Green Energy for Bitcoin Market to Hit $12.5B by 2034 | CAGR 19.2%

Global Green Energy for Bitcoin Market Size, Share & Analysis Report By Energy Source (Hydroelectric, Wind, Solar, Geothermal), Deployment (Large-Scale Mining Farms, Mid-Sized Operations, Small Miners), End User (Institutional & Independent Miners, Mining Pools), Application (Transaction Processing, Grid Balancing, Carbon Offset), Regional Insights, Key Players, Trends & Forecast 2025-2034

Report Overview

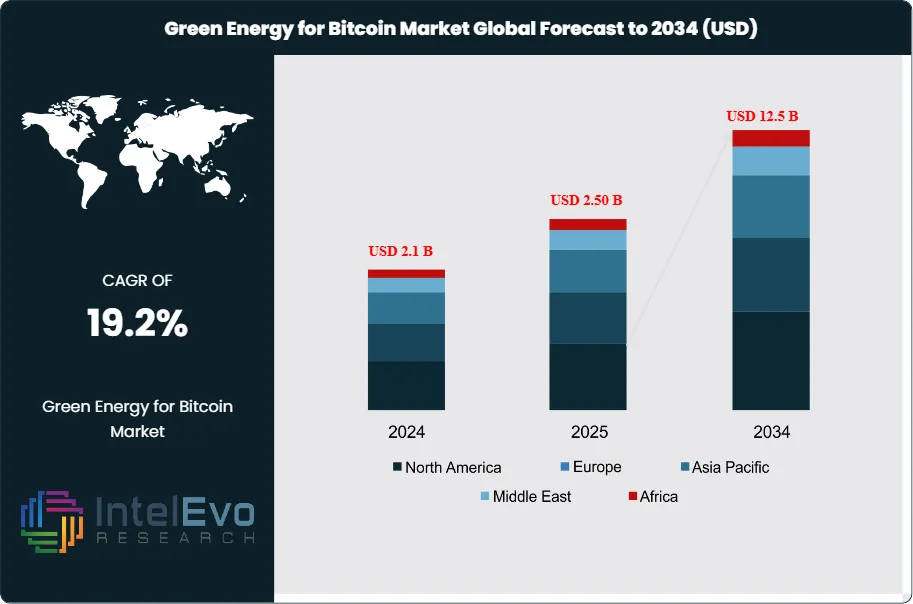

The Global Green Energy for Bitcoin Market is projected to reach USD 12.5 Billion by 2034, up from USD 2.1 Billion in 2024, growing at a CAGR of 19.2% during the forecast period from 2024 to 2034. The Global Green Energy for Bitcoin Market refers to the ecosystem of technologies, solutions, and services that enable Bitcoin mining operations to be powered by renewable and low-carbon energy sources such as hydroelectric, wind, solar, and geothermal power. This market addresses the environmental concerns associated with the high energy consumption of Bitcoin mining by promoting the use of sustainable energy, reducing carbon emissions, and supporting the transition to a more eco-friendly digital asset infrastructure. It encompasses the integration of renewables into mining farms, the development of green mining technologies, and the creation of certification and carbon offset mechanisms for sustainable cryptocurrency production.

Get More Information about this report -

Request Free Sample ReportKey drivers of the Global Green Energy for Bitcoin Market include increasing regulatory and investor pressure for environmental, social, and governance (ESG) compliance, the declining cost and improved efficiency of renewable energy technologies, and the growing public scrutiny of Bitcoin’s carbon footprint. Additionally, miners are motivated by the long-term economic benefits of stable, low-cost renewable power and the opportunity to access new markets and capital by demonstrating sustainability. Strategic partnerships between miners and renewable energy providers, as well as innovations in energy storage and grid management, further accelerate the adoption of green energy in the sector.

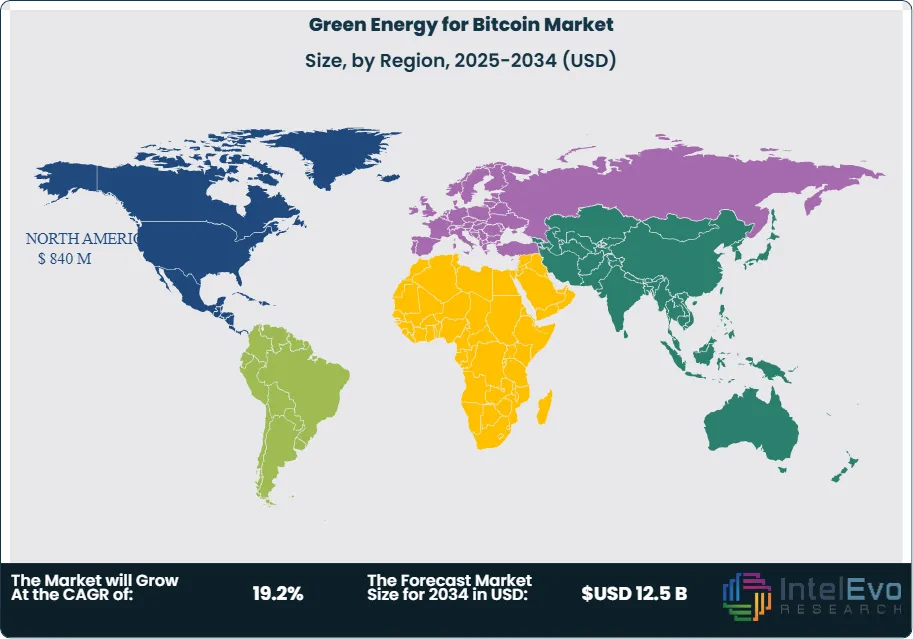

The market is segmented by energy source (hydroelectric, wind, solar, geothermal, and others), deployment (large-scale mining farms, mid-sized operations, and small/individual miners), end user (institutional miners, independent miners, and mining pools), application (transaction processing, grid balancing, carbon offset and certification), and region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa). This segmentation reflects the diverse approaches and technologies used to integrate green energy into Bitcoin mining, as well as the varying needs and capabilities of different market participants. Regionally, North America leads the market due to abundant renewable resources, supportive regulatory frameworks, and significant institutional investment in sustainable mining. The U.S. and Canada, in particular, benefit from access to low-cost hydro and wind power. Asia-Pacific is the fastest-growing region, with countries like Kazakhstan, China (post-ban), and Southeast Asian nations investing in renewables for mining. Europe is notable for its strict environmental regulations and high renewable penetration, especially in the Nordics. Latin America, led by Paraguay and El Salvador, is emerging as a green mining hub due to surplus hydroelectricity, while the Middle East and Africa are in early stages, with potential in solar-rich and off-grid areas.

The COVID-19 pandemic had a mixed impact on the Green Energy for Bitcoin Market. On one hand, global supply chain disruptions and economic uncertainty temporarily slowed the deployment of new renewable energy projects and mining hardware. On the other hand, the pandemic accelerated digital transformation and increased interest in alternative investments like Bitcoin, driving up mining activity. As energy markets became more volatile, miners sought stable, long-term renewable energy contracts to hedge against price fluctuations, further incentivizing the shift toward green energy solutions. Geopolitical dynamics play a significant role in shaping the market. Regulatory crackdowns on crypto mining in countries like China have shifted mining operations to regions with more favorable policies and abundant renewables, such as North America and Central Asia. Trade tensions, cross-border energy agreements, and national energy security strategies influence where and how green mining projects are developed. Additionally, global efforts to combat climate change, such as the Paris Agreement, are prompting governments to incentivize renewable-powered mining and impose stricter emissions standards, further driving the adoption of green energy in the Bitcoin mining industry.

Key Takeaways

- Market Growth: The Green Energy for Bitcoin Market is expected to reach USD 12.5 Billion by 2034, driven by ESG mandates, renewable energy cost declines, and regulatory incentives.

- Energy Source Dominance: Hydroelectric and wind power lead due to their scalability, reliability, and prevalence in key mining regions.

- Deployment Dominance: Large-scale mining farms are the primary adopters, but small and mid-sized operations are increasingly integrating green energy through power purchase agreements (PPAs) and on-site renewables.

- Regional Dominance: North America leads in green Bitcoin mining capacity, while Asia-Pacific shows the fastest growth, especially in China, Kazakhstan, and emerging Southeast Asian markets.

- Drivers: Key drivers include regulatory pressure for decarbonization, investor demand for ESG-compliant crypto assets, and the economic benefits of renewable energy.

- Restraints: Barriers include grid integration challenges, renewable intermittency, high upfront capital costs, and regulatory uncertainty in some jurisdictions.

- Opportunities: Growth opportunities lie in energy storage integration, carbon credit trading, and the development of mining operations in off-grid or stranded energy locations.

- Trends: Notable trends include the rise of “green Bitcoin” certification, tokenized carbon offsets, and the use of AI for energy optimization in mining operations.

Energy Source Analysis:

Among all energy sources, hydroelectric power holds the largest share in the green energy for Bitcoin market. Its dominance is attributed to its low operational cost, high reliability, and widespread availability in regions such as Canada, Scandinavia, and South America. Hydroelectric plants provide a stable, year-round supply of renewable electricity, making them ideal for powering energy-intensive Bitcoin mining operations at scale. Wind energy is rapidly gaining ground, particularly in the United States and Europe, where large wind farms offer scalable, low-carbon power solutions. Solar energy is increasingly being adopted in sun-rich regions like Texas, the Middle East, and Australia, and is especially valuable for off-grid or remote mining sites. Geothermal energy, while geographically limited, plays a crucial role in Iceland and certain parts of the U.S., offering consistent, sustainable power. Other sources, including biomass, tidal, and hybrid renewable systems, contribute to the market but remain niche compared to hydroelectric’s overwhelming share.

Deployment Analysis

Large-scale mining farms account for the majority of market share in deployment. These industrial-scale operations leverage direct power purchase agreements (PPAs) with renewable energy providers and often invest in on-site generation infrastructure to ensure a reliable, cost-effective, and sustainable energy supply. Their scale allows for significant capital investment in renewables and advanced energy management systems, making them the primary drivers of green energy adoption in Bitcoin mining. Mid-sized operations are increasingly adopting modular renewable solutions and participating in grid balancing strategies to optimize costs and sustainability. Small and individual miners, while a smaller segment, are turning to community solar projects, microgrids, and green energy credits to access renewable power, reflecting a growing democratization of green mining practices.

End User Analysis

Institutional miners represent the largest end-user segment in the market. These include publicly traded companies and large private firms that are under increasing pressure from investors and regulators to meet ESG (environmental, social, and governance) standards. Their substantial resources enable them to secure long-term renewable energy contracts, invest in cutting-edge green technologies, and pursue carbon-neutral or even carbon-negative mining operations. Independent miners—small businesses and individuals—are motivated by cost savings and regulatory compliance, but typically operate at a smaller scale. Mining pools, which aggregate the resources of multiple miners, are also prioritizing green energy to enhance their competitive advantage and appeal to environmentally conscious investors.

Application Analysis:

The transaction processing segment commands the largest share of applications in the green energy for Bitcoin market. This core activity involves the validation and recording of Bitcoin transactions, which requires significant computational power and, consequently, large amounts of electricity. As a result, the shift to renewables in transaction processing has the greatest impact on reducing the overall carbon footprint of Bitcoin mining. Grid balancing and ancillary services are an emerging application, where miners use their flexible loads to provide demand response and support grid stability, creating new revenue streams and further integrating renewables. Carbon offset and green certification initiatives are also growing, with some mining operations focusing on generating and trading carbon credits or producing “green Bitcoin” to meet the demands of ESG-focused investors.

Region Analysis:

North America leads the global market with over 40% share, driven by abundant hydro and wind resources, favorable regulatory environments, and significant institutional investment in sustainable mining. The U.S. and Canada, in particular, have become hubs for green Bitcoin mining, leveraging their renewable energy infrastructure and supportive policies. Asia-Pacific is the fastest-growing region, with countries like Kazakhstan, China (post-mining ban), and Southeast Asian nations investing heavily in renewables to power mining operations. Europe is notable for its strict ESG and regulatory standards, with the Nordics excelling in hydro and geothermal-powered mining. Latin America, especially Paraguay, El Salvador, and Brazil, is emerging as a green mining hotspot due to surplus hydroelectricity and pro-crypto policies. The Middle East and Africa are in the early stages of development, but show strong potential for solar-powered and off-grid mining projects as renewable infrastructure expands.

Get More Information about this report -

Request Free Sample Report

Key Market Segment

By Energy Source

- Hydroelectric

- Wind

- Solar

- Geothermal

- Others

By Deployment

- Large-Scale Mining Farms

- Mid-Sized Operations

- Small/Individual Miners

By End User

- Institutional Miners

- Independent Miners

- Mining Pools

By Application

- Transaction Processing

- Grid Balancing & Ancillary Services

- Carbon Offset & Green Certification

By Region

- North America

- Asia-Pacific

- Europe

- Latin America

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 2.50 B |

| Forecast Revenue (2034) | USD 12.5 B |

| CAGR (2025-2034) | 19.2% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Energy Source (Hydroelectric, Wind, Solar, Geothermal, Others), By Deployment (Large-Scale Mining Farms, Mid-Sized Operations, Small/Individual Miners), By End User (Institutional Miners, Independent Miners, Mining Pools), By Application (Transaction Processing, Grid Balancing & Ancillary Services, Carbon Offset & Green Certification) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Bitfarms Ltd., HIVE Blockchain Technologies Ltd., Argo Blockchain plc, Marathon Digital Holdings, Inc., Genesis Digital Assets, CleanSpark, Inc., Core Scientific, Inc., Iris Energy Limited, Greenidge Generation Holdings Inc., Northern Data AG, DMG Blockchain Solutions Inc., Soluna Holdings, Inc., Blockstream Mining, Sphere 3D Corp., Stronghold Digital Mining, Inc. |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Green Energy for Bitcoin Market

Published Date : 02 Sep 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date