Generative AI in Waste Management Market Size & 23.4% CAGR

Global Generative AI in Waste Management Market Size, Share & Technology Analysis By Solution (AI Forecasting, Computer Vision, Smart Sorting, Route Optimization), By Application (Recycling, Landfills, Smart Cities), By End User (Municipalities, Industrial, Commercial), ESG Impact, Key Players, Digital Waste Trends & Forecast 2025–2034

Report Overview

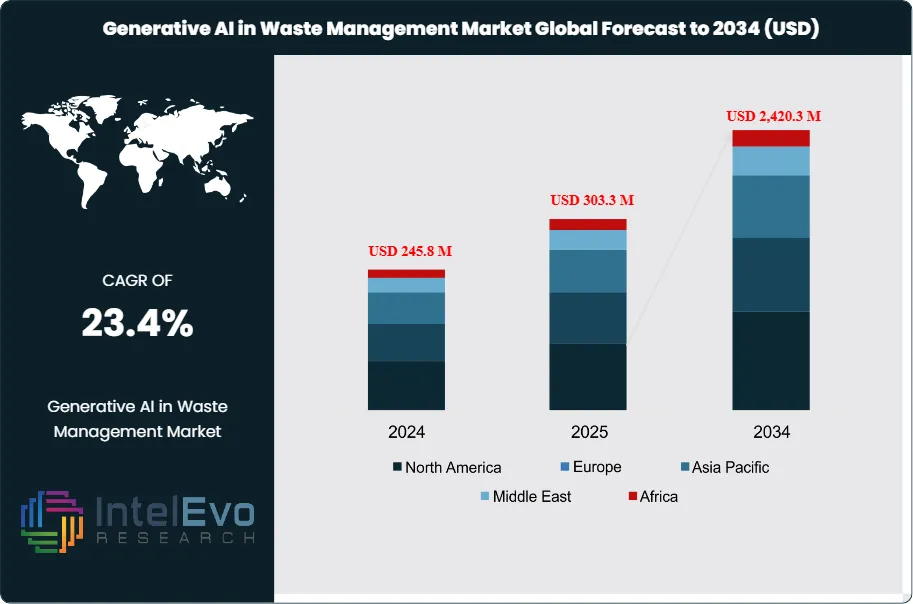

The Generative AI in Waste Management Market is estimated at USD 245.8 million in 2024 and is projected to reach approximately USD 2,420.3 million by 2034, registering a strong CAGR of about 23.4% during 2025–2034. This accelerated growth is driven by rising adoption of AI-powered waste sorting, route optimization, and predictive maintenance across municipal and commercial waste operations. Generative AI models are increasingly deployed to improve material recovery rates, reduce landfill diversion costs, and enhance real-time decision-making in material recovery facilities. In parallel, stricter recycling mandates, labor shortages, and the need for operational efficiency are positioning generative AI as a core technology within next-generation, data-driven waste management ecosystems.

Get More Information about this report -

Request Free Sample ReportYou are seeing a shift from pilot projects to scaled deployments across collection, sorting, and landfill operations. Cost pressure, labor shortages, and rising regulatory standards push adoption. Collection can represent up to 60 percent of operating costs; AI route planning and dynamic dispatch cut mileage and fuel use by double digits. Contamination in mixed recyclables often exceeds 20 percent; real‑time computer vision increases purity and yield. In March 2024, SUEZ reported up to a 90 percent recovery rate for secondary raw materials, supported by 99 percent line visibility using advanced scanners and AI, versus roughly 1 percent coverage with manual sampling. A 2023 Greyparrot study found residue streams in Europe, the United States, and Asia still contain 37 percent paper and cardboard and 26 percent recyclable plastics; the loss highlights immediate recovery upside.

Demand grows in large manufacturing and processing sites that need traceable waste flows and lower disposal fees. Landfill operators use AI to forecast compaction and settlement; better placement and timing extend cell life and defer new site development. Cities deploy smart bins with sensors; alerts reduce overflow and lift collection satisfaction scores. On the supply side, vendors combine cameras, hyperspectral sensors, and robotic arms; models now identify over 50 material classes in real time. Integrations with weighbridges and ERP systems close data gaps; predictive maintenance lowers unplanned downtime on MRF lines.

Policy tailwinds matter. The EU Waste Framework, EPR schemes, and landfill restrictions tighten targets; Europe leads deployments and funding. North America accelerates AI‑enabled MRF upgrades and fleet routing; you should expect strong public‑private projects. Asia Pacific posts the fastest growth on urban build‑out and rising waste volumes; China, Japan, and South Korea are key buyers.

The Middle East and Latin America advance via smart city programs and donor‑backed pilots. Investors watch computer vision sorting, landfill modeling software, AI SaaS for routing and contamination analytics, and robotics retrofits of existing lines. Key risks persist; data quality, integration with legacy equipment, model accuracy on soiled materials, and procurement cycles can slow rollout. Vendors that prove payback within 12 to 24 months will win share.

Key Takeaways

- Market Growth: The market reached USD 245.8 million in 2024 and is projected to hit USD 2,420.3 million by 2034 at a 23.4% CAGR, driven by digitization of collection and sorting, rising industrial waste volumes, and compliance pressure across regions. You should plan for sustained investment cycles in AI-enabled routing, sorting, and maintenance as operators target measurable cost and yield gains.

- Segment Dominance - Component: Solutions led revenues in 2023 as operators prioritized computer vision, routing engines, and landfill modeling; services supported deployments and training at scale. Quantified outcomes include a 13% fuel reduction from AI routing at a UK firm and a 25% route efficiency uplift at a US operator.

- Segment Dominance - Application: Waste Sorting and Segregation was the top application in 2023, reflecting rapid computer vision rollout at MRFs and transfer stations. Residue analytics show immediate upside: 37% paper and cardboard and 26% recyclable plastics still appear in residue streams, signaling recoverable value for you to capture.

- Segment Dominance - End User: Waste Management Companies were the leading adopters in 2023, focusing on cost-to-serve reduction, purity, and uptime across fleets and MRF lines. Municipalities and local governments formed the second-largest group, scaling AI for smart collection, contamination control, and service KPIs.

- Driver: Performance proof points are clear; SUEZ reports up to a 90% recovery rate supported by AI and advanced scanners with 99% visibility versus 1% manual sampling coverage, improving purity and secondary material yield. Route optimization and predictive maintenance further cut fuel, downtime, and overflow incidents, strengthening payback cases.

- Restraint: High upfront costs for data infrastructure, sensors, and integration slow adoption among smaller operators, extending sales cycles. Workforce resistance and change management needs can delay deployments unless you budget for training and phased rollouts.

- Opportunity: AI SaaS for route optimization, predictive maintenance, and residue analytics offers near-term ROI; target retrofits that raise capture of high-loss materials highlighted by residue data. You can prioritize computer vision modules and model updates that convert missed paper and plastics into sellable tonnage.

- Trend: Computer vision is scaling across MRFs; Greyparrot documented billions of detected items and quantified material losses on residue lines, guiding operational setpoints and investment. Vendors are bundling analytics with integrations to weighbridges and ERPs, enabling real-time decisions and measurable yield gains.

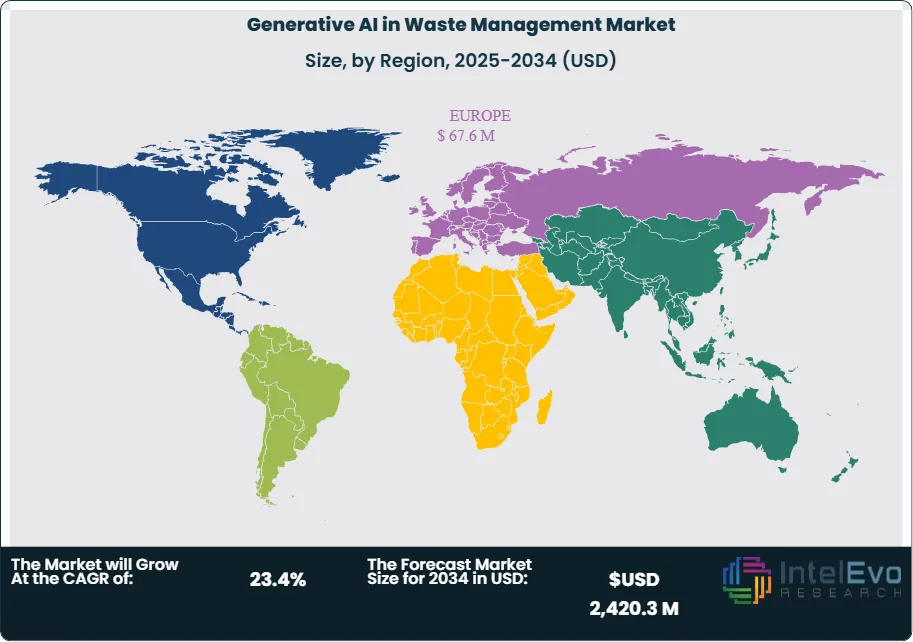

- Regional Analysis: Europe leads with a 27.50% share, supported by strict policy, EPR schemes, and funded upgrades to AI-enabled sorting and routing. North America is accelerating MRF and fleet deployments, while Asia Pacific shows rapid adoption as urbanization and waste growth push AI-led efficiency programs.

Application Analysis

Waste sorting and segregation remains the anchor use case, accounting for over 38% of AI in waste management revenue in 2023 and staying at the center of 2025 deployment roadmaps for material recovery and purity improvement. You can point to field metrics such as up to 120 picks per minute as evidence that AI-led sortation can support higher throughput without expanding labor, improving line stability and bale quality. Scaling datasets strengthen model performance; one leading provider reported 40 billion detected waste objects across 55 facilities in 20 countries in 2024, underscoring rapid maturation of vision systems that your teams can tap for SKU-level insights.

Predictive maintenance is moving from pilots to systematic rollouts across MRF equipment and collection fleets as operators target uptime and lower maintenance costs in a market projected to reach USD 18.2 billion by 2033 at a 27.5% CAGR. GenAI layered on IoT telemetry supports failure forecasting and work order automation for optical sorters, conveyors, balers, and trucks, which helps you cut unplanned stops and align parts inventory with actual condition signals.

Route planning and dynamic scheduling integrate with fill-level sensors and geospatial data in digital waste platforms that are sized at USD 3.36 billion in 2025, creating clear pathways to fuel, overtime, and service reliability gains for your contracts. Other applications include demand forecasting, contamination analytics, and regulatory reporting within broader environmental AI programs that are attracting growing budgets for sustainability outcomes.

End-Use Analysis

Waste management companies are the primary adopters of generative AI tools, leading purchases for sortation, fleet planning, and decision analytics as they seek measurable productivity and margin gains you can validate in quarterly KPIs. Software accounted for about 42.5% of AI spending in 2023, reflecting a platform-first approach that you can scale across multi-site networks and mixed OEM environments.

Municipalities and local governments are expanding smart collection and MRF modernization, supported by North America’s 36.9% share of the AI in waste management market and growing public expectations on recycling performance and transparency. You gain service reliability and citizen reporting benefits when city contracts include AI-enabled route planning, contamination detection, and automated compliance dashboards.

Commercial and industrial facilities are adding AI sorting and analytics to meet packaging recovery, brand commitments, and regulatory requirements, with deployments now spanning 20 countries across public and private sites. You can use these systems to track material flow by brand or polymer and feed procurement decisions and EPR reporting with near real-time evidence.

Regional Analysis

Europe holds about 27.5% of generative AI in waste management, supported by strict policy frameworks, EPR schemes, and advanced recycling infrastructure that accelerate procurement and commissioning cycles for your projects. You see faster adoption in markets such as Germany and the Nordics where regulation, automation budgets, and data availability align with enterprise-scale rollouts.

North America leads the broader AI in waste management market with 36.9% share, anchored by private MRF operators, robotics OEMs, and data platforms that can retrofit brownfield sites at pace. Field case work shows high pick rates and measurable purity improvement from AI sorting lines, which supports your investment cases for phased modernization across aging facilities.

Asia Pacific is positioned for the fastest growth through 2033 as urbanization, extended producer responsibility, and capacity expansion drive AI adoption in sortation and logistics that you can stage in major metros first. Latin America and the Middle East and Africa are in early adoption phases, with pilots clustering around large cities and integrated utilities that will set reference architectures for your regional scale-up plans.

Get More Information about this report -

Request Free Sample ReportKey Market Segments

By Component

- Hardware

- Software

- Services

By Technology

- Machine Learning

- Natural Language Processing

- Computer Vision

- Other Technologies

By Application

- Waste Sorting and Segregation

- Predictive Maintenance

- Route Optimization

- Other Applications

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 245.8 M |

| Forecast Revenue (2034) | USD 2,420.3 M |

| CAGR (2024-2034) | 23.4% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Component, Hardware, Software, Services, By Technology, Machine Learning, Natural Language Processing, Computer Vision, Other Technologies, By Application, Waste Sorting and Segregation, Predictive Maintenance, Route Optimization, Other Applications |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | ABB Group, Intuitive AI, Microsoft Corporation, AMP Robotics Corporation, CleanRobotics, IBM Corporation, Rubicon, Greyparrot AI Ltd., TOMRA Systems ASA, Terex Corporation, Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Generative AI in Waste Management Market

Published Date : 24 Dec 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date