Heat Pump Market Size, Trends, Forecast & Growth | CAGR 9.78%

Global Heat Pump Market Size, Share, Analysis Report Product Type (Air Source Heat Pumps Air-to-Air & Air-to-Water, Ground Source Heat Pumps (Geothermal), Water Source Heat Pumps, Hybrid Heat Pumps); Application (Residential Heating & Cooling, Residential Water Heating, Commercial Heating & Cooling, Commercial Water Heating, Industrial Process Heating & Cooling) Industry Region & Key Players-Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends & Forecast 2025-2034

Report Overview

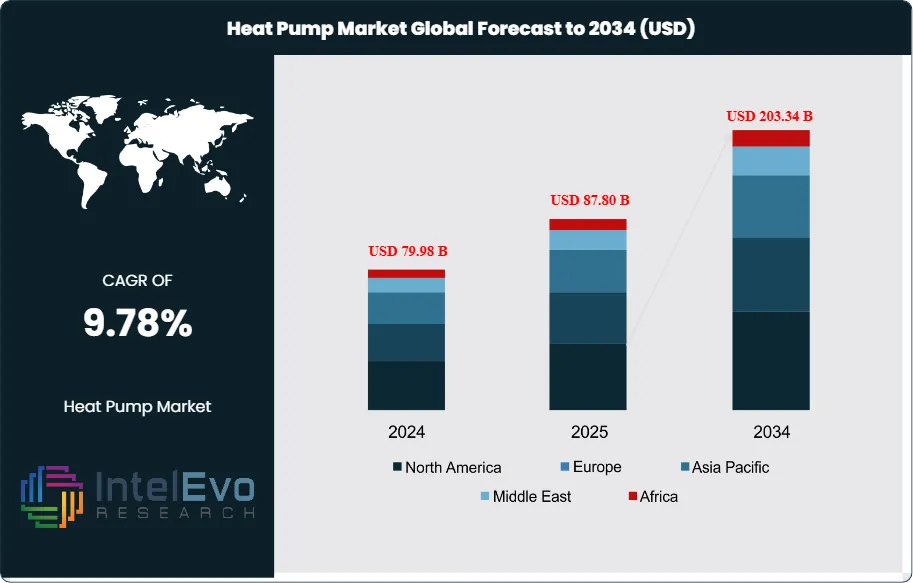

The Heat Pump Market was estimated at USD 79.98 billion in 2024 and is forecasted to reach approximately USD 203.34 Billion by 2034, growing at a Compound Annual Growth Rate (CAGR) of 9.78% during the forecast period from 2024 to 2034. It is growing quickly as more people and businesses look for energy-saving ways to heat and cool their spaces. Heat pumps are an innovative technology that move heat from one place to another. They can be used to both heat and cool for residential, commercial, and industrial applications efficiently.

Get More Information about this report -

Request Free Sample ReportThe heat pump market is changing fast and has all sorts of products. You've got air-to-air, air-to-water, water-to-water, and geothermal types, and they all use different heat sources. Tech keeps getting better, and there are strict rules to cut down on pollution and push for energy independence and being green. Heat pumps are catching on because of government help, rising energy prices, and because people know they're better for the environment than old-school fuel systems.

A few things are making the heat pump market grow, like the global goal to kill off emissions, more folks wanting energy-smart buildings, and governments backing it all up with policies and cash. The market is also moving because smart homes are getting big, better coolants are being used, and hybrid heating is needed. Also, hooking up heat pumps to green energy like solar power is opening up ways for the market to get even bigger.

COVID-19 Impact: At first, COVID messed up the world's heat pump biz because stuff wasn't getting made, people couldn't work, and building stopped for a bit. But then, people realized how important clean air and saving energy are in their homes and offices, so they started caring more about good HVAC systems. After the pandemic, governments put money into getting things back on track and going green, which really helped the heat pump market grow. Countries put cash into energy-saving tech to boost their economies and reach their climate goals.

Regional Conflicts and Trade Tensions: Conflicts and trade issues can mess with the heat pump market. If we can't get important parts like semiconductors or certain metals, costs go up, and it's hard to know what's going to happen with investments. Taxes on imported stuff can also make things more expensive, which might slow down sales in some places. But all this can push countries to make their own stuff and come up with new ideas, which changes how the market works.

Key Takeaways

- Market Growth: The Global Heat Pump Market is expected to reach USD 203.34 Billion by 2034, driven by the global imperative for decarbonization, energy efficiency mandates, and supportive government policies.

- Product Type Dominance: Air Source Heat Pumps currently hold the largest market share due to their versatility, relatively lower installation costs, and applicability across diverse climate zones for both heating and cooling.

- Technology/Component Dominance: Inverter technology is dominant within heat pump components, enabling variable speed operation for enhanced energy efficiency, precise temperature control, and quieter operation.

- Application Dominance: Residential applications represent the largest segment, fueled by increasing consumer awareness, government subsidies for home heating/cooling upgrades, and the growing trend of sustainable living.

- End-User Dominance: Residential users constitute the largest end-user group, driven by homeowners seeking to reduce energy bills and carbon footprints.

- Distribution Channel Dominance: HVAC distributors and specialized installers currently dominate the distribution landscape, offering expertise in system design, installation, and after-sales service.

- Driver: Stringent government regulations and ambitious decarbonization targets, particularly in Europe and North America, are the primary drivers for heat pump adoption.

- Restraint: High upfront installation costs and the complexity of retrofitting heat pump systems in older buildings remain significant restraints, impacting widespread consumer adoption.

- Opportunity: The increasing integration of heat pumps with smart home energy management systems and grid flexibility programs presents vast opportunities for enhanced efficiency and demand-side management.

- Trend: The development of high-temperature heat pumps and hybrid systems, combining heat pumps with existing boilers, is a key trend to address diverse heating requirements and accelerate adoption in colder climates.

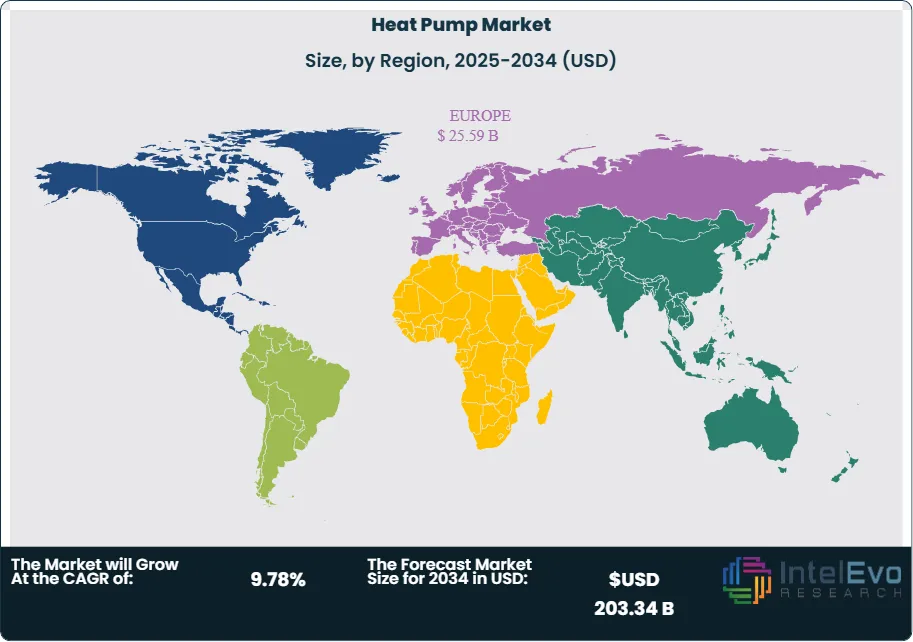

- Regional Analysis: Europe leads the market due to strong policy support and high environmental awareness. Asia-Pacific is expected to record the fastest growth, driven by rapid urbanization and increasing energy demand.

Product Type:

The different types of products are really important in the global heat pump market. These systems pull heat from different places. Air source heat pumps (ASHPs), which include both air-to-air and air-to-water types, are the most popular right now. They make up over 84.7% of the market in 2024. People like them because they can be used in many ways, they don't cost as much to install as ground source systems, and they work in different climates for both heating and cooling. They are also getting better all the time, which helps them work even better in cold weather.

Ground source heat pumps (GSHP), water source heat pumps, and hybrid heat pumps make up the rest of the market. GSHPs are really good at saving energy and work well no matter what the outside temperature is, but they cost more to drill and install, which means fewer people buy them. Hybrid systems, which use a heat pump with a regular boiler, are becoming more popular. They are a good way for people to use less fuel without completely changing their current heating system, especially in areas where the temperature changes a lot.

Technology:

The Technology segment explores the main elements that shape a heat pump's performance and efficiency. Key components include Compressors, Refrigerants, Heat Exchangers, Expansion Valves, Inverter Technology, and Controls & Sensors. Inverter technology plays a major role among heat pump components. It greatly boosts overall market efficiency. Although we do not have specific market share data for inverter technology alone in 2024, its widespread use drives market growth. It allows variable speed operation, improves energy efficiency, provides precise temperature control, and offers quieter performance compared to traditional fixed-speed compressors.

Refrigerants are another important component. There is a growing shift towards low Global Warming Potential (GWP) alternatives like natural refrigerants, such as Propane R290, CO2 R744, due to strict environmental regulations. Compressors, including scroll, rotary, and reciprocating types, serve as the heart of the heat pump, determining its capacity and efficiency. Ongoing innovation in these components, alongside improvements in heat exchangers and smart controls, is crucial for enhancing overall performance, reliability, and environmental impact of heat pump systems.

Application:

The Application segment categorizes heat pump use in different sectors, including Residential, Commercial, and Industrial. Residential applications form the largest segment, making up over 80.3% of the market's revenue share in 2024. This dominance stems from growing consumer awareness about energy savings, government support for home heating and cooling upgrades, and the worldwide trend of sustainable living. In residential applications, space heating, cooling, and water heating are the main uses, driven by the need for comfortable indoor spaces and lower energy bills.

Commercial applications, which include offices, retail, hospitality, healthcare, and educational institutions, represent a significant and expanding segment. Businesses are increasingly utilizing heat pumps to meet energy efficiency goals, cut operational costs, and enhance their environmental profile. Industrial process heating and cooling, although a smaller segment, is set for considerable growth as industries aim to reduce carbon emissions and use high-temperature heat pumps for various manufacturing tasks, promising energy savings and lower emissions.

End-User:

The End-User segment reflects the different types of consumers and organizations using heat pump technology. Residential users make up the largest group, driven by homeowners wanting to lower energy bills and carbon footprints. This segment’s growth benefits from various government incentives, rebates, and awareness campaigns that promote energy-efficient heating and cooling options in homes and multi-family buildings. The wish for better indoor comfort and environmental responsibility further boosts demand from this user group.

The Commercial sector, which includes offices, retail shops, hotels, hospitals, and educational institutions, is another key end-user segment. These organizations are increasingly investing in heat pumps to meet energy efficiency regulations, reach sustainability goals, and reduce operational costs. The Industrial sector, which includes manufacturing, food and beverage processing, and chemical industries, is a new end-user segment for heat pumps, especially for process heating and cooling uses, as these industries seek to electrify and lower emissions in their energy-intensive operations.

Distribution Channel:

The Distribution Channel segment describes the different ways heat pumps are sold and installed. HVAC distributors and specialized installers currently lead the distribution landscape, holding a significant market share (the heat pump equipment segment had 34.7% of the total HVAC distribution market in 2024). These channels are essential because of the technical complexity of heat pump systems, which often require expert knowledge for proper sizing, installation, and integration with existing HVAC setups. HVAC distributors offer a wide range of products, technical support, and training to installers, ensuring effective market entry.

Direct sales from manufacturers, online retail, wholesalers, and retail outlets (like home improvement stores) also play a role in the market's distribution. While online shopping offers ease and a wider selection, the need for professional installation usually requires working with local installers. After-sales service, maintenance, and warranty support further underscore the significance of established distribution networks that can provide complete solutions to end-users.

Regional Analysis:

Europe currently leads the global heat pump market, driven by strong decarbonization goals, significant government incentives, and a developed market for renewable heating solutions. Countries like Germany, France, and the Nordics are leading the way in heat pump adoption. Asia-Pacific is becoming the fastest-growing region, particularly due to rapid urban growth, increasing construction activity, and a greater focus on energy efficiency in countries like China, Japan, and South Korea. North America also represents a notable market, fueled by consumer demand for energy savings and supportive federal programs.

Get More Information about this report -

Request Free Sample ReportMarket Key Segment

Product Type:

- Air Source Heat Pumps Air-to-Air

- Air Source Heat Pumps Air-to-Water

- Ground Source Heat Pumps (Geothermal)

- Water Source Heat Pumps

- Hybrid Heat Pumps

Capacity:

- Up To 10 KW

- 10 – 20 KW

- 20 – 30 KW

- Above 30 KW

Technology:

- Compressors (Scroll, Rotary, Reciprocating)

- Refrigerants (HFC, HFO, Natural Refrigerants - e.g., Propane, CO2)

- Heat Exchangers

- Expansion Valves

- Inverter Technology

- Controls & Sensors

Refrigerant Type:

- R410A

- R407C

- R744

- CO2

- Ammonia (R717)

- Hydrocarbon (R134A)

- Others

System Type:

- Air-Source Heat Pumps

- Ductless Mini-Split Heat Pumps

- Geothermal Heat Pumps

- Absorption Heat Pumps

Distribution Channel:

- HVAC Distributors

- Direct Sales

- Online Retail

- Wholesalers

- Retail Stores (e.g., Home Improvement Stores)

End-User:

- Industrial

- Commercial

- Institutional

- Air Conditioning

Application:

- Residential Heating

- Residential Cooling

- Residential Water Heating

- Commercial Heating

- Commercial Cooling

- Commercial Water Heating

- Industrial Process Heating

- Industrial Process Cooling

Region:

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 87.80 B |

| Forecast Revenue (2034) | USD 203.34 B |

| CAGR (2025-2034) | 9.78% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Product Type: (Air Source Heat Pumps Air-to-Air, Air Source Heat Pumps Air-to-Water, Ground Source Heat Pumps (Geothermal), Water Source Heat Pumps, Hybrid Heat Pumps); Capacity: (Up To 10 KW, 10 – 20 KW, 20 – 30 KW, Above 30 KW); Technology: (Compressors (Scroll, Rotary, Reciprocating), Refrigerants (HFC, HFO, Natural Refrigerants - e.g., Propane, CO2), Heat Exchangers, Expansion Valves, Inverter Technology, Controls & Sensors); Refrigerant Type: (R410A, R407C, R744, CO2, Ammonia (R717), Hydrocarbon (R134A), Others); System Type: (Air-Source Heat Pumps, Ductless Mini-Split Heat Pumps, Geothermal Heat Pumps, Absorption Heat Pumps); Distribution Channel:(HVAC Distributors, Direct Sales, Online Retail, Wholesalers, Retail Stores (e.g., Home Improvement Stores)); End-User: (Industrial, Commercial, Institutional, Air Conditioning); Application: (Residential Heating, Residential Cooling, Residential Water Heating, Commercial Heating, Commercial Cooling, Commercial Water Heating, Industrial Process Heating, Industrial Process Cooling) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Daikin Industries, Ltd., Mitsubishi Electric Corporation, Carrier Global Corporation, Johnson Controls International plc, Trane Technologies plc, LG Electronics Inc., Panasonic Corporation, Bosch Thermotechnology (Robert Bosch GmbH), Vaillant Group, Stiebel Eltron GmbH & Co. KG, NIBE Industrier AB, Viessmann Climate Solutions SE, Danfoss A/S, Thermaflex (part of Kingspan Group), Glen Dimplex Group, Fujitsu General Limited, Hitachi, Ltd., Samsung Electronics Co., Ltd., Lennox International Inc., York (Johnson Controls brand) |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date