Generative AI in FMCG Market Size, Growth & Forecast to 2034

Global Generative AI in FMCG Market Size, Share & Analysis By Component (Generative AI Software, Generative AI Services), By Application (Price Optimization, Supply Chain Optimization, Consumer Insights, Demand Forecasting, Product Design and Innovation, Personalized Marketing, Content Generation, Quality Control, Packaging Design, Promotion Planning, Others), By FMCG sub-industries (Food & Beverages, Household Products, Personal Care and Hygiene, Electronics and Appliances, Others) Industry Regions & Key Players – AI Adoption Trends, Competitive Intelligence & Forecast 2025–2034

Report Overview:

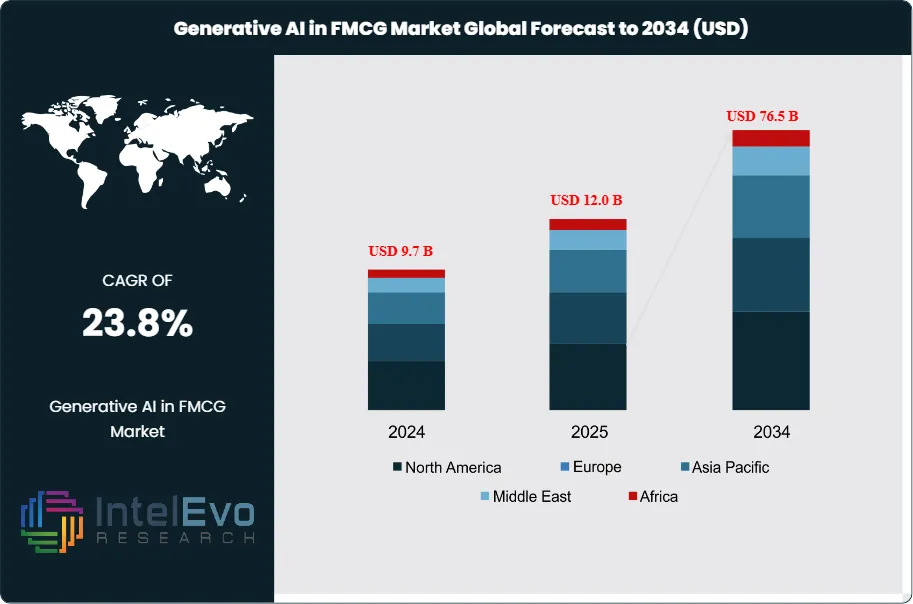

The Generative AI in FMCG Market size is expected to be worth around USD 76.5 Billion by 2034, from USD 9.7 Billion in 2024, growing at a CAGR of 23.8% during the forecast period from 2025 to 2034. This rapid growth underscores the rising importance of generative AI technologies in reshaping the fast-moving consumer goods (FMCG) sector, as companies increasingly leverage advanced algorithms to enhance efficiency, improve customer engagement, and accelerate product innovation.

Get More Information about this report -

Request Free Sample ReportGenerative AI, encompassing solutions capable of producing text, images, designs, and predictive insights, is becoming a cornerstone of digital transformation within FMCG. By enabling dynamic product design, intelligent packaging concepts, and hyper-personalized marketing strategies, the technology allows firms to differentiate themselves in highly competitive markets. These capabilities also support faster time-to-market and stronger brand resonance, as AI-driven personalization aligns closely with evolving consumer expectations for customized products and experiences.

Several structural drivers are propelling adoption. The need for product and marketing differentiation, rising demand for personalized offerings, and the drive to optimize development processes are pushing FMCG companies toward greater AI integration. Innovations such as real-time customization, AI-enabled virtual product trials, and automated campaign generation are increasingly redefining how businesses interact with consumers. However, challenges remain, including concerns around data privacy and security, ethical use of algorithms, and a persistent shortage of AI-skilled professionals. Successfully addressing these barriers will be critical for unlocking the full potential of generative AI in this industry.

On a broader scale, the generative AI ecosystem is experiencing exponential growth, with the global market projected to reach USD 347.5 Billion by 2034, up from USD 18.1 Billion in 2024 at a CAGR of 35.1%. Consumer adoption trends further reinforce its momentum: surveys indicate that 70% of consumers seek product or service recommendations from generative AI tools, while younger demographics, particularly Millennials and Gen Z, are emerging as the most active users.

Regional adoption is equally noteworthy. India leads with a 73% generative AI usage rate, followed by Australia (49%), the United States (45%), and the United Kingdom (29%). Within the retail ecosystem—a critical channel for FMCG—executives report that more than one-third of employees already use generative AI, a figure expected to rise sharply by 2025. These patterns highlight the technology’s deepening role as both an operational enabler and an investment hotspot across global consumer markets.

Key Takeaways

- Market Growth: The global Generative AI in FMCG Market is forecasted to reach approximately USD 76.5 Billion by 2034, expanding from USD 9.7 Billion in 2024 at a CAGR of 23.8% between 2025 and 2034. This momentum is underpinned by rising consumer expectations for personalization, rapid innovation cycles, and efficiency gains enabled by AI automation.

- Technology Leadership – Software: Software platforms represent the core of market growth, holding the majority share as of 2024. Their dominance stems from extensive use in packaging design, product development, and marketing content generation, with scalability and seamless integration into enterprise workflows keeping them ahead of services-based solutions.

- Application Leadership – Demand Forecasting: Demand forecasting remains the top application, representing more than 15% of market share in 2024. FMCG companies are increasingly applying AI-driven predictive models to better align inventory, reduce supply chain disruptions, and adapt production to evolving consumer behavior.

- End-Use Leadership – Food & Beverages: The food and beverages industry accounted for over 30% of the market in 2024. Generative AI is being deployed for recipe creation, flavor testing, and consumer-specific marketing strategies, enabling faster adaptation to shifting dietary preferences and lifestyle-driven consumption patterns.

- Growth Driver: Heightened demand for individualized products and experiential shopping is propelling adoption. Generative AI tools support hyper-personalized campaigns, real-time customization, and immersive trial experiences that strengthen consumer-brand engagement.

- Market Restraint: Data security challenges and ethical concerns around automated decision-making remain significant hurdles. Regulatory compliance—particularly in highly scrutinized sectors such as food and healthcare—adds complexity to widescale AI adoption.

- Emerging Opportunity: Generative AI is unlocking high-potential areas such as virtual product trials, AI-led concept generation, and on-demand customization. Companies that accelerate R&D investment in these domains are positioned to shorten innovation cycles and gain first-mover advantage.

- Key Trend: The fusion of generative AI with omnichannel retail ecosystems is transforming customer interaction models. Survey data suggests employee adoption within retail operations, currently around one-third, is expected to rise to nearly half by 2025, highlighting rapid mainstream integration.

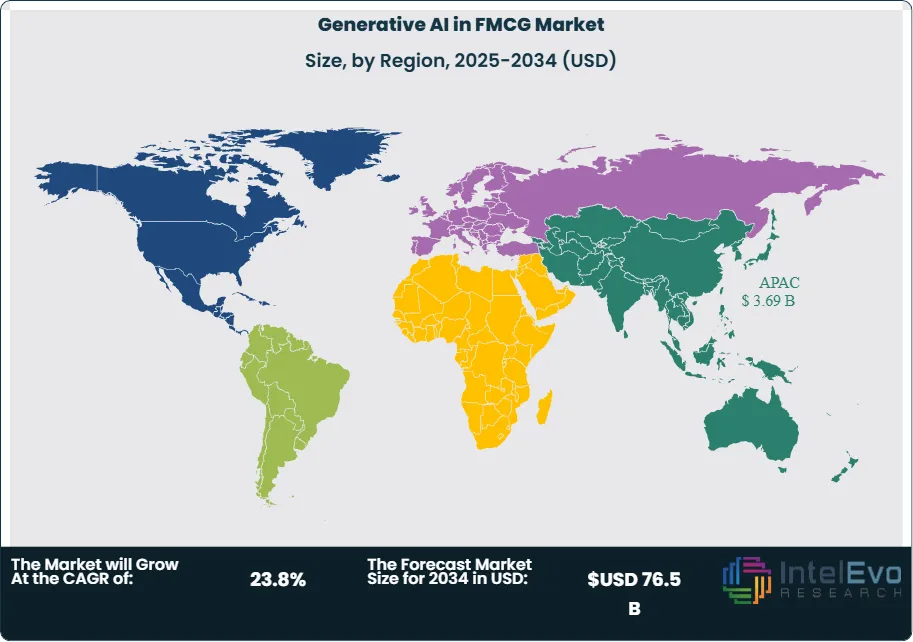

- Regional Dynamics: Asia–Pacific accounted for more than 38% of global share in 2024, with strong adoption in India, China, and Southeast Asia. India, in particular, leads consumer-level AI usage, while North America and Europe continue to attract investment due to advanced retail infrastructure and established AI ecosystems.

Component Analysis

As of 2025, the Generative AI Software segment continues to dominate the FMCG market, accounting for over 70% of total share. The strength of this segment lies in its ability to automate core business functions—ranging from product development and consumer engagement to supply chain optimization—at a scale that services alone cannot match. Software platforms enable real-time insights and dynamic modeling, making them indispensable for companies competing in fast-moving consumer categories.

FMCG enterprises increasingly deploy software-driven AI to interpret vast consumer datasets, translating these insights into tailored product formulations, optimized promotions, and demand-driven inventory strategies. By minimizing routine manual processes and reducing inefficiencies such as overstocking, software solutions allow companies to improve output while lowering costs. Use cases now extend to predictive logistics, precision-based price modeling, and generative content for omnichannel campaigns. The continuous rollout of new applications and the prioritization of AI-driven digital transformation initiatives by market leaders suggest that software will remain the growth engine of this market in the coming decade.

Application Analysis

Within applications, Demand Forecasting maintains its leadership position, holding more than 15% share in 2025. The ability to anticipate consumer needs with high accuracy has become critical in an environment shaped by fluctuating demand, volatile supply chains, and rising sustainability concerns. Generative AI enhances forecasting accuracy by assimilating structured and unstructured data—from past sales and macroeconomic indicators to real-time consumer sentiment—providing FMCG companies with actionable, forward-looking intelligence.

Global players such as Nestlé and Procter & Gamble have integrated AI-driven forecasting into their operations to optimize production schedules, reduce waste, and improve agility. Accurate forecasts also create ripple effects across procurement, distribution, and promotional planning, ensuring that new product launches and campaigns are precisely aligned with demand cycles. Going forward, the demand forecasting segment is expected to expand further as generative AI capabilities integrate with IoT-enabled supply chains and sustainability frameworks, reinforcing resilience while minimizing overproduction and waste.

FMCG Sub-Industries Analysis

The Food & Beverages sector continues to represent the largest share of the generative AI in FMCG market, exceeding 30% in 2025. This dominance reflects the sector’s reliance on AI to navigate challenges unique to perishable goods, regulatory compliance, and evolving consumer preferences. Companies are leveraging generative AI to design new flavors, develop healthier product lines, and craft personalized campaigns that resonate with increasingly health- and sustainability-conscious buyers.

Beyond product innovation, AI tools play a pivotal role in maintaining freshness through predictive inventory management, optimized delivery scheduling, and enhanced quality control mechanisms. For example, AI-generated simulations are helping firms reduce waste by aligning production with precise consumption patterns. With sustainability rising as a critical differentiator, food and beverage companies are also adopting AI to design eco-friendly packaging and streamline compliance reporting. These applications will continue to consolidate the sector’s leadership position, making it a key beneficiary of generative AI innovation through 2033.

Regional Analysis

In 2025, Asia-Pacific (APAC) remains the leading region in the generative AI in FMCG market, contributing more than 38% of global share. The region’s dominance is driven by large-scale digital adoption in consumer markets such as China, India, and Southeast Asia, where FMCG demand is both diverse and fast-growing. Governments across APAC have introduced AI-friendly policies and invested heavily in digital infrastructure, creating favorable conditions for rapid adoption. India, in particular, has emerged as a key growth hotspot, with its high consumer base and strong AI uptake among younger demographics.

Europe and North America follow closely, each shaped by distinct dynamics. In Europe, strict data privacy regulations such as GDPR have influenced the design of AI frameworks, pushing companies to balance innovation with compliance and ethical responsibility. North America, meanwhile, benefits from its advanced technology ecosystem and culture of innovation, positioning it as a leader in developing cutting-edge AI applications for personalization, content generation, and consumer insights. Together, these regions form critical investment hubs, while APAC’s scale and adoption speed continue to make it the global growth engine for generative AI in FMCG.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Component

- Generative AI Software

- Generative AI Services

By Application

- Price Optimization

- Supply Chain Optimization

- Consumer Insights

- Demand Forecasting

- Product Design and Innovation

- Personalized Marketing

- Content Generation

- Quality Control

- Packaging Design

- Promotion Planning

- Others

By FMCG sub-industries

- Food & Beverages

- Household Products

- Personal Care and Hygiene

- Electronics and Appliances

- Others

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 12.0 B |

| Forecast Revenue (2034) | USD 76.5 B |

| CAGR (2025-2034) | 23.8% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Component (Generative AI Software, Generative AI Services), By Application (Price Optimization, Supply Chain Optimization, Consumer Insights, Demand Forecasting, Product Design and Innovation, Personalized Marketing, Content Generation, Quality Control, Packaging Design, Promotion Planning, Others), By FMCG sub-industries (Food & Beverages, Household Products, Personal Care and Hygiene, Electronics and Appliances, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | IBM, Microsoft, Google Cloud, Amazon Web Services (AWS), SAP, Oracle, Accenture, Capgemini, SAS, Alibaba Cloud, Other key players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the Generative AI in FMCG Market?

The Generative AI in FMCG Market is projected to reach USD 76.5 Billion by 2034, growing at a 23.8% CAGR. Rising adoption of AI-driven innovation, customer engagement enhancement, and product development efficiency is transforming the FMCG sector.

Who are the major players in the Generative AI in FMCG Market?

IBM, Microsoft, Google Cloud, Amazon Web Services (AWS), SAP, Oracle, Accenture, Capgemini, SAS, Alibaba Cloud, Other key players

Which segments covered the Generative AI in FMCG Market?

By Component (Generative AI Software, Generative AI Services), By Application (Price Optimization, Supply Chain Optimization, Consumer Insights, Demand Forecasting, Product Design and Innovation, Personalized Marketing, Content Generation, Quality Control, Packaging Design, Promotion Planning, Others), By FMCG sub-industries (Food & Beverages, Household Products, Personal Care and Hygiene, Electronics and Appliances, Others)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Generative AI in FMCG Market

Published Date : 06 Nov 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date