Generative AI in Chemical Market Size, Growth & Forecast | CAGR 29.1%

Global Generative AI in Chemical Market Size, Share & Industry Analysis By Technology (Machine Learning, Deep Learning, Generative Models, Quantum Computing, Reinforcement Learning, NLP), By Application (Molecular Design & Drug Discovery, Process Optimization, Chemical Engineering, Market Trend & Pricing Analysis), Industry Region & Key Players – Industry Segment Overview, Market Drivers, Challenges, Competitive Strategies, Innovation Trends & Forecast 2025–2034

Report Overview

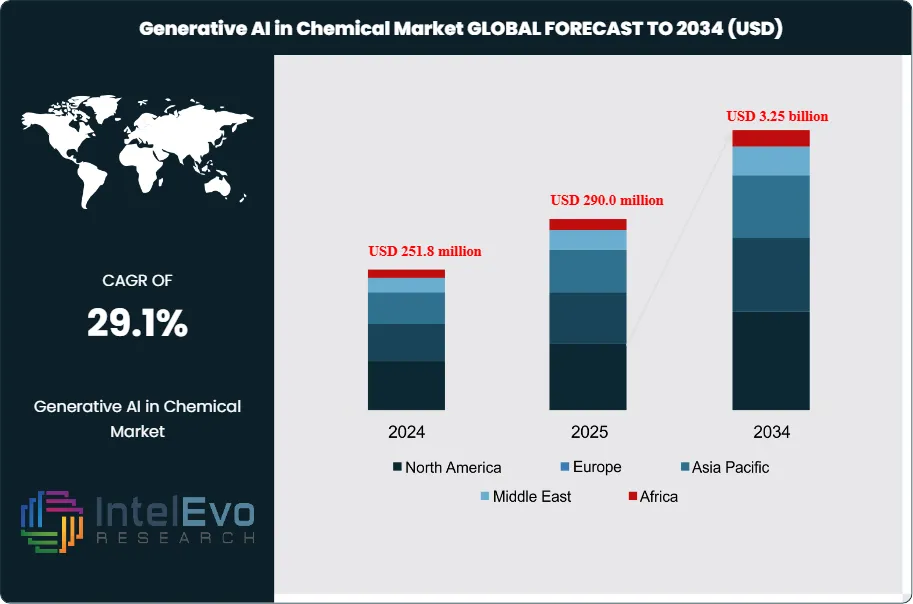

The Generative AI in Chemical Market is valued at approximately USD 290.0 million in 2025 and is projected to reach around USD 3.25 billion by 2034, expanding at a robust compound annual growth rate (CAGR) of about 29.1% during the forecast period from 2026 to 2034. Market growth is fueled by accelerating adoption of AI-driven molecular design, reaction optimization, and predictive analytics across specialty chemicals, pharmaceuticals, and materials science. In addition, rising R&D automation, increasing demand for faster product development cycles, and growing integration of generative models in sustainable chemistry and green manufacturing workflows are positioning the market for exponential long-term expansion.

Growth reflects a move from pilot projects to integrated AI engines embedded in research, development, and manufacturing. Generative models propose novel molecules, estimate properties, and optimize formulations, which shortens discovery cycles and can lower early-stage R&D spending by 20–30% for advanced users.

Demand for sustainable chemistries, higher asset utilization, and rapid product refresh drives adoption. Generative AI supports low-carbon process design, better catalysts, and bio-based materials that help producers respond to stricter emissions rules and circular economy goals. On the supply side, cloud providers, AI platforms, and leading chemical companies form alliances that link molecular design software with automated laboratories and plant control systems, enabling more continuous, data-driven development.

Scientific uptake underpins commercial progress. The Royal Society of Chemistry expects institutions using generative AI to predict chemical behaviors and characteristics to increase by about 40% from 2022 to 2024. The Materials Research Society notes that around 50% of materials science experts plan to use generative AI for new materials design and performance tuning by the end of 2024. The National Science Foundation points to a 35% rise in generative AI use to simulate and visualize complex chemical processes over the same period, reinforcing trust in the technology.

Risk factors remain significant. Data are fragmented, proprietary, and uneven in quality, which constrains model accuracy in specialized domains. Concerns around intellectual property, model explainability, and reproducibility slow deployment in safety-critical and regulated segments. Regulators in North America and Europe now expect explainable models, auditable data pipelines, and alignment with chemical safety regimes, pushing governance and validation costs up by an estimated 10–15% for large implementations.

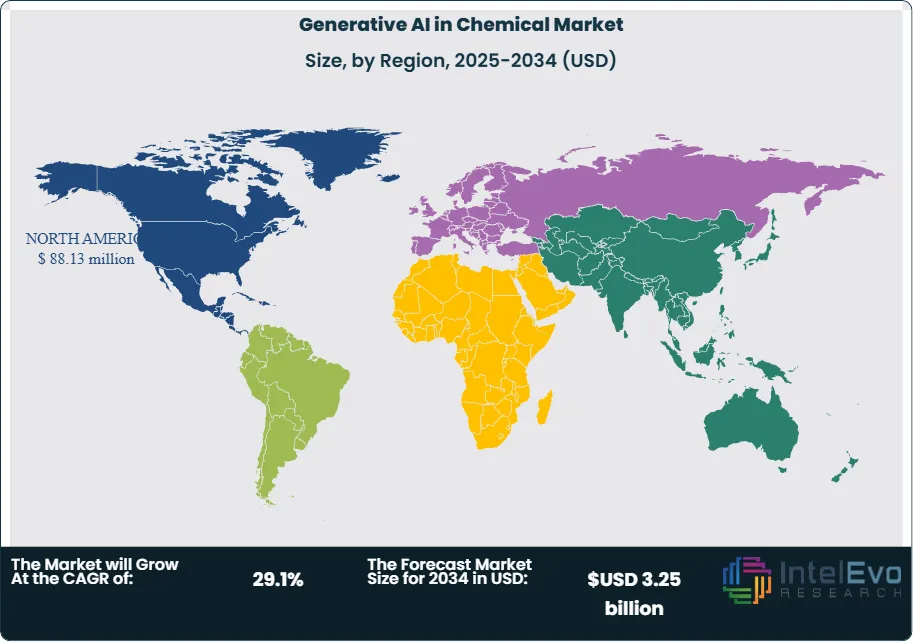

North America is expected to represent about 35% of revenue in 2024, with Europe near 30%, supported by strong pharmaceutical and specialty chemical clusters. Asia Pacific is the fastest-growing region, with a projected CAGR above 30% through 2034, led by China, Japan, South Korea, and India in batteries, electronic materials, and advanced polymers. New initiatives in the Middle East and Latin America around petrochemicals and sustainable feedstocks signal additional investment opportunities across the forecast horizon.

Get More Information about this report -

Request Free Sample ReportKey Takeaways

- Market Growth: The global generative AI in chemicals space accelerates from early pilots to scaled adoption, with market value reaching estimated: USD 251.8 million in 2024; USD 290.0 million in 2025 and projected to approach estimated: USD 3.25 billion by 2034, implying a CAGR of estimated: 29.1%, 2026-2034.

- Segment Dominance: R&D and molecular design workflows hold the largest revenue share as firms prioritize AI-driven compound and formulation discovery, with these use cases accounting for estimated: 55.0%, 2024 of total spending and maintaining leadership through estimated: 2034.

- Segment Dominance: Pharmaceuticals and specialty chemicals remain the primary adopters of generative AI platforms, together contributing estimated: 60.0%, 2024 of end-user demand and expected to retain more than estimated: 50.0%, 2034 as downstream industries scale AI-enabled innovation.

- Driver: Pressure to cut development timelines and achieve sustainable chemistry outcomes acts as the main growth engine, with leading adopters targeting R&D cycle-time reductions of estimated: 20.0%, 2024 and cost savings of estimated: 15.0%, 2024 versus traditional methods.

- Restraint: Data scarcity, IP concerns, and explainability requirements restrict deployment in regulated domains, with governance and compliance efforts adding an extra overhead of estimated: 10.0%, 2024 to large-scale implementations and slowing full-stack integration.

- Opportunity: Generative AI unlocks new revenue pools in green chemistry, battery materials, and advanced polymers, where solution providers can capture incremental opportunities worth estimated: 1.0 billion USD, 2034 as clients pursue decarbonization and performance gains.

- Trend: Partnerships between AI vendors, cloud platforms, and chemical producers expand, with collaborative ecosystems expected to power more than estimated: 65.0%, 2030 of new deployments and drive strong growth in integrated design-to-manufacturing workflows by estimated: 2034.

- Regional Analysis: North America leads early adoption with an estimated: 35.0%, 2024 revenue share, while Europe holds estimated: 30.0%, 2024 and Asia Pacific, at estimated: 25.0%, 2024, records the fastest trajectory toward an expected regional CAGR above estimated: 30.0%, 2024-2034.

By Technology

Machine learning continues to anchor the technology landscape in 2025 as the most widely adopted toolset across chemical research, modeling, and production workflows. It accounted for more than 26 percent of global revenue in 2024 and maintains its lead in 2025 due to its capacity to process large datasets and generate accurate predictions for molecular behavior, process variables, and material performance. You see this reflected in R&D teams that rely on trained models to shorten discovery cycles and improve hit rates in early-stage screening. Adoption remains high because machine learning supports the full chain of activities from formulation work to plant-level quality assurance.

Its position strengthens as downstream technologies draw from machine learning foundations. Deep learning and generative models, including GANs and VAEs, require structured datasets and pre-trained feature extraction systems that machine learning provides. These models now assist chemical developers in exploring new compound families and simulating structural variations at speeds unattainable through conventional laboratory workflows. Quantum computing and reinforcement learning add further scale. Early pilots in 2025 show improvements in reaction optimization and property prediction for catalysts and energy materials, signaling broader use of hybrid approaches over the next five years.

As the technology stack matures, natural language processing and other analytical tools help researchers consolidate scientific literature, patents, and experimental reports into actionable intelligence. Combined, these technologies create an integrated environment where chemical insights update continuously and guide high-value decisions in R&D and advanced manufacturing.

By Application

Molecular design and drug discovery continue to dominate application demand. This segment held more than 39 percent of the market in 2024 and remains the fastest-growing area in 2025. Generative models evaluate molecular structures, simulate behavior, and rank candidates with higher precision than traditional computational tools. Pharmaceutical companies now shorten target identification phases by up to 30 percent, and your teams can screen thousands of potential drug candidates in a fraction of the time required in the past. Chemical producers apply similar methods to design polymers, coatings, additives, and specialty materials with tailored property profiles.

Process optimization and chemical engineering follow as major application clusters. AI systems help operators reduce energy use, stabilize product specifications, and extend asset uptime. Plants implementing AI-supported process control have reported energy reductions of 8 to 12 percent, with measurable improvements in overall throughput. These systems also identify failure risks early, which supports maintenance planning and safety compliance.

Market trend analysis and pricing optimization increase in importance as global volatility raises pressure on margins. AI models track feedstock movements, supply shifts, and customer demand patterns to support commercial decisions. The remaining application areas include recycling optimization, carbon monitoring, and predictive environmental assessment. These segments expand gradually as chemical companies prepare for regulatory targets tied to emissions and waste recovery.

By End-Use

Residential builders show growing interest in generative chemical design as material standards move toward durability, safety, and environmental compliance. AI-assisted formulations for construction chemicals, such as admixtures and sealants, support improved performance with lower resource use. These solutions gain relevance in 2025 as governments push for higher energy-efficiency ratings and longer product life cycles.

Commercial building projects adopt AI-enabled chemical solutions at a faster pace. Large developers and infrastructure firms prioritize materials with predictable behavior, reduced curing times, and enhanced resistance to thermal and mechanical stress. AI-generated material insights help you select products that meet project-specific constraints, which benefits large-scale flooring, façade, and structural applications.

Industrial facilities remain the most advanced users. Operators integrate AI-driven chemical models to support coatings, protective materials, process fluids, and filtration systems tailored to heavy-duty environments. Adoption rises in sectors such as oil and gas, mining, and electronics manufacturing, where even small performance improvements produce significant operational gains.

By Region

North America continues to lead global adoption in 2025 with more than 42 percent of market revenue. Strong demand from pharmaceuticals, specialty chemicals, and advanced materials accelerates uptake. Investment in AI research, high digital maturity, and an active startup base strengthens the regional position. You see partnerships forming between software providers and chemical producers to co-develop models tuned for specific chemistries and process conditions.

Europe follows with steady growth driven by regulatory pressure related to emissions, safety, and circular design. Companies adopt AI tools to meet compliance targets and support low-carbon material development. Activity is especially strong in Germany, France, and the Nordic countries, where chemical firms expand AI budgets and build long-term digitalization strategies.

Asia Pacific shows the highest growth rate through 2030. China, Japan, South Korea, and India increase investment in material science and battery technology. Regional manufacturers implement AI to accelerate product development and strengthen export competitiveness. Latin America and the Middle East and Africa expand at a slower pace but gain attention as petrochemical operators explore AI-supported process enhancement and energy optimization programs.

Get More Information about this report -

Request Free Sample ReportKey Market Segments

By Technology

- Machine Learning

- Deep Learning

- Generative Models (GAN & VAE)

- Quantum Computing

- Reinforcement Learning

- Natural Language Processing (NLP)

- Others

By Application

- Molecular Design and Drug Discovery

- Process Optimization and Chemical Engineering

- Market Trend Analysis & Pricing Optimization

- Others

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

Driver

Accelerated R&D Cycles and Faster Time-to-Market

By 2025, chemical producers will face more pressure to shorten development timelines and respond quickly to regulatory and customer needs. Generative AI addresses this challenge by screening large compound libraries, predicting structure-property relationships, and guiding formulation decisions in hours instead of months. Early adopters report a 20 to 40% reduction in early-stage development cycles, along with significant savings in experimental costs.

Cost Efficiency and Competitive Product Pipelines

These efficiency improvements help you introduce new materials, additives, and specialty chemicals more quickly while meeting compliance and safety standards. Speeding up R&D without expanding laboratory capacity boosts competitiveness and supports higher-margin product pipelines, especially in specialty, performance, and advanced materials segments.

Restraint

High Upfront Investment and Technical Complexity

Adoption remains uneven because of the significant upfront investments and the complexity of the systems involved. Companies often need to build new data infrastructure, acquire AI models specific to their domain, and retrain technical staff before seeing measurable returns. Larger chemical producers can absorb these costs, but small and mid-sized firms encounter serious financial and operational hurdles.

Integration Challenges and Digital Readiness Gaps

Integration issues further delay deployment when generative AI tools must connect with older laboratory information systems or plant control platforms. These problems widen the gap between companies that are digitally advanced and those that are not. Consequently, AI adoption moves more slowly in firms that lack strong digital transformation capabilities.

Opportunity

Sustainability-Driven Innovation and Compliance

Sustainability goals present a significant opportunity for generative AI to transform chemical development and manufacturing practices. By 2025, over 60% of global chemical companies plan to actively initiatives aimed at reducing emissions and improving resource efficiency. Generative models support these efforts by identifying low-carbon reaction pathways and alternatives to harmful substances.

Expansion of AI-Enabled Green Chemistry Markets

AI-driven sustainable chemistry is expected to surpass USD 1.2 billion by 2030, boosted by stricter regulations and growing demand for eco-friendly materials. You can use generative AI to lower operational risks and create new revenue opportunities in biodegradable polymers, green solvents, and recycled or bio-based feedstocks.

Trend

Integration of Sustainability and Custom Molecular Design

AI-driven sustainable chemistry is accelerating as producers incorporate life-cycle assessment metrics directly into generative design workflows. At the same time, custom molecular design is gaining traction in pharmaceuticals, electronics, and advanced materials, where precise control over structure and performance is key for niche applications.

Expansion Toward Digital Twins and Advanced Computing

Quantum computing pilots are pushing the boundaries of chemical simulation by enhancing accuracy for complex reactions beyond the limits of traditional models. Meanwhile, digital twins are becoming more popular in large manufacturing sites, enabling real-time scenario testing and predictive process optimization. Together, these trends are moving generative AI from isolated projects to a central capability that connects R&D, scale-up, and plant operations.

Key Player Analysis

Mitsui Chemicals: Mitsui Chemicals holds a leader position in the generative AI in chemical applications. The company strengthens its portfolio by deploying AI-driven molecular design tools across polymer development, catalysts, and specialty materials. It integrates machine learning with long-standing expertise in chemical synthesis to shorten development cycles and improve formulation accuracy. Internal programs launched between 2023 and 2025 show measurable gains in R&D efficiency, with reported reductions of up to 20 percent in early-stage screening times. Mitsui Chemicals expands partnerships with software firms and universities to advance AI-supported property prediction for sustainable materials. The company’s broad manufacturing base in Japan and Southeast Asia gives it strong control over scale-up and customer alignment, which differentiates its position in the market.

Accenture: Accenture acts as a challenger and system integrator within the generative AI in chemical market. The firm focuses on deploying enterprise AI frameworks, digital engineering platforms, and data governance systems for global chemical producers. Its analytics and cloud migration services help clients introduce AI into R&D pipelines, pilot automated laboratories, and restructure manufacturing workflows. Accenture reports strong demand in 2024 and 2025 for AI transformation programs in Europe and North America, with chemical accounts contributing to a steady rise in its industry vertical revenue. The company invests in joint innovation centers with leading chemical companies to develop domain-specific generative AI models. Accenture differentiates itself through its global consulting footprint and ability to integrate AI with existing ERP and plant systems.

Azelis Group NV: Azelis Group NV positions itself as a niche player that uses generative AI to strengthen formulation support for customers across personal care, home care, and specialty chemical segments. The company operates a large technical services network and increasingly relies on AI-enabled formulation engines to provide faster recommendations and improve product matching. These tools help Azelis handle large volumes of customer requests with higher accuracy, which increases conversion rates and supports regional growth. Azelis expands its digital labs and data infrastructure across Europe and Asia Pacific to support AI-driven formulation trials. Its differentiator lies in its distributor model combined with technical expertise, which enables the company to deliver AI-informed solutions directly to mid-sized manufacturers that lack in-house R&D capabilities.

Market Key Players

- Sinochem Corporation

- Accenture

- Biesterfeld AG

- IBM Corporation

- Tricon Energy Inc.

- Omya AG

- Mitsui Chemicals

- Azelis Group NV

- HELM AG

- Other Key Players

Recent Developments

Dec 2024 – Mitsui Chemicals: Mitsui Chemicals announced an internal patent chat platform based on generative AI, designed to read experimental data tables and chemical structures and cut in-house patent search time by up to 80 percent. This move strengthens its R&D productivity and underpins wider use of generative AI in chemical product development workflows.

Jan 2025 – IBM and L'Oréal: IBM and L'Oréal launched a collaboration to build a generative AI model for cosmetic formulation that mines large formulation datasets to promote the use of sustainable raw materials and reduce energy and material waste. The partnership positions IBM as a key AI technology provider for specialty chemicals and supports L'Oréal’s push toward lower-impact formulations.

Jan 2025 – Microsoft Research: Microsoft Research introduced MatterGen, a diffusion-based generative model for inorganic materials that directly generates crystal structures with target mechanical, electronic, or magnetic properties and more than doubles the share of stable, unique new materials versus prior models. This release advances foundation-model approaches for material and chemical design and sets a new technical benchmark for AI tools used by chemical and materials R&D teams.

Jun 2025 – Matlantis (PFCC): PFCC announced a corporate name change to Matlantis to align with its Matlantis cloud-based atomistic simulator, already used by more than 100 companies and organizations for AI-supported materials discovery. The rebrand clarifies its identity as a specialist platform provider for AI-driven molecular and materials modeling in chemical-intensive industries.

Aug 2025 – Merck KGaA / MilliporeSigma: MilliporeSigma introduced AIDDISON Explorer, a cloud platform that combines generative AI molecule design with predictive ADMET modeling and synthesis planning to speed up hit discovery and lead optimization for small molecules. The launch broadens commercial access to AI-based molecular design capabilities and helps Merck KGaA deepen its role in AI-supported chemistry and drug discovery.

Sep 2025 – CuspAI: CuspAI, a Cambridge-based startup focused on generative AI for materials discovery, secured a Series A round of more than EUR 85 million to scale its platform for automotive, semiconductor, energy, and climate applications. The funding round signals strong investor confidence in generative AI for chemical and materials design and introduces a well-capitalized challenger into collaboration discussions with large industrial and chemical groups.

| Report Attribute | Details |

| Market size (2025) | USD 290.0 million |

| Forecast Revenue (2034) | USD 3.25 billion |

| CAGR (2025-2034) | 29.1% |

| Historical data | 2020-2024 |

| Base Year For Estimation | 2025 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Technology, (Machine Learning, Deep Learning, Generative Models (GAN & VAE), Quantum Computing, Reinforcement Learning, Natural Language Processing (NLP), Others), By Application, (Molecular Design and Drug Discovery, Process Optimization and Chemical Engineering, Market Trend Analysis & Pricing Optimization, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Sinochem Corporation, Accenture, Biesterfeld AG, IBM Corporation, Tricon Energy Inc., Omya AG, Mitsui Chemicals, Azelis Group NV, HELM AG, Google, Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Generative AI in Chemical Market

Published Date : 04 Feb 2026 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date