration of decentralized finance (DeFi) mechanics, and growing interest from mainstream gaming studios are further positioning GameFi as a key convergence point of gaming, finance, and digital economies.

Get More Information about this report -

Request Free Sample ReportThe GameFi market, a fusion of gaming and decentralized finance (DeFi), is reshaping the digital entertainment landscape by enabling players to earn financial rewards while playing blockchain-based games. The keyword “GameFi” refers to play-to-earn ecosystems that integrate non-fungible tokens (NFTs), cryptocurrencies, and smart contracts to provide both entertainment and monetary incentives. The market’s growth is driven by the rising adoption of blockchain technology, increasing investment from venture capital firms, and the rapid popularity of NFT-based in-game assets. Moreover, the surge in mobile gaming and the growing interest in metaverse platforms are further fueling the demand for GameFi solutions. Factors such as enhanced internet penetration, wider cryptocurrency acceptance, and the desire for decentralized ownership of digital assets are also shaping the industry trajectory.

However, the GameFi market faces challenges alongside its opportunities. Regulatory uncertainty surrounding digital currencies, risks of volatile token prices, and concerns over cybersecurity pose potential hurdles for sustained growth. Scalability issues on blockchain networks and the complexity of onboarding new players who may not be familiar with cryptocurrency wallets also affect market expansion. Despite these challenges, continuous innovation in gaming models—such as play-to-earn (P2E), move-to-earn (M2E), and guild-driven ecosystems—is expected to attract both players and institutional investors. Strong collaborations between game developers and blockchain platforms are set to enhance user experience and market credibility.

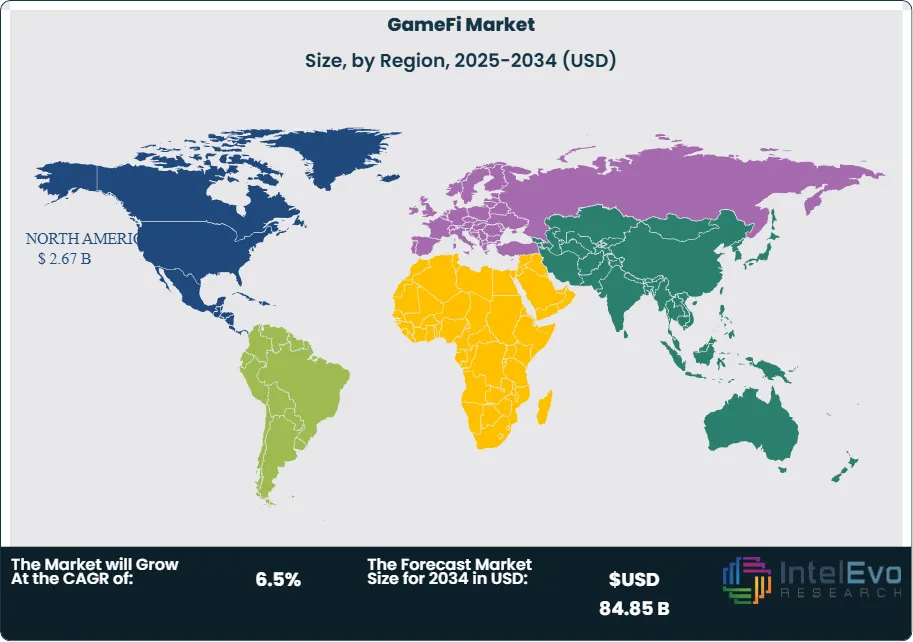

From a regional perspective, Asia-Pacific currently leads the GameFi market, owing to a large base of tech-savvy gamers in countries like China, South Korea, and Japan, alongside growing crypto adoption in Southeast Asia. North America follows closely, driven by venture capital investment and high blockchain adoption rates, while Europe demonstrates steady growth with increasing regulatory clarity and active gaming communities. Emerging markets in Latin America and Africa are also witnessing a rise in GameFi adoption, largely due to the appeal of supplemental income opportunities through play-to-earn models.

The COVID-19 pandemic significantly influenced the GameFi market, as extended lockdowns increased online gaming activity and accelerated digital asset adoption. Many individuals turned to play-to-earn platforms as an alternative income source during economic uncertainty. This trend boosted user participation and transaction volumes across multiple blockchain gaming platforms.

Nevertheless, geopolitical tensions and trade conflicts between major economies have had complex effects on the GameFi market. Tariffs on hardware components like graphic cards, increased regulatory scrutiny on cross-border crypto transactions, and sanctions affecting blockchain developers have raised operational costs. For example, conflicts between the U.S. and China have created uncertainty for blockchain-based investments and limited collaborations in technology transfer, slowing down certain GameFi projects.

On the other hand, international trade deals and cooperation in digital economy frameworks are creating positive momentum. Agreements between the European Union and Asian economies, as well as U.S. partnerships with countries like South Korea and Singapore, are fostering smoother cross-border digital trade. These deals aim to standardize digital asset regulations, improve cybersecurity protocols, and enable fair participation in the global GameFi ecosystem, ensuring stable long-term growth for the industry.

Key Takeaways

- Market Growth: The GameFi Market is expected to reach USD 84.85 Billion by 2034, factors are driving this are technological advancements in blockchain scalability and user experience are making GameFi platforms more accessible.

- Product Type Dominance: Play-to-earn (P2E) games lead the market due to broad adoption and strong user retention.

- Technology Component Dominance: Blockchain infrastructure is the leading technology segment, driven by security and decentralization needs.

- Distribution Channel Dominance: Online marketplaces (DApps/platforms) lead, powering asset liquidity and user engagement.

- End User Dominance: Individual gamers represent the fastest-growing user segment, followed by guilds and speculative investors.

- Drivers: Key drivers include blockchain gaming adoption and tokenization of in-game assets, boosting engagement and financial inclusion.

- Restraints: Volatility in crypto asset prices and security vulnerabilities hinder growth through increased investment risk and user trust issues.

- Opportunities: Expansion in cross-chain interoperability and branded IP/game studio partnerships unlocks large-scale adoption and richer experiences.

- Trends: DAO-driven governance and integration with social/creator economies are reshaping power structures and introducing novel earning models.

- Regional Analysis: North America leads the due to its strong digital infrastructure, early tech adoption, and robust investment, while Asia Pacific and Europe are rapidly growing thanks to large player bases and increasing blockchain interest.

Product Type Analysis:

Play-to-Earn (P2E) Games Leads With over 45% Market Share In GameFi Market: Play-to-earn games sustain leadership as their earning mechanisms attract diverse player bases, especially in regions with high youth unemployment or limited traditional gaming purchasing power. Viral growth is often driven by community incentives, social sharing, and in-game economies rewarding skill and time. Metaverse-based titles trail with broader experiential aims but rely more on partnership rollouts and hardware adoption. Move-to-earn games, though smaller today, are propelled by health and wellness tie-ins, creating differentiated engagement.

Technology Component Analysis:

The bedrock for GameFi is blockchain infrastructure, as it facilitates transparent and immutable transactions, securing both in-game assets and overall economies. Smart contracts enhance automation, while NFTs provide tradable value, but all are dependent on the underlying blockchain's robustness. Interoperable blockchains are increasingly preferred, supporting game asset migrations and cross-game play.

Distribution Channel Analysis:

GameFi users overwhelmingly choose online DApp marketplaces thanks to their liquidity, broad access, and the ability to trade assets instantly across jurisdictions. Centralized exchanges offer fiat rails and onboarding, while independent app stores focus on UX but struggle with liquidity and visibility compared to community-anchored platforms.

End User Analysis:

Gamers as a user segment continue to expand as more mainstream audiences embrace earning, trading, and ownership models. Guilds aggregate large numbers of players for shared economic benefit, but remain niche compared to the vast individual user base. Investors/speculators now play a smaller but influential role, impacting market cycles via capital inflows and trading activity.

Regional Analysis:

North America Leads With more than 40% Market Share In GameFi Market: North America stands at the forefront of the global GameFi market, propelled by its robust digital infrastructure, the rapid embrace of blockchain technologies, and a deeply rooted gaming culture. The United States, in particular, has cultivated a thriving ecosystem with extensive investments from both tech giants and emerging startups. This innovative environment fosters the early adoption of cutting-edge digital assets such as cryptocurrencies and NFTs among consumers. In addition, the regulatory frameworks in the U.S. and Canada create a secure, reliable landscape that attracts ongoing development and substantial investment in GameFi platforms, reinforcing the region’s leadership.

Although North America leads, the Asia Pacific region—featuring countries like China, Japan, and South Korea—has a vast gamer population and continues to experience dynamic growth, driven by high rates of technology adoption and an established love of gaming. Europe is also solidifying its presence in the market, especially in Western European nations, as interest in blockchain-based games and NFTs grows. Meanwhile, Latin America and Africa, while currently smaller players, are emerging as promising markets due to the increasing popularity of mobile gaming and their young, digitally savvy population eager to engage in new interactive opportunities. Together, these regions reflect the expanding reach and evolving nature of the GameFi sector worldwide.

Get More Information about this report -

Request Free Sample ReportMarket Key Segment

Product Type

- Move-to-Earn Games

- Metaverse-Based Games

- Play-to-Earn (P2E) Games

Technology Component

- NFTs

- Smart Contracts

- Blockchain Infrastructure

Distribution Channel

- Centralized Exchanges

- Independent App Stores

- Online Marketplaces/DApps

End User

- Gaming Guilds

- Investors/Speculators

- Gamers

Region:

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 7.11 B |

| Forecast Revenue (2034) | USD 84.85 B |

| CAGR (2025-2034) | 6.5% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Product Type (Move-to-Earn Games, Metaverse-Based Games, Play-to-Earn (P2E) Games) Technology Component (NFTs, Smart Contracts, Blockchain Infrastructure) Distribution Channel (Centralized Exchanges, Independent App Stores, Online Marketplaces/DApps) End User (Gaming Guilds, Investors/Speculators, Gamers) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Axie Infinity (Sky Mavis), The Sandbox, Decentraland, Gala Games , Illuvium, StepN, Wemix, Star Atlas |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the GameFi Market?

GameFi Market projected to surge from USD 6.68 Bn in 2024 to USD 84.85 Bn by 2034, growing at 6.5% CAGR. Explore trends in gaming, DeFi, and blockchain tech.

Who are the major players in the GameFi Market?

Axie Infinity (Sky Mavis), The Sandbox, Decentraland, Gala Games , Illuvium, StepN, Wemix, Star Atlas

Which segments covered the GameFi Market?

Product Type (Move-to-Earn Games, Metaverse-Based Games, Play-to-Earn (P2E) Games) Technology Component (NFTs, Smart Contracts, Blockchain Infrastructure) Distribution Channel (Centralized Exchanges, Independent App Stores, Online Marketplaces/DApps) End User (Gaming Guilds, Investors/Speculators, Gamers)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date