Generative AI in Legal Market Size, Growth, Trends | CAGR of 29.1%

Global Generative AI in Legal Market Size, Share & Analysis Report by Product (Language Models, Research Assistants, Contract Review Engines, E-Discovery Tools, Compliance Platforms), Application (Contract Analysis, Drafting, Research, Litigation, Compliance, E-Discovery), End-User (Law Firms, Corporate Legal, Courts, Government) with Regional Insights, Key Players, Trends & Forecast 2025–2034

Report Overview

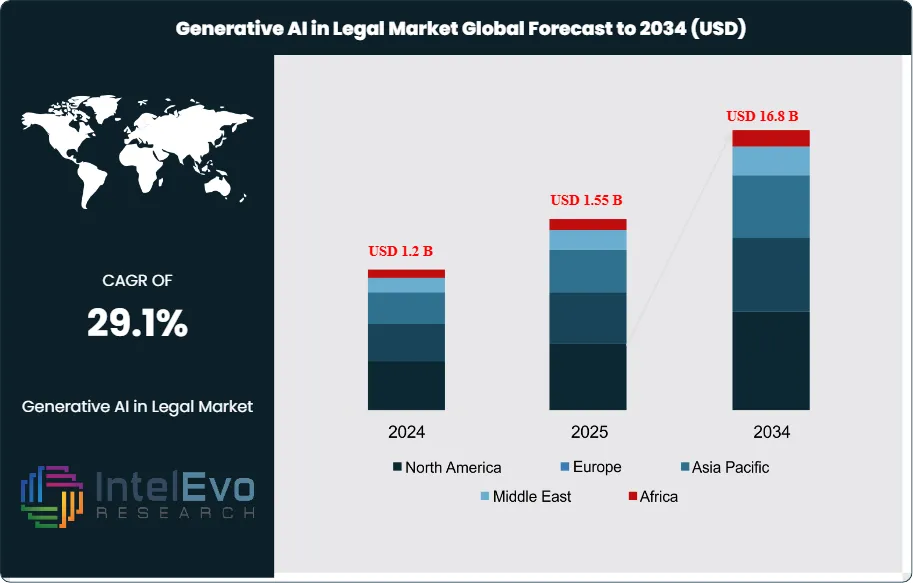

The Generative AI in Legal Market is projected to reach approximately USD 16.8 billion by 2034, rising from USD 1.2 billion in 2024, and expanding at a CAGR of 29.1% during the forecast period from 2024 to 2034. This exceptional growth is driven by increasing adoption of AI-powered contract analysis, legal research automation, and document drafting solutions across law firms and corporate legal departments. Rising pressure to reduce legal costs, improve case accuracy, and accelerate turnaround times is further positioning generative AI as a transformative force reshaping the global legal services ecosystem.

Get More Information about this report -

Request Free Sample ReportThe generative AI in legal market encompasses a dynamic ecosystem of AI-powered platforms, tools, and services designed to automate, augment, and transform legal research, document drafting, contract analysis, litigation support, and compliance management. This market includes generative language models, legal research assistants, contract review engines, e-discovery tools, and AI-driven compliance solutions tailored for law firms, corporate legal departments, courts, and regulatory bodies. The market serves a diverse range of end-users, from solo practitioners and boutique law firms to multinational corporations and government agencies, each with unique requirements for accuracy, security, and workflow integration.

The market is experiencing exponential growth driven by the increasing complexity of legal work, rising demand for efficiency, and the need to manage vast volumes of legal data. Key growth catalysts include advancements in large language models (LLMs), natural language processing (NLP), and machine learning algorithms that enable context-aware document generation, rapid legal research, and predictive analytics. The market benefits from growing cost pressures on legal services, the globalization of business operations, and the need for real-time compliance with evolving regulations. Additionally, the COVID-19 pandemic accelerated digital transformation in the legal sector, highlighting the value of remote collaboration, automated workflows, and AI-powered legal research.

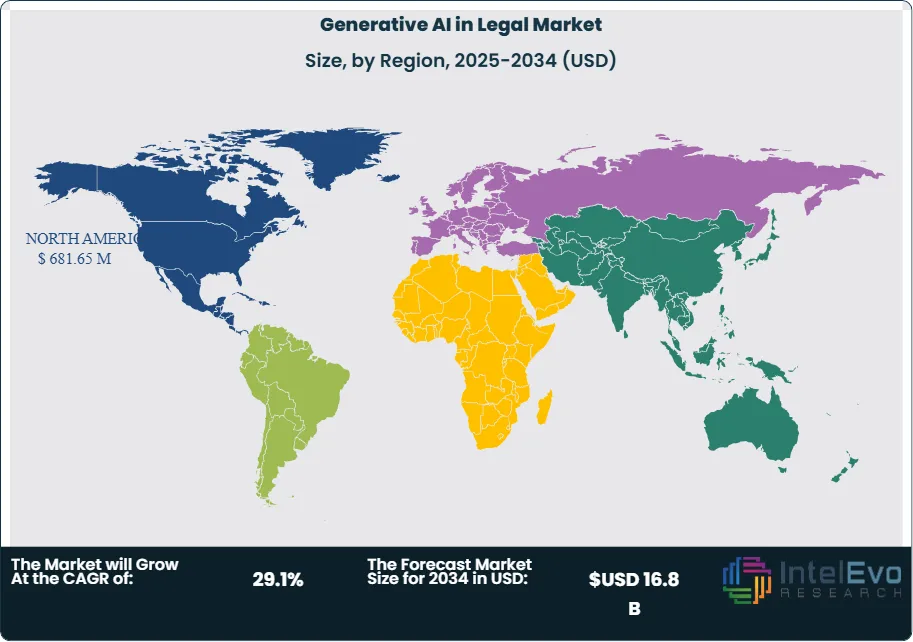

North America leads the global generative AI in legal market, supported by a mature legal services industry, high technology adoption rates, and a robust ecosystem of legal tech startups. The Asia-Pacific region is the fastest-growing market, driven by rapid digitalization, regulatory modernization, and the expansion of cross-border business activity. Europe maintains a significant market presence due to its established legal frameworks, focus on data privacy, and strong demand for compliance automation.

The legal sector’s traditional resistance to technology is rapidly diminishing as law firms and legal departments seek to improve productivity, reduce costs, and enhance client service. Generative AI is increasingly being integrated into core legal workflows, from contract lifecycle management and due diligence to litigation strategy and regulatory compliance. The market is also witnessing the emergence of AI-powered legal assistants capable of drafting complex documents, summarizing case law, and providing real-time legal insights.

Rising concerns about data privacy, ethical use of AI, and regulatory compliance are shaping market dynamics, prompting the development of explainable AI models, secure cloud platforms, and robust governance frameworks. The integration of generative AI with legal knowledge graphs, blockchain, and e-signature solutions is further expanding the scope and impact of AI in the legal domain.

Key Takeaways

- Market Growth: The Generative AI in Legal Market is expected to reach USD 16.8 Billion by 2034, fueled by the need for efficiency, cost reduction, and the automation of complex legal tasks.

- Product Type Dominance: Generative Language Models lead the segment, primarily due to their versatility in drafting, summarizing, and analyzing legal documents.

- Application Type Dominance: Contract Analysis and Document Drafting hold the largest share, driven by the high volume and complexity of legal documentation.

- End-User Dominance: Law Firms and Corporate Legal Departments are the primary adopters, seeking to streamline workflows and enhance service delivery.

- Driver: Key drivers include the explosion of legal data, increasing regulatory complexity, and the demand for faster, more accurate legal research and drafting.

- Restraint: Growth is hindered by concerns over data privacy, ethical risks, and the need for human oversight in high-stakes legal matters.

- Opportunity: The market is poised for expansion through opportunities such as AI-powered compliance automation, multilingual legal support, and integration with legal knowledge management systems.

- Trend: Emerging trends include explainable AI, AI-driven legal research assistants, and the convergence of generative AI with blockchain and e-signature platforms.

- Regional Analysis: North America leads due to advanced legal infrastructure and tech adoption. Asia-Pacific shows high growth potential due to regulatory modernization and digital transformation.

Product Type Analysis

Generative Language Models represent the leading product category, enabling the automated drafting, summarization, and review of legal documents. These models are foundational for AI-powered legal research, contract analysis, and litigation support, offering significant time and cost savings. Their adaptability allows for integration with a wide range of legal tech platforms, supporting applications from e-discovery to compliance monitoring. Legal Research Assistants and Contract Review Engines are also significant, providing rapid access to case law, statutes, and regulatory updates, as well as automated risk assessment and clause extraction.

Application Type Analysis

Contract analysis and document drafting are the largest application areas, reflecting the high volume of contracts, agreements, and legal filings processed by law firms and corporate legal teams. Generative AI streamlines these processes by automating clause extraction, risk flagging, and document generation, reducing manual workload and improving accuracy. Other key applications include legal research, litigation support, compliance management, and e-discovery.

End-User Analysis

Law firms and corporate legal departments are the primary users of generative AI solutions, leveraging these tools to enhance productivity, reduce turnaround times, and deliver higher-value services to clients. Adoption is also growing among courts, regulatory agencies, and government legal teams seeking to automate routine tasks and improve decision-making.

Region Analysis

North America dominates the global generative AI in legal market, supported by a large legal services sector, high investment in legal tech, and a culture of innovation. The region benefits from a strong presence of leading AI vendors, legal tech startups, and established law firms driving adoption. The Asia-Pacific region is the fastest-growing market, driven by regulatory reforms, digital transformation, and the expansion of cross-border business. Countries such as India, China, and Singapore are investing in legal tech infrastructure and AI-powered compliance solutions. Europe maintains a significant market share due to its focus on data privacy, regulatory compliance, and the adoption of AI for multilingual legal support.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

Product Type

- Generative Language Models

- Legal Research Assistants

- Contract Review Engines

- E-Discovery Tools

- Compliance Automation Platforms

Application Type

- Contract Analysis

- Document Drafting

- Legal Research

- Litigation Support

- Compliance Management

- E-Discovery

End-User

- Law Firms

- Corporate Legal Departments

- Courts & Regulatory Agencies

- Government Legal Teams

Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 1.55 B |

| Forecast Revenue (2034) | USD 16.8 B |

| CAGR (2025-2034) | 29.1% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Product Type (Generative Language Models, Legal Research Assistants, Contract Review Engines, E-Discovery Tools, Compliance Automation Platforms) Application Type (Contract Analysis, Document Drafting, Legal Research, Litigation Support, Compliance Management, E-Discovery) End-User (Law Firms, Corporate Legal Departments, Courts & Regulatory Agencies, Government Legal Teams) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Thomson Reuters, LexisNexis (RELX Group), Casetext (now part of Thomson Reuters), Harvey AI, Luminance, ROSS Intelligence, OpenAI, IBM Corporation, Eigen Technologies, LawGeex |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the Generative AI in Legal Market?

The Generative AI in Legal Market is set to grow from $1.2B in 2024 to $16.8B by 2034, driven by a 29.1% CAGR as AI transforms legal research, drafting & compliance.

Who are the major players in the Generative AI in Legal Market?

Thomson Reuters, LexisNexis (RELX Group), Casetext (now part of Thomson Reuters), Harvey AI, Luminance, ROSS Intelligence, OpenAI, IBM Corporation, Eigen Technologies, LawGeex

Which segments covered the Generative AI in Legal Market?

Product Type (Generative Language Models, Legal Research Assistants, Contract Review Engines, E-Discovery Tools, Compliance Automation Platforms) Application Type (Contract Analysis, Document Drafting, Legal Research, Litigation Support, Compliance Management, E-Discovery) End-User (Law Firms, Corporate Legal Departments, Courts & Regulatory Agencies, Government Legal Teams)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Generative AI in Legal Market

Published Date : 02 Aug 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date