Generative AI in Music Market Size, Share & Forecast | 30.4% CAGR

Global Generative AI in Music Market Size, Share & Analysis By Component (Solutions, Services), By Deployment (Cloud-based, On-premises), By Application (Composition and Music Generation, Performance Enhancement and Virtual Collaboration, Personalized Music Recommendations, Music Production and Remixing, Music Transcription and Analysis), By End-User (Artists, Studios, Platforms), Licensing Models, Copyright Challenges, Innovation Trends & Forecast 2025–2034

Report Overview

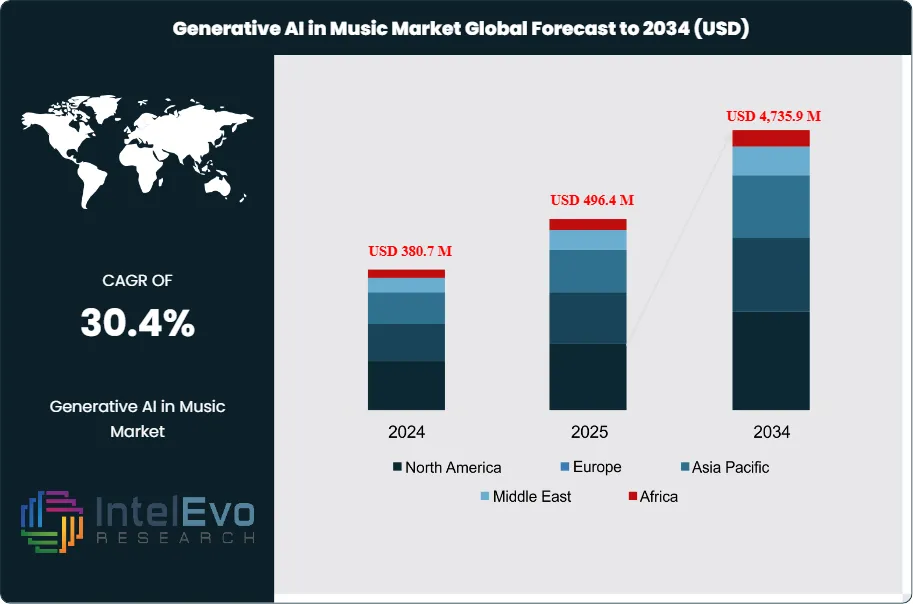

The Generative AI in Music Market size is expected to be worth around USD 4,735.9 Million by 2034, from USD 380.7 Million in 2024, growing at a CAGR of 30.4% during the forecast period from 2025 to 2034. This sharp growth reflects the increasing convergence of artificial intelligence with the global music industry, where AI tools are transforming how compositions are created, produced, and distributed. By leveraging advanced machine learning models, generative AI enables the automatic creation of melodies, harmonies, and soundscapes, allowing artists, producers, and content creators to explore new creative frontiers and streamline production processes.

Get More Information about this report -

Request Free Sample ReportThe market’s rapid expansion is underpinned by rising adoption among independent musicians and professional producers. Surveys indicate that a majority of artists now integrate AI into workflows such as mixing, mastering, and songwriting. Platforms like AIVA, trained on tens of thousands of musical scores, are empowering creators with style replication and genre-based innovation, while new AI plugins and production tools are lowering barriers for independent musicians seeking affordable, high-quality output. Additionally, streaming platforms are increasingly embedding AI-driven features, such as Spotify’s AI Playlist launched in 2024, to personalize listening experiences and boost user engagement.

Several structural drivers are fueling this momentum. The proliferation of digital streaming services, the growing demand for cost-efficient music production, and the rise of immersive technologies such as virtual reality (VR) and augmented reality (AR) are expanding the commercial use cases of AI-generated music. Investment trends also reflect strong institutional confidence, with governments in the U.S., EU, and UK channeling billions into AI research and innovation to maintain leadership in this fast-evolving domain. These funding streams are fostering breakthroughs in generative models and supporting the development of regulatory frameworks to address copyright, ownership, and ethical considerations.

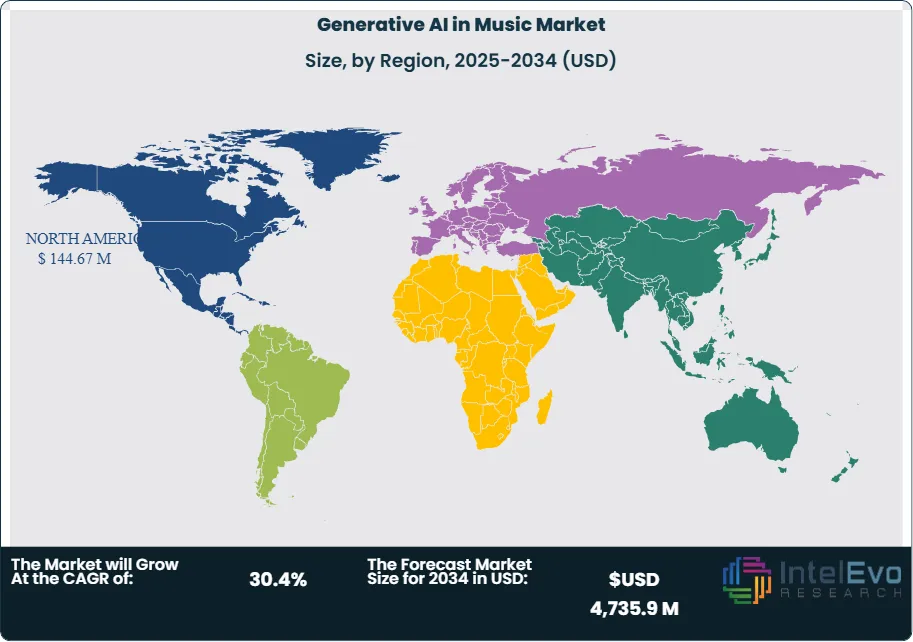

Regionally, North America leads the market, driven by strong AI investment ecosystems, early adoption by technology-forward music companies, and vibrant independent music communities. Europe follows closely, supported by significant R&D funding and policy alignment, while Asia-Pacific is emerging as a growth hotspot with rising adoption of AI tools among creators and rapid expansion of streaming platforms.

As generative AI continues to mature, opportunities lie in enhancing human creativity rather than replacing it. The technology is expected to play an increasingly integral role across every stage of music creation—from ideation and sound design to production and distribution—positioning it as a transformative force in the future of the global music industry.

Key Takeaways

• Market Growth: The Generative AI in Music Market was valued at USD 380.7 Million in 2024 and is projected to reach USD 4,735.9 Million by 2034, expanding at a CAGR of 30.4%. Growth is driven by rising adoption of AI tools for music creation, mixing, and mastering, alongside demand from digital streaming and content platforms.

• Component: Solutions accounted for 65% of market share in 2023, led by AI-powered platforms such as AIVA and Amper Music, which provide cost-effective and scalable tools for artists and producers. Services are expected to gain traction as enterprises adopt customized AI integration for production workflows.

• Deployment: Cloud-based deployment represented 74% of the market in 2023, supported by scalability, lower upfront costs, and collaborative capabilities for remote music production. On-premises solutions remain relevant for enterprises prioritizing data security and intellectual property protection.

• Application: Composition and music generation led with a 28% share in 2023, reflecting growing use of AI algorithms to generate original melodies and harmonies. Mixing and mastering applications are gaining momentum as AI plugins simplify post-production processes.

• Driver: The democratization of music production is a key driver, as AI lowers entry barriers for independent musicians by reducing reliance on costly studio setups and enabling rapid creation of high-quality tracks.

• Restraint: Intellectual property and copyright concerns remain a major barrier, as AI-generated compositions raise questions around ownership, originality, and royalties, potentially slowing widespread adoption.

• Opportunity: Integration of generative AI with immersive technologies such as virtual reality (VR) and augmented reality (AR) offers high-growth potential, enabling personalized, interactive, and adaptive music experiences for entertainment and gaming sectors.

• Trend: Streaming platforms are embedding AI features to enhance listener engagement, exemplified by Spotify’s AI Playlist launched in 2024, which curates music based on conversational user input and listening behavior.

• Regional Analysis: North America held 38% of the market in 2023, supported by strong AI investment ecosystems, tech-forward music companies, and early adoption. Europe is accelerating with €9 billion in AI investments in 2023, while Asia-Pacific is emerging as the fastest-growing region due to expanding streaming platforms and rising creator adoption of AI tools.

Component Analysis

The component landscape of the Generative AI in Music Market is dominated by solutions, which accounted for approximately two-thirds of overall revenue in 2024 and are projected to maintain leadership through 2025. Solutions encompass AI-powered platforms, software, and creative toolkits that automate composition, arrangement, mixing, and mastering. Their popularity stems from the ability to shorten production cycles, reduce costs, and empower both independent artists and professional studios with advanced creative capabilities. Well-established platforms such as AIVA and Amper Music exemplify how AI-driven solutions are reshaping workflows by blending algorithmic precision with artistic intent.

The services segment, while smaller in share, plays a critical role in the ecosystem by enabling the effective deployment and integration of AI solutions. Services include consulting, customization, technical training, and ongoing support, which ensure seamless adoption across user groups with varying technical expertise. As generative AI solutions evolve and become more sophisticated, demand for service-oriented offerings is expected to rise, particularly from enterprises and studios seeking to optimize AI adoption without disrupting existing production processes. Together, solutions and services form a complementary value chain that underpins the growth trajectory of the market.

Deployment Analysis

Cloud-based deployment has emerged as the clear frontrunner, representing nearly three-quarters of the market in 2024 and expanding further in 2025. The model’s scalability, affordability, and accessibility make it highly attractive for independent musicians, startups, and global streaming platforms. Cloud infrastructure enables the training and operation of large-scale generative models without requiring costly local infrastructure, while also supporting real-time collaboration across geographies. Frequent software updates and enhanced data security offered by leading cloud providers further strengthen the segment’s appeal.

In contrast, on-premises deployment retains a niche presence, primarily among organizations that prioritize control over intellectual property and sensitive datasets. Certain high-end studios and enterprises continue to favor this model to address compliance or security concerns. However, as cloud providers integrate stronger encryption, governance, and compliance frameworks, the long-term shift toward cloud-based solutions is expected to accelerate, particularly in regions where distributed, collaborative music production is becoming standard.

Application Analysis

Generative AI in music is applied across multiple domains, with composition and music generation leading the market at roughly 28% share in 2024. This segment continues to grow in 2025, as AI algorithms increasingly assist artists in creating original melodies, harmonies, and rhythmic structures. The ability to co-create with AI is particularly valuable in sectors such as gaming, film scoring, and streaming content, where demand for new music is continuous. AI-driven composition platforms not only reduce creative bottlenecks but also expand artistic possibilities, enabling musicians to explore novel sounds and genres.

Beyond composition, other applications are rapidly gaining importance. Performance enhancement and virtual collaboration are being integrated into live events and remote music creation platforms, expanding opportunities for cross-border artistic engagement. Personalized music recommendations are a core driver of user engagement for platforms such as Spotify and Apple Music, where AI tailors experiences to individual preferences. Music production and remixing applications are streamlining workflows for producers, while music transcription and analysis tools are proving valuable for educational institutions and musicologists. Collectively, these applications highlight the diverse role of generative AI in reshaping both music creation and consumption.

Regional Analysis

North America continues to hold the largest share of the Generative AI in Music Market, commanding approximately 38% in 2024 and expected to expand further in 2025. The region benefits from a robust AI innovation ecosystem, strong venture funding, and the presence of leading streaming platforms that are embedding generative AI to personalize and produce music. The U.S. in particular remains a hub for AI startups specializing in music, supported by collaborations between technology companies and creative industries.

Europe follows closely, supported by significant public and private investments in AI research and a strong emphasis on regulatory frameworks that balance innovation with intellectual property rights. Countries such as the UK, Germany, and France are at the forefront of integrating AI into professional music production and academic research.

Meanwhile, Asia-Pacific is emerging as the fastest-growing region, fueled by a surge in music streaming adoption, a large base of independent creators, and rapid digitalization in markets such as China, India, and Japan. Local platforms are increasingly adopting AI tools to meet consumer demand for personalized and localized content. Together, these dynamics position Asia-Pacific as a high-potential growth hotspot for the coming years.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Component

- Solutions

- Services

By Deployment

- Cloud-based

- On-premises

By Application

- Composition and Music Generation

- Performance Enhancement and Virtual Collaboration

- Personalized Music Recommendations

- Music Production and Remixing

- Music Transcription and Analysis

- Other Applications

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 496.4 M |

| Forecast Revenue (2034) | USD 4,735.9 M |

| CAGR (2025-2034) | 30.4% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Component (Solutions, Services), By Deployment (Cloud-based, On-premises), By Application (Composition and Music Generation, Performance Enhancement and Virtual Collaboration, Personalized Music Recommendations, Music Production and Remixing, Music Transcription and Analysis, Other Applications) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Shutterstock Inc., Soundful, Boomy Corporation, OpenAI, Google DeepMind, AIVA Technologies, Amper Music, Mubert, Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the Generative AI in Music Market?

The Generative AI in Music Market is projected to reach USD 4,735.9 Million by 2034, growing at a CAGR of 30.4%. AI-driven music composition and production tools are reshaping creativity, accelerating workflows, and transforming the global music landscape.

Who are the major players in the Generative AI in Music Market?

Shutterstock Inc., Soundful, Boomy Corporation, OpenAI, Google DeepMind, AIVA Technologies, Amper Music, Mubert, Other Key Players

Which segments covered the Generative AI in Music Market?

By Component (Solutions, Services), By Deployment (Cloud-based, On-premises), By Application (Composition and Music Generation, Performance Enhancement and Virtual Collaboration, Personalized Music Recommendations, Music Production and Remixing, Music Transcription and Analysis, Other Applications)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Generative AI in Music Market

Published Date : 06 Nov 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date